- Link Logistics is planning a 1.1MSF industrial complex at Juniper Crossing near Tesla’s gigafactory in East Austin.

- There’s been rapid growth from Tesla’s gigafactory all the way to Austin-Bergstrom Airport, in particular.

- Austin’s industrial sector boasts steady leasing and robust construction, projecting a positive overall outlook.

Building Bigger

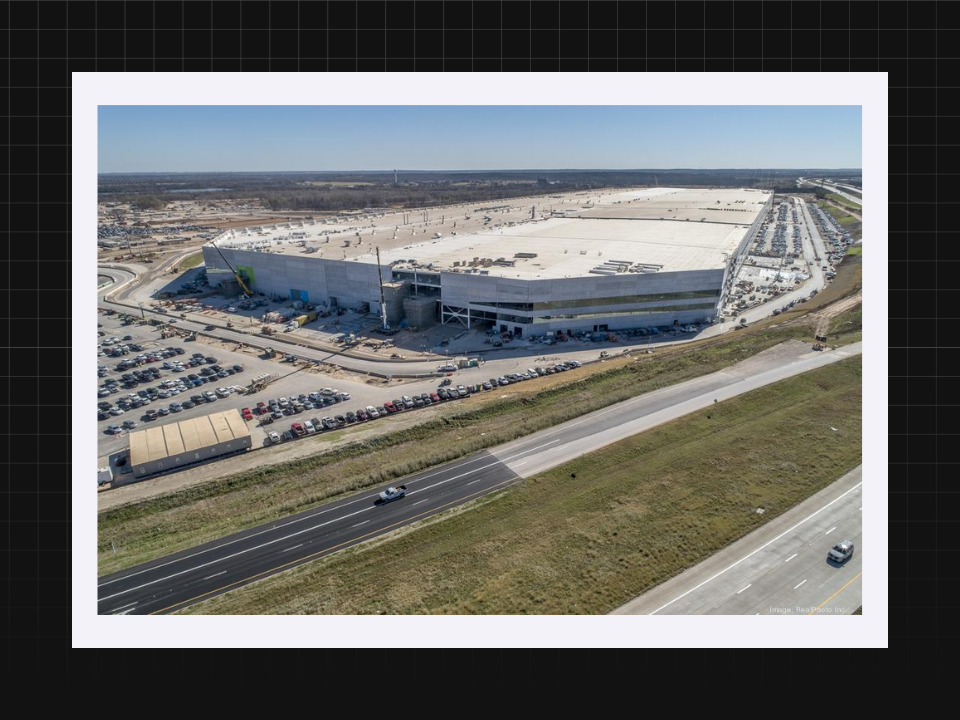

Blackstone’s (BX) industrial arm, Link Logistics, is embarking on a sizeable project near Tesla’s (TSLA) Austin gigafactory, according to the Austin Business Journal.

Juniper Crossing will be a 1.1MSF industrial complex on 127 acres at 11902 Farm to Market Road 969. Blackstone acquired the land in 2021 and filed preliminary plans, as reported by The Real Deal.

Rapid Growth

Far East Austin has become a hotbed for industrial development, especially with Link Logistics and Sansone Group initiating massive projects near Tesla’s gigafactory. The area’s overall marketability in the capital of Texas, as well as the presence of major companies like Tesla, continue to attract investors and developers.

Zooming out, the industrial development that’s currently underway from the Tesla gigafactory all the way to Austin-Bergstrom International Airport includes projects from Brookfield Properties (BN), Patrinely Group, Stream Realty Partners, and Stoneridge Capital Partners (SRI).

Why It Matters

According to Avison Young, Austin’s industrial market is enjoying sustained leasing activity and a robust construction pipeline, with the industrial vacancy rate at 13.5% in Q1. Despite pandemic complications, the delivery of 8.7MSF of industrial space in the Far Northeast market since 2016 is a clear sign of sustained growth.