- Suburban markets outperformed urban ones, with NYC Metro’s CBD as an exception, showing strong Class A and B/C recoveries.

- Demand for premium office space remained strong in 2024, but Class B+ rents also showed signs of improvement, suggesting a spillover effect.

- The technology, advertising, media, and information (TAMI) sector reached its highest leasing share since 2021, with upcoming expirations likely to fuel demand into 2025-2027.

- Lease renewals saw longer terms in 2024, indicating landlord efforts to retain tenants, though concessions such as free rent remained high.

- Major law firms in Midtown Manhattan secured some of the highest-value leases, reinforcing legal services as a key demand driver.

Suburban vs. CBD Performance: A Market Divide

The 2024 office market revealed significant disparities between suburban and CBD/urban areas. While nine suburban markets showed clear signs of recovery, only five urban markets demonstrated similar momentum, according to CompStak’s 2024 Year-End Office Market Report.

Notably, NYC Metro’s CBD was the only major market where urban space showed a strong comeback, whereas its suburban submarkets lagged behind.

Despite these improvements, the national CBD office vacancy rate remained higher than the suburban vacancy rate. However, urban vacancy rates trended downward by year-end—a positive shift after years of increasing rates.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Peak of Prime Class A Rents?

Prime Class A office rents continued an upward trajectory in 2024, signaling potential stabilization at a cyclical peak. High-end space remained in demand, especially in gateway markets. However, an interesting shift occurred in Class B+ space, which saw rising rents—suggesting demand may be spilling over from top-tier buildings.

TAMI’s Return & AI’s Role in Office Demand

The TAMI sector showed signs of resurgence, reaching its highest share of leasing activity since 2021. As AI-driven industries expanded, demand for office space in the sector increased. Leasing momentum is expected to grow through 2027 as more TAMI leases expire.

The legal sector maintained its strength, capturing a double-digit share of office leasing for the second consecutive year. The FIRE (Financial Services, Insurance, and Real Estate) sector continued to lead but has steadily declined in market dominance over the past two years.

Renewals Grow, But Concessions Still Play a Role

The length of lease renewals grew steadily in 2024, marking a positive trend for office landlords. However, tenants still commanded significant concessions, particularly free rent, which reached record highs for renewals.

Tenant Improvement (TI) Packages Hit Record Highs

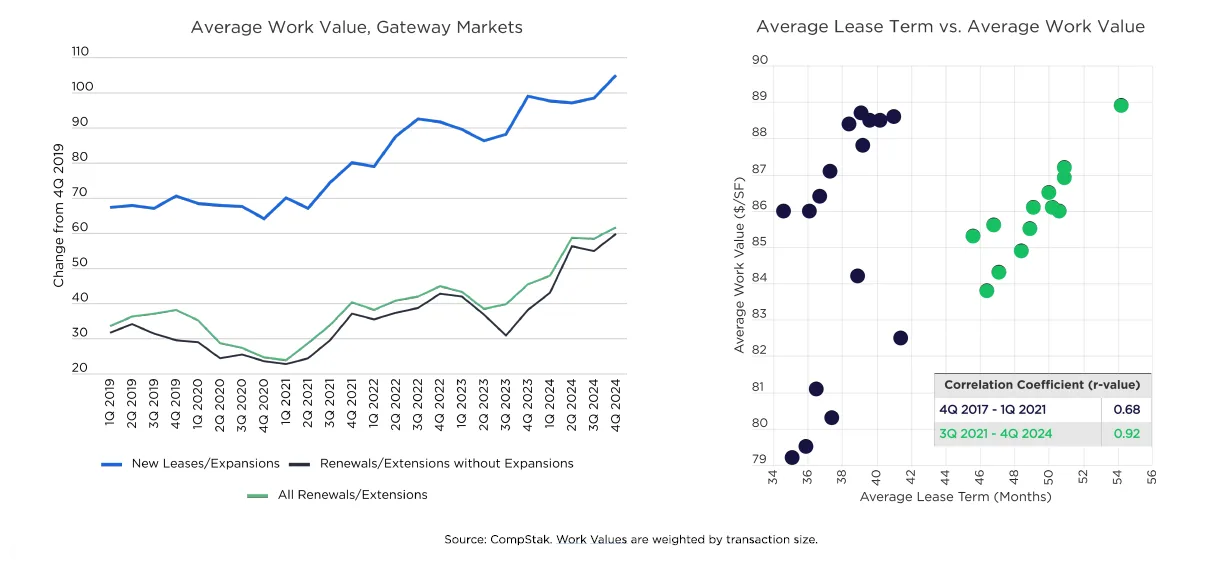

Tenant improvement (TI) allowances surged to a new cyclical peak at the end of 2024 as landlords continued using high work value incentives to secure long-term lease commitments. The increase was most pronounced in renewals and extensions, which saw higher TI allowances than new leases for three consecutive quarters from Q2 to Q4 2024.

A key trend emerging post-COVID is the strong correlation between lease term length and work value, with longer commitments attracting more generous TI packages. This relationship has strengthened significantly in recent years—between Q3 2021 and Q4 2024, the correlation (R-value) between lease duration and TI spending rose to 0.92, compared to 0.68 in the pre-pandemic years (Q4 2017–Q1 2021).

NYC Dominates High-Value Office Leases Across Key Sectors

NYC remained the top market for high-value office leases in 2024, securing the majority of the largest transactions across the TAMI (Technology, Advertising, Media, and Information), Legal Services, FIRE (Financial Services, Insurance, and Real Estate), and Life Sciences sectors.

Life Sciences: While life science tenants generally signed smaller leases, NYC still secured a major deal, with Roivant Sciences leasing space at 1 Penn Plaza for over $105M.

TAMI: This category’s top five lease deals were concentrated in NYC and San Francisco, with Bloomberg leading the pack by signing a 924,797-square-foot lease worth $719.3M. OpenAI also made a significant deal, valued at $238.8 million.

Legal Services: Three of the biggest leases were signed in NYC, with Ropes & Gray taking the top spot, committing to 427,000+ SF for $786.8M in Midtown Manhattan.

FIRE: Financial firms led leasing activity, with The Blackstone Group securing one of the largest 2024 transactions at over 1 MSF for $635M. TPG inked the only new lease in this category, valued at over $1B.

Source: CompStak

Why It Matters

While the office sector remains in transition, 2024 brought notable signs of stability, particularly in NYC’s urban core. The divergence between suburban and urban market recovery, increasing TAMI activity, and potential stabilization in Class A rents suggest the office market is entering a new phase.

What’s Next?

Looking ahead, watch for continued shifts in lease renewals, potential stabilization of Class A rents, and increasing TAMI leasing activity. With nearly a third of all gateway market office leases set to expire by 2027, the next few years will be crucial in shaping office market trends.