- Over $6.1B in community bank multifamily loans are delinquent, adding up to a 0.97% delinquency rate within a $629.7B loan pool.

- As of September 2024, realized losses in apartment loans reached $504M, the highest since 2013, signaling ongoing distress.

- The distress rate for multifamily CMBS loans surged to 12.9% in January 2025, up from 2.6% a year earlier.

- Multifamily owners who secured loans at low interest rates (2–3%) now face higher rates (5–6%), straining cash flows and raising distress.

- With $500B in CRE loans maturing this year, multifamily is heading for a refinancing cliff, and distress could reach 14–15% by year-end.

CRED iQ’s latest analysis reveals growing delinquent multifamily loans held by community banks, according to Bloomberg. Notably, losses have gone up for eight consecutive quarters, signaling deepening issues in the sector.

By The Numbers

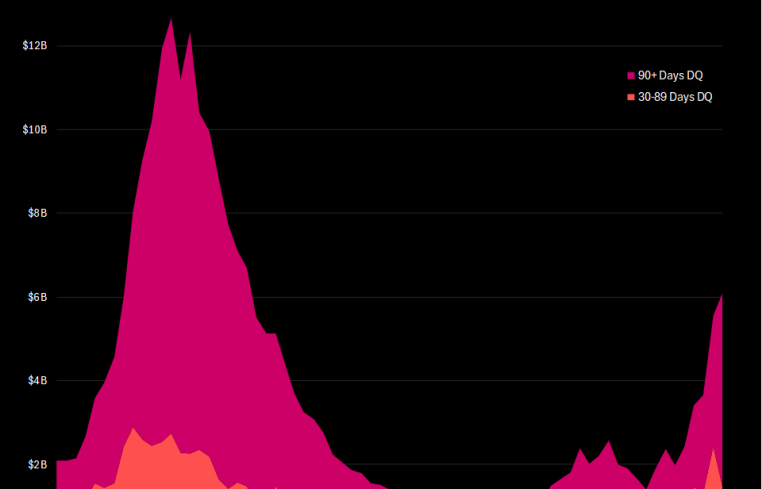

Over $6.1B in loans secured by apartment buildings are now delinquent, with a 0.97% delinquency rate on $629.7B in multifamily loans. The last time delinquent multifamily loans surpassed $6B was in March 2012, with a delinquency rate peaking during the 2008–2010 financial crisis.

In addition to the rise in delinquent loans, CRED iQ also highlights that realized losses from multifamily loans have been climbing steadily. As of September 2024, total losses amounted to $504M—the highest level since 2013.

Spreading Distress

The distress is not limited to community banks. In the CMBS sector, the multifamily loan distress rate jumped to 12.9% in January 2025, a sizeable spike from 2.6% in January 2024. This spike combines both delinquent loans (30+ days late) and loans under special servicing, indicating broader concerns.

A key driver of rising distress is large, troubled loans, such as the $1.75B loan tied to San Francisco’s Parkmerced residential complex. These large loans pushed the distress rate upward, and the trend shows no signs of slowing down.

CRED iQ’s analysis suggests multifamily distress has been accelerating over the past year, with CMBS multifamily delinquency rates reaching 4.5% in January 2025, up from 3.8% a year prior.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Refinancing Challenges

The Federal Reserve’s rate hikes in 2022–2023 have amplified challenges for multifamily owners. Many loans originated in the low-rate era (2–3%) now face refinancing at higher rates (5–6%), straining cash flows, particularly for properties with high leverage or slim margins.

This shift in interest rates has worsened the distress, as property owners find it increasingly difficult to manage rising debt service costs.

Bumpy Road Ahead

With $500B in CRE loans maturing in 2025, multifamily loans face a potential refinancing cliff. Without lower interest rates, the pressure could continue to mount, particularly for high-leverage properties.

If rates ease 25 bps by mid-2025, that would be a welcome relief. But oversupply in certain markets and unresolved large distressed loans (like Parkmerced) could keep distress levels high.

CRED iQ’s data indicates that the overall distress rate for all CRE reached a record 11.5% in January. Absent a major shift in market conditions, if multifamily continues to see rising distress, we could see distress rates reach 14–15% by the end of the year.