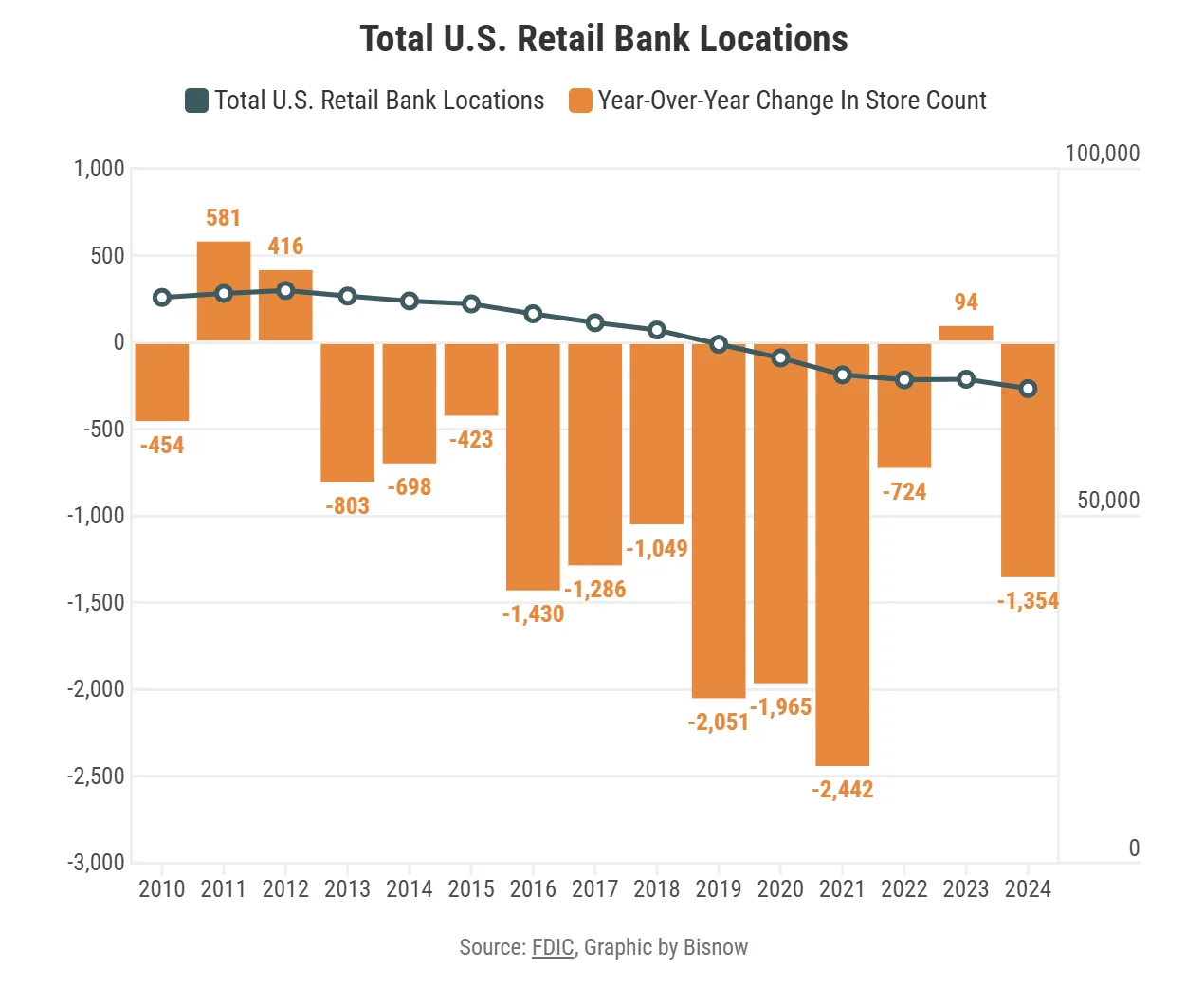

- The US lost 1,354 bank branches in 2024, reversing a temporary uptick in openings seen the year before.

- Tight retail vacancy rates have made former bank locations highly desirable for retailers, medical offices, and restaurants.

- Reuse or redevelopment of these prime retail parcels is often more profitable for landlords, especially given the limited new construction in recent years.

Banks Out, Tenants In

As reported by Bisnow, retail bank closures picked up again in 2024 after a brief pause in 2023. Banks shut down 1,354 branches last year, adding to a decade-long decline. Since 2010, the US has seen 13,588 branches disappear, according to FDIC data.

Banks say customer behavior is driving the shift. More people handle basic transactions on their phones, reducing the need for physical locations. As a result, banks now focus in-person visits on complex services like loans or financial planning.

“There’s very limited new supply,” said Terrison Quinn of SRS Real Estate Partners. “There’s enough demand out there, and we’re often competing for these boxes.”

Prime Real Estate

Freestanding bank buildings on outparcels or corner lots are valuable. These spots, often near major retailers like grocers or Target, attract strong interest. Even as more branches close, landlords don’t see long-term vacancies.

Retail vacancy rates stayed low in 2024, ending the year at just 4.1%. Many landlords quickly repurpose empty banks or sign new tenants, and bank closures have only intensified competition for these prime spaces. It typically takes six to twelve months to lease or sell a former branch, said JLL’s Vijay Jesrani.

Some owners reuse the buildings. They convert banks into urgent care centers, veterinary clinics, or split the space for restaurants. Others choose to demolish the structure and sign a ground lease with a corporate tenant.

Vault removal is often a sticking point. These heavy features add costs and delay deals, especially when a tenant plans a full rebuild. Still, demand stays high.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Evolution of Banking

Banks are rethinking their branches, not abandoning them entirely. The classic model—tellers behind glass and pens on chains—has faded. In its place, many banks offer a concierge-style experience. Employees with tablets now greet customers and help with advanced services.

US Bank said it’s adapting to customers’ digital preferences and simplifying services. Bank of America and Wells Fargo echoed this approach. Both cited changes in foot traffic and consumer habits as reasons to close or consolidate locations.

Jesrani noted that banks remain strategic about site selection. They still seek high-traffic, high-visibility locations. Some even target properties near Amazon return centers or Starbucks to attract younger users.

“Getting into a market is not so hard,” Jesrani said. “Getting the exact spot you want is challenging.”

Why It Matters

Banks continue to shrink their footprints, but that hasn’t hurt retail landlords. In fact, the trend has created new opportunities. Prime locations once locked into long leases are now hitting the market.

Many landlords now choose between quick conversions and long-term redevelopment. While reuse generates faster income, ground leases with national tenants often yield higher long-term returns.

As digital banking rises, expect more retail banks to shift strategies. In turn, landlords will continue to benefit from high demand for quality retail space.