- Over 138K units were absorbed in Q1 2025 — a record for the first quarter.

- New supply is slowing, with 2025 deliveries expected to drop 26% from 2024.

- Rent growth returned, rising 0.3% in Q1 — the first Q1 increase since 2022.

- Richmond is forecast to lead in rent growth, while Austin, Denver, and Phoenix may see slight declines.

Demand Defies the Downturn

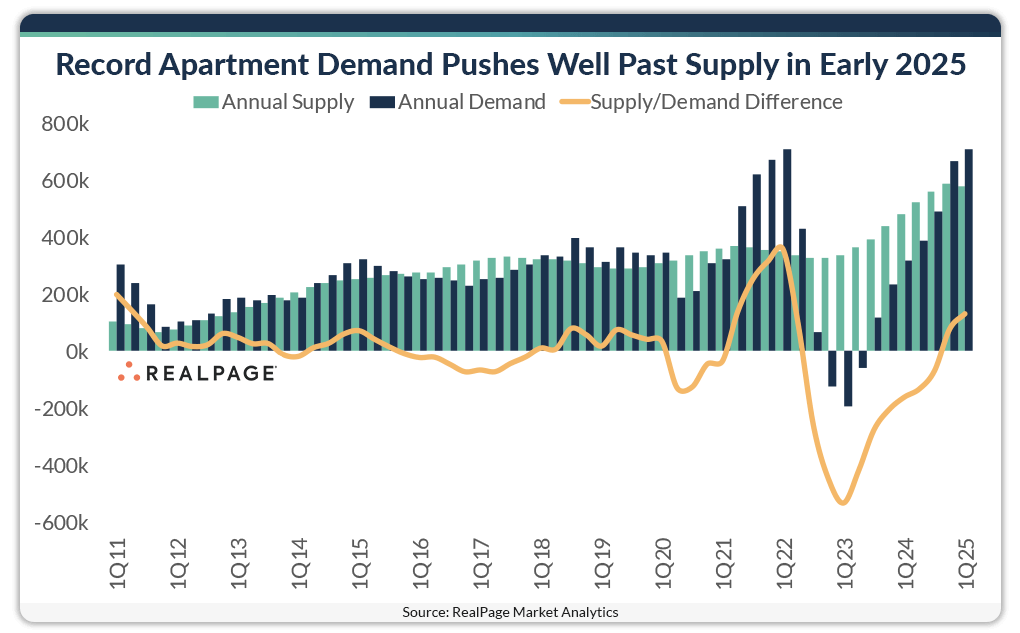

Multifamily apartment demand hit a Q1 record in 2025, highlighting the sector’s strength despite slower job growth and rising inflation, as reported by Real Page.

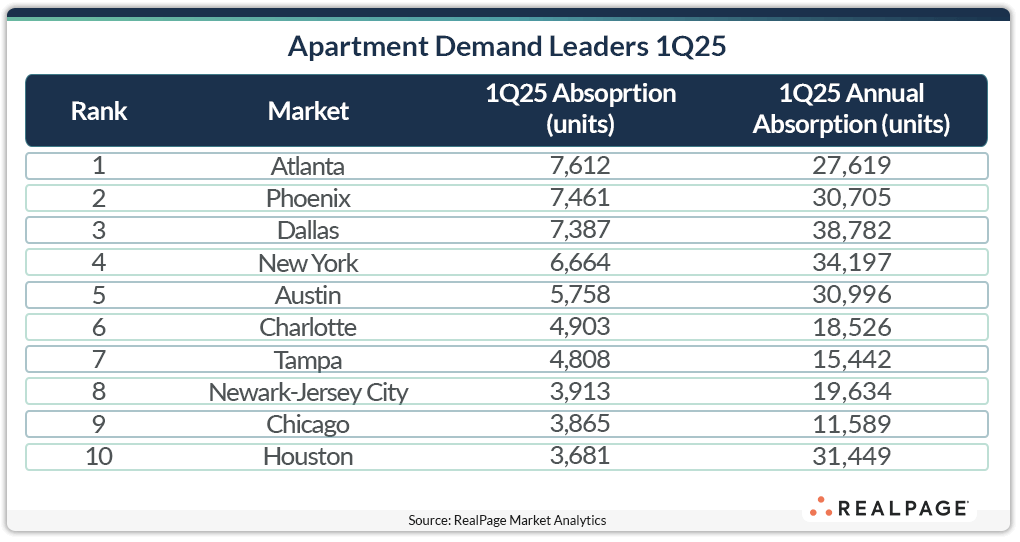

In Q1 2025, apartment absorption surged past 138K units — the strongest first-quarter performance on record. Leading the pack were Atlanta, Phoenix, and Dallas, while Anaheim was the only major market to report net move-outs.

Real Page anticipates total absorption of nearly 460K units in 2025, signaling continued multifamily apartment demand even amid weaker job growth and rising economic headwinds.

Supply Shrinks From Peak

On the development front, new supply is clearly decelerating. Roughly 116K units were delivered in Q1, and 2025 is expected to see a total of 431K units come online — a 26% drop from the previous year. This tapering supply could help balance markets still working through elevated vacancy rates due to prior construction surges, especially as multifamily apartment demand remains historically strong.

Rent Growth Returns

Nationally, effective asking rents climbed 0.3% in Q1 2025, marking the first Q1 rent growth in three years. The first Q1 increase in three years — buoyed by steady multifamily apartment demand in several key markets. Real Page expects rents to rise 2.3% this year, with about 32% of the top 50 markets forecast to see increases between 3.0% and 3.9%.

Richmond is projected to post the strongest gains, while Austin, Denver, and Phoenix may face modest rent cuts — a hangover from oversupply and slower economic growth in 2024. Despite a solid Q1 showing, Washington, DC’s forecast has been downgraded due to anticipated federal job losses.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Growth Slows, Inflation Ticks Up

While the multifamily market remains strong, macroeconomic indicators point to caution ahead. The US economy added just 456K jobs in Q1 — the weakest Q1 since 2011, excluding 2020 — falling short of the 10-year average. Government layoffs and new tariffs have further constrained growth.

Meanwhile, inflation is heating back up. The core PCE Price Index rose 40 basis points in February, following a 30-bps jump in January. These inflationary pressures, coupled with weaker job creation, may limit broader economic momentum through the rest of 2025.

Steady Demand Amid Mixed Signals

Despite slowing job growth and rising inflation, multifamily apartment demand and fundamentals remain strong. Absorption is on pace to match or exceed new supply, and rents are stabilizing. If economic headwinds moderate, the sector could maintain positive momentum — but for now, resilience will be key.