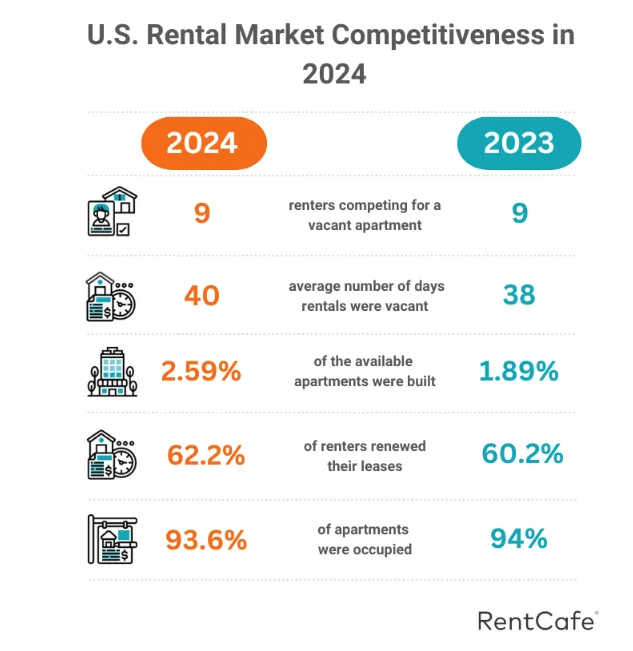

- Two-thirds of US renters renewed their leases in 2024, keeping the Rental Competitiveness Index (RCI) high at 74.4, even as new apartments entered the market.rn

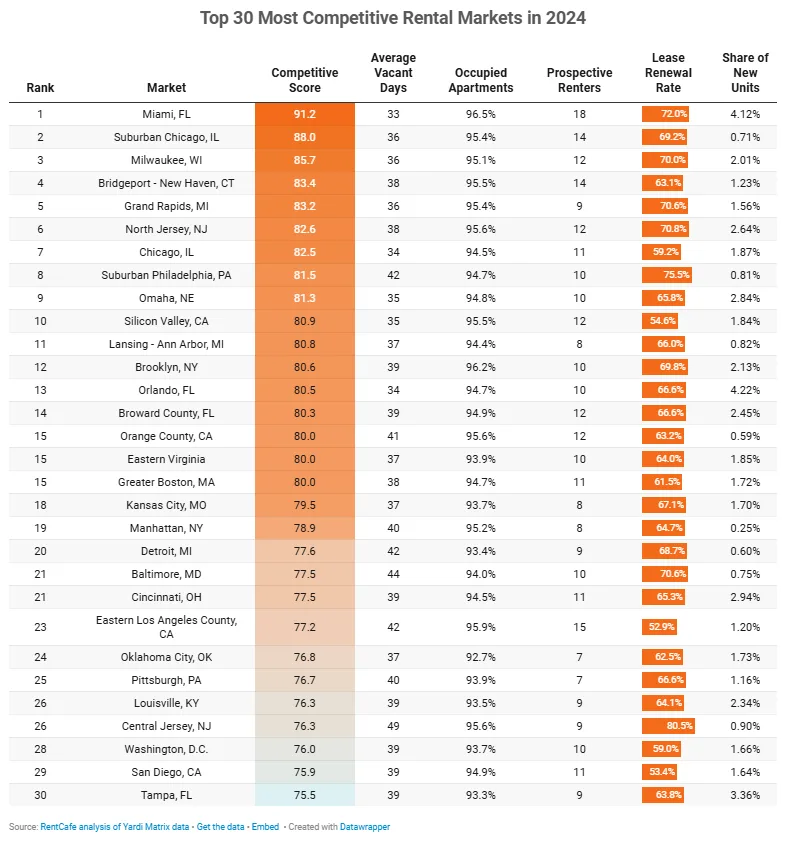

- Miami remains #1, with apartments in Miami renting out in just 33 days on average, with 18 renters competing per unit — double the national average.rn

- Suburban Chicago (#2) and Milwaukee (#3) lead the Midwest’s dominance, with nine of the top 30 most competitive markets in the region.

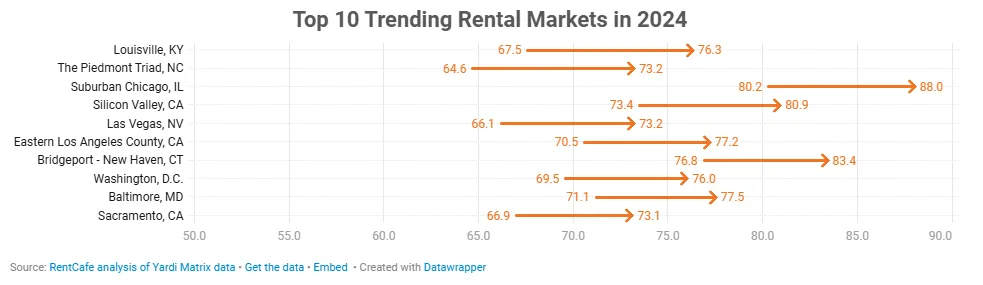

- Louisville, KY, topped the list of trending rental markets, while Grand Rapids, MI, and Fayetteville, AR, showcased growing demand.rn

- A wave of new apartments will ease competition slightly, but high lease renewals and expensive homeownership will keep renters in the market.rn

Apartment seekers faced tough conditions nationwide in 2024, according to RentCafe’s Year End Report. While new apartments sprang up across the US, high lease renewal rates (62.2%) limited availability.

On average, renters had to compete with eight others for each available unit, which was typically rented out within 40 days. Nationwide, occupancy stood at 93.6%, slightly lower than last year’s 94%.

Miami Holds the Crown

Miami remains the hottest rental market in 2024, with an RCI score of 91.2, driven by its booming tech and finance sectors, no-tax policies, and strategic location.

However, signs of softening have emerged, with apartments staying on the market slightly longer (33 days) and fewer renters competing per unit (18, down from 22 in 2023). Despite a 4.12% increase in apartment supply, occupancy remains high at 96.5%.

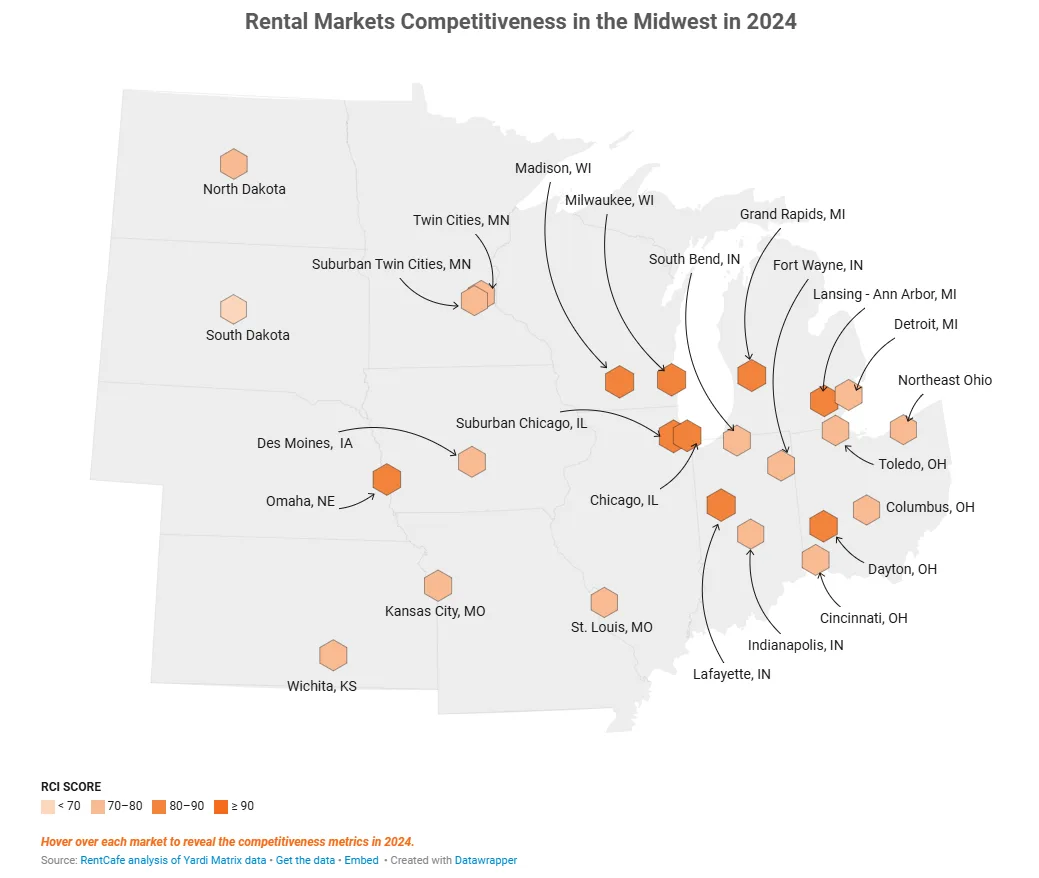

Midwest Markets Close In

The Midwest dominated in 2024, claiming 9 of the top 30 spots for rental competitiveness, driven by affordability and a balance of urban amenities.

Suburban Chicago emerged as the nation’s second-hottest rental market in 2024 with an RCI score of 88, driven by corporate relocations, affordability, and “hipsturbia” appeal in areas like Naperville and Evanston. With 95.4% occupancy and 69.2% of renters renewing leases, competition remains high, as 14 renters vie for each unit.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Meanwhile, Chicago ranks seventh nationally, with a 94.5% occupancy rate and an influx of job seekers keeping demand strong despite a slight supply increase.

Milwaukee ranks third, with an RCI score of 85.7, as homebuying hurdles and limited supply push more renters into the market. With less than 5% of units available and 70% of renters renewing leases, apartments are snapped up within 36 days, attracting 12 renters per unit.

Trending Markets in 2024

Several metros saw significant jumps in their RCI scores:

- Louisville, KY: This year’s top-trending market climbed 8.8 points to an RCI score of 76.3. A mismatch between demand and supply drove lease renewal rates up 5.4%, further intensifying competition.

- Piedmont Triad, NC: The Greensboro, Winston-Salem, and High Point metro areas saw their RCI rise by 8.6 points, driven by a housing shortage and growing demand in their manufacturing and transportation sectors.

- Silicon Valley and Las Vegas: Both markets experienced similar gains in competitiveness, reflecting their strong economies and limited rental availability.

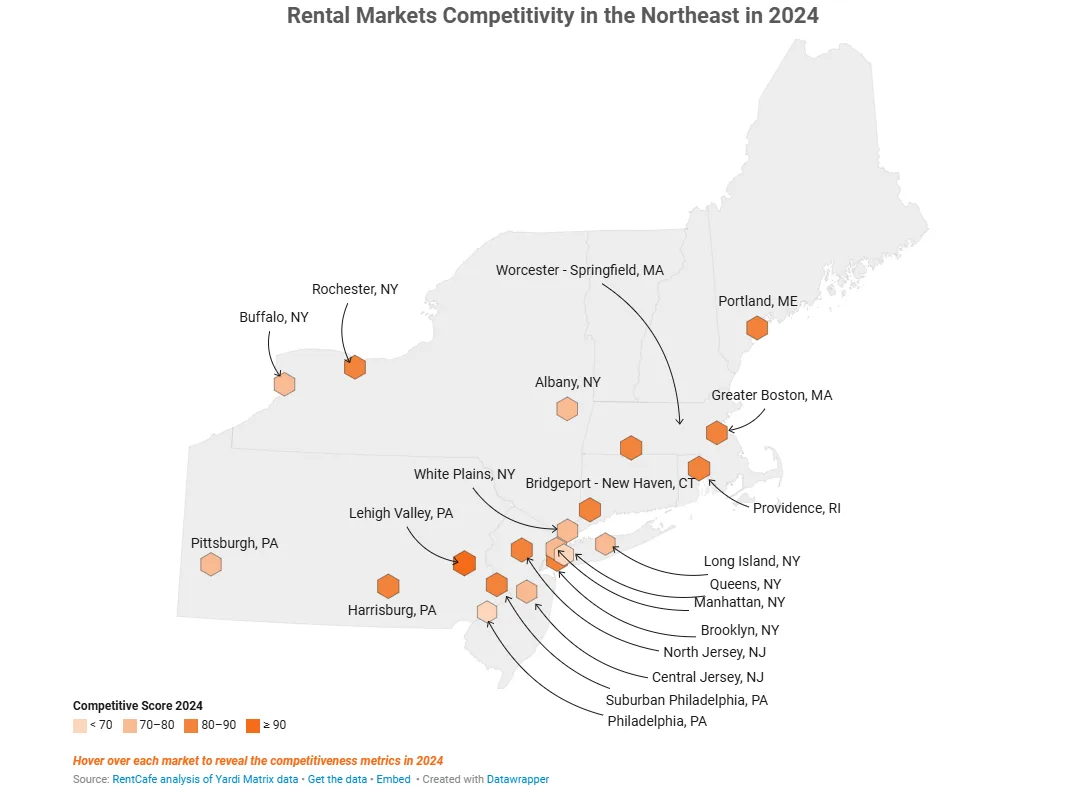

Northeast Markets Stay Hot

The Northeast remained highly competitive for renters, with eight metros ranking in the top 30 despite increased apartment construction.

Bridgeport-New Haven, CT, led the region, driven by growing demand from families and younger renters drawn to biotech and education jobs, pushing the RCI score to 83.4.

North Jersey ranked second in the region, with high lease renewal rates and occupancy at 95.6%, fueled by proximity to New York City and a strong tech sector.

Brooklyn emerged as a hot spot in New York City, with fierce competition as less than 4% of units remained available. Meanwhile, Manhattan saw a slight increase in lease renewals, keeping apartments scarce and highly sought after.

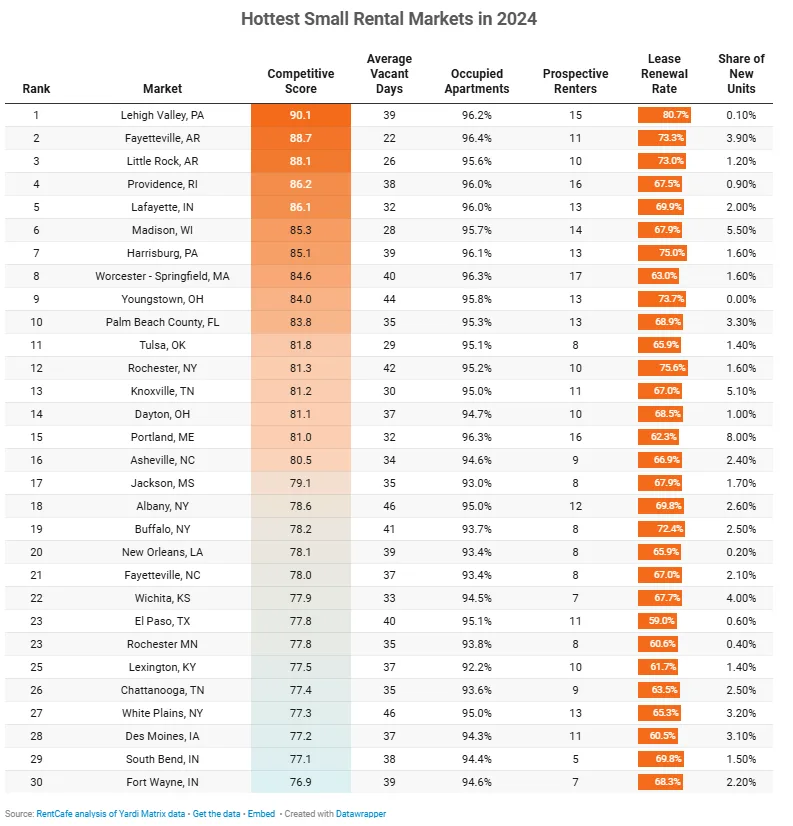

Smaller Markets Gain Ground

Smaller rental markets faced intense competition in 2024, with Lehigh Valley, PA, emerging as the hottest small market, boasting an RCI score of 90.1. Limited new apartment construction (0.14% increase) and high demand from locals, students, and remote workers pushed 80.7% of renters to renew their leases, leaving less than 4% of units available and drawing 15 renters per unit.

Fayetteville, AR, and Little Rock, AR, followed closely, with strong job markets and minimal new housing, keeping competition high. Across other small markets like Worcester-Springfield, MA, and Palm Beach County, FL, surging lease renewals and limited supply drove RCI scores up, underscoring the challenges for renters nationwide.

What Can Renters Expect in 2025?

Renters in 2025 can anticipate slightly less competition due to a surge in new apartments opening nationwide. This increase in supply is expected to ease pressure on the rental market, making it easier to find available units, as reflected in improved vacancy rates and fewer renters per vacant unit.

However, competition will remain moderately high due to a significant share of lease renewals. Factors like high home-buying costs and additional financial responsibilities tied to homeownership will continue influencing renter demand.