Moody’s CRE Broker Solutions Overview

Moody’s is dedicated to providing brokers with the tools and insights needed to stay ahead of the market. Moody’s comprehensive suite of broker solutions includes the open-to-the-public Moody’s CRE Marketplace, the newly rebranded Market Core (formerly Catylist), and the premier offering, Market Pro. Each solution is tailored to meet the diverse needs of the CRE community, from increasing listing visibility on a nationwide Marketplace to offering in-depth market analyses and forecasts through Market Pro.

Market Core provides a robust foundation of capabilities that combines essential listing services, extensive CRE data, marketing, and reporting functionalities for brokers. Market Pro builds upon the features of Market Core by offering advanced market analytics, comprehensive economic briefings, true owner data, and unique data sets designed for brokers seeking a competitive edge.

Market Pro Overview

This review will focus on Market Pro, which offers comprehensive market-level and property-level data, including forecasts, trends, and granular details for various property types. The platform covers 8.2M properties with detailed information on the unit mix, asking rents, tax info, and deed/mortgage history. Market Pro includes unique features like commercial location scores and detailed loan information for CMBS, Freddie Mac, and Fannie Mae loans.

For nearly a decade, Moody’s has invested world-class resources into building a comprehensive CRE data platform that creates a seamless, intuitive, and comprehensive solution. Market Pro is meticulously designed to empower brokers by offering deep insights into market trends, supply and demand dynamics, and demographic shifts, facilitating a nuanced understanding of the ever-changing CRE landscape.

Our Take On Moody’s Market Pro

Best for brokers and CRE professionals seeking a comprehensive data tool that offers market research and business development resources

Market Pro distinguishes itself through its analytical capabilities and ensuring that all listings are prominently featured on the CRE Marketplace. This integration guarantees that every listing benefits from maximum visibility, reaching a wide and engaged audience actively seeking commercial spaces, properties, and listing availabilities.

Pros

Pros- Comprehensive market-level and property-level data and KPIs, including forecasts, trends, and granular details for various property types

- Economist-curated metro-level overview narratives for 300+ metro areas

- Granular loan details for CMBS, Freddie Mac, and Fannie Mae loans and key data points for balance sheet loans from public records

- Custom searches, market analysis, and transaction tracking

- All Market Pro listings are automatically published to the public Marketplace

Cons

Cons- Ongoing data expansion (perfection is always a moving target)

- Developing more sophisticated, on-the-fly analytics capabilities

Pros Explained

Comprehensive market-level and property-level data: Market Pro offers extensive data at market and property levels, covering forecasts, trends, and granular information across different property types, including niche categories like student housing, senior living, affordable housing, and self-storage. Their team of CRE economists crafts detailed forecasts on rents, vacancies, and construction, which are essential for property valuation, loan underwriting, and market analyses. Users can explore historical and forecasted data on rents and vacancies, with multiple forecast options like baseline and multiple downside scenarios.

Human-generated metro-level overviews for 300+ metro areas: Market Pro features expertly crafted overviews for over 300 metro areas written by expert data scientists and economists. These narratives provide insightful, human-generated summaries of each market’s economic drivers, trends across property types, and future outlooks. Investment and lending committees highly value this personalized analysis, seeking a solid market understanding before making critical decisions. For added convenience, Moody’s also offers executive briefings tailored to specific property types, giving users a quick, data-driven snapshot of the market landscape relevant to their interests. Many large lenders in the CRE market leverage this content in underwriting decisions, making it valuable for brokers to know what their debt market counterparts are seeing.

Vacancy Trends and Forecast

Multifamily Performance Data

Granular loan details for CMBS, Freddie Mac, and Fannie Mae loans: The Market Pro platform also provides highly detailed loan information for CMBS, Freddie Mac, and Fannie Mae loans, covering every key metric. Whether it’s a specific loan’s origination date, maturity, rate, or term, users can access a granular level of data, including amortization details, interest-only terms, and delinquency or watchlist status and commentary. Additionally, users will find comprehensive financial data—revenues, expenses, NOI, debt service coverage, occupancy rates, and appraisals—all in one place.

Loan Data and KPIs

Loan Details

Custom searches, market analysis, and transaction tracking: The Market Pro platform empowers users to conduct custom searches with alerts, perform targeted market analysis, and track transactions precisely. If, for example, you’re interested in retail spaces within a specific area, you can view real-time data on properties for sale or lease, recent sales and lease comps, average sale and lease prices, and price per square foot. Explore historical trends, filter outliers, and analyze transaction volume over time. You can even check current asking rents, distinguishing between triple net and gross leases. Additionally, users can gain insights into active market players, enabling informed, strategic decisions at every level.

Cons Explained

Ongoing data set expansion: Moody’s has completed an extensive property data expansion executed by hundreds of researchers and connected to internal and external partner datasets. Moody’s efforts have focused on building a robust, property-level dataset, including highly detailed inventory information for listings, available spaces, and properties for sale. In certain markets, Moody’s is finalizing the listing inventory buildout, expected to be complete in early 2025. CRE data constantly evolves, and Moody’s is committed to continual updates and improvements to keep its platform ahead of the curve.

Developing more sophisticated on-the-fly analytics capabilities: Moody’s is committed to developing advanced, on-the-fly analytics capabilities that take real-time insights to the next level. Imagine instantly accessing beautifully visualized, dynamic KPIs—like a Tableau experience—where you can pivot analyses across any dimension: lender, owner, tenant, property type, and more. With powerful on-the-fly analytics, users can dive deep into the metrics that matter most, enhancing their decision-making with speed and precision. This expanded functionality is a significant focus for Market Pro.

Moody’s CRE Product Offerings

Market Pro delivers comprehensive, data-driven insights for market and property levels across all property types, including niche sectors like student housing. With human-crafted metro-level narratives for 300+ areas, automated executive briefings, and granular property details for over 8.2M assets, the platform is ideal for in-depth analysis.

Comprehensive Market-Level Data

Market Pro encompasses all property types. It delivers in-depth trends and forecasts on key metrics such as rents, vacancies, and construction activity. Users can access insightful, human-generated metro-level overviews for over 300 metro areas and automated executive briefings tailored to specific property types for quick, relevant market insights.

Extensive Property-Level Data for Deeper Insights

Market Pro property-level data spans 8.2M properties, offering rich details like the unit mix, asking rents, tax data, and deed/mortgage history. It monitors local climate regulations impacting properties and features an exclusive “commercial location score” to rank location desirability. The platform provides comprehensive loan data for even deeper insights into CMBS, Freddie Mac, and Fannie Mae loans, helping users confidently make informed, location-based decisions.

Analytics and Visualization Tools

Moody’s analytics and visualization tools empower users with customizable searches, targeted market analysis, and real-time transaction tracking. Users can easily access comp sets and conduct detailed property market comparisons to gain competitive insights and make more informed, confident, data-driven decisions.

Sales Analytics Scatter Chart

Public-Facing Marketplace

Moody’s has innovated the CRE landscape by introducing a CRE Marketplace that is fully open to the public. The Marketplace enhances the user experience, connecting buyers, tenants, and brokers as they navigate the journey to discover their next deal, client, or space. By providing transparent inventories and consistent and reliable data, Moody’s open Marketplace fosters stronger brokerage connections and brings efficiency to the industry, creating a win-win for all.

User Experience

Market Pro offers a streamlined, intuitive experience designed to simplify commercial real estate analysis and decision-making for users of all experience levels.

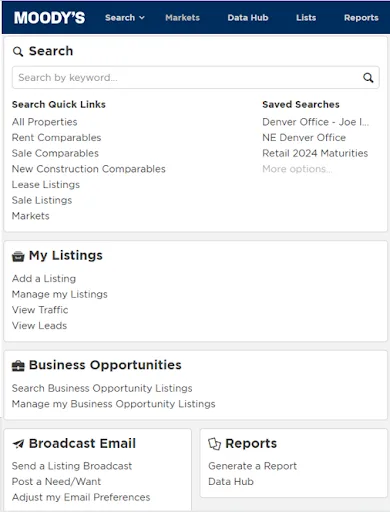

Upon logging in, users are greeted with a clean, well-organized dashboard that provides quick access to powerful tools for property search, market analysis, and transaction tracking.

The search functionality is easy to use and highly customizable. Users can filter by property type, location, market trends, and specific metrics like asking rents or vacancy rates.

Navigating between market-level and property-level data is seamless, with each section logically structured to provide insights at a glance. Users can also dive deeper with just a few clicks, accessing detailed reports, loan data, and visually presented trends to enhance comprehension.

Visual elements, like trend graphs and interactive maps, help convey complex data in a digestible format. Custom searches and market comparisons can be set up in seconds, empowering users to make informed, strategic decisions efficiently.

Customer Support

Moody’s customer support is structured to meet diverse needs with a tiered approach:

- Level 1: A dedicated, large-scale client service team ensures prompt, reliable assistance, adhering to service-level agreements for maximum responsiveness.

- Level 2: Moody’s Customer Success team provides consultative, relationship-focused support, working closely with clients to maximize their platform experience and success.

For larger clients, Moody’s offers exclusive, value-added services:

- Speaking Engagements: Access to their experts for impactful presentations and insights at your events.

- Custom Research: Moody’s offers tailored research and deliverables to meet customers’ unique business objectives and information needs.

Pricing

The Marketplace, a standout feature of Moody’s offerings, is accessible at no cost, allowing all users to benefit from the nationwide listings.

Moody’s offers tiered solutions, with broker-focused products starting at approximately $500 monthly. Moody’s premium access package is designed for brokers who want top-tier insights and tailored tools.

Pricing is customized to fit any business’s unique requirements. Moody’s enterprise pricing varies based on business size, assets under management, use case, and division, offering flexibility to best align with an organization’s objectives.

Moody’s pricing is fairly competitive with other leading financial services data providers, ensuring you receive exceptional value and expertise at a comparable rate.

Competitors

Market Pro’s main competitors are Green Street, CoStar, and MSCI.

Green Street

Green Street is a market-level data competitor for Market Pro. Green Street’s Data & Analytics solution delivers analytics and actionable intelligence that empowers private and public commercial real estate investors to make wiser investment decisions, optimize portfolios, mitigate risks, and secure capital effectively.

Their data coverage spans 18 property sectors, 80 major markets, and 147 REITs and publicly traded real estate firms in the U.S. and Europe. Additionally, they offer data, market grades, and forecasts for 334 tertiary U.S. markets across four core sectors.

Green Street’s proprietary tools offer a data suite with verified sales comps, rent comps, cap rates, Commercial Property Price Indices® (CPPIs®), return expectations, REIT NAV models, debt market metrics, and exclusive insights. Their solutions integrate into models and workflows, providing flexible access to extensive time series data and market forecasts.

Their solution is highly regarded in the real estate industry for its strong, independent macro-level insights and research. The platform is known for providing valuable, unbiased perspectives that help professionals make well-informed strategic decisions.

Green Street is especially recognized for its superior research on Real Estate Investment Trusts (REITs), making it an essential resource for investors and analysts focused on REIT markets.

The platform has a few limitations that users should keep in mind. Green Street offers limited property-specific data compared to other providers, which may disadvantage professionals seeking detailed information on individual properties.

Additionally, Green Street only covers transactions valued at $5M or more, potentially excluding smaller deals that could be relevant for users. Users may also require additional training to become fully proficient, as its features and tools can take time to master.

CoStar

CoStar is a property-level data competitor to Moody’s. For over 37 years, CoStar has been a leading platform for commercial real estate information, analytics, and news, empowering professionals across industries to make faster, more informed decisions.

CoStar uses a census-level approach to deliver the most comprehensive and accurate data available. Its technology transforms this data into actionable insights, giving users a complete, dynamic market picture.

With an inventory covering over 7M commercial properties, CoStar offers market insights, opportunity identification, asset analysis, transaction analysis, and market forecasting. The platform provides access to one of the most comprehensive property databases available, giving users a near-unrivaled depth and breadth of information.

CoStar is also a go-to resource for sales and lease comps. Its data is highly trusted, setting the standard across the industry and giving professionals reliable insights for informed decision-making.

CoStar has a few notable drawbacks that users should consider. It lacks built-in lead-generation tools, which may be a limitation for professionals looking to expand their client base directly through the platform.

CoStar is also among the most expensive platforms in the industry, which can be a significant consideration for budgeting. Its pricing model lacks transparency and consistency, making it challenging for users to understand costs upfront or anticipate future expenses.

MSCI Real Capital Analytics

MSCI’s Real Capital Analytics is a property-level competitor of Moody’s Marketplace. MSCI’s solutions empower institutional investors with a clear, intuitive view of risk and return by directly integrating award-winning risk tools and actionable insights into investment decisions.

Built on rigorously reviewed data, MSCI’s platform enables smarter investment choices and a deeper understanding of risks across all asset classes and time horizons, including market, factor, credit, liquidity, and counterparty. It maintains a team of over 60 research analysts who verify data integrity, ensuring users can trust the accuracy and reliability of the information provided.

MSCI offers valuable features that enhance its appeal to real estate professionals. It provides detailed profiles of investors and property owners, giving users critical insights into key market players. The platform’s TrendTracker tool analyzes essential metrics for the top 50 metro areas in the U.S., making it easier for users to monitor major market trends.

Of course, MSCI has some limitations that may impact its usability for certain real estate professionals. The platform does not offer leasing data or ownership contact info, which can be a drawback for users who need comprehensive market information. Also, MSCI’s user interface isn’t the most intuitive, which may pose a learning curve and reduce efficiency for new users.

FAQs

Joining Market Pro as a broker is simple and seamless. Moody’s makes it easy to elevate your presence in the commercial real estate market from day one via the Marketplace.

Just visit moodyscre.com and sign up for a free Marketplace account. Once your credentials are verified, you’re ready to dive in. Start creating new listings immediately or effortlessly manage existing ones that are likely already showcased on our platform.

Moody’s is driven by a powerful, tech-enabled research team that meticulously verifies listings for accuracy and refreshes data at least every 30 days.

Plus, with tens of thousands of brokers actively managing their listings in real time, Moody’s delivers the most up-to-date and reliable information available.

This blend of cutting-edge technology and hands-on expertise makes Moody’s solutions a trusted resource for CRE professionals seeking dependable data and insights.

Market Pro offers brokers a dynamic platform far beyond standard listing. It’s a robust marketing and networking hub designed to maximize visibility and connections without the hefty costs of traditional options.

All listings from Market Pro are seamlessly published on the Marketplace, ensuring they receive nationwide exposure and connect with a wide audience of potential buyers and tenants.

For those searching for the ideal space, the Marketplace provides a comprehensive, up-to-date collection of listings—no limited inventory or biased promotions. Customers can see the entire market landscape in one place.

And with real-time updates, Moody’s solutions empower you to make the best, most informed decisions in commercial real estate.

How We Evaluated Moody’s Market Pro

When evaluating Market Pro, we examined several factors, including:

- Product and service offerings: We dug into Moody’s Market Pro features, products, and services, including its comprehensive property and market data.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make Moody’s stand out from its competitors.

- Ease of Use/Functionality: We examined Moody’s data platform’s user-friendliness, the intuitiveness of the onboarding process, and the speed with which a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated Moody’s existing customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined how Moody’s products and services are priced and whether readily available pricing information is available on its website.

Summary of Moody’s Market Pro Review

Moody’s is pioneering a new era in commercial real estate by providing the first platform that combines a thoroughly researched, nationwide inventory with unrestricted public access through the Marketplace.

Unlike other marketplaces that limit visibility to paid listings or showcase only broker-specific inventories, Moody’s is designed to be a comprehensive, transparent destination for anyone seeking commercial spaces and properties.

Moody’s vision is to be the go-to resource for CRE professionals and decision-makers, offering unmatched access to the full breadth of market opportunities. Moody’s commercial real estate data also serves as a foundation for Moody’s other products and solutions, including underwriting software, portfolio monitoring software, and its commercial real estate credit model.

Beyond listings, Market Pro delivers a robust data platform with extensive details, from true ownership information and debt data to CMBS/Freddie/Fannie insights.

Users also gain access to property details, sale comps, rent comps, updates on new projects, climate regulations, zoning, tax data, and predictive market trends, all supported by Moody’s commitment to continuous innovation and expansion.

At the heart of the CRE industry are people—brokers, investors, landlords, tenants—working hard, building connections, and making deals. Moody’s solutions are designed to enhance this network, creating a transparent and efficient environment that empowers CRE practitioners to do their jobs more effectively.

By supporting brokers’ success, the Marketplace expands transaction opportunities and stimulates more industry participation. This, in turn, attracts lenders, investors, and other stakeholders, ultimately adding greater value to the entire CRE ecosystem.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!