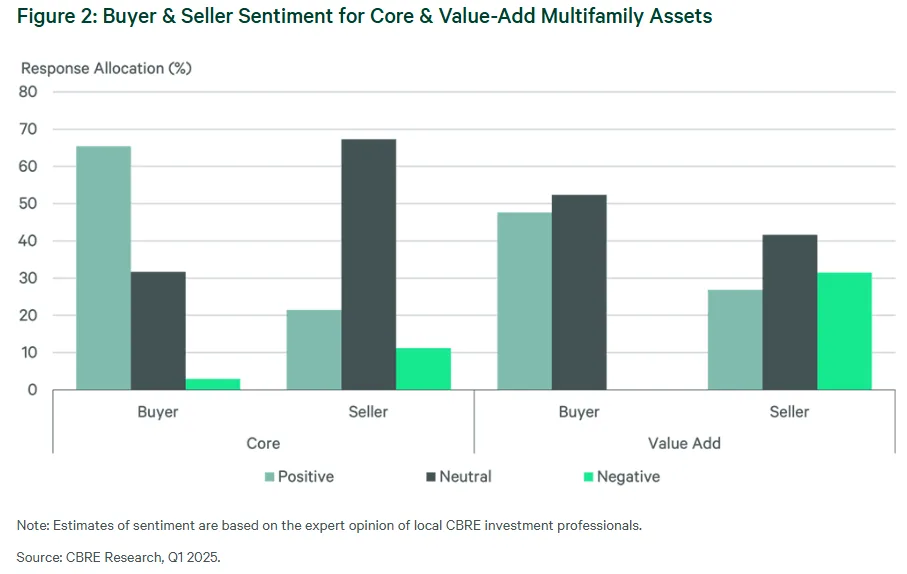

- Buyer and seller sentiment improved for both core and value-add multifamily assets, with the strongest gains seen in the core segment.

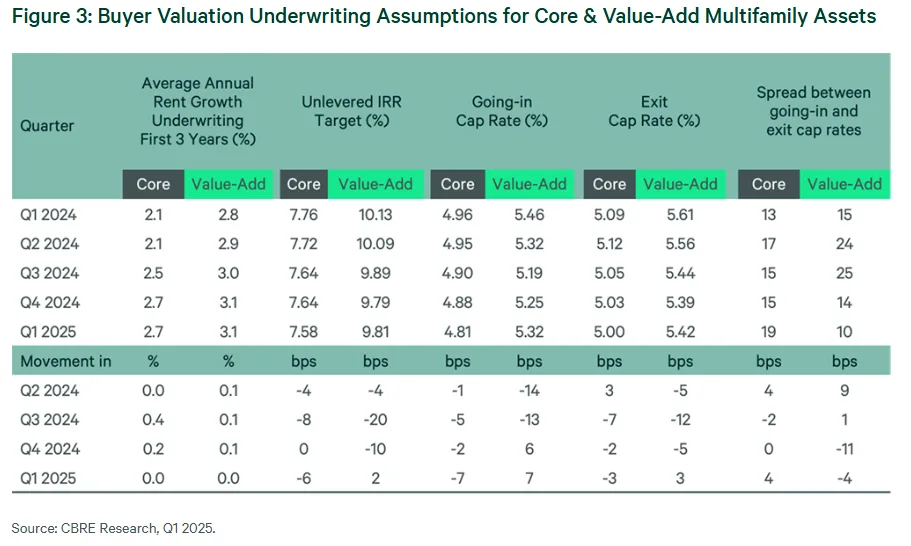

- Cap rates for core assets compressed, reflecting renewed investor confidence, while value-add cap rates increased slightly.

- Despite uncertainty from the Trump administration and the Fed’s cautious rate path, underwriting assumptions remained stable across most markets, especially for annual rent growth expectations.

- The spread between going-in and exit cap rates for core assets widened, while value-add spreads narrowed for the second straight quarter.

A Sentiment Shift in Multifamily

Multifamily investor sentiment saw an uptick in Q1 2025, with buyers and sellers alike more optimistic—especially in the core segment, per CBRE.

This comes as a welcome development amid macroeconomic uncertainty, including slower-than-expected interest rate cuts and a wait-and-see approach to anticipated policy shifts under the Trump administration.

Core Assets Lead the Rebound

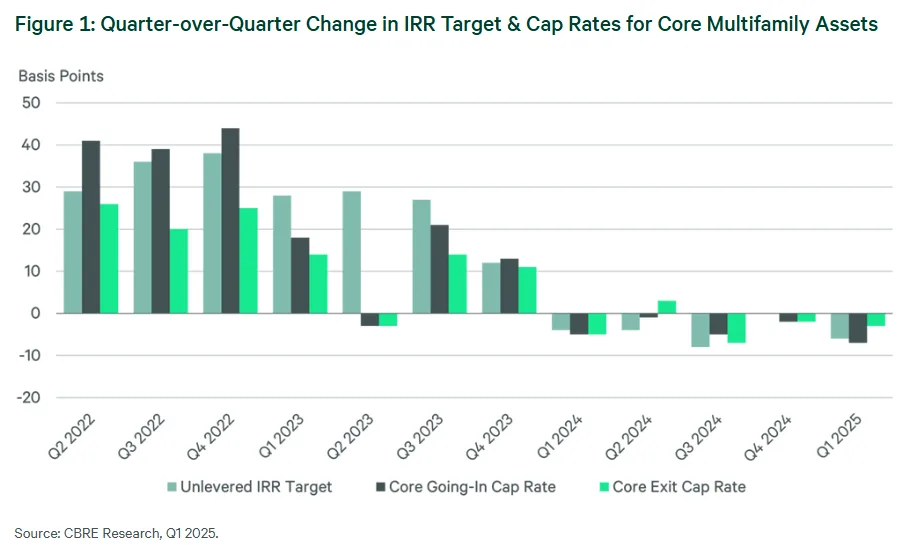

Core multifamily assets saw cap rate compression, with going-in cap rates falling 6 basis points (bps) to 4.83% and exit cap rates down 3 bps to 5.00%. Unlevered IRR targets dipped by 6 bps to 7.58%, a level not seen since mid-2023. Meanwhile, the spread between going-in and exit cap rates widened to 19 bps—a signal of increasing investor confidence in the sector’s long-term stability.

Sentiment among core buyers surged, with 65% expressing positive sentiment—up from just 44% last quarter. Seller sentiment also turned more neutral, indicating a potential alignment between pricing expectations.

Value-Add Shows Mixed Results

While sentiment improved slightly for value-add investors, underwriting metrics painted a more cautious picture. Value-add going-in cap rates rose 7 bps to 5.32%, and exit cap rates ticked up to 5.42%. The IRR target increased by 2 bps to 9.81%. Notably, the spread between going-in and exit cap rates narrowed for the second consecutive quarter, falling to just 10 bps.

Markets like Austin and Miami saw modest cap rate compression in value-add deals, but four other markets posted increases, signaling uneven optimism in the space.

Regional Dynamics and Rent Growth Outlook

Seven markets, including Los Angeles, Washington, D.C., and San Francisco, saw compression in core cap rates. Meanwhile, Indianapolis bucked the trend with a slight increase. Rent growth projections held steady—2.7% for core and 3.1% for value-add over the next three years—reinforcing the narrative of market stabilization following a major supply wave.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

With investor sentiment improving across both asset types and fundamentals holding firm—particularly for core product—multifamily continues to present strong relative value. Developers and institutional investors may find more deal alignment in coming quarters, especially as capital markets stabilize and long-term policy direction becomes clearer.

What’s Next

Expect continued tailwinds in the multifamily market, particularly for core assets in Sun Belt markets and gateway cities. As the Fed gradually shifts toward a looser monetary stance and policy clarity emerges, investor appetite could broaden—bringing more liquidity and competition back to the market.