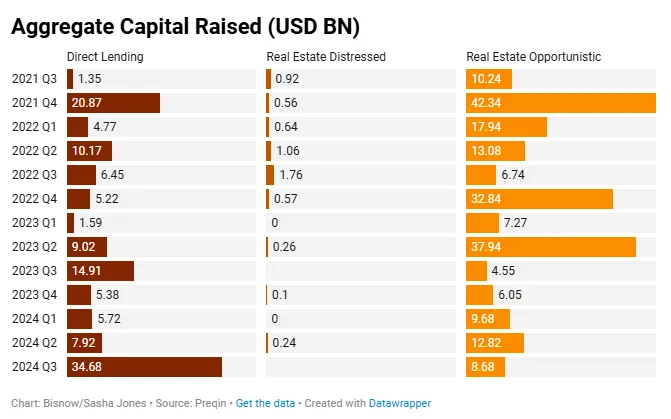

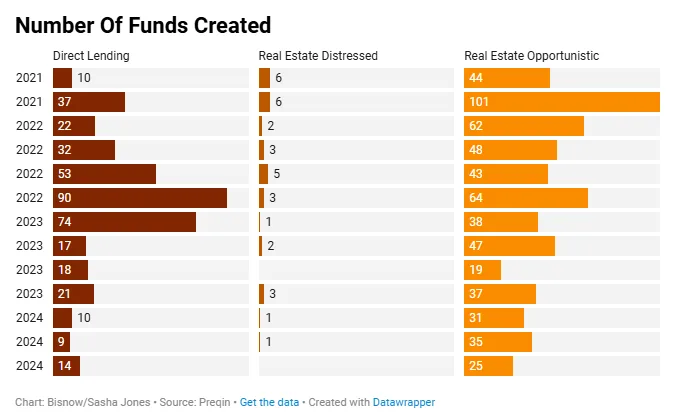

- From 2021 to 2024, $210B was raised across 594 real estate opportunity funds, but much of this capital remains undeployed.

- Distress-focused funds raised only $6B across 33 funds during the same period, with activity slowing significantly in 2024.

- Lenders modifying loans have mitigated the expected tsunami of distressed asset sales, while direct lending has gained traction due to reduced traditional lending activity.

In the wake of the pandemic, many commercial real estate investors anticipated a wave of distressed asset sales, prompting a surge in fundraising for opportunity and distress funds.

But, as reported in Bisnow, the anticipated surge in sales hasn’t happened.

By The Numbers

According to MSCI, the number of U.S. properties in financial distress reached $102.6B in Q3, but the pace of distress has slowed down. Banks are opting to modify or extend loans instead of foreclosing or forcing sales.

The Federal Reserve Bank of New York estimates around $400B in near-term commercial real estate maturities, with many lenders allowing owners to retain assets longer than expected.

Falling Fundraising

After raising $70B in 2022, opportunity funds have seen contributions trickle in, with just $31B raised in the first three quarters of 2024, according to Preqin.

Meanwhile, distress funds have seen an even steeper drop in new capital, with only $240M raised across two funds this year.

Experts like Eric Requenez of Ropes & Gray cite the backlog of deal activity as a major challenge, noting many funds are nearing the end of their investment periods, without deploying much capital.

Investors, meanwhile, are reluctant to commit to more new acquisitions without clear distress-related opportunities.

Give it to Me Straight

While CRE distress and opportunity funds are facing very real challenges, direct lending funds have seen steady interest. These funds offer solutions to borrowers impacted by the limited availability of traditional commercial real estate loans.

Since 2021, 407 direct lending funds have raised $128B. High-profile funds include Goldman Sachs’ $7B real estate credit fund and Madison Realty Capital’s $2B CRE debt fund.

KKR’s head of real estate credit described direct lending as offering “equity-like returns,” driven by the lending gap left by traditional lenders. Firms like KDM Financial have leaned into this strategy, offering tailored bridge loans and opportunistic lending solutions.

Strategic Focus

Industry experts suggest that funds with niche, well-defined strategies are more likely to succeed in today’s market.

According to Matt Posthuma of Ropes & Gray, successful funds differentiate themselves by focusing on specific asset classes, geographies, or investment types.

For smaller players like KDM Financial, personalized, hands-on management has also proven to resonate with investors in uncertain times.

Looking Ahead

The outlook for CRE distress and opportunity funds remains mixed. While capital remains on the sidelines, the lack of significant distress may continue to delay its deployment.

At the same time, direct lending is expected to remain a bright spot in commercial real estate fundraising as borrowers continue to seek alternative financing options.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes