CRE Data Sources

Price

Value-based

pricing model

Value-based

pricing model

$1,200/month

for up to

4 users

$4,800/user/year

Membership tiers:

Free

Pro: varies; estimated

around $250-

$400/month

Value-based

pricing model

Value-based

pricing model

Value-based

pricing model

Value-based

pricing mode

$499/month

for up

to 4 users;

price per

user

decreases

for

additional

users

Value-based

pricing model

Value-based

pricing model

$319-$389/user/month

Value-based

pricing model

Free;

Gold

membership $20/month

Free Trial

No; company

led demo

only

No; company

led demo

only

Yes, 48 hours

Yes, 7 days

Yes, free

basic

membership available

No; company

led demo

only

Yes; free

basic

account

available

Yes after

company

led demo;

free basic

account

available

No; company

led demo

only

No; company

led demo

only

No; company

led demo

only

No; company

led demo

only

Yes

Yes

Yes

Provides Owner Contact Info

Yes

No

Yes

Yes

Yes

Yes

No

Yes

No

Yes

No

No

Yes

Yes

Limited

National Coverage

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

CRM Integration

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

Access to high-quality data in commercial real estate is of the utmost importance. However, with so many data platforms, picking the best for your needs can take time and effort.

Not all real estate data providers are created equal. The best data providers offer extensive property and market data, robust lead filtering and management, and other tools to help you grow your business. CRE professionals use this data to generate business and can use this data to learn about the market and generate client and listing leads.

Here’s the good news: we researched the top commercial real estate data sources and their key differentiators so you don’t have to. Below is a detailed review of each offering, including its pros and cons, unique features, and more.

How We Chose The Best CRE Data and Analytics Platforms

To choose the best commercial real estate data sources, we vetted each company based on the following criteria:

- Pricing and Transparency: How are products priced and how readily available is pricing information online?

- Free Trial and Demo Options: Does the platform offer a free trial or demo for users to try it out firsthand before making a financial commitment?

- Product Offerings: We looked at the depth and breadth of data provided on each platform, including what offerings set it apart from competitors.

- Ease of use/Functionality: How user-friendly and intuitive is each platform? How quickly can new users learn the functionality?

- Data Accuracy and Updates: How accurate and timely is the data provided? Does the platform offer regular, relevant, and reliable updates?

- Data Coverage and Quality: What does data coverage look like in terms of geographic regions, property types, and data depth?

- Customer Support and Training: What is the level of customer support offered? How available are training resources and customer service reps?

CoStar

Best one-stop shop for property data and research

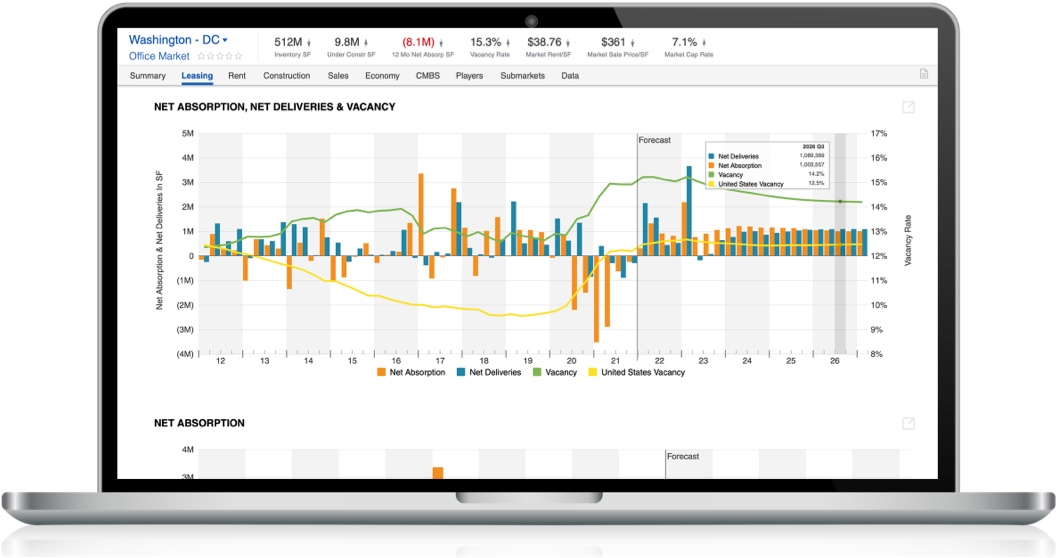

CoStar is the leading provider of CRE data. They offer a comprehensive database that includes sales and lease comps, property listings, vacancy rates, rental information, tenant details, ownership data, and market trends.

Pros

Pros- Extensive, near-unrivaled property database

- Industry-standard when it comes to sale and lease comps

- Superior market research capabilities

Cons

Cons- Doesn’t offer lead-generation tools

- Almost certainly the most expensive platform

- Pricing isn’t transparent or consistent for subscribers

CoStar is arguably the most widely recognized and utilized CRE data and analytics company. It provides a comprehensive database of commercial properties and market intelligence to a broad spectrum of users, including investors, brokers, landlords, and tenants.

Main Features

The CoStar Group owns many other real estate brands, including LoopNet, Ten-X, Homesnap, Apartments.com, and Apartment Finder. CoStar leverages these affiliate businesses to gather CRE data. For example, comps within CoStar come from LoopNet, Apartments.com, Apartment Finder, etc. A team of analysts at CoStar also confirms all property info with owners, brokers, and other stakeholders.

CoStar also comes with tools for investment analysis, advertising, property management, and much more. CoStar Comps provides up to a million verified sales records. The platform also offers up-to-date commentaries on markets and submarkets, which can be used for your research and marketing efforts.

Overall, CoStar provides very detailed information and makes it relatively easy to find and understand what you’re looking for. It offers easy-to-read analytics and reports. You can see properties on a map, get forecasts from local experts, and view graphs showing market trends. Plus, you can create your reports based on location, building type, or sales activity.

User Experience, Support, and Pricing

- User Experience: CoStar’s user interface is clean and easy to use, but proficiency may require some additional training. Many users will find it easy to search for properties, analyze market data, and make informed decisions. However, most users will likely need more advanced training to truly use the software to its full potential.

- Pricing: CoStar’s pricing is not transparent. They operate on a value-based pricing model, which means pricing can vary widely among users. While pricing isn’t obvious, however, CoStar is reportedly the market’s most expensive data analytics platform.

- Customer Support: CoStar subscribers receive a dedicated customer service rep who will provide ongoing training and support. The CoStar website doesn’t provide additional training materials or videos. Users can call or email CoStar at 800-613-1303 or [email protected] with any questions.

CoStar Summary

As the most widely recognized and utilized company in the CRE data and analytics sphere, CoStar, supported by prominent real estate brands like LoopNet and Apartments.com, solidifies its position as the largest and most well-known commercial real estate database. If money is no object and you’re a research and data junkie, CoStar is the leading CRE data choice.

Trepp

Best for CMBS data and research

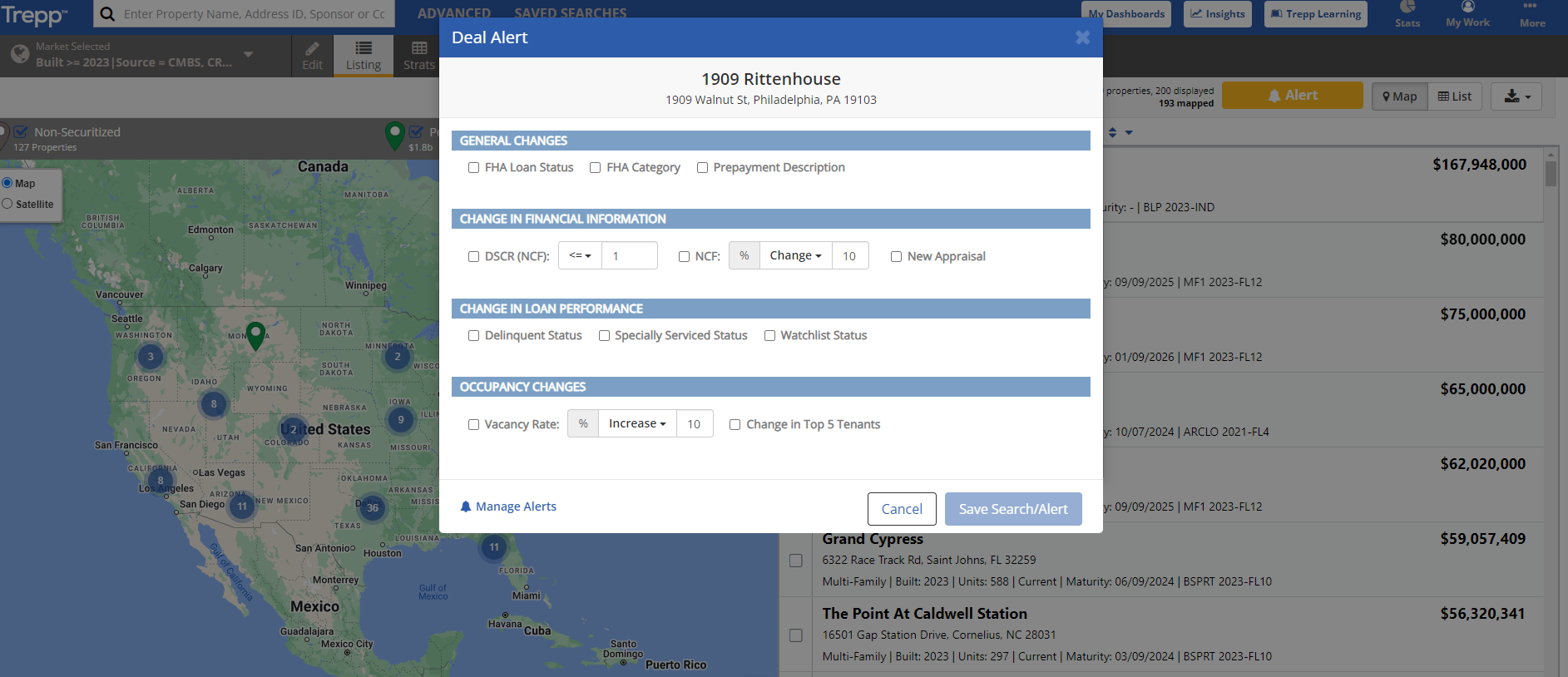

Trepp, founded in 1979, specializes in comprehensive data, technology solutions, and insights into the structured finance, commercial real estate, and banking sectors. Their suite of products caters to those looking to monitor and analyze both securitized and non-securitized commercial mortgages, properties, whole loan portfolios, and nationwide commercial mortgage financial statistics.

Pros

Pros- Highly regarded for its CMBS data

- Extensive research team that publishes daily

- Newly added data for the non-securitized space

Cons

Cons- Requires training to be truly proficient

- Property owner contact info not provided

- Limited data for non-securitized assets

Primarily a tool for sourcing securitized loans, Trepp includes all the relevant loan data you’d expect, such as original loan balance, current balance, modifications, interest rate, watchlist status, delinquency, and more. Trepp aggregates data from prospectuses, servicers, special servicers, and trustees. The information is updated quarterly, annually, or biannually, depending on the property.

Main Features

Although Trepp’s search functionality may require a longer learning curve for users to be proficient compared to other platforms, it offers extensive filtering options. Lease comps are available only for properties that are part of a securitized loan, while sales comps cover any property.

A recent initiative by Trepp is the launch of TreppCRE in 2024, emphasizing their commitment to the non-securitized side of the business. While Trepp has recently expanded its coverage to include non-securitized loans, the data on these properties is currently limited compared to other providers. Trepp currently tracks approximately 5 million non-securities properties.

Clients appreciate the list view feature, resembling a dynamic spreadsheet with filtering, sorting, and export capabilities. Users can receive notifications for new property additions and set custom alerts. But while Trepp provides property owner names (typically LLCs), it does not go beyond that to provide true owner and contact information.

Trepp also offers a wealth of CRE research through blog posts, newsletters, research reports, and the weekly TreppWire podcast.

User Experience, Support, and Pricing

- User Experience: The Trepp home screen has a nice layout and offers quick access to Trepp’s latest research, podcasts, trends, and more. However, using Trepp is slightly more clunky than using some other data providers. Most users will need additional training from the onboarding team to maximize usage.

- Pricing: Like many other data platforms, Trepp operates a value-based pricing model. This means potential subscribers need to have a sales call with Trepp to discuss individual data needs, and then Trepp will propose pricing.

- Customer Support: Trepp subscribers receive a dedicated customer support rep who provides ongoing support and training. Trepp also offers an e-learning portal where users can view training videos, webinars, and tutorials to master the platform. The Trepp website also offers a chatbot and dedicated email addresses for general inquiries.

Trepp Summary

Trepp stands out for its robust CMBS data and market research offerings. While it excels in securitized loan data, recent initiatives like TreppCRE reflect its commitment to non-securitized sectors, although data availability is currently more limited. Trepp is a great option for those who love data and want to target business development opportunities in the securitized space.

CRED iQ

Best for CMBS data and property valuation

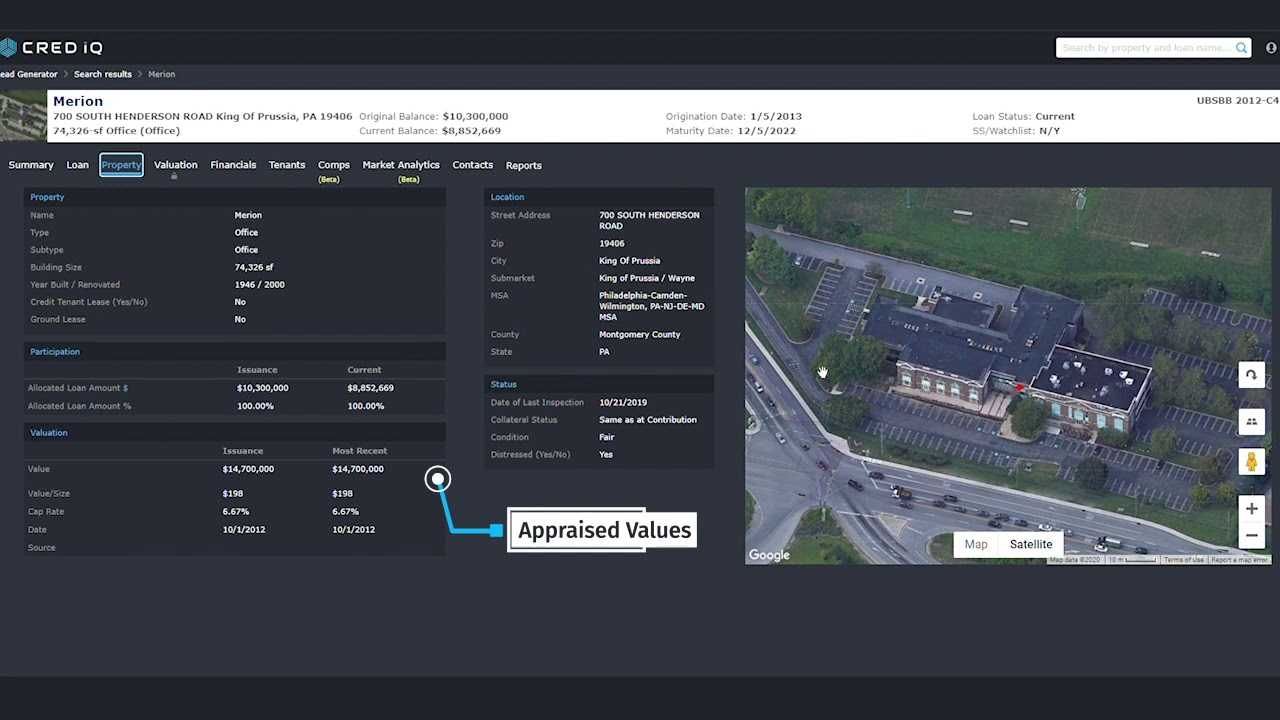

CRED iQ is a comprehensive platform for CRE information, analysis, and assessment, delivering insights to investors and capital markets, and a standout choice for small to medium-sized teams looking for cost-effective commercial real estate and CMBS data access. Users subscribe to access prospects for leasing, lending, refinancing, distressed debt, and potential acquisitions.

Pros

Pros- Easy-to-use interface

- Advanced borrower and owner contact info

- Built-in valuation tools

Cons

Cons- Short company track record

- Loan data is limited for non-securitized assets

CRED iQ’s flagship product is its data and analytics platform. It includes loan data, property data, parcel information, tenant details, income and expenses, valuations, and borrower information across various market segments and asset classes. The platform is powered by over $2 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and GSE / Agency.

Main Features

CRED iQ, the interactive discounted cash flow analysis tool, is a key differentiator. The software lets CRED iQ subscribers value any commercial property using a streamlined discounted cash flow analysis or direct capitalization approach. Unlike any other tool in the market today, MyQ pre-fills a property’s actual in-place financial data and utilizes it as the foundation for the valuation assumptions. Financial and appraisal comps well support assumptions for up to 25 comparable properties. Users can change 20-30 key assumptions, including rent, expense, cap rate, etc. Each valuation assumption is fully interactive, allowing subscribers to adjust based on % of revenue, $ per size, or full dollar amounts.

Many well-known news publications turn to CRED iQ as a trusted source. Data and insights from CRED iQ have been featured in The Wall Street Journal, Reuters, Bloomberg, GlobeSt, Commercial Observer, and more. Subscribers and non-subscribers can access CRED iQ’s News and Research directly on their website. The team puts together a monthly Delinquency Report outlining the market’s distress and other industry trends. The site also offers reports on market trends, sector-specific commentary, case studies, and more. While the research is available to anyone, only subscribers can access the underlying data supporting the reports.

User Experience, Support, and Pricing

- User Experience: CRED iQ’s data platform is intuitive and easy to navigate. The layout is clean and simple, making it easy to learn. The intuitive search function gives many filter options to search for properties. You don’t need to be tech-savvy to use the platform.

- Pricing: Pricing is based on an organization’s size and the number of users requested. The Enterprise Subscription starts at $1,200/month and includes full access to every market and every property for up to 4 users. CRED iQ offers customized programs for smaller or larger organizations to reconcile team sizes. Finally, special discounts are offered for non-profits and universities.

- Customer Support: The CRED iQ team can be contacted in several ways. First, you can either email [email protected] or [email protected]. Next, the website offers a chatbot to submit support requests. The site also offers a support portal where users can pick from a list of options to make specific requests to the CRED iQ team. Finally, each subscriber receives a dedicated customer success rep to answer questions. While the website doesn’t offer training materials or FAQs, the CRED iQ team is easily accessible and responsive to answer questions.

CRED iQ Summary

Overall, CRED iQ is an exciting addition to the commercial real estate industry. CRED iQ’s emphasis on data accuracy and innovative tools positions it as a credible and valuable tool for the industry. Ultimately, CRED iQ shines in its data capabilities, making it the best CRE data analytics platform for navigating the complexities of CRE and ensuring accurate valuations and transparent ownership information.

Read CRE Daily’s full CRED iQ Review.

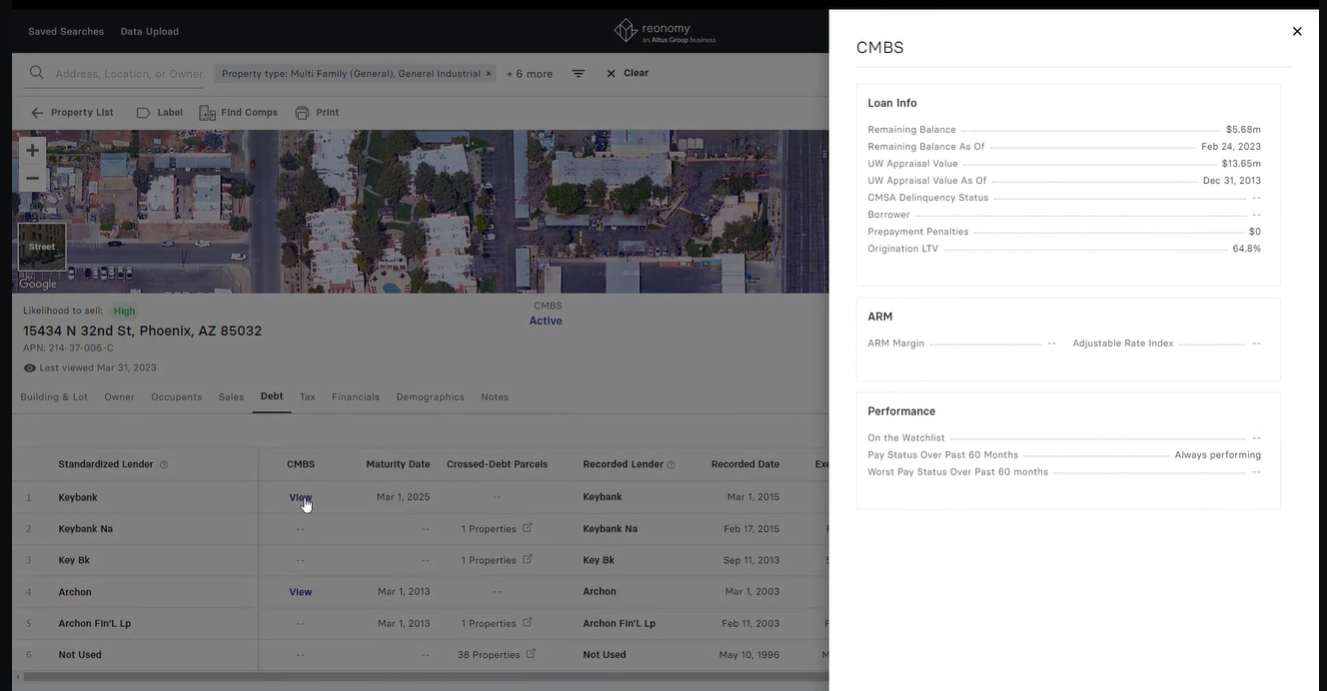

Reonomy

Best machine learning platform for prospecting

Reonomy, acquired by Altus Group in November 2021, is a CRE data provider that uses proprietary algorithms and machine learning to identify property opportunities. It gathers data from a wide range of resources to evaluate deals and market potential, displaying up to 100 data points for any given asset, such as renovation details, sales history, and comps.

Pros

Pros- Easy-to-use interface

- Predictive analytics calculates a “likely to sell” score

- Extensive owner contact information (and data tree)

Cons

Cons- Accuracy of data is questionable

- Limited comp data overall

- Somewhat stale market insights

The Reonomy platform enhances public data with info from various private sources, including transaction data, mapping coordinates, legal entity records, and ownership details. Using machine learning techniques and unique property identification strings, Reonomy consolidates these varied data sets at the parcel level, creating a unified database covering over 50 million US properties across all 50 states.

Main Features

Reonomy’s flagship solution is its web application, which gives users access to a vast database of property info. The web app aims to help CRE professionals recognize potential acquisitions or new listing opportunities. The platform’s data pool consists of over 50 million properties and has customizable filters that facilitate targeted searches based on specific preferences.

Reonomy’s machine-learning algorithms scour billions of contact records to connect true owners with accurate phone numbers, emails, and mailing addresses. The algorithms pierce LLC layers to get to the true property owner. Reonomy takes ownership data one step further by allowing users to see all businesses and properties with the same owner. Users can build phone, SMS, and email campaigns with targeted lists.

Reonomy also has workflow tools to help stay on top of prospects. Users can add their notes directly to the property card. Users can also create labels to track a list of properties and create dynamic searches by saving recent filters.

User Experience, Support, and Pricing

- User Experience: The Reonomy web app is intuitive and easy to use, with a dynamic mapping function and the ability to create multiple lists for tracking and following up on leads. The search function is intuitive, and users can filter based on address, submarket, owner name, property type, and more.

- Pricing: Standard pricing is $4,800 per year per user or $400 per month per user. Discounts are given if paid in full upfront. A subscription allows users to access all geographies and property types across all 50 states. Anyone can sign up for a free trial directly from the Reonomy website, which gives access to 100% of the features any paying subscriber receives. Trials are good for seven days.

- Customer Support: The Reonomy website has a Help Center with training guides, FAQs, and best practices. If someone wants to reach out to a support person directly, it may need to take a few steps before getting a live person. If a Help Center article doesn’t answer the question, a user can message the chatbot in the lower right-hand corner of the page. Response times are within 2 hours. Paid subscribers receive a dedicated customer success rep as the main point of contact to answer any questions.

Reonomy Summary

With its competitive pricing and machine learning technology, Reonomy is an excellent option for investors and brokers aiming to streamline research and focus more on business development. The platform’s data aggregation, particularly its ownership data tree, stands out by helping users uncover true ownership through LLC layers. Despite occasional accuracy inconsistency due to stale data, Reonomy remains a valuable tool for CRE professionals looking to expand portfolios or enhance their book of business at a reasonable price point.

Read CRE Daily’s full Reonomy Review.

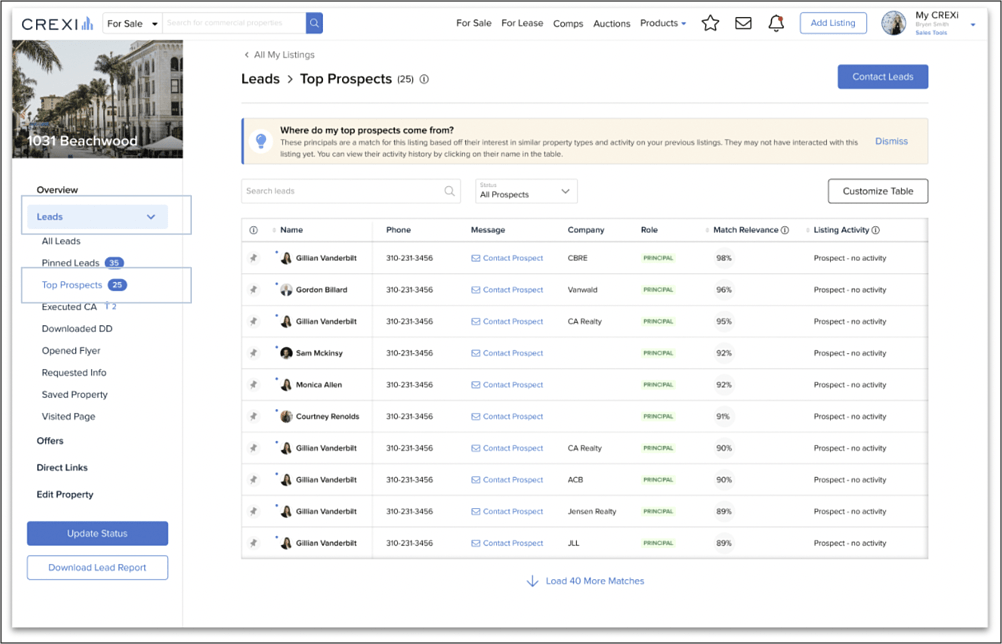

Crexi

Best for Broker Marketing and Lead Management

Crexi, short for Commercial Real Estate Exchange, is an online platform dedicated to buying, selling, and researching commercial real estate. It connects buyers, sellers, and brokers in a comprehensive marketplace and offers tools and resources to streamline CRE transactions.

Pros

Pros- Strong broker marketing capabilities

- Superior lead generation for brokers

- Always free to list properties

Cons

Cons- Access to data analytics only available to paid PRO subscribers

- Property data analytics is not the platform’s primary function

Built to serve as a one-stop shop for commercial agents and brokers, Crexi covers all asset types and geographies. It allows users to post listings for free, with the option to subscribe to a paid PRO plan.

Main Features

One of Crexi’s key strengths is its ability to track buyer actions by monitoring user clicks. Up to 75% of Crexi users are principals/buyers, so Crexi leverages their combined activity to help listing agents target their audience more effectively.

Crexi provides unique contact info for listing visitors, facilitates monthly targeted email blasts, and offers full transparency on who is viewing a listing. The platform scores every lead on a 1-5 scale, allowing users to filter search results based on lead strength while providing full phone numbers and emails for leads. Crexi actively markets deals and grants users full access to generated leads.

The platform supports user efficiency by allowing anyone to save searches or favorites and receive notifications. Crexi retrieves sales comps from county/state records, offering a unique approach compared to partnering with brokers for this information. Users can export any data they want from the platform.

While listing and marketing services are Crexi’s specialty, the platform also provides robust property data, including CMBS and private loan data, ownership contact info, and more, through its PRO plan. The platform enables nationwide property searches and offers valuable market and demographic insights.

User Experience, Support, and Pricing

- User Experience: The Crexi platform is straightforward to learn and use. Users will find a quick learning curve to add listings and search properties for sale and lease. The property search and filter function is also easy to use without requiring additional training from Crexi.

- Pricing: Crexi has two subscription tiers—free and pro—and a dedicated broker dashboard. Posting listings and searching for For-Sale and For-Lease properties is always free. The paid Crexi PRO tier allows users to access more valuable ranks in leads and searches, too.

- Customer Support: Crexi offers an extensive Help Center that answers the most common user questions. Users can also contact Crexi support directly at (888) 273-0423.

Crexi Summary

Crexi is great for brokers who want a superior listing and marketing service. With user-friendly features and a robust lead generation function, it effectively aids brokers in targeting potential leads and conducting transactions. While the platform’s primary strength lies in listing and marketing services, Crexi PRO offers additional benefits, including access to robust property data. It’s a versatile solution for nationwide property searches and insights. The platform’s free and paid plans, coupled with accessible customer support, contribute to an overall user-friendly and efficient experience.

Read CRE Daily’s full Crexi Review.

Yardi Matrix

Best for Business Development and Major Market Research

Yardi Matrix is a data platform and service provided by Yardi Systems, which is most well-known for its property management software. Yardi Matrix offers a wide range of information concerning multifamily properties of 50 units or more in 178 markets. Yardi also has a team of over 1,100 research analysts who source the platform’s data directly.

Pros

Pros- Relatively objective and reliable rating system

- Yardi Expert research leverages updated data from users

- Includes data for all loan types, not just CMBS

Cons

Cons- Only tracks properties with 50 or more units

- Institutional research only covers major markets and no submarkets

- Data not as robust for office, retail, and other non-multifamily assets

Unlike every other provider that only has CMBS debt data, Yardi Matrix has info on all loan types (bridge, construction, line of credit, permanent, CMBS, bond, etc.) and loan provider types (GSEs, banks, credit unions, CMBS, insurance companies, government agencies, debt funds, private Lenders, etc.). The platform boasts nearly 22 million units nationwide and about 12-13 million users.

Main Features

Yardi Matrix also provides true ownership contact information. Users can click into ownership groups and instantly see everything the group owns in every market around the country, including completed and pipeline deals.

Other key differentiators in Yardi’s process involve capturing unit mix and occupancy data. The research team calls upon properties monthly, posing as prospective tenants. They must document any concessions, if applicable, and who they spoke to in the management office. From there, Yardi has quality assurance processes to eliminate human error before data is uploaded into the database. To capture occupancy data, Yardi tracks USPS live mailbox records in the middle of the month when there’s the least tenant turnover and confirms property data quarterly.

Yardi Matrix also has a patented and completely objective rating system used by Fannie/Freddie, Ginnie, DUS lenders, etc. The rating is the industry-standard, letter-grade system that allows users to not only filter by asset class but also by different ratings, like location rating or improvement rating, to identify potential value-add plays or get extra specific when creating a comp set. Users can also sort by unit counts, age, asset class, geography, etc.

Users also access Yardi Expert, where Yardi taps directly into the back end of the Yardi centralized property database (including all properties that use Yardi for accounting/management). This is where users can see true incomes, expenses, reference cap rates, transactional in-place, renewal, new lease rents, occupancies down to the unit type level, renewal and turnover percentages, average lease terms, average resident length of stay, prospect metrics, etc.

User Experience, Support, and Pricing

- User Experience: The Yardi Matrix platform and functionality are intuitive and easy to use. Users can easily search by various filters or use the interactive mapping function. While it would be a nice feature to access a property’s market report directly from the property page, the premium institutional reports are also easy to navigate.

- Pricing: Yardi Matrix pricing is not transparent. Like many other data platforms, it operates on a value-based pricing model dependent on a company’s specific data needs. Users will need to schedule a sales call and demo with the Yardi team before pricing is proposed.

- Customer Support: The Yardi Matrix website offers a “Contact Us” form for general inquiries. Subscribers receive a dedicated customer service rep as well as unlimited training sessions. Users can also contact the team directly at (480) 663-1149.

Yardi Matrix Summary

Overall, Yardi Matrix is a good option for those focusing on larger properties of 50+ units in nearly all major markets. Users love Yardi’s objective rating system and unbiased research backed by Yardi’s property management clients. Yardi Matrix also offers a good mix of business development and institutional market research.

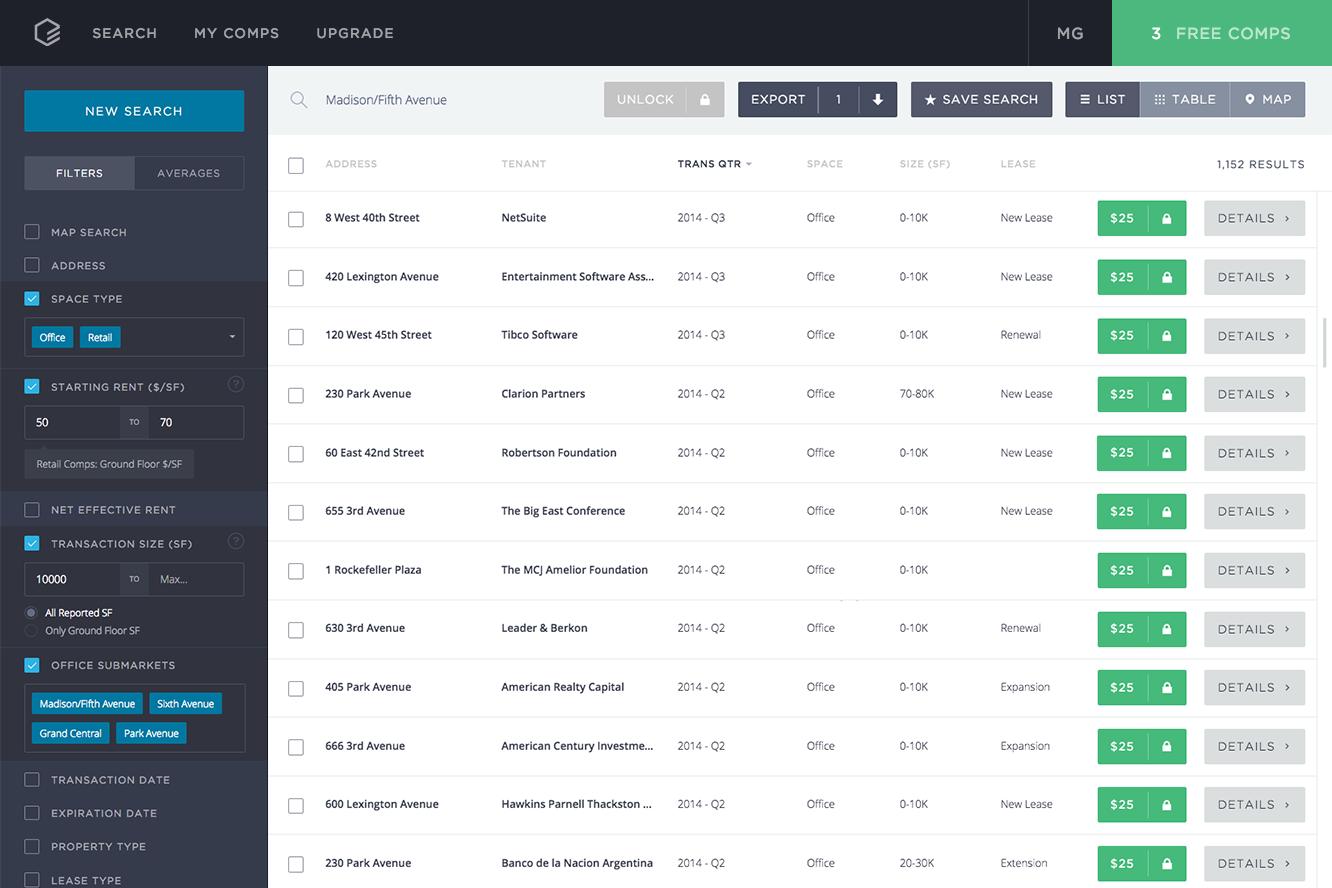

CompStak

Best for sales and lease comps

CompStak is the first crowdsourced commercial real estate database. It collects verified and standardized comps from professionals in leading brokerages and appraisal firms. CompStak’s crowdsourcing process is unique to the industry and differs from any other source of lease comps.

Pros

Pros- Provides highly accurate sales and lease comps

- Provides great data for office, retail, and industrial

Cons

Cons- Need a RealPage subscription for multifamily data

- Does not provide property owner contact information

Over 35,000 brokers, independent appraisers, and CRE researchers submit their comps to CompStak daily through its Exchange platform in exchange for credits. Those credits can then be exchanged for access to specific comps needed to complete their current transactions.

Main Features

CompStak provides hard-to-find data points such as actuals for starting rents, free rent, TI amounts, rent increases, term, expiration dates, net effective rent, cap rates, true buyer/seller, and more. CompStak covers over 2.3M properties in 105 markets in all 50 states. Their data is best for office, retail, and industrial assets. To see detailed data for multifamily, users will also need a separate subscription to RealPage, which they can purchase for a discount through CompStak.

CompStak also includes CMBS loan data directly from a partnership with Trepp and publicly recorded mortgages. The platform also offers a Market Dashboard where users can run analytics on major U.S. markets.

User Experience, Support, and Pricing

- User Experience: The CompStak platform is user-friendly and intuitive. Most users should be able to achieve proficiency without any additional training.

- Pricing: Like many other data platforms, CompStak operates a value-based pricing model. This means potential subscribers need to have a sales call with CompStak to discuss individual data needs, and then CompStak will propose pricing. Access to the Exchange Platform is free for professionals providing data.

- Customer Support: The CompStak website has a chatbot in the lower right-hand corner to answer questions. Paid subscribers also receive a dedicated customer success rep as the main point of contact to answer any questions. Users can also contact the team at 646.926.6707 or [email protected].

CompStak Summary

Overall, CompStak is a leading sales and lease comps provider. The platform provides accurate property data sourced directly from brokers and appraisers. Just be advised that access to detailed multifamily property information requires a separate RealPage subscription.

Read CRE Daily’s full CompStak Review.

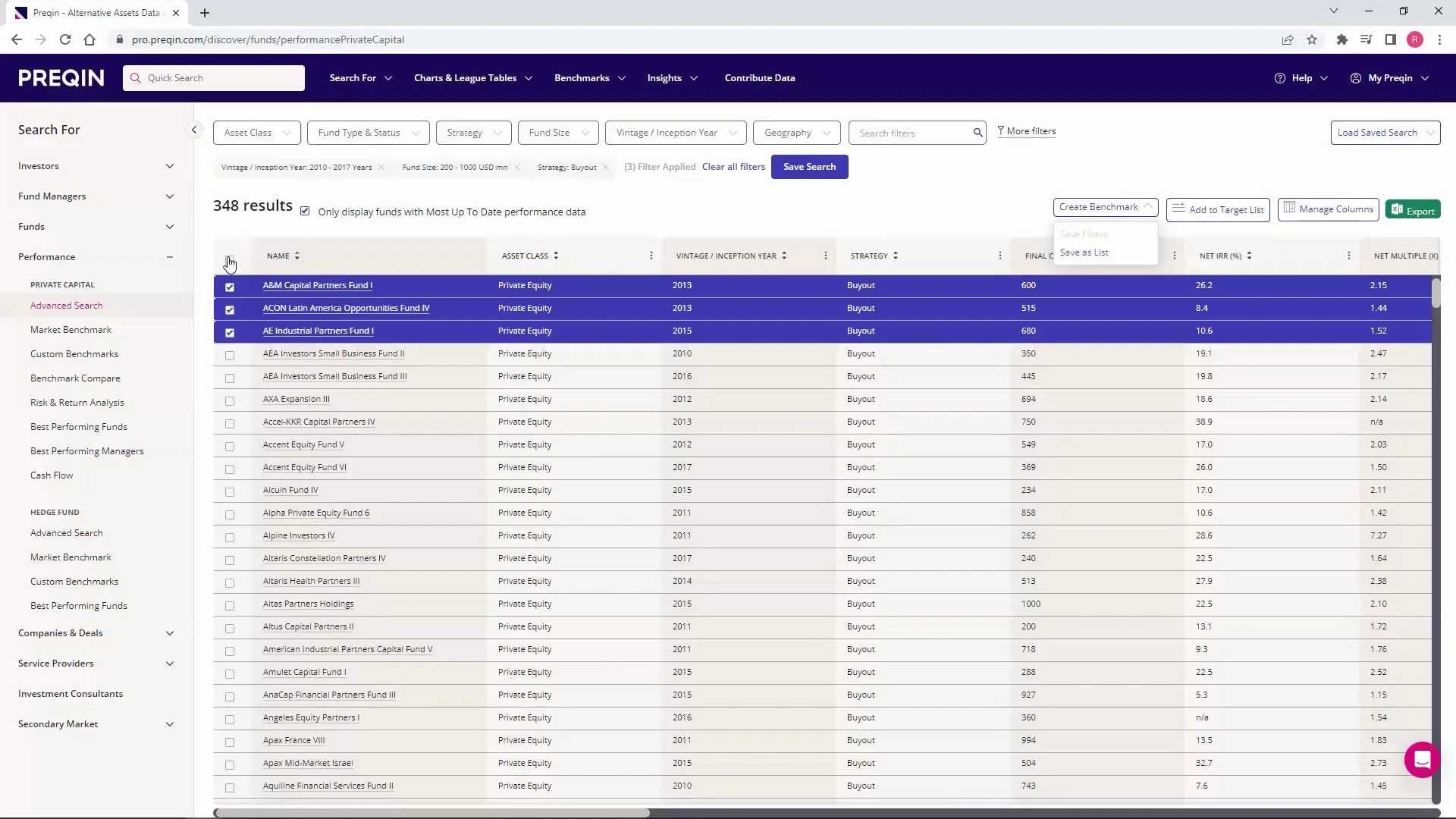

Preqin

Best for alternative asset business development & benchmarking

Preqin is the only data provider dedicated to the whole alternative assets industry, with coverage including private equity & venture capital, private debt, hedge funds, real estate, infrastructure, and natural resources. Preqin includes data on fund performance, fundraising activities, deals and transactions, investor profiles, and market trends.

Pros

Pros- Offers a free research subscription

- Info comes directly from companies

- Provides direct contact info for private companies

Cons

Cons- Lacks asset/property level data

Preqin aims to provide in-depth data and research to support its global client base in daily activities, including fundraising, investor relations, asset allocation, fund manager selection, and business development. However, the data is at the company and fund level. Property-level data is only provided if the property is part of a fund.

Main Features

Preqin is best suited for sourcing business development opportunities in the alternative asset space at the company or fund level. Users can filter their search by company, fund, role, location, asset class, etc. Preqin also provides performance data to help with benchmarking. Preqin has transparent return metrics for over 10,000 private capital funds and 20,000 hedge funds globally.

Preqin’s data is sourced directly through personal relationships with over 6,000 individual General Partners (GPs), over 2,000 hedge fund managers, and direct conversations with Limited Partners (LPs) on the Preqin platform. Company and fund profiles are confirmed by their partners and updated monthly. Firms also like to leverage the platform for more name recognition and to market themselves. Most firms reach out to Preqin to be included in their database.

Finally, anyone can sign up for a free Preqin account to access free alternative assets, datasets, analytics, and industry reports. A free account also allows for a preview of Preqin Pro, the subscription-based plan.

User Experience, Support, and Pricing

- User Experience: The Preqin platform is easy to learn and navigate. Users have many search options to filter for funds and companies and view investor documents. When you click on a fund or company, you can easily dig deeper into the assets within the fund, view the investors within the fund, and even view the key contacts for each investor. Preqin’s FAQ also gives easy-to-understand instructions on creating lists and alerts.

- Pricing: Preqin operates a value-based pricing model like many other data platforms. This means potential subscribers need to have a sales call with Preqin to discuss individual data needs, and then Preqin will propose pricing. Subscriptions typically range anywhere from $5,000-$30,000 per year.

- Customer Support: Preqin offers a searchable Help Center and FAQ. It also provides a live chat on its website, and support can also be reached directly by emailing [email protected]. Finally, subscribers receive a dedicated support rep to answer questions.

Preqin Summary

The Preqin platform is best suited for users researching private companies in the alternative asset space. Firms can also leverage the platform for marketing purposes and to gain more name recognition. If you’re looking for alternative asset class benchmarking, Preqin is the right choice.

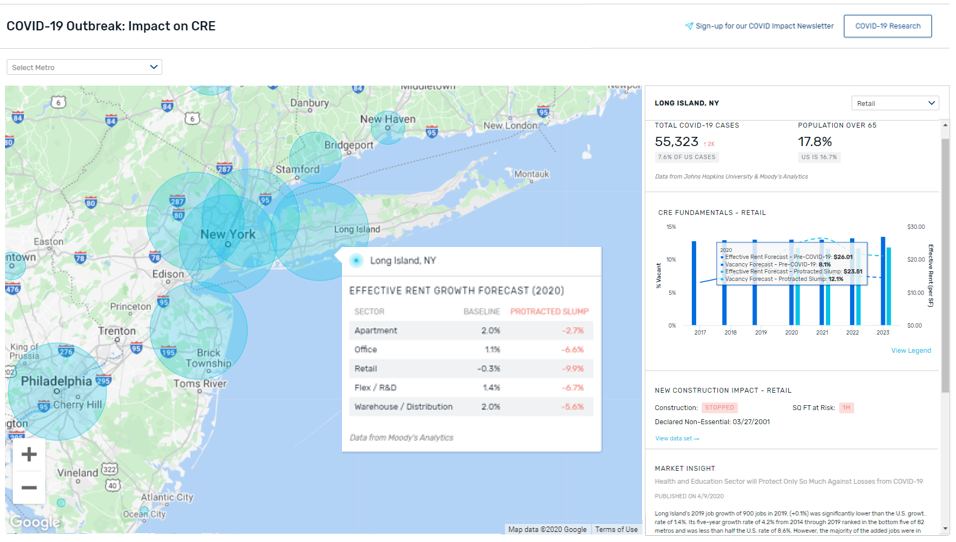

Moody’s Analytics

Best one-stop shop for property data and research

Moody’s Analytics, the result of Moody’s acquisition of Reis, is a leading provider of insights into major U.S. commercial real estate markets. The platform offers proprietary data and advanced analytics, allowing users to access real estate information at the property, submarket, and market levels. The database covers over 8 million properties across various asset classes and geographies.

Pros

Pros- Extensive research capabilities

- Provides detailed market and submarket reports, including commentaries

Cons

Cons- Does not currently provide property owner contact information

- Pricing can be steep

In June 2023, Moody’s revamped its analytics platform, enhancing its capabilities. As a CRE market research firm, Moody’s Analytics acquired Catylist for lease-level data. The platform provides market and submarket reports, commentaries, and intelligent solutions powered by a comprehensive integrated database.

Main Features

Moody’s CRE Analytics is recognized as one of the most robust commercial real estate data sources, offering advanced property search capabilities. Users can research property, market, and submarket, search risk profiles and exposure, and utilize data for market comparisons.

The Moody’s Analytics platform provides information on every commercially zoned property and parcel in the U.S. Users can monitor multifamily and commercial projects from groundbreaking through lease-up with real-time updates on project stages and construction analytics. The database includes historical property performance data, sales transactions, and new construction projects.

The platform also goes beyond property-level data, offering economic insights that affect commercial real estate performance at national, regional, and sub-regional levels. It provides core economic data, including employment, income, and population metrics, as well as visibility into consumer demand, economic activity levels, and demographics.

User Experience, Support, and Pricing

- User Experience: The Moody’s Analytics platform is user-friendly and intuitive. Most users will be proficient without any additional training. Users should also find the robust map and filter options easy to navigate.

- Pricing: Moody’s Analytics operates a value-based pricing model. Potential subscribers need to have a sales call and demo to discuss individual data needs, and then Moody’s will propose a pricing structure. Moody’s pricing is customizable and the platform does not charge a per-user fee. Discounts are offered on multi-year contracts.

- Customer Support: Moody’s support team is available Monday through Friday from 8:00 AM to 7:00 PM ET by phone at (212) 553-1653 or by email at [email protected]. Paid subscribers also receive a dedicated customer success rep as their main point of contact to answer any questions, as well as unlimited training.

Moody’s Analytics Summary

Moody’s Analytics is best used as a one-stop shop for CRE data and analytics. If you want as much data as possible at your fingertips, Moody’s Analytics is the right choice. While the platform may be on the higher end when it comes to pricing, the data and research on offer make it worth it.

Read CRE Daily’s full Moody’s Review.

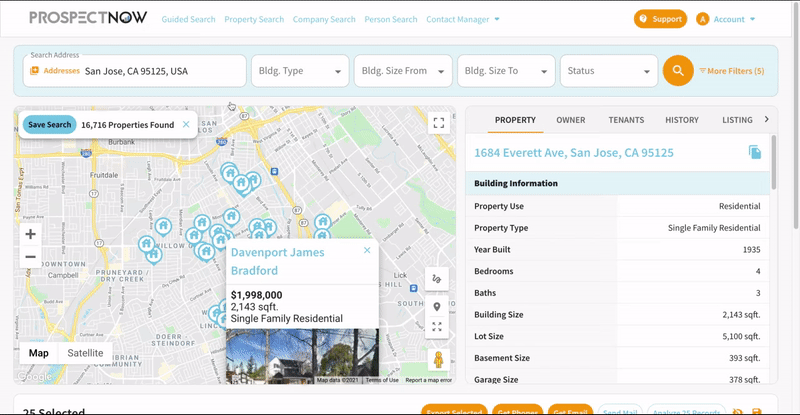

ProspectNow by Buildout

Best low-cost prospecting tool

ProspectNow is designed primarily to pinpoint ownership information for residential and commercial properties. It provides accurate and detailed ownership information for single-family homes, multifamily homes, apartment buildings, industrial properties, and other commercial properties. This makes it easy for agents and investors to connect with owners and generate new high-quality leads.

Pros

Pros- Predictive analytics help find higher-quality leads

- Economical, low-cost pricing plans

- Easy-to-use guided search function

Cons

Cons- Limited leasing data

- Limited demographic data

ProspectNow helps CRE brokers find sellers before they list their property and contact sellers to get more listings and close more deals. The platform combines credit header, public record, and publicly available and proprietary data to provide a comprehensive view of the network of people and relationships associated with any given property.

Main Features

ProspectNow is best known for its predictive analytics. This tool, developed over 10 years ago, predicts future market trends by analyzing over 140 million properties every week. The technology helps pinpoint higher-quality leads with a “Likely Sellers” feature that identifies the properties most likely to sell in the next 12 months.

The platform can also integrate with Buildout CRM and marketing tools, making it easy to keep everything in one place rather than using multiple tools.

User Experience, Support, and Pricing

- User Experience: ProspectNow’s platform is intuitive and easy to navigate. The platform offers a guided search feature that helps users quickly narrow property searches. ProspectNow also makes it easy to view the “Likely Seller” data point on any list, save contacts, and even send mailers to prospects. Users can upload their list of addresses to populate a leads list. The platform allows search by company name, a great tool for prospecting triple net lease prospects. All of this functionality is very easy to use.

- Pricing: ProspectNow is one of the market’s most economically priced prospecting and data tools. A subscription for up to 4 users is $499 per month, 5-15 users is $949 per month, and 16+ users is $1,849 per month.

- Customer Support: ProspectNow is owned by Buildout. Users can contact customer service during business hours by phone at 888-956-9998. Reaching a support person may be a bit more challenging, but that’s the price you pay for a low-cost tool.

ProspectNow Summary

Overall, if the main functionality you’re looking for in a data platform is lead generation, ProspectNow is the best bang for your buck. The platform makes it easy to search for likely-to-sell properties before contacting property owners.

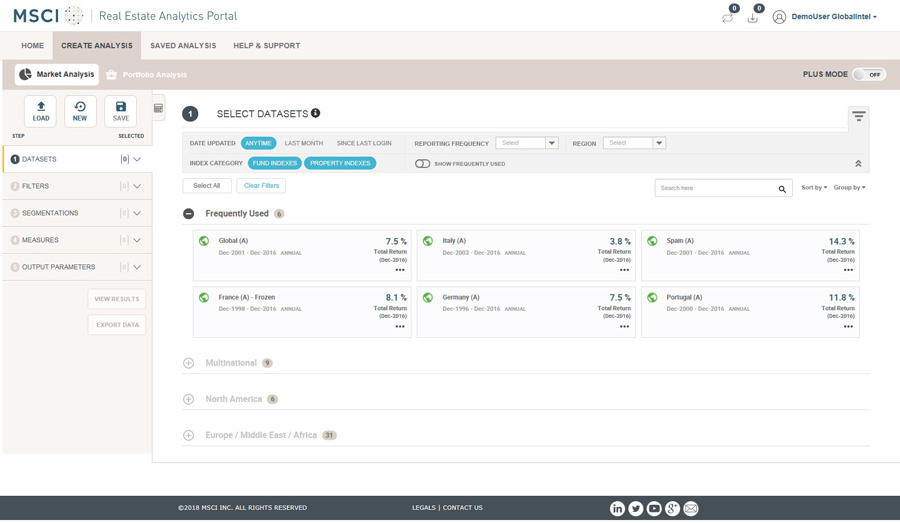

MSCI Real Capital Analytics

Best for tracking market trends

MSCI’s Real Capital Analytics (RCA) is a CRE data and analytics provider that specializes in tracking and analyzing information related to property sales, capital trends, and market trends. RCA offers a comprehensive platform with data on property transactions, sales, financings, re-financings, foreclosures, development sites, and mortgage debt information.

Pros

Pros- Provides detailed investor and owner profiles

- TrendTracker analyzes key metrics for the top 50 metros

- Over 60 research analysts verify data integrity

Cons

Cons- Does not provide leasing data

- User interface not intuitive

- Does not provide ownership contact info

Having recorded over $40 trillion of commercial property transactions linked to over 200,000 investor and lender profiles, MSCI Real Capital Analytics (RCA) aims to bridge every possible information gap.

Main Features

RCA users can look up any commercial asset in the U.S., including niche property types, untraded and off-market assets, and those below the traditional $2.5 million floor. The mapping functions allow you to visualize lot borders, building use classes, and ownership information across all commercial properties.

The RCA Database includes data on owners, buyers, sellers, developers, and lenders. The data can be sorted by ranking, investment, and property type and exported to Excel or PDF. Users can view detailed profiles summarizing each company’s deals, properties, and partners. While RCA provides detailed owner and investor profiles, it does not provide their contact information (phone numbers, email addresses).

RCA pulls its data from both public and private records. Every piece of data on each property comes from at least two different data feeds to confirm accuracy. RCA also has a team of over 60 research analysts who will confirm and update data if necessary.

The analytics platform publishes monthly and quarterly research, market insights, and webinars. Users can view and compare countries, regions, markets, and submarkets. RCA’s TrendTracker tool also allows graphing and downloading time series data for volumes, pricing, yields, spreads, capital flows, and more. TrendTracker covers the top 50 metros across the U.S.

User Experience, Support, and Pricing

- User Experience: RCA’s user interface is less intuitive than that of other data providers. The search function is somewhat clunky, and to maximize usability, MSCI may need to provide additional training.

- Pricing: Real Capital Analytics operates a value-based pricing model. Potential subscribers need to have a sales call and demo to discuss individual data needs, and then MSCI will propose a pricing structure.

- Customer Support: The MSCI website offers a “Contact Us” page where users can contact Sales or Customer Service, read the FAQs, or submit a support ticket. Subscribers will receive a dedicated support rep who will answer any questions.

Real Capital Analytics Summary

MSCI’s Real Capital Analytics is a good choice for those looking to access market trend data and investigate investor and owner profiles, but it falls short in providing ownership contact info. While the RCA user interface isn’t as intuitive and users may need additional training from MSCI, anyone should be able to quickly become proficient. Backed by over 60 research analysts and the MSCI institutional brand, users can also expect RCA data to be accurate and robust.

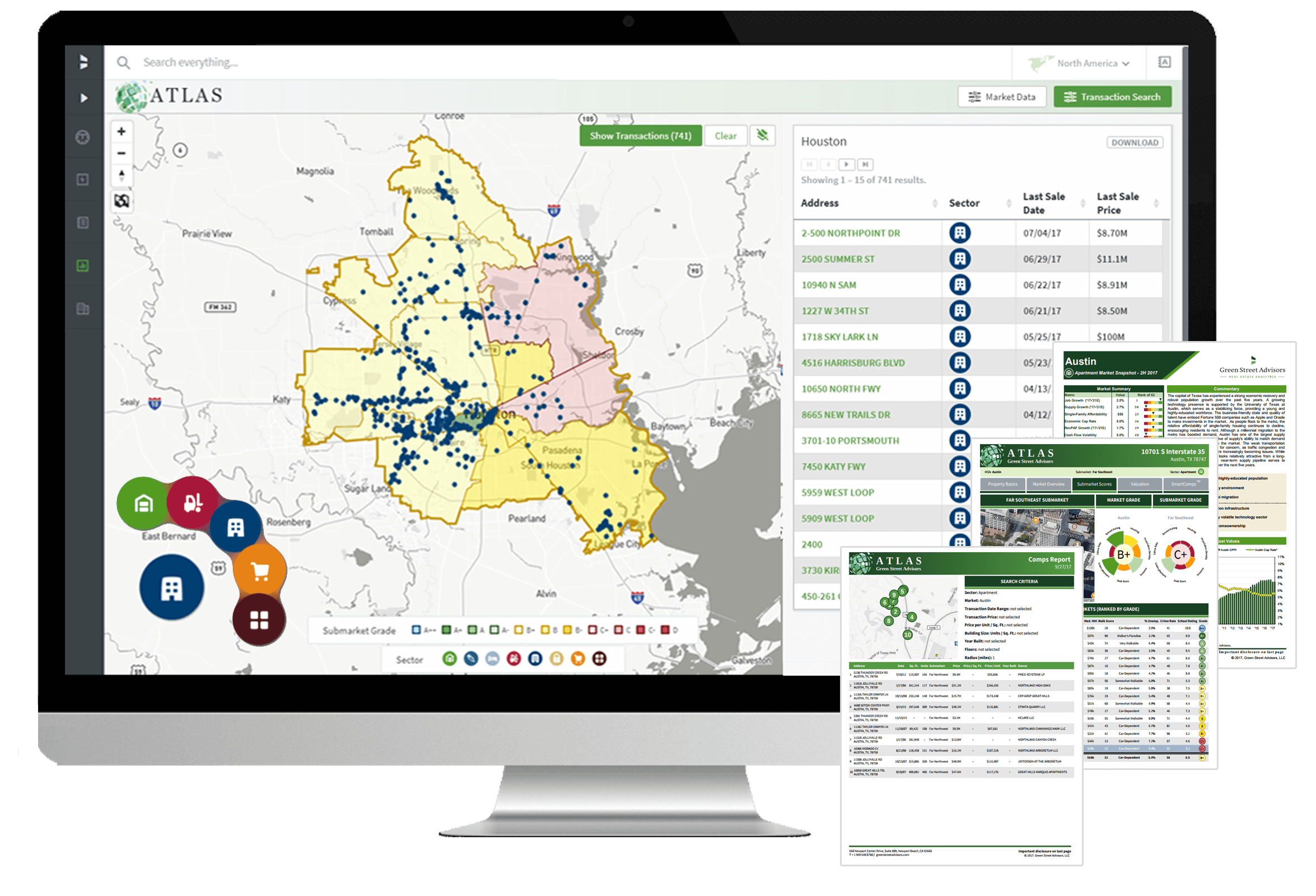

Green Street

Best for broad market and sector coverage and REIT research

Green Street is a real estate and REIT-focused research and advisory firm known for its CRE insights. Initially known for its extensive REIT research and investment recommendations, Green Street expanded its business over 20 years ago to include private real estate, offering detailed information on assets and companies.

Pros

Pros- Strong and independent macro-level opinions and research

- Well-regarded in the industry

- Superior REIT research

Cons

Cons- Property-specific data is limited compared to other providers

- Only covers transactions over $5M

- Users may need extra training to be proficient

Green Street stands out by combining market analytics, macro insights, industry news, asset valuations, and sales/rent comparables into a unified platform. Its approach to data ingestion sets Green Street apart, pulling information from various sources like CBRE, Compstak, Placer AI, Moody’s, and more. Unlike other data providers focused on asset-level details, Green Street provides opinions and outlooks across sectors and markets it deems worthy of investment.

Main Features

Green Street aims to enhance a firm’s research capabilities at a lower cost. With around 40 analysts covering 10 asset classes, 50 MSAs, and 700 submarkets, you gain access to a wealth of expertise, over $1 million in purchased data, and comprehensive vetting and interpretation. The focus is on analytic output across sectors and markets with a roughly 5-year outlook.

The platform’s research features include a transactional database with verified transactions spanning 15+ years. The firm provides an opinion and outlook on sectors and markets worth investing in, offers early warning signals for strategic planning, and delivers easy-to-digest conclusions. A proprietary ranking of the top 50 MSAs and trending metrics adds market-level analytics to the mix, along with forecasts, risks, and opportunities.

Green Street’s grading system involves ranking and grading markets down to the zip code, providing an independent view of each sector and market. This includes considering macro events’ impact at the market level, such as population growth, employment growth, and supply growth. The grading system incorporates various metrics to assess the attractiveness of a market for each property sector, evaluating it in three different ways and ranking it against other markets based on these metrics.

User Experience, Support, and Pricing

- User Experience: The Green Street platform is slightly more complex than other data providers. Tech-savvy users can catch on quickly, but many users may need additional training to be proficient.

- Pricing: Green Street’s pricing is not transparent. Like many other platforms, it operates a value-based pricing model depending on a company’s data needs. Depending on research requirements, users can expect average pricing to fall in the $20,000-$35,000 range.

- Customer Support: Subscribers will receive a dedicated customer support rep who can provide ongoing support and training. The Green Street website also offers a Contact Us form to reach the sales team, but no other training resources for subscribers.

Green Street Summary

Green Street is the best choice if you’re looking for expert opinions and macro-level research on markets and submarkets. While other providers give you the data, Green Street goes a step further by ranking, grading, and providing forecasts.

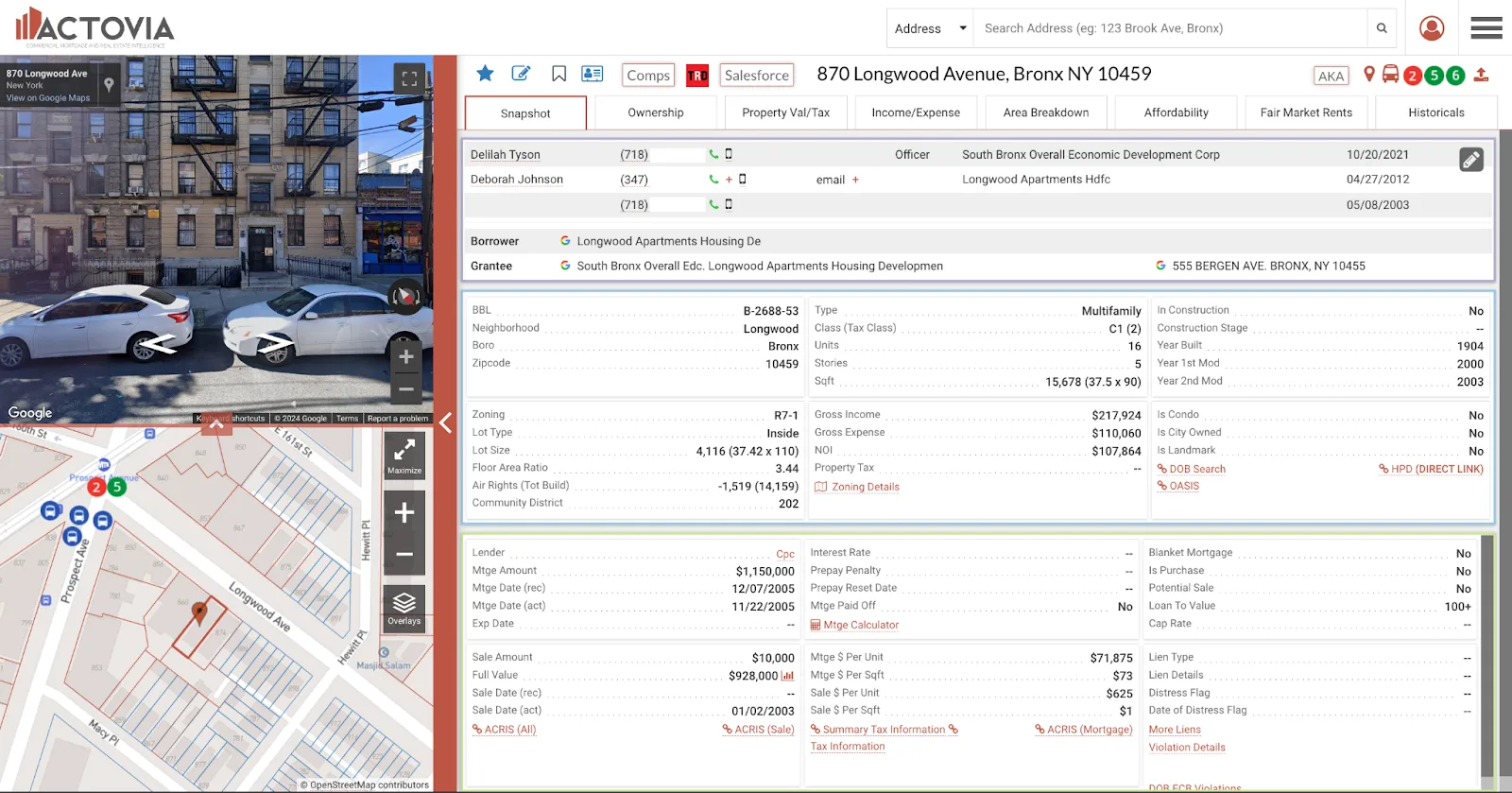

Actovia

Best for brokers, lenders, investors, and service professionals looking to canvas leads and reach decision-makers.

Actovia is an accurate and robust real estate and mortgage data platform that offers CRE professionals a powerful toolset for property research, lead generation, and market analysis. Its expanding database and specialized features cater to small firms and large enterprises alike, making it a versatile solution in the industry.

Pros

Pros- Comprehensive contact info, including owner/lender portfolio and analysis

- Versatile comps tools, including detailed mortgage intelligence

- User-friendly interface and intuitive tools with a minimal learning curve

- API integration, bulk data, customized features, and reports

- Concierge-level service with direct access to Actovia’s founder

- Well-thought-out data visualizations

Cons

Cons- Nationwide contact data (emails, phone numbers) may be limited for smaller portfolios.

- If information is not publicly accessible, it may not be available on the platform.

Main Features

Actovia is a comprehensive tool designed for commercial real estate professionals, offering a range of features to streamline workflows, enhance client management, and uncover new opportunities. Its flagship NYC and Nationwide platforms enable users to search by address, owner, parcel, or company and access property ownership details, including the individuals behind LLCs. The platforms also provide daily and weekly email updates on property transactions, liens, and trades, ensuring users stay informed. Integrated tools like spreadsheet and map views, as well as note-taking and appointment scheduling linked to properties, enhance usability and productivity.

Key features include a robust CMBS loans database that identifies opportunities by property type, loan expiration dates, and more. The NYC Violations Monitoring Platform aggregates code violations to assess property and owner risk, making it a valuable resource for mortgage brokers and service providers. Actovia’s built-in CRM system allows users to manage leads, track client portfolios, and sync schedules, while its API facilitates seamless bulk data integration with systems like Salesforce and Hubspot. Custom solutions and API capabilities further enhance the platform’s versatility, ensuring Actovia meets the diverse needs of CRE professionals.

User Experience, Support, and Pricing

User Experience: Actovia’s data is top-tier; its interface is simple and effective. Users can quickly navigate the platform’s extensive features with minimal training.

The search function is user-friendly and offers a range of search options and filters, including address, owner, company, phone, and email. Users can export data in various formats (PDF, Excel, etc.).

Users can create customized lists by filtering nearly every available data field. The data can be visualized in different formats, such as spreadsheets and maps, or aggregated by the owner or lender.

Pricing: Actovia operates on a month-to-month subscription model, with pricing ranging from $319 to $389 per user per month, depending on geographic needs and user limits. Discounts are available for multiple accounts, annual subscriptions, and upfront payments.

Unlike many other providers, Actovia doesn’t require an annual commitment. The team is confident in its product and believes offering the flexibility of a monthly subscription is best for its clients.

Customer Support: Actovia is known for its high level of customer support, with users reaching out directly to the team for help. Actovia’s concierge service helps clients find their niche and provides custom solutions on and off the platform.

While Actovia doesn’t offer a Help Center and only limited tutorials on its website, users get a free live demo upon signing up. They can expect a quick response when reaching out by phone or email.

Actovia Summary

Actovia delivers on its promise of data precision, advanced search capabilities, and effective lead tracking. Its commitment to providing high-quality CRE and mortgage data and CRM integration gives users a competitive advantage in the complex CRE landscape.

Whether you’re dealing with CMBS loans or navigating the NYC or Nationwide markets, Actovia equips users with the confidence to make informed decisions, identify off-market deals, and uncover leads across the US.

Actovia proves to be an indispensable tool for any CRE professional seeking reliable, comprehensive data solutions.

Read CRE Daily’s full Actovia Review.

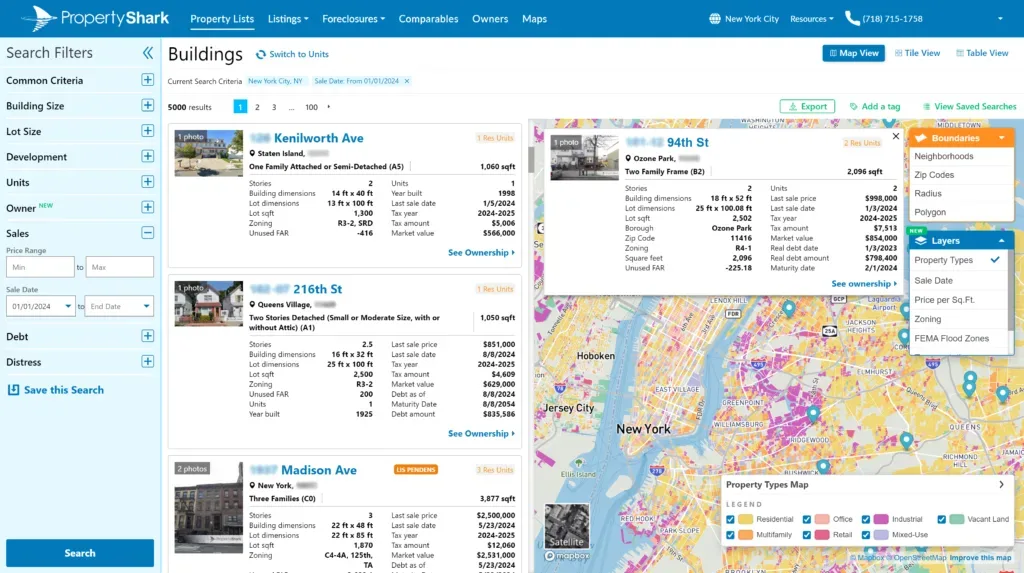

PropertyShark

Best for real estate companies looking for a data analytics/business development/research tool

PropertyShark is a leading property research tool that was acquired by Yardi in 2010 and has since grown to over 4 million registered users. The platform offers the most recent data on property transfers, permit filings, and more to give users cutting-edge insights nationwide.

Pros

Pros- The platform is user-friendly and offers a wide range of features.

- Sales data is refreshed every 24 hours for the most up-to-date information to drive informed analysis and decision-making.

- The comparable sales analysis tool provides an instant estimate of value based on similar recently traded properties.

Cons

Cons- Some regions have less publicly available data than primary markets like NY or CA.

- While some CRM features are included, PropertyShark may be lacking compared to competitors that focus on relationship management and outreach.

- PropertyShark doesn’t have all active listings, which may impact prospecting opportunities.

Main Features

PropertyShark is a robust platform aggregating public records and providing detailed insights into property ownership, sales history, zoning data, permits, and more. Its flagship feature, the property report, compiles comprehensive data on any searched property, including deed transfers, loans, and contact information for associated owners. This makes it a valuable resource for business development and prospecting. Users can view search results in various formats, such as maps, tables, and lists, while interactive zoning maps and tools like the development site grading feature offer visual and analytical capabilities for identifying trends and opportunities. Verified contact information and a daily data refresh enhance the platform’s reliability and accuracy.

Additional features include the Property Lists tool, which generates dynamic leads with customizable filters, and a foreclosure tracker for monitoring distressed properties. PropertyShark also supports strategic decision-making with investment tools like the Conversion Feasibility Index and Construction Pipeline, which identify redevelopment opportunities and analyze market trends. Its “Find Comps” feature simplifies the process of generating comparable sales data, which is essential for underwriting properties. Overall, PropertyShark equips CRE professionals with advanced tools for navigating complex markets, streamlining workflows, and identifying lucrative opportunities.

User Experience, Support, and Pricing

User Experience: The PropertyShark platform boasts a user-friendly experience with property-specific reports and intuitive category tabs that help consolidate key data points.

The General tab allows general users to quickly and easily access essential property information, such as square footage and unit count. Real estate professionals can use the Documents and Contact tabs to locate the deed trail, including ownership history, loan records, internal transfers, and more.

Pricing: PropertyShark offers a subscription-based pricing model with different tiers depending on the market(s) a user needs access to. The three tiers—Pro, Elite, and Platinum— come with varying numbers of property reports each month.

Pro users who want more functionality can upgrade their subscription to view and export verified contact information. Annual subscriptions offer up to 17% savings.

Customer Support: PropertyShark offers comprehensive customer support to users across tiers from Monday through Saturday. For assistance with the platform, users can either fill out a support form or contact a representative directly.

The training center also offers informational articles and weekly webinars to help subscribers learn about new features and how to get the most out of the platform. These resources are free to subscribers across tiers. Some of the upcoming webinars include topics such as “How to Evaluate a Property’s Value,” “How to Research and Find the Owners of Properties,” “How to Buy Foreclosures & Distressed Property,” and more.

PropertyShark Summary

Overall, PropertyShark is a powerful product for its target markets—like New York, New Jersey, and California—where transaction volumes tend to be highest and there’s plenty of data. Most users value the easy-to-use interface and straightforward layout of each property report. Since being acquired by Yardi, the platform has also rapidly expanded its features and coverage areas.

Real estate professionals rely on PropertyShark to analyze properties and ownership records and to identify and source new business opportunities. The platform presents key property-level data, such as building size, lot dimensions, and much more, on an easy-to-read dashboard with separate tabs that aggregate key information.

Users can also expect the continued development of PropertyShark’s embedded CRM features, which could help the platform stand out even more from the competition as an all-in-one property research and CRM platform.

Read CRE Daily’s full PropertyShark Review.

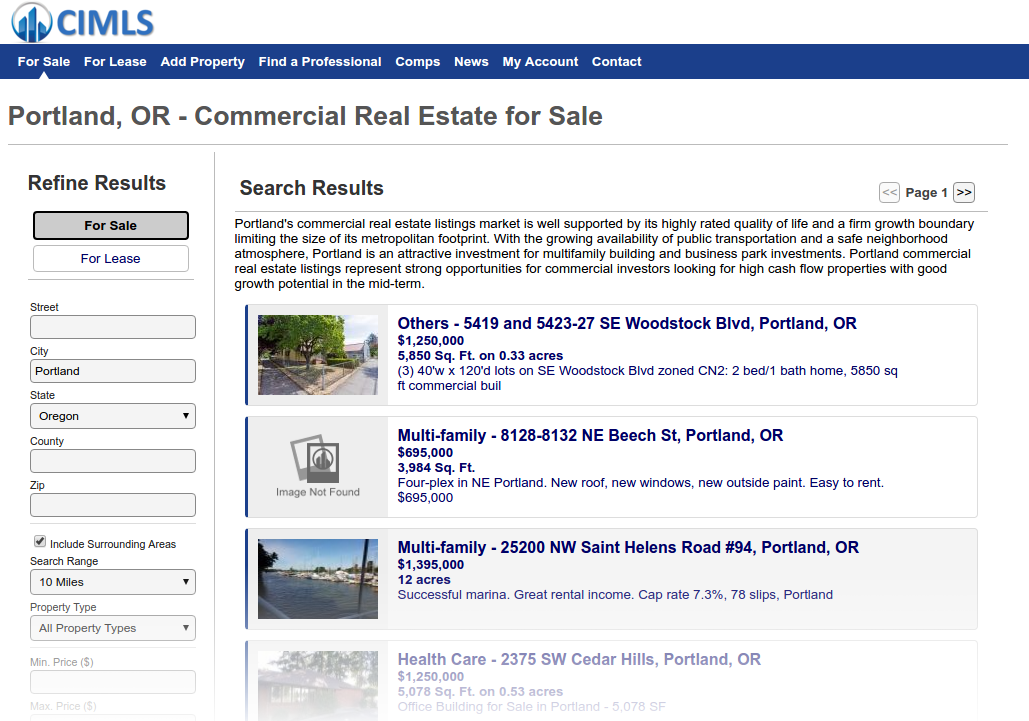

Commercial Investment Multiple Listing Service (CIMLS)

Best Free CRE Database

The Commercial Investment Multiple Listing Service (CIMLS) is one of the only free commercial real estate databases available. Like Multiple Listing Services (MLS) for residential properties, CIMLS is a centralized database for CRE brokers and agents. It’s a hub for sharing property listings, market data, and available property info. The platform’s public availability makes it an effective tool for showcasing listings and connecting with clients.

Pros

Pros- 100% free to access

- Easy and free to post a property listing

- Gold membership is only $20 per month

Cons

Cons- Limited property owner data

- Limited market coverage

- User interface is less intuitive compared to other platforms

With over 370,000 members, CIMLS.com brings together individual investors and commercial real estate brokers. The platform’s popularity results in over 70,000 direct visitors each month, and an additional audience accessing CIMLS.com content through search engines like Google, Yahoo, and Bing.

Main Features

CIMLS.com offers both Basic and Gold Memberships. The Basic Membership is entirely free and allows users to search the entire database and list unlimited properties.

The Gold Membership, a premium offering, aims to maximize exposure for listings by positioning them above free listings in user searches. Additional benefits of the Gold Membership include lead generation and enhanced listing features, making it a comprehensive solution for users seeking premium exposure for their commercial properties.

User Experience, Support, and Pricing

- User Experience: The CIMLS interface feels antiquated compared to other data providers on the market. The search function is easy to use, but the features and dataset are limited. It’s easy to post listings on the platform, but the visibility of free listings is questionable.

- Pricing: CIMLS is one of the only free CRE databases on the market. CIMLS also offers a Gold Membership for a low $20 a month with advanced features, including Top Placement in Search Results, Maps and StreetView, Comparable Property Searches, Business/Service Listing in its “Find a Professional” Directory, Activity Reports, Detailed Investor Leads, and Property Demographics Information.

- Customer Support: CIMLS offers all free members 24/7 access to support via email. But since the database is free, expect delayed response times. Gold members have access to in-person phone support.

CIMLS Summary

While CIMLS is a risk-free option for users due to its free membership, property data and analytics are limited compared to other data providers. We recommend supplementing CIMLS with another data provider for a more comprehensive solution rather than relying on it as a sole provider.

Summary of Best CRE Data Sources For 2025

- CoStar: Best one-stop shop for property data and research

- Trepp: Best for CMBS data

- CRED iQ: Best for CMBS data and valuation

- Reonomy: Best machine learning platform for prospecting

- Crexi: Best for broker marketing and lead management

- Yardi Matrix: Best for business development and major market research

- RealPage: Best as a complement to property management

- CompStak: Best for sales and lease comps

- Prequin: Best for alternative asset business development & benchmarking

- Moody’s Analytics: Best one-stop shop for property data and research

- ProspectNow: Best low-cost prospecting tool

- MSCI’s Real Capital Analytics: Best for tracking market trends

- Green Street: Best for broad market and sector-specific coverage and REIT research

- Actovia: Best for brokers, lenders, investors, and service professionals looking to canvas leads and reach decision-makers

- PropertyShark: Best for real estate companies looking for a data analytics/business development/research tool

- CIMLS: Best free CRE database