- CRE CLO distress fell to 14.4% in March 2025, but a high share of matured and non-performing loans signals ongoing stress.

- 69.5% of loans are past maturity, with a surge in “performing matured” loans, highlighting borrower struggles to refinance in a tighter capital market.

- Only 15% of loans remain current, down over 500 basis points month-over-month, reflecting rising debt service pressures.

- The 1213 Walnut loan, despite strong occupancy, became non-performing due to insufficient cash flow and failed extensions—echoing broader market trends.

Distress Levels Improve, But Maturity Risks Climb

The CRE CLO market saw modest progress in March.

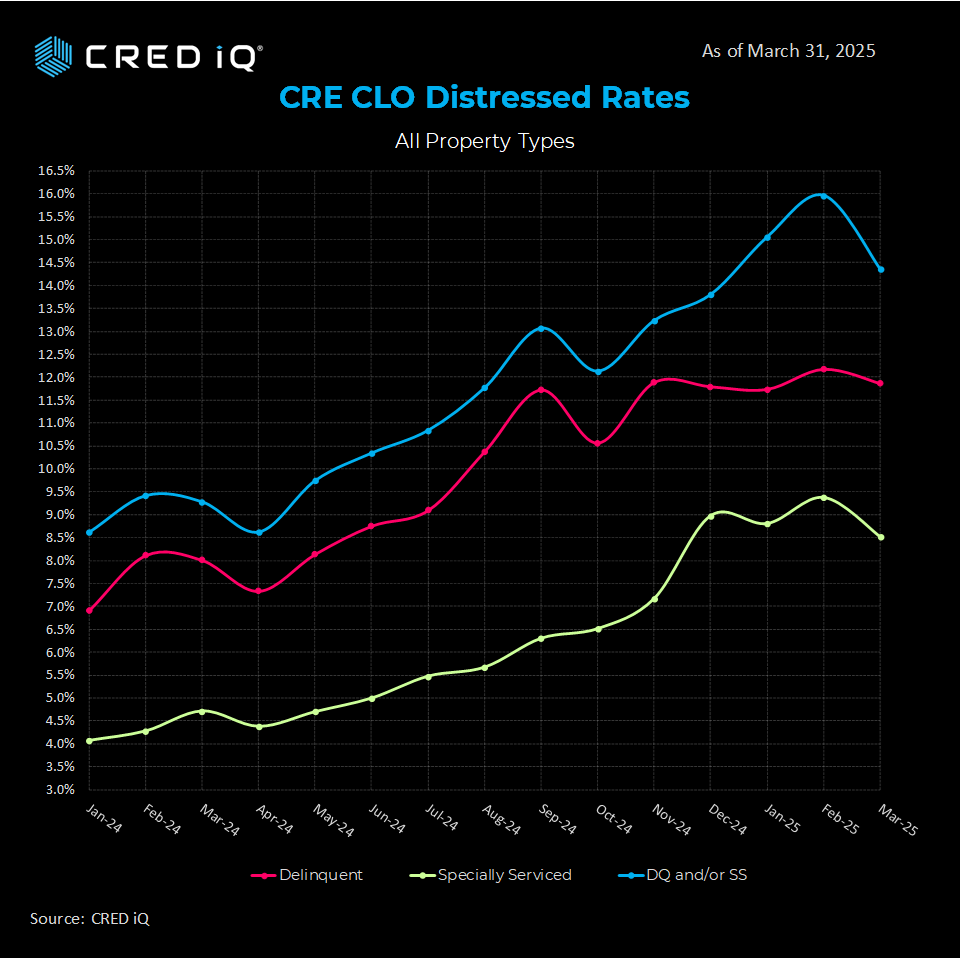

According to CRED iQ, the overall distress rate dropped to 14.4%, down from 16.0% in February. The delinquency rate declined 30 basis points to 11.9%, and the special servicing rate dipped to 8.5%.

Despite these gains, stress remains. A growing share of loans have passed maturity and depend on short-term extensions.

Maturity Wall Poses a Big Risk

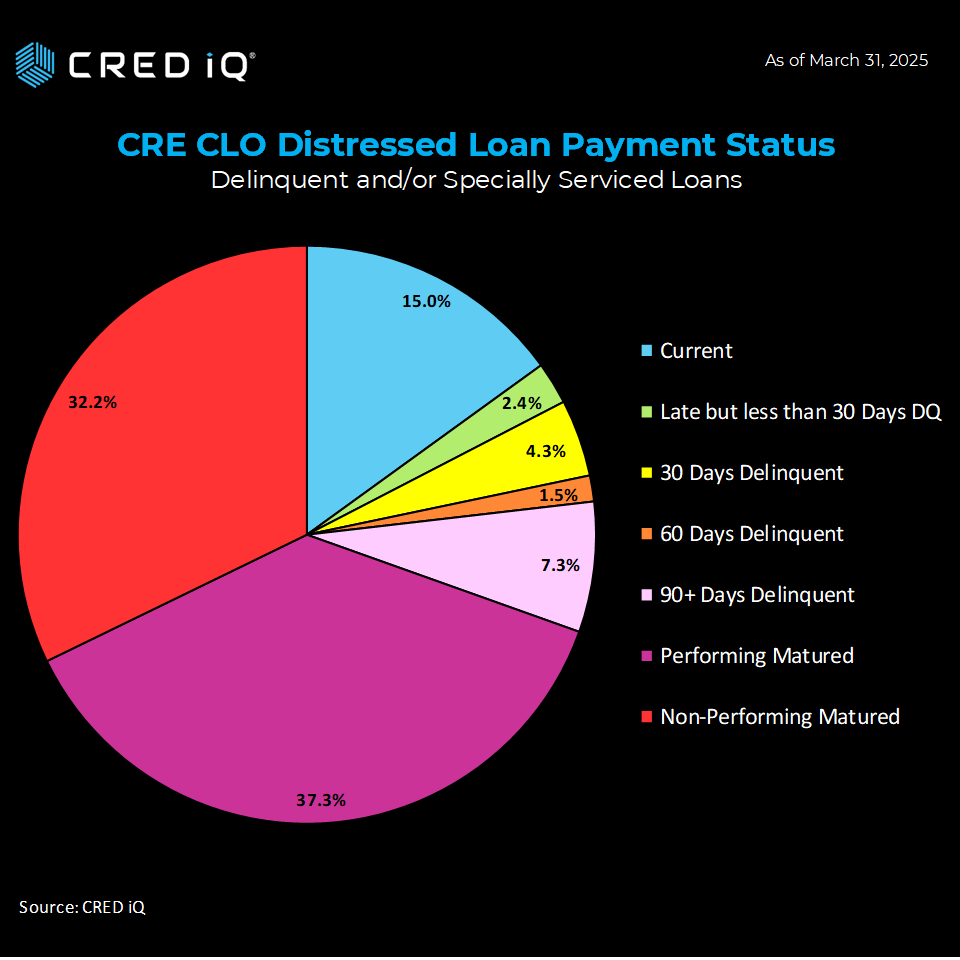

A key concern is the surge in “performing matured” loans, now 37.3% of the total. That’s up 660 basis points from the prior month.

These loans are not in default, but they’re past due and continuing under extension terms.

In total, 69.5% of CRE CLO loans are past maturity—raising red flags about borrower liquidity and refinancing prospects.

Loan Payment Performance Weakens

The percentage of current loans dropped sharply to 15%, down from 20.3% in February.

Meanwhile:

- 32.2% of loans are non-performing matured—largely flat from last month.

- 15.4% of loans are delinquent but not yet matured, a slight improvement from 16.3%.

These figures reflect rising strain on borrowers. Most loans originated in 2021 under low-rate, high-valuation assumptions. Many used floating rates and short three-year terms.

Case Study: The 1213 Walnut Loan

A high-profile loan shows how these issues play out. The $125M loan for 1213 Walnut, a 322-unit multifamily in Philadelphia, became non-performing matured in March.

The property was 90.4% occupied as of March 2025. Yet its DSCR was just 0.64, well below breakeven.

Though the loan had two one-year extension options, it now relies on month-to-month extensions. The deal is now on the servicer’s watchlist.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Behind These Trends?

Four main forces are shaping the current market:

- Rising Interest Rates: Floating-rate debt now carries much higher service costs.

- Loan Maturities: Many 2021 deals are reaching the end of their terms without refinancing in place.

- Economic Uncertainty: Office and retail face added pressure, while multifamily remains steadier.

- Extension Dependence: Many borrowers are leaning on extensions, often under tighter terms and higher costs.

What It Means for CRE Professionals

To manage risk in today’s market, CRE stakeholders should:

- Monitor DSCR Closely: Properties under 1.0 DSCR are vulnerable, even if fully leased.

- Track Maturities: With nearly 70% of loans past due, early engagement with borrowers is key.

- Focus on Resilient Sectors: Multifamily and industrial continue to show stronger performance.

- Stay Flexible: Bridge loans or JV equity may be needed as traditional refinancing remains difficult.

Looking Ahead

The improvement in distress levels is a welcome change. But the market remains under stress, especially as large volumes of loans hit maturity.

Key issuers like MF1, Arbor, LoanCore, and Benefit Street Partners are navigating a difficult environment.

Informed decision-making will be essential. CRED iQ’s data shows the value of tracking performance, maturity risk, and asset-level health in real time.