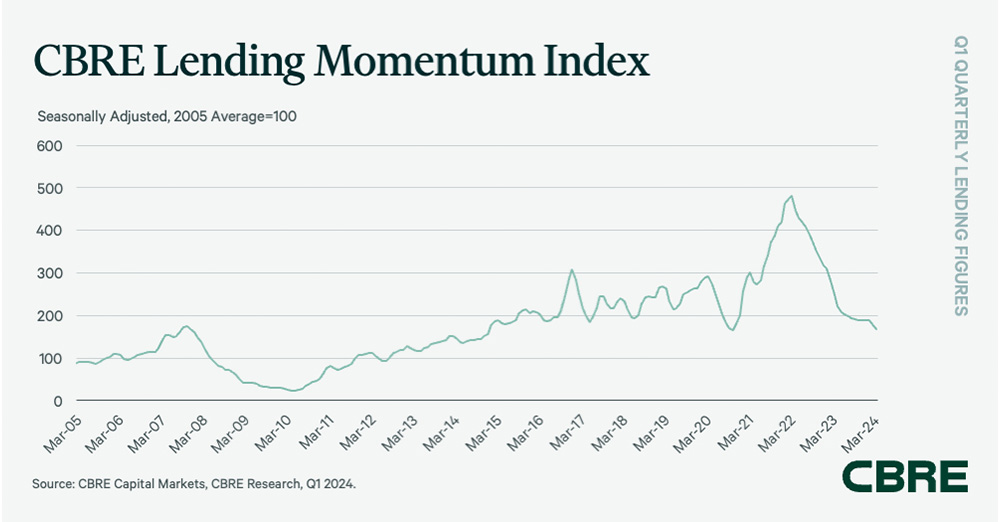

- The CBRE Lending Momentum Index shows an 11% quarter-over-quarter decrease, closing Q1 2024 at 168, which is 32.7% lower than the same period last year.

- Credit spreads have tightened, with a decrease in both commercial and multifamily loan rates, suggesting a potential stabilization in the lending environment.

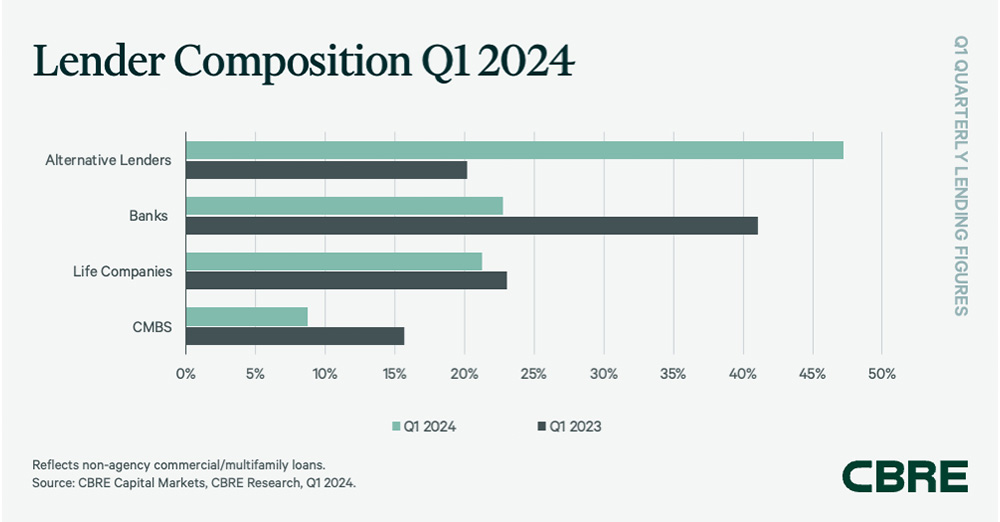

- Alternative lenders dominated 1Q24 lending activity with 47.2% loan volume, as banks keep tightening their underwriting.

The commercial real estate lending market faced challenges in the first quarter of 2024, primarily due to high interest rates and limited credit availability. However, CBRE’s latest research indicates some positive trends, including a tightening of credit spreads.

State of the Market

In Q1 2024, the CBRE Lending Momentum Index, which tracks the pace of U.S. commercial loan closings originated by CBRE, declined by 11% from the previous quarter and 32.7% year-over-year, settling at 168. Despite the slowdown, credit spreads between the 10-year Treasury yield and commercial loans tightened by 22 basis points, signaling improving conditions.

Despite a broader Q1 slowdown, CRE lending was up for the quarter, driven by institutional investors seeking to reinvest capital. According to GlobeSt.com, there were more high-value broker opinions and financings of over $100M.

With investment sales slowing, the market is pivoting towards specific loan types. A shift to hard-maturity refinancing, construction loans, and bridge lending reflects the ongoing impact of lingering post-pandemic problems and the uncertainty surrounding upcoming 2H24 rate cuts.

Multifamily agency lending also reported a notable decline, down to $19.2B from $27.1B in Q4 2023.

Alternative Lenders Step In

Banks are still limiting originations, allowing alternative lenders to swoop in and take the lead in Q1. Case in point: Goldman Sachs just raised $7 billion for its new real estate debt fund. Agency, life companies, CMBS, debt funds, and other nontraditional lending sources accounted for 47.2% of total loan volume, driven mainly by bridge lending. Meanwhile, the share of bank non-agency lending fell to 23% from 41% in 1Q23.

But even with favorable credit spreads at the moment, it’s still difficult to secure financing in a timely manner for high-quality assets due to higher-than-usual benchmarks.

Mortgage Rate Impacts

Thankfully, mortgage rates dropped 50 bps from Q4, and rates on fixed 7- to 10-year agency loans fell 32 bps (but were up 40% YoY). Debt yields and underwritten cap rates declined by 9.75% and 6%, while interest-only loans slipped to 75.2% from 77.8%, raising the amortization rate by 120 bps.

The 80 bps QoQ rise in average LTV ratios to 62.3% across loan categories points to more leverage in lending. While multifamily loans saw higher LTV ratios of 63.9%, commercial loans fell by 30bps to 57.9%.

Why It Matters

The share of Q1 non-agency lending by banks has fallen significantly YoY, driven by extended loan terms and regulatory constraints. The shift towards larger loans and alternative lenders means there’s still plenty of debt to go around. But securing favorable financing, even fore core assets, remains challenging. All eyes will be glued to the Fed through 2H24 for guidance.