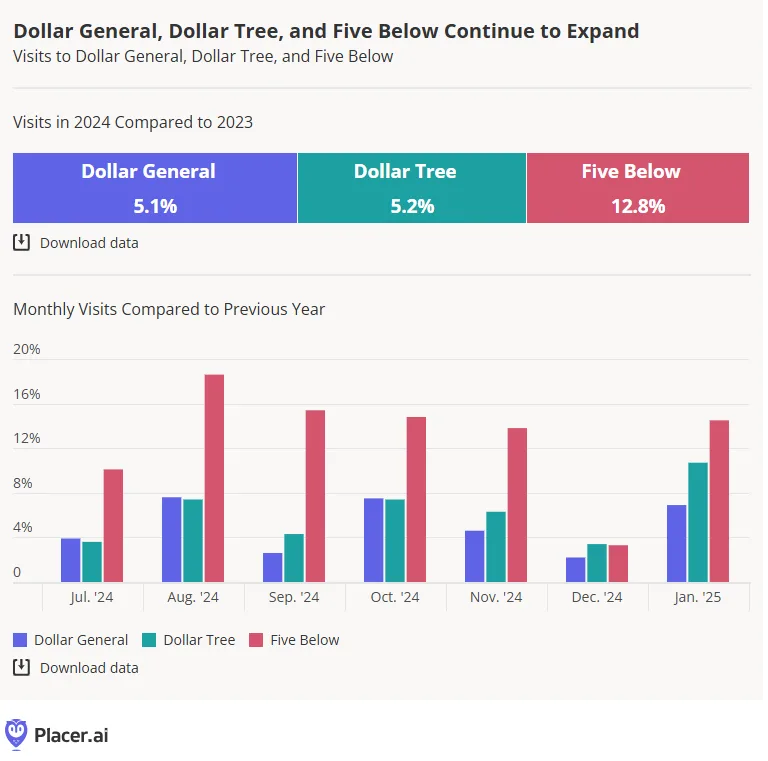

- Dollar General, Dollar Tree, and Five Below saw YoY traffic growth of 5.1%, 5.2%, and 12.8%, respectively, in 2024, supported by store expansion strategies.

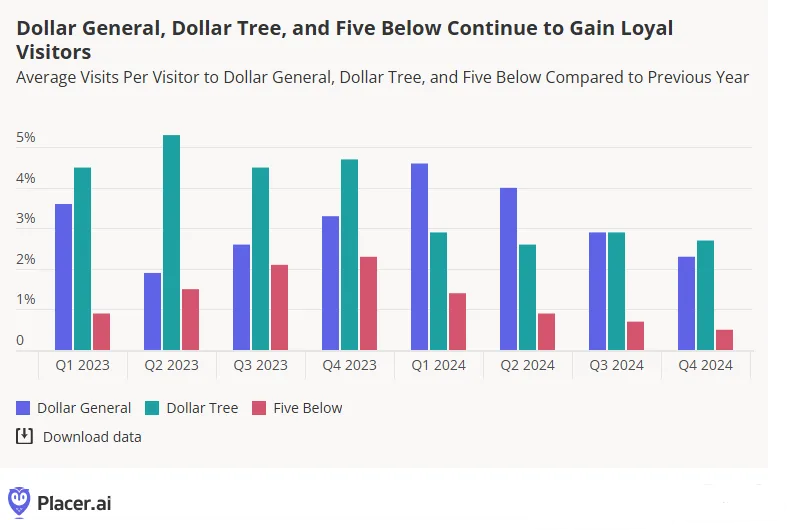

- Visit frequency has increased across all three chains since Q123, suggesting higher customer loyalty and repeat visits.

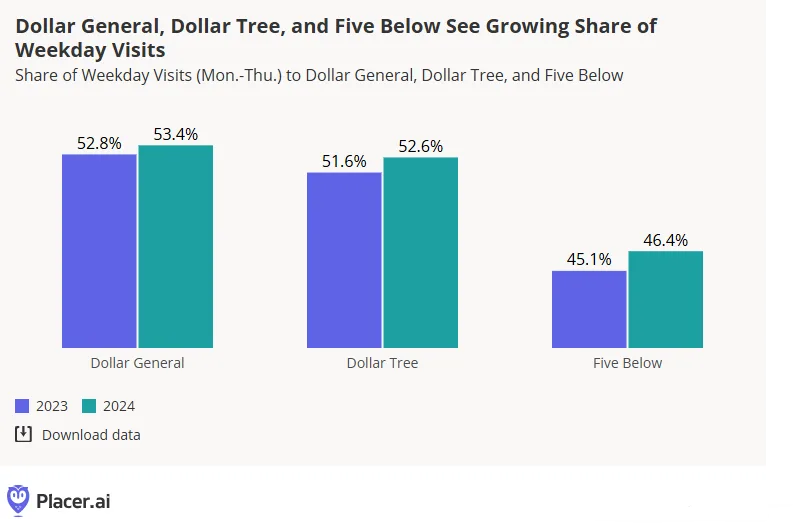

- Weekday visits (Monday through Thursday) rose in 2024, indicating consumers increasingly shop at discount retailers for everyday essentials.

The discount and dollar store sector continued its upward trajectory in 2024, with Dollar General (DG), Dollar Tree (DLTR), and Five Below (FIVE) leading the charge. These retailers, long known for their budget-friendly pricing, are now expanding their footprints and product assortments, drawing in both value-conscious and frequent shoppers, according to Placer.ai.

Expanding Footprints Drive Traffic Growth

A key factor in these retailers’ success is their aggressive expansion strategy. Since the second half of 2024, all three chains experienced consistent monthly visit growth compared to the previous year, leading to an overall increase in YoY traffic.

- Dollar General: +5.1% YoY traffic growth

- Dollar Tree: +5.2% YoY traffic growth

- Five Below: +12.8% YoY traffic growth

Even as 2025 unfolds, visits continue trending upward. A slight dip in February 2025 visits for Dollar General was attributed to the shorter February in 2024 (a leap year) rather than a decline in customer interest. Looking ahead, these retailers plan to keep investing in new stores and remodels, which should further drive foot traffic.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Repeat Visits Are on the Rise

Beyond just attracting more visitors, discount and dollar stores are also seeing an increase in visit frequency. Since Q123, the average number of visits per customer has steadily risen.

This trend suggests that shoppers are returning more often, likely due to:

- Rising inflation and economic pressures making discount shopping more attractive

- Expanded product assortments that meet more consumer needs

- Increased convenience with more store locations nearby

Weekday Visits Gain Momentum

Traditionally seen as destinations for discretionary, bargain-driven purchases, discount retailers are now playing a more prominent role in consumers’ daily routines.

In 2024, all three chains saw a rise in weekday visits (Monday through Thursday), indicating that shoppers are increasingly turning to these stores for essentials like snacks, health products, and beauty items.

Notably, Five Below saw the largest increase in weekday visits—from 45.1% in 2023 to 46.4% in 2024—suggesting stronger demand for its consumable product categories.

What’s Next for Discount Retail in 2025?

With strong foot traffic growth, repeat visits, and increasing demand for essentials, Dollar General, Dollar Tree, and Five Below are well-positioned for continued success in 2025. As inflation concerns persist and value-driven shopping habits remain prevalent, expect these retailers to continue expanding their footprints and diversifying their offerings.