- The MBA now forecasts rates between 6.4–6.6% in 2025, up from its earlier prediction of 5.9–6.2%.

- The mortgage origination volume for 2025 has been revised down to $2.1T, with existing home sales projected at 4.25M, below October’s estimates.

- Trade tariffs proposed by President-elect Trump could stall Fed rate cuts, potentially reigniting inflation and keeping rates higher.

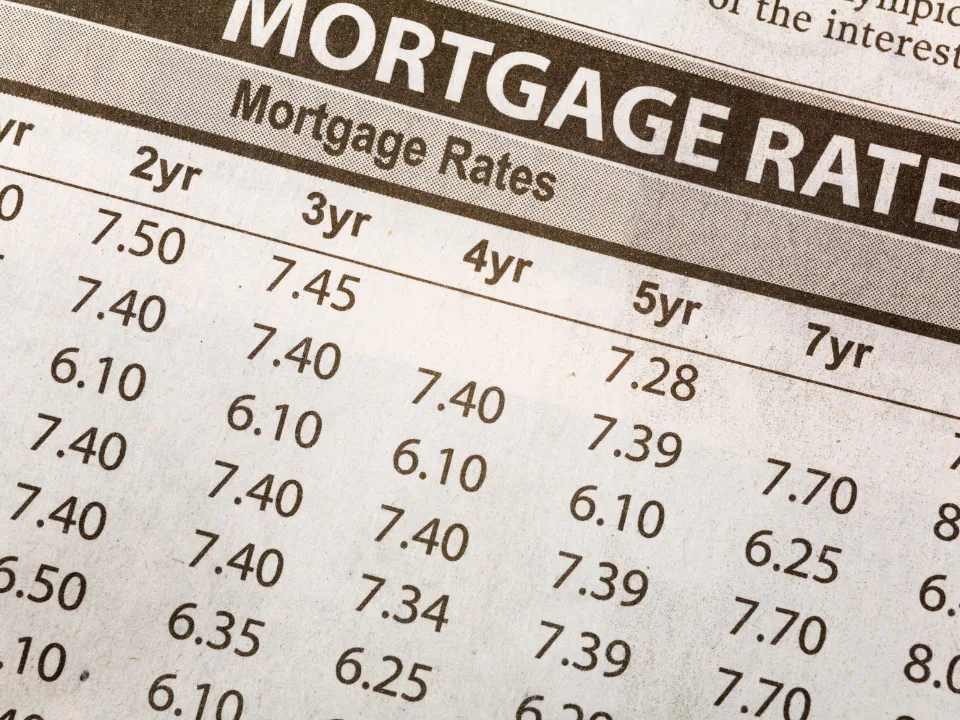

As reported in HousingWire, The Mortgage Bankers Association revised its 2025 mortgage rate projections upward in its November forecast, citing growing economic uncertainties.

By The Numbers

The MBA now expects rates to hover between 6.4% and 6.6%, a stark revision from its October forecast of 5.9% to 6.2%. Rates are expected to hold steady at 6.3% into 2026.

Other major forecasts, including those from Fannie Mae, have also been adjusted. Fannie Mae now projects 2025 mortgage rates at 6.3%, compared to its earlier expectation of sub-6% rates.

Impact on Housing

The higher mortgage rate outlook has prompted MBA to revise projections for housing market activity in 2025.

Mortgage origination volume is now expected to reach $2.1T, down from the previously forecasted $2.3T. Existing home sales are projected at 4.25M, slightly below October’s 4.3M estimate.

The trend extends beyond the MBA’s outlook. Fannie Mae reduced its home sales growth expectations for 2025 from 11% to 4%, while HousingWire and Goldman Sachs forecast existing home sales at 4.2M.

Tariff Risks Loom

A key factor contributing to these adjustments is the potential inflationary impact of President-elect Trump’s proposed tariffs. His campaign floated a 10% blanket tariff on imports and higher rates on goods from China and Mexico.

Economists warn that such measures could reignite inflation, compelling the Federal Reserve to pause planned rate cuts or even increase rates further.

Why It Matters

With mortgage rates hovering near 7% and the Federal Reserve’s next moves unclear, the housing market faces a challenging 2025. Higher mortgage rates are expected to constrain housing affordability, suppress demand, and weigh the housing market’s recovery.

The potential for inflation-driven monetary tightening adds another layer of uncertainty for homebuyers and the broader real estate sector.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes