- Despite e-commerce growth, over 80% of retail transactions still happen in-store, reinforcing the continued relevance of physical retail.

- Post-pandemic behavior shifts fueled beauty’s rise, softened demand for home goods, and boosted off-price retail as shoppers reprioritized.

- Grocery, dollar stores, and warehouse clubs gained long-term traction by meeting shoppers’ needs for affordability and convenience.

- Discretionary retail is rebounding, but success in 2025 will depend on appealing to high-income consumers and adapting to ongoing economic uncertainty.

Retail After Lockdowns

Five years ago, thousands of US stores closed seemingly overnight. At the time, retail insiders speculated whether the pandemic would be the final blow for physical retail. In 2025, retail looks much like it did pre-pandemic—resilient and refocused, as The Anchor reports.

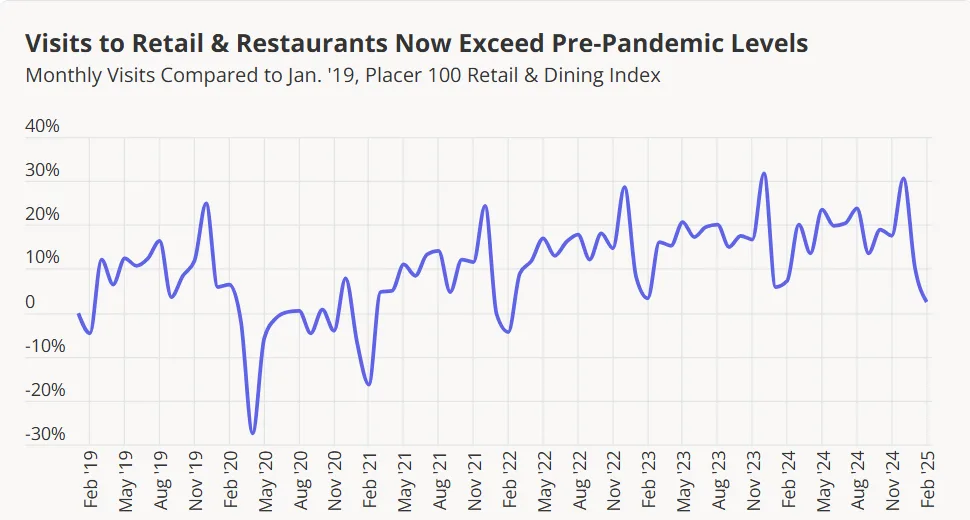

Despite the digital acceleration, the majority of retail activity still happens offline. Brick-and-mortar stores have not only survived but, in many cases, thrived, with foot traffic surpassing pre-2020 levels, according to the Placer.ai Retail and Dining Index.

The Category Shuffle

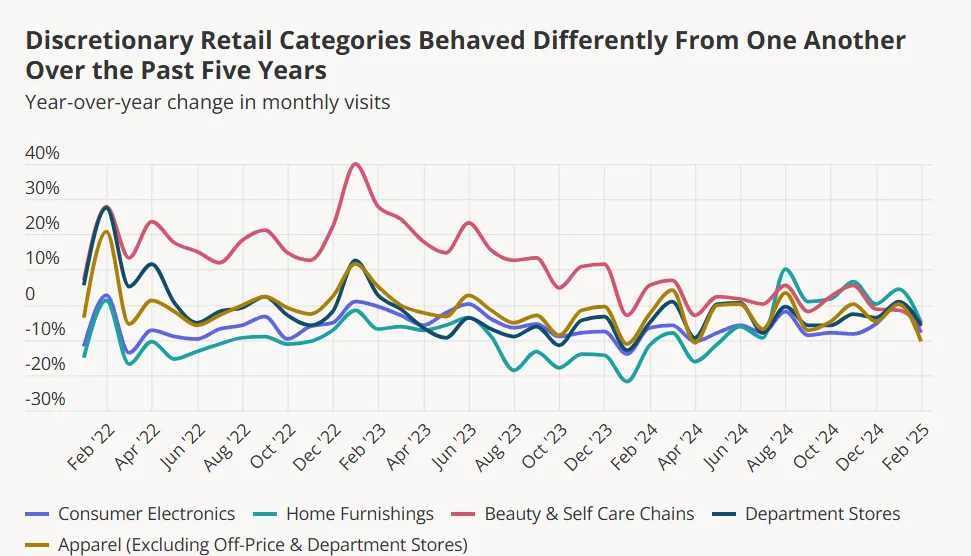

Post-pandemic, category performance diverged dramatically:

- Beauty became the standout discretionary winner, buoyed by social media influence, the return of in-person socializing, and value-driven mass market appeal.

- Home goods and consumer electronics, which saw major gains in 2020 and 2021, experienced demand fatigue—but began a slow rebound in 2024.

- Apparel sales took time to bounce back as work-from-home norms reduced the need for traditional wardrobes. But trends like wellness culture and new sizing needs helped drive a return to fashion in 2024.

Meanwhile, off-price retail emerged as a consistent performer, combining value, in-store discovery, and immediate availability to meet shifting consumer expectations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Essential Retail’s Reinvention

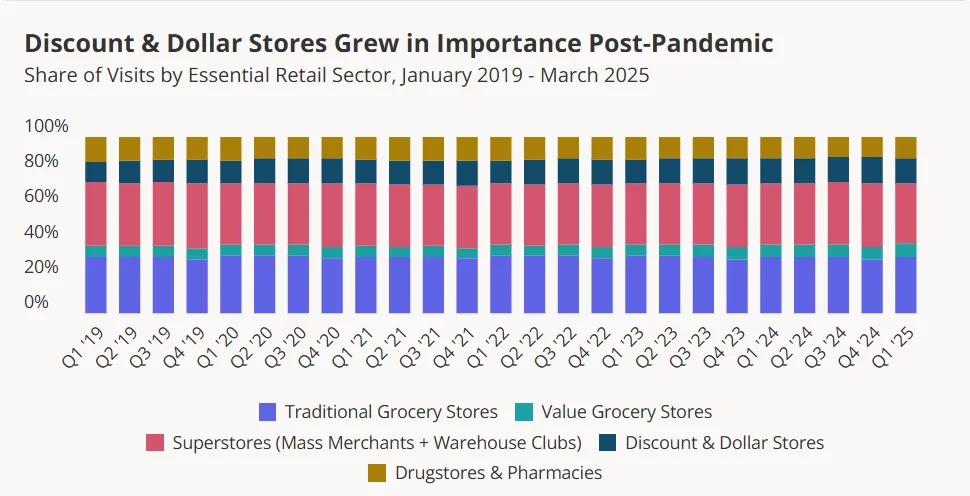

The pandemic cemented the role of essential retail—grocery, pharmacy, and superstore chains—in consumers’ lives. What started as crisis response behavior has evolved into habitual loyalty. Consumers now make more frequent visits to grocery chains, favoring trusted retailers for their daily needs.

Dollar stores and discount grocers saw the largest gains in visit share, especially among inflation-conscious consumers. Chains like Dollar General, Aldi, and Trader Joe’s capitalized on their value proposition and geographic expansion. By contrast, drugstores, initially boosted by vaccine demand, have struggled to retain relevance. Increased competition from beauty chains, wellness brands, and superstores, coupled with overbuilt footprints, has left the sector searching for its post-pandemic identity.

Evolving Store Visits and Shopping Habits

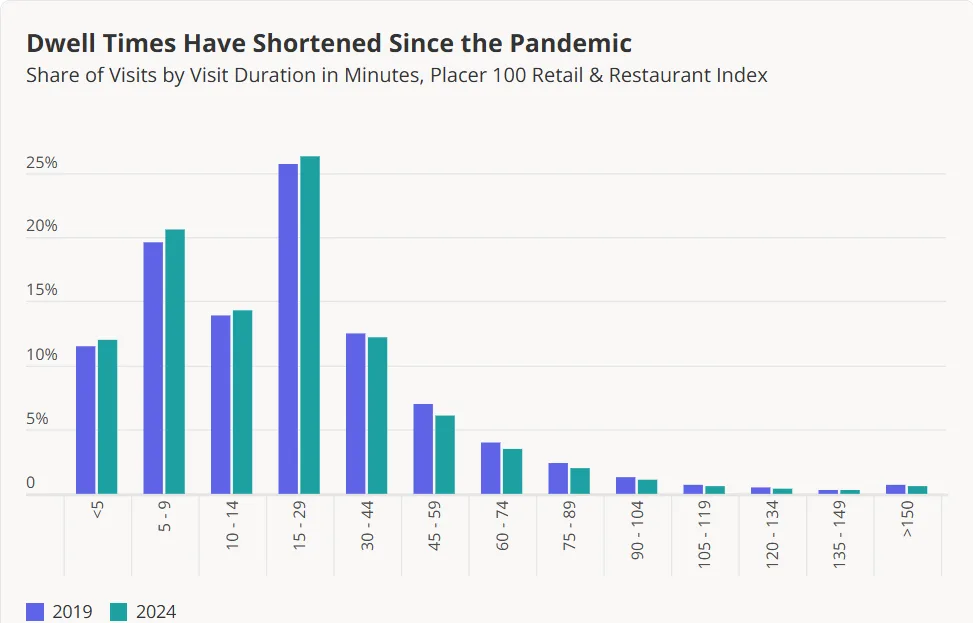

While foot traffic has rebounded, dwell times are down. Shoppers are more mission-driven, possibly due to:

- Pre-shopping online to streamline in-store trips

- BOPIS and curbside adoption

- More frequent but shorter trips

Additionally, weekday visits are up, reflecting hybrid work schedules that allow shoppers to avoid weekend crowds.

From a demographic lens, high-income consumers are making fewer trips but spending more per visit—making them increasingly important to discretionary retailers. Lower-income consumers, meanwhile, are visiting essential stores more frequently to manage rising costs.

Challenges and Opportunities Ahead

The road hasn’t been easy for discretionary retail, but signs of recovery are visible. As economic pressures persist, success will hinge on understanding evolving consumer expectations.

- Off-price and value retailers remain well-positioned to capture demand in a cautious spending environment.

- Discretionary players must emphasize differentiation—through price, experience, or assortment—to lure shoppers away from online alternatives.

- Store openings are on the rise, not for showy experiences, but to deliver reliable, frictionless service.

Looking Forward

Retailers can’t be everything to everyone. But the most successful brands in the post-pandemic era have leaned into what they do best—be it convenience, value, or experience.

Five years after COVID-19’s arrival, the industry has proven its adaptability. And with new challenges on the horizon—economic uncertainty, changing demographics, and shifting consumer values—retailers who remain agile and connected to their core shopper will be the ones best positioned to thrive in 2025 and beyond.