- Opportunity Zones boosted apartment construction in low-income areas, with new units opening at more than double the national rate since the program began in 2018.

- Developers and investors are pushing for “Opportunity Zones 2.0”, seeking to make the tax program permanent and more flexible to expand its reach and impact.

- Individual investors have been key participants, with over $40B raised through qualified funds—more than three-fourths of it targeted for residential development.

Incentive at Risk

As reported by CoStar, a tax incentive created by the 2017 Tax Cuts and Jobs Act is showing real results. Yet its future is uncertain. Opportunity Zones, aimed at boosting investment in struggling areas, are set to expire in 2026. Now, developers and investors are calling for a revamped “Opportunity Zones 2.0” to keep the progress alive.

A Measurable Impact

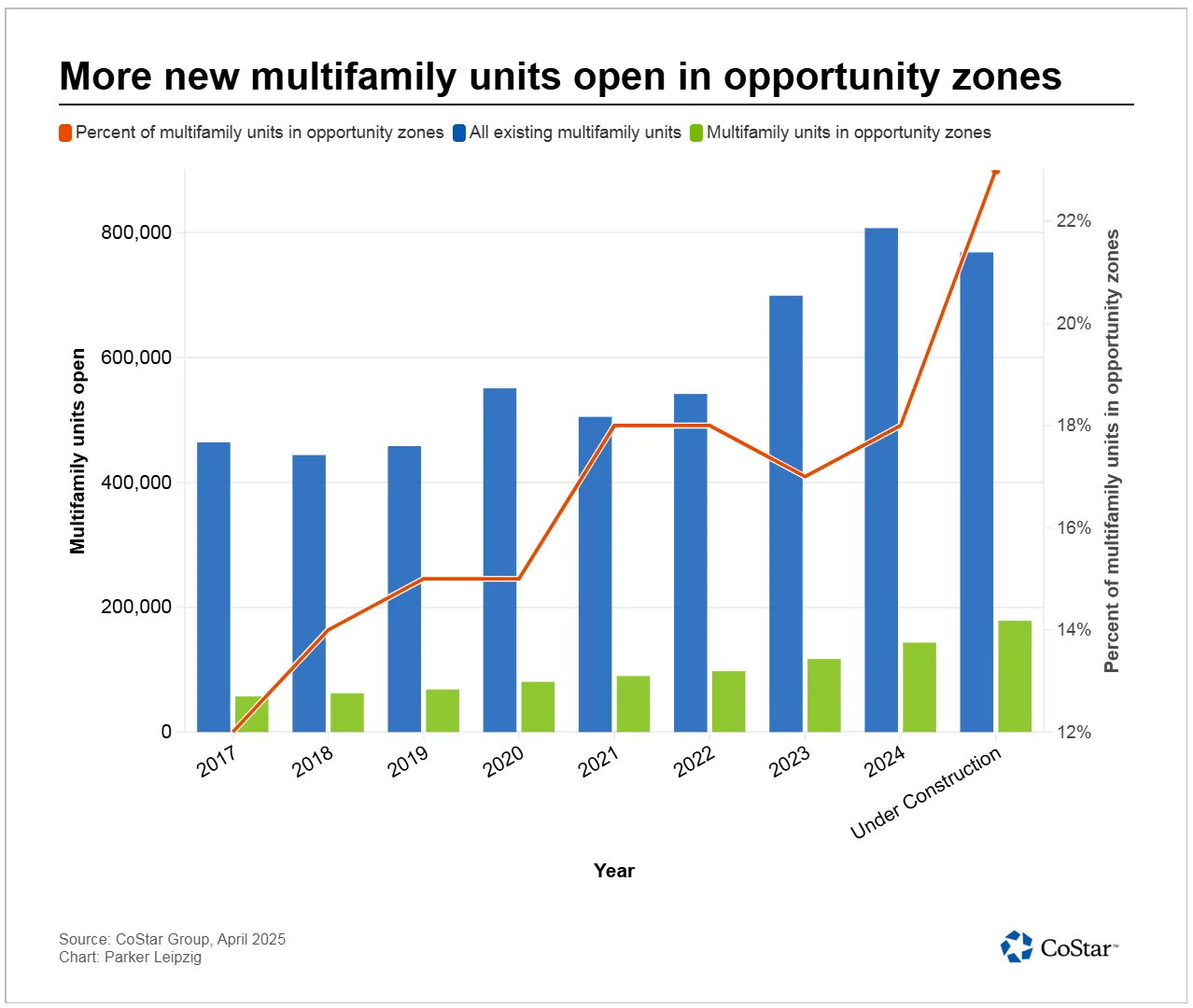

The numbers tell a clear story. In 2023, developers delivered 143,219 new apartment units in designated zones. That’s a 151% increase from 2017, according to CoStar data. Nationally, apartment deliveries rose only 63% during that same period.

Furthermore, Opportunity Zones now account for 23% of all apartments under construction. Back in 2017, that number was just 12%.

The impact is especially clear in Los Angeles. In 2017, developers opened 1,245 apartments in the city’s zones. Last year, they opened 3,432 units, and 7,441 more are under construction.

Developer Momentum

Cityview, a Los Angeles-based multifamily developer, quickly embraced the program. Its first project under the program was Jasper, a 296-unit complex in West Adams. The project replaced a former bookbinding factory with a luxury community. It includes rooftop decks, a pool, game areas, and outdoor dining spaces.

Cityview’s CFO Damian Gancman said the project has been a success. “Let’s go do it again and again over the next 10, 15, 20 years,” he added.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Housing-First Results

The program is generating more than just units—it’s delivering scale. So far, qualified opportunity funds have raised over $40B, funding nearly 200,000 housing units, mostly multifamily. These numbers come from Novogradac, a firm that tracks fund performance.

Ben Glasner, an economist with the Economic Innovation Group, called the housing impact “a good sign.” His group’s March report found that opportunity zones “caused a large — and still rising — increase in housing supply.”

He also noted that long-term outcomes like job growth and poverty reduction will take time to evaluate. “The housing boost is an early and encouraging signal,” Glasner said.

A Tool for Retail Investors

Unlike many tax programs, opportunity zones attracted mostly individuals. According to Steve Glickman, CEO of advisory firm Develop, 84% of investors in the program are individuals, not institutions. That matches a trend in US apartment investment, where high-net-worth buyers play a major role.

Cityview used the program to expand beyond its usual base of institutional investors. It found success with wealthy individuals and family offices. “It was a nice entrée to the high-net-worth world,” Gancman said.

What Comes Next

With Republicans holding the House, Senate, and White House, the chances of extending or improving the program are rising. Supporters want to make it permanent. Others are pushing for updates.

Some proposals aim to fix its flaws. For example, Gancman said the timing of capital gains deferral is too rigid. Under current rules, investors benefit less if they enter the program late. A rolling deferral window could fix that, he suggested.

Attorney Andrew Weiner also called for changes. He cited issues with complex rules, delays in regulations, and COVID-related setbacks. In his view, these made the program hard to use. That complexity kept some investors on the sidelines.

Despite its flaws, many believe the program has delivered. “The general sense is it meets the public policy objective,” Gancman said. “It is proven to be successful in ways that other policies haven’t in very tangible ways.”

Why It Matters

Opportunity Zones have helped increase housing supply in underserved communities. With the tax breaks set to expire, there is bipartisan momentum to preserve and improve the program. It could remain a key driver of new housing and neighborhood revitalization.

What’s Next

Lawmakers may soon consider proposals for a long-term version of the program. These would address current limitations while expanding benefits. As the housing crisis persists, Opportunity Zones 2.0 could become a vital part of the national strategy.