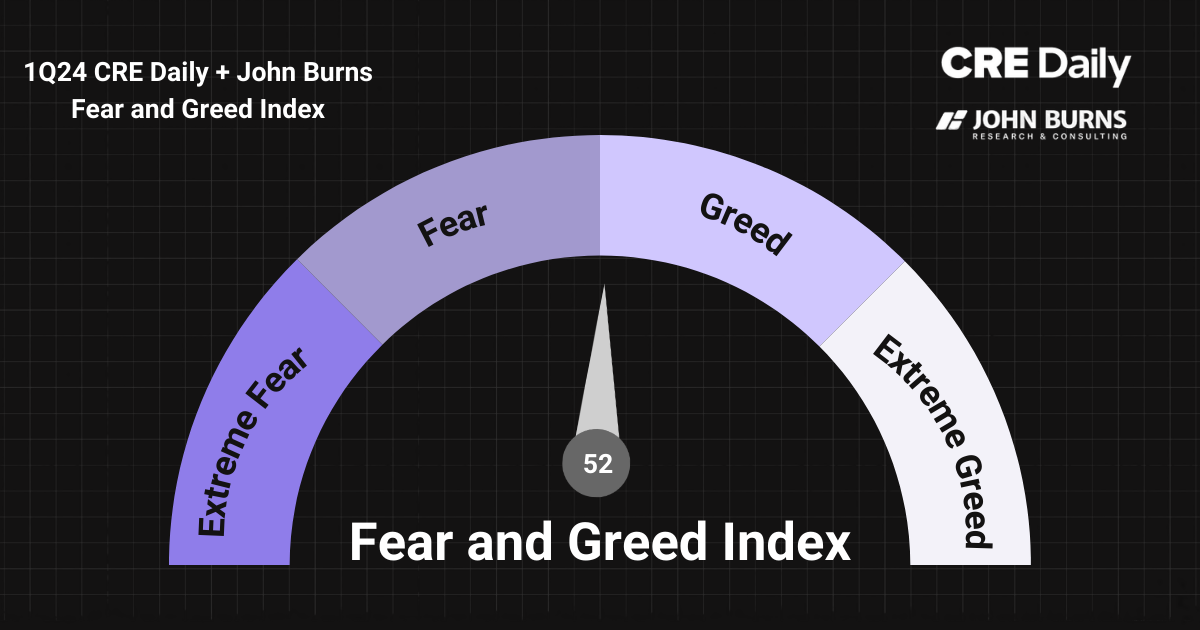

Q1 2024 Burns + CRE Daily Fear and Greed Index

Commercial real estate investors became even less optimistic this quarter, in large part because optimism over declining rates has waned.

Good morning. Good morning. The Q1 2024 results for the John Burns + CRE Daily Fear and Greed Index are in. Thank you to the 1,400+ subscribers who participated. Today’s issue breaks down how investors plan to adjust their CRE exposure and in which sectors.

Today’s issue is brought to you by Pine Peak Partners. Get direct access to first-lien transactions with strong risk-adjusted returns.

Market Snapshot

|

|

||||

|

|

*Data as of 5/28/2024 market close.

Fear & Greed

1Q24 Burns + CRE Daily Fear and Greed Index

Over 1.4K CRE investors responded to the 1Q24 Burns + CRE Daily Fear and Greed Index survey. The sentiment score of 52/100 shows a market cautiously awaiting Fed cues before making big investment decisions.

Holding steady: Despite reportedly having plenty of capital, the percentage of investors planning to increase their CRE exposure fell from 54% to 43% this quarter. Investors view industrial and retail investments much more favorably than office and multifamily investments.

By the numbers: 68% of investors plan to maintain their current CRE exposure, up from 66% in 4Q23 and 49% in 3Q23. Only 20% of respondents increased CRE exposure last quarter, while 12% lowered it. Meanwhile, 43% plan to increase their CRE exposure over the next six months, down from 54% last quarter.

Lower asset values: Investors believe asset values have decreased year over year for all major asset types, though their estimated declines have become less steep over the last few quarters. This sentiment data is valuable because actual CRE transactions are currently scarce, which can obscure the true declines in value.

“Pricing has not changed quite yet. You do not have comps data to support the decline. What you have is a standoff between sellers and buyers. Once things start to transact, you will see the declines come. Unfortunately, sellers are still holding out, which will extend the slow-moving market.”

Multifamily & office hurdles: Elevated vacancy rates in central business districts make urban office properties particularly vulnerable to potentially distressed loan maturities. Lower downtown living demand also led to lower premiums for urban multifamily properties, which are expected to slip in value by 3%.

Industrial & retail resilience: Limited supply is expected to drive retail growth in prime locations over the next few years. Meanwhile, strong demand from tenants for spaces from 30–150KSF due to onshoring and population growth supports stable or growing industrial asset values.

➥ THE TAKEAWAY

All eyes on the Fed: As traditional CRE lenders remain on the sidelines, high capital costs and expenses are impacting all CRE. And as long as the timing of future rate cuts remains uncertain, capital will likely stay on the sidelines. Pretty much everything depends on what the hawkish Fed decides to announce next. The 1Q24 survey findings are available for download here.

TOGETHER WITH PINE PEAK PARTNERS

Your Capital Invested Alongside Ours

Our vision at Pine Peak Partners is to deliver strong risk-adjusted returns to our investors. Our bridge lending opportunities offer direct access to first-lien transactions, delivering immediate cash flow.

And best of all, we’ve got skin in the game. Up to 50% of the capital invested into each opportunity is our own, providing direct alignment between our investors and our firm.

* Past performance and past distributions to investors may not be indicative of future results. An investment in real estate is speculative and subject to risk and as such there can be neither any assurance as to the final results of any such specific investment nor can there be any assurance that any investment strategy into securities offered by FNRP will achieve specific investment goals. Securities are only available to verified accredited investors who can bear the loss of their investment.

✍️ Editor’s Picks

-

NIMBY roadblocks: California’s SB9 to allow duplexes alongside single-family homes faces obstacles, with fewer than 500 landowners seeking such subdivisions.

-

Jobs surge: According to RealPage, Myrtle Beach and Charleston lead nationwide YoY job market gains despite the national slowdown.

-

Cold, hard asset: Real estate remains the top long-term investment choice for Americans (36%), followed by stocks (22%) and gold (18%).

-

Real Estate Expansion: Blackstone (BX) Real Estate Debt Strategy (BREDS) acquired a $1B senior mortgage loan portfolio with over $190B in loan volume.

-

Asian markets surge: Luxury real estate prices in NYC are declining, while prime property in Manila, Tokyo, and Mumbai show double-digit gains.

🏘️ MULTIFAMILY

-

Multifamily madness: According to Marcus & Millichap, Q1 multifamily absorption surged by nearly 104K units, setting a historic high.

-

Where Brooklyn at? Lonicera Partners secured a $74M loan from First Citizens Bank to refinance a 160-unit luxury building in Downtown Brooklyn.

-

RI rollercoaster: The Rhode Island housing market sees a surge in sales, with the median price for multifamily homes up 16.7%, hitting $525K.

-

Pace by pace: Bayview PACE provided $15.5M in C-PACE financing for Whitmore Villa, a $52M multifamily development in Monterey Park.

🏭 Industrial

-

Buford boom: U-Haul (UHAL) plans a new Buford self-storage site, adding to the company’s Georgia portfolio. The facility will feature 800 units and multiple services.

-

Deal of the day: EQT Exeter acquired a 5.1MSF industrial portfolio in Minneapolis-St. Paul for $284.6M from Prologis (PLD).

-

Off to the races: The Indianapolis industrial market is booming with 4.3MSF under construction, driven by growing e-commerce, logistics demand, and corporate relocations.

-

The hottest data: Equinix (EQIX) is investing $94M in its third Rio de Janeiro data center, RJ3, with 560 racks across nearly 15.8KSF.

🏬 RETAIL

-

Retail resilience: Retail bankruptcies are rising, with Red Lobster closing 108 locations, but landlords are also quickly filling vacancies with better tenants.

-

Net-lease boom: Single-tenant net-lease properties show strong performance, with the national vacancy rate down 10 bps, supporting retail spending growth.

-

Growing pains: The FRESH program in NYC for healthy food access has led to 30 new grocery stores since 2009. Arguably, that’s not nearly enough.

🏢 OFFICE

-

Office shuffle: Office vacancies drop slightly in Downtown San Jose and San Francisco yet rise in Oakland.

-

Tower makeover: A Slate Asset Management affiliate acquired the 60-story Comerica Bank Tower in Dallas, planning a mixed-use redevelopment with 535KSF available.

-

Shareholders revolt: Vornado Realty Trust (VNO) faces serious shareholder backlash, with 40% opposing CEO Roth’s $19.7M pay raise, citing pay-for-performance misalignment.

-

Latest listing: RFR Holding seeks to sell its Gramercy Park office building at 281 Park Avenue South, with 45KSF, previously linked to Anna Delvey.

🏨 HOSPITALITY

-

Landmark purchase: Blue Suede Hospitality Group acquired the historic Blue Moon Hotel in Miami Beach, featuring 75 rooms, for $16.6M.

📈 CHART OF THE DAY

According to the BLS, the number of employed people rose by 0.32% YoY (or 515K employees) in April 2024. Meanwhile, the total number of unemployed shot up 14.5% (coincidentally also 515K people).

You currently have 0 referrals, only 1 away from receiving B.O.T.N Multifamily Deal Screener .

What did you think of today’s newsletter? |