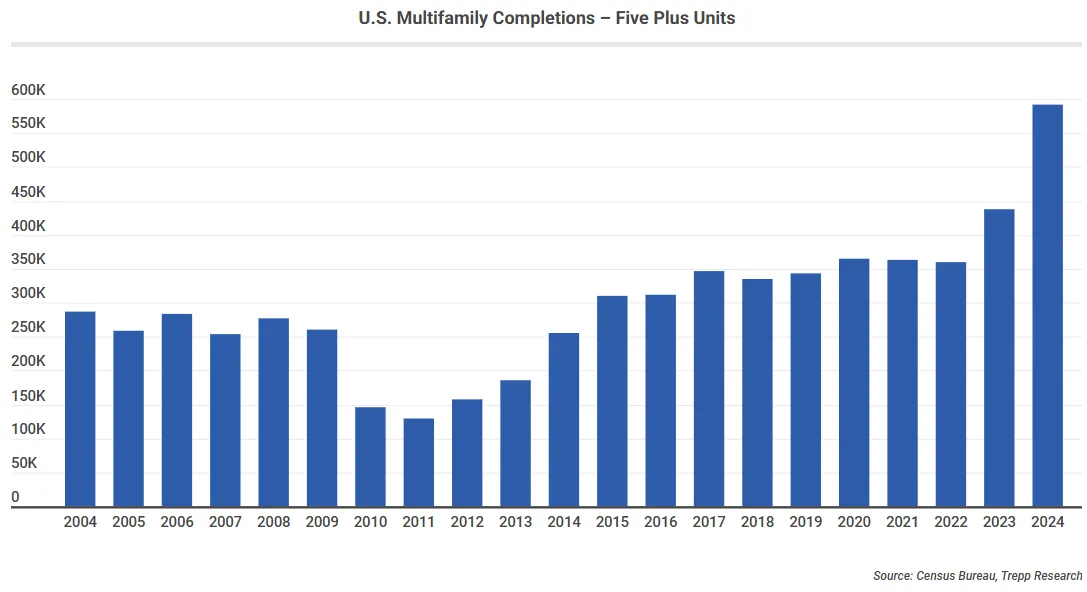

- 2024 saw the largest increase in multifamily completions in 50 years, with nearly 592,000 new units delivered—primarily in high-growth Sunbelt markets.

- Operating costs are significantly higher than five years ago, with insurance expenses alone nearly doubling, squeezing owner margins.

- Floating-rate debt and DSCR stress have exposed vulnerabilities, with markets like Houston and Atlanta seeing the highest concentration of underperforming multifamily loans.

- Demand remains strong, with net absorption of 530,600 units in 2024—more than double 2023’s total—helping offset supply pressures.

Supply Surge Creates a Split Market

The multifamily sector delivered nearly 600,000 new units in 2024, the highest annual total since 1974. But this surge has had mixed effects, per Trepp.

In Sunbelt markets where construction has been aggressive—like Dallas-Fort Worth, Miami, and Charlotte—landlords are seeing higher vacancy rates and rent declines. By contrast, high-barrier cities such as Boston, Chicago, and Washington, D.C. have remained more stable due to limited new supply.

Rising Costs and Floating-Rate Debt Add Pressure

Landlords aren’t just grappling with weaker rents—they’re also facing sharply rising expenses. According to Trepp:

- Repairs & maintenance: +16.5%

- Real estate taxes: +16.6%

- Utilities: +21%

- Insurance: +99.5%

On the financing side, floating-rate debt has become a major risk. Over 5,100 multifamily properties within the securitized market now have a debt service coverage ratio (DSCR) below 1.0, signaling that income is no longer covering debt payments. The highest concentrations are in overbuilt Sunbelt metros like Houston, San Antonio, and Atlanta.

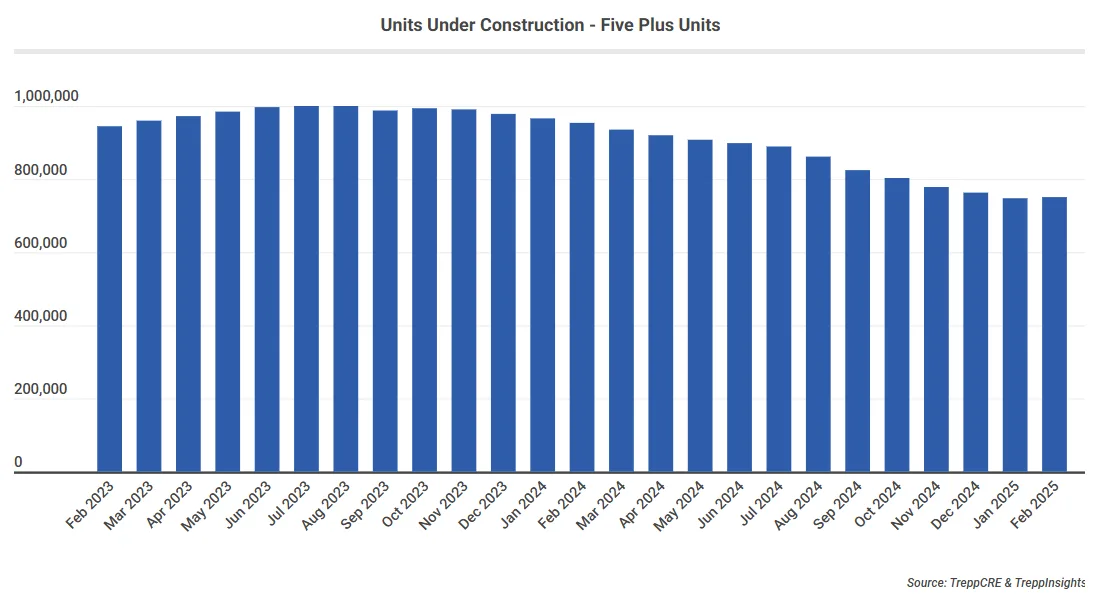

Pipeline Is Slowing, Giving Market Time to Stabilize

There’s some relief ahead. As of early 2025, about 750,000 units are under construction—half of which are set to deliver this year. That’s a notable slowdown compared to recent years.

This pause will give the market time to absorb new inventory, especially as supply levels return closer to long-term historical averages.

At the same time, recent declines in the 10-year Treasury yield may allow borrowers to refinance at lower rates. This could improve loan performance and reduce delinquency rates.

Loan Performance

Trepp’s CMBS data shows how changing interest rates have shifted loan performance trends. Early in the post-COVID period, fixed-rate loans had higher delinquency rates. But as the Fed raised rates, floating-rate loan delinquencies caught up.

Multifamily CMBS delinquency rate:

- Mid-2022: Below 2%

- Early 2025: Over 4.5%

- March 2025: 5.44%

While this rise reflects stress in the system, it also signals that financing conditions are normalizing, and capital markets are adjusting to a higher-rate environment.

Demand Resilience and Institutional Confidence

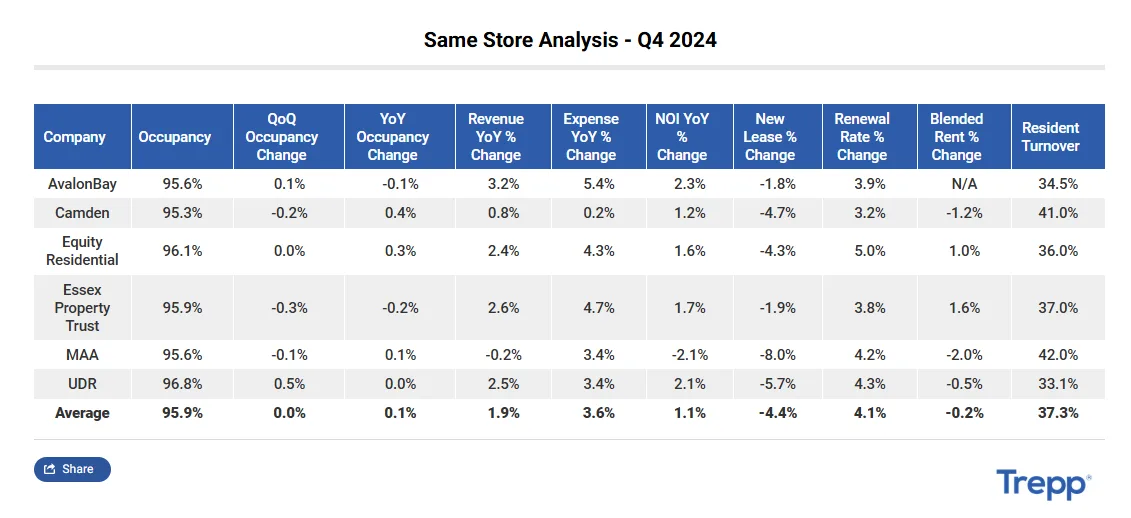

Despite the supply pressure, demand is holding strong. Net absorption totaled 530,600 units in 2024, more than double the 2023 figure, and has outpaced completions for three consecutive quarters. Public REITs continue to show relatively stable performance, especially those with portfolios skewed toward higher-end product.

Management commentary and 2025 guidance suggest REITs are still bullish on long-term fundamentals. MAA is leaning into development, and AvalonBay plans to have $3.5B under construction by year-end. Even Equity Residential, which is not pursuing development, is targeting expansion markets for acquisitions.

Looking Ahead

The multifamily sector is undergoing a meaningful market reset—but not a retreat. While distress is real in overbuilt areas, especially in the Sunbelt, it remains concentrated and manageable. With construction activity slowing, refinancing conditions improving, and demand staying resilient, fundamentals are expected to stabilize.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes