- Microsoft and Amazon are under scrutiny for potential cutbacks in AI-related capital expenditures, signaling a possible cooling in tech investment.

- Microsoft reportedly paused some global data center projects, while Amazon reassured that AWS expansion plans remain steady despite market concerns.

- Wall Street expects steady earnings growth for both companies, with analysts urging investors to stay focused on long-term AI demand.

AI Spending at a Crossroads

With Microsoft set to report earnings on Wednesday and Amazon on Thursday, analysts are paying special attention to their capital expenditure plans.

Both companies, dominant forces in cloud computing, are rumored to be slowing investments in AI-related infrastructure, which could signal a broader economic cooling, per Bloomberg.

Joe Tigay, portfolio manager at Rational Equity Armor Fund, noted that a slowdown in cloud capex would “scream economic caution” and could negatively affect market valuations. Given the market’s recent volatility and tariff-driven uncertainty, investors are bracing for any signs of recessionary trends.

Shifts in Investment Patterns

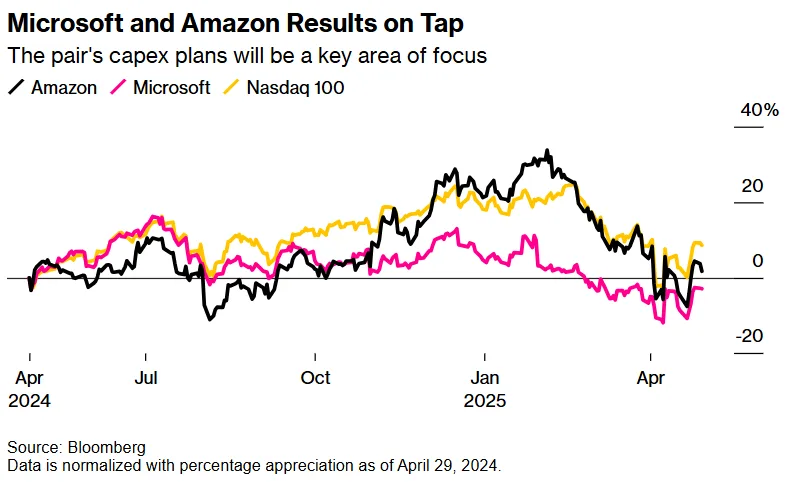

Amazon shares have slid more than 20% from February highs, and Microsoft has not reached a new peak since last July. Reports indicate Microsoft is pulling back on global data center projects, with canceled equipment orders for facilities requiring long lead times. Similarly, Amazon Web Services is reportedly pausing some data center leases, though AWS leadership insists demand remains strong for both generative AI and foundational workloads.

Adding to the cautious outlook, Wells Fargo and TD Cowen analysts have warned of a “material” slowdown in AI-related infrastructure spending, exacerbated by growing policy uncertainty and global trade tensions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Bigger Picture

The four largest AI infrastructure spenders — Alphabet, Meta, Microsoft, and Amazon — are still expected to collectively invest over $300B this fiscal year. Alphabet’s $75B capex plan and better-than-expected Google Cloud operating profits suggest some resilience. However, Chinese competition from AI startups like DeepSeek and broader concerns about an overheated data center market are pushing analysts to reassess long-term growth trajectories.

Investor Sentiment

Despite looming concerns, Wall Street remains largely bullish on Microsoft and Amazon, with more than 90% of Bloomberg-tracked analysts recommending their shares. Earnings forecasts predict Microsoft’s revenue will rise nearly 11% and Amazon’s net earnings will jump almost 40% year-over-year.

Jim Worden of Wealth Consulting Group advises patience, noting that AI’s full potential is still unfolding and that investors should “play the long game” despite current uncertainties.

Why It Matters

A material reduction in tech giants’ capex would not only dampen AI enthusiasm but also signal deeper worries about economic strength. Given the premium valuations many tech stocks still command, any significant slowdown could have broad repercussions for the stock market.