- Crown Castle has reached an agreement to sell parts of its fiber business for a total of $8.5B.

- The transaction involves EQT AB acquiring Crown Castle’s small cells business, valued at $4.25B, and Zayo Group Holdings getting its fiber solutions business.

- The sale is expected to close by mid-2026, with Crown Castle planning a $3B share buyback program.

- The move allows Crown Castle to focus on its core business of multi-tenant towers, which had 4.5% organic revenue growth in 2024.

Telecommunications giant Crown Castle Inc. sold its fiber business for $8.5B, focusing on multi-tenant tower assets and launching a $3B share buyback program, according to Bloomberg.

Deal of The Day

Crown Castle agreed to sell separate parts of its fiber business to an EQT AB fund and Zayo Group Holdings Inc. for a combined $8.5B. This deal, set to close in 1H26, is part of Crown Castle’s plan to streamline its focus on multi-tenant tower assets, where it sees steady growth.

The deal involves two distinct parts of Crown Castle’s fiber business: the small cells unit, valued at $4.25B, will be acquired by EQT’s Active Core Infrastructure fund, while Zayo Group, backed by EQT and DigitalBridge Group Inc., will acquire the fiber solutions business.

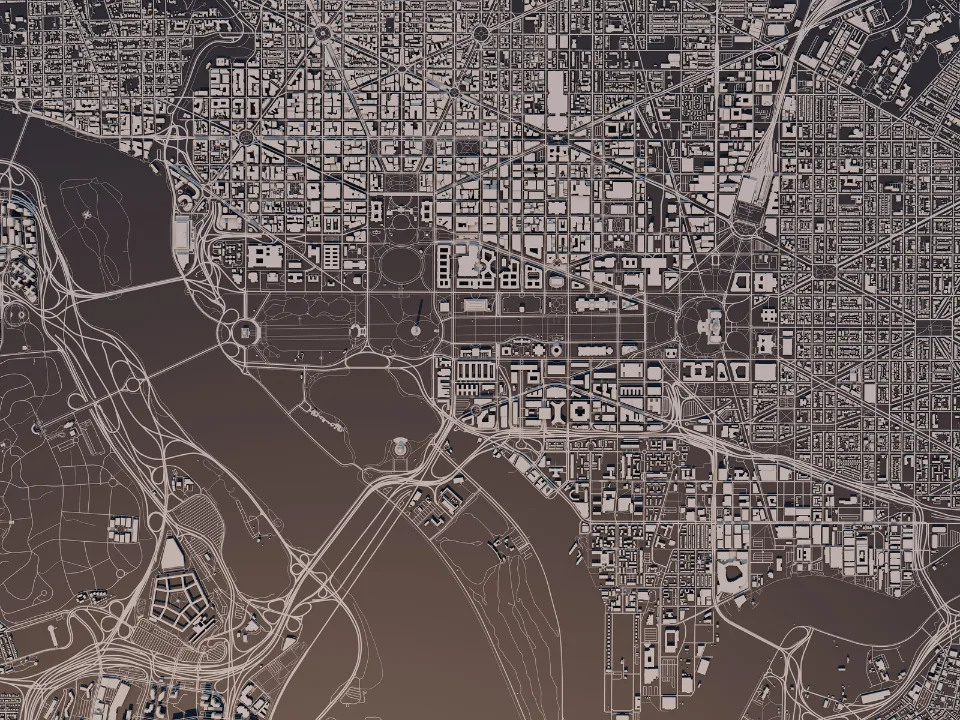

These moves allow Crown Castle to concentrate on core assets, with approximately 40K towers across the country, which saw 4.5% organic revenue growth in 2024.

Shifting to Core Business

Crown Castle’s CEO, Steven Moskowitz, stated the sale represents a “significant step” towards the company’s goal of being a “pure-play provider of multi-tenant tower assets.” As part of the deal, the company also announced a $3B share buyback program.

While Crown Castle’s shares have dropped 14% over the past year, the announcement of the deal led to a positive market reaction, with shares rising as much as 5.5% after the close of regular trading.

The company, which has faced pressure from activist investors like Elliott Investment Management, continues to adapt to a rapidly changing telecom and infrastructure market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Fiber Business Split

The fiber portion of the deal will add significant capacity to both EQT and Zayo’s operations. Crown Castle’s small cells business, which operates 115K small cells across 43 states, will enhance EQT’s infrastructure portfolio, with a focus on high-demand areas lacking large macro towers.

Meanwhile, Zayo’s acquisition of Crown Castle’s fiber solutions business will extend its reach by adding around 90K route miles of fiber to its network, expanding its overall coverage to over 70K locations.

This deal is the culmination of Crown Castle’s strategic review, which began in 2023, partly due to pressure from Elliott Investment Management. It concludes a 15-month process that saw various proposals, including one from TPG Inc. to buy both units, before Zayo presented a higher offer.