- Construction costs are rising more slowly, with a Q1 2025 increase of 0.98%—a sign the market is stabilizing after years of rapid escalation.

- Tariff impacts remain limited for now, but industry leaders are watching closely as potential policy changes could affect pricing and supply chains.

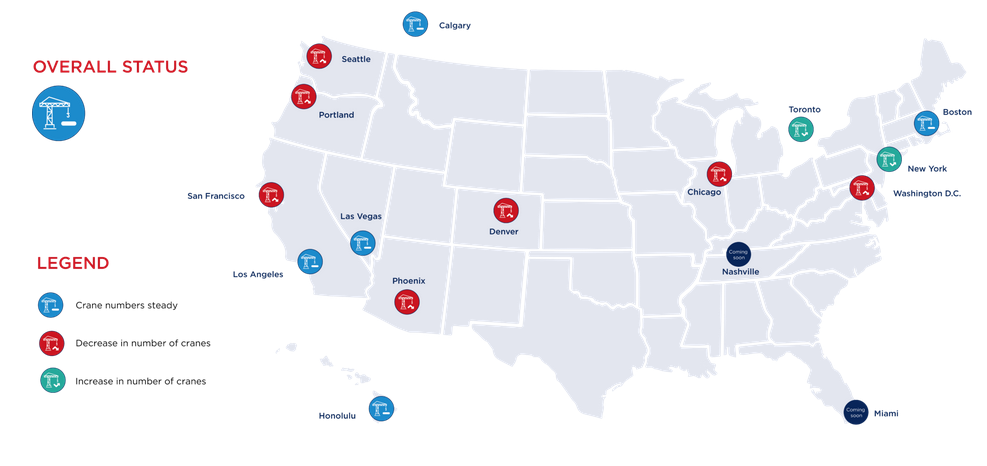

- Crane activity fell sharply in seven major cities, signaling hesitation around large-scale project starts amid economic uncertainty.

- Design slowdowns may foreshadow fewer starts later this year, making adaptability and forward planning crucial for developers and contractors.

Cooling Costs, For Now

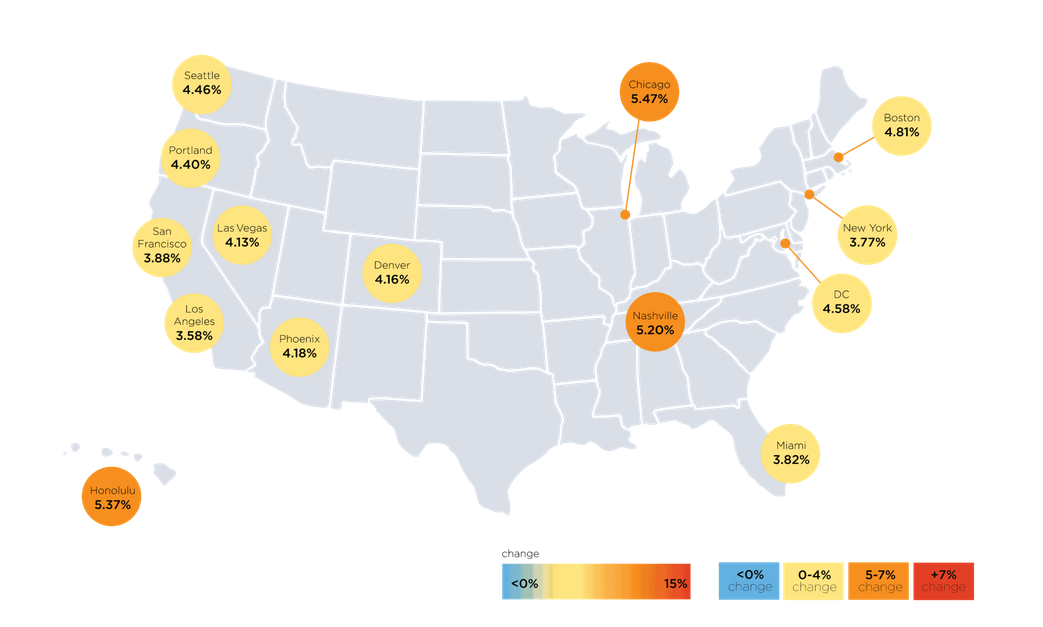

Construction costs are decelerating nationwide, per Rider Levett Bucknall’s Q1 2025 report, with a modest 0.98% increase in Q1, according to Commercial Search.

The year-over-year escalation rate now sits at 4.35%, down from 5.86% a year ago. Cities such as Honolulu, Portland, Seattle, Boston, and Chicago reported higher-than-average increases, while Miami, Washington, DC, and Los Angeles saw milder gains.

While new tariffs and inflation fears dominate headlines, they haven’t significantly impacted material prices—yet. Stamped steel, Canadian lumber, and fuel remain relatively stable, and analysts say inflationary pressures could take more time to ripple through to construction costs.

“The industry continues to adapt and is relatively stable, with escalation getting closer to pre-pandemic levels,” said Paul Brussow, president of RLB North America.

Tariffs on the Horizon

Despite the current steadiness, industry leaders are wary. New tariffs could pressure procurement and project budgets, especially for long-lead items. However, some see silver linings: increased reshoring could boost domestic construction demand.

“Ongoing tariff discussions are pushing manufacturers to move operations to the US, which could drive new construction needs,” Brussow added.

Local Challenges Remain

Even as national trends moderate, individual markets tell a more complex story. Chris Curran, CEO of Curran Young Construction, pointed to insurance spikes and permitting delays as bigger cost drivers in Southwest Florida than materials.

“Construction has always been a dynamic business. The best builders are the ones who can pivot,” Curran noted.

Other regional factors, like local fill material shortages, continue to drive up costs in specific geographies, according to Miller Construction CEO Brian Sudduth.

Crane Counts Reveal Caution

The RLB Crane Index found a 20%+ drop in crane activity across seven key cities, including San Francisco, Denver, and Phoenix. The only two cities to see an increase were New York City and Toronto—both buoyed by infrastructure and mixed-use development projects.

“Declining crane counts reflect strategic slowdowns, permitting constraints, or shifting capital priorities,” said Brian Gallagher, VP of corporate development at Graycor.

In NYC, four new cranes were added between August 2024 and February 2025—bringing the total to nine. Five developers are currently working on large-scale mixed-use projects in Midtown and the Garment District.

Eyes on Design Slowdowns

While overall sentiment is holding steady, the 2025 CIRT Sentiment Index flagged a sharp drop in the Design Index—a potential leading indicator of reduced construction starts in the coming 6–12 months.

“A slowdown in design activity could mean fewer starts down the road,” Gallagher cautioned. “It’s a signal to remain agile, especially in cooling markets.”

As the industry braces for potential policy-driven disruptions and project reprioritizations, adaptability remains key for developers and builders heading into the second half of 2025.