- Welltower is acquiring 38 ultra-luxury senior housing communities in Canada for $3.2B, reflecting its commitment to expanding in high-demand markets.

- The portfolio includes 31 stabilized properties and 7 properties under construction, which will be completed in the next two years.

- The deal marks Welltower’s second major acquisition in 2025, following a $1B purchase of 25 senior housing communities in the Pacific Northwest.

- Welltower is forming a strategic partnership with Amica Senior Lifestyles, including a minority stake in Amica’s management company, to enhance its platform and drive future growth.

- Welltower’s investment strategy aligns with forecasts predicting senior housing demand will exceed supply by 400K units by 2030.

Welltower (WELL), a leading healthcare and senior housing REIT, is expanding its portfolio with a major acquisition in the ultra-luxury senior housing sector, as reported by Bisnow.

The Ohio-based company announced it will spend nearly $3.2B to acquire 38 senior housing communities and nine entitled development parcels from Amica Senior Lifestyles. These properties are located in Vancouver, Victoria, and Toronto, three of Canada’s most affluent cities.

Strategic Canadian Investment

The purchase from the Ontario Teachers’ Pension Plan is expected to close in 4Q25. It marks another significant move for Welltower, just weeks after the company revealed plans to spend nearly $1B to acquire 25 senior housing communities in the Pacific Northwest from Affinity Living Communities.

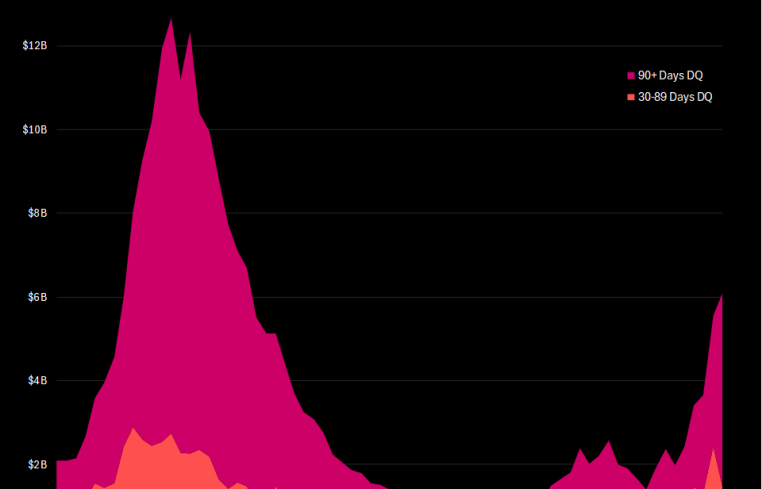

This deal reflects Welltower’s ongoing strategy to capitalize on the growing demand for senior housing. According to industry forecasts, demand for senior housing in North America is expected to outpace supply by nearly 400K units by 2030, prompting Welltower to increase acquisitions.

In 2024 alone, Welltower spent more than $6B during the first three quarters, surpassing the entirety of its 2023 acquisitions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

High-Quality Portfolio

The $3.2B deal includes 31 stabilized properties, with 7 additional properties currently in lease-up and expected to reach full occupancy soon. In addition, Welltower will acquire 7 more under-construction properties, which will be completed over the next two years as they receive certificates of occupancy.

Welltower’s CEO, Shankh Mitra, emphasized the high quality of the portfolio, calling it the “highest quality” in North America. “Against a backdrop of rapidly growing demand and limited new supply, we expect the portfolio to drive outsized revenue and cash flow growth in the coming years,” Mitra said.

The acquisition also includes a long-term strategic partnership with Amica Senior Lifestyles. As part of the deal, Welltower plans to purchase a minority stake in Amica’s management company. This partnership aims to leverage Welltower’s industry-leading data science capabilities to enhance the scale of Amica’s platform.

Expanding Footprint

In addition to the Amica deal, Welltower recently completed the sale of 5 senior housing communities for $175M to Brookdale Senior Living (BKD), one of the largest senior housing operators in the US.

This sale was part of a broader transaction in which Brookdale acquired a 25-community portfolio from Diversified Healthcare Trust (DHC) for $135M.

As Welltower continues to make large-scale acquisitions, the REIT remains focused on expanding its footprint in high-demand markets and positioning itself to capture the growing needs of an aging population.