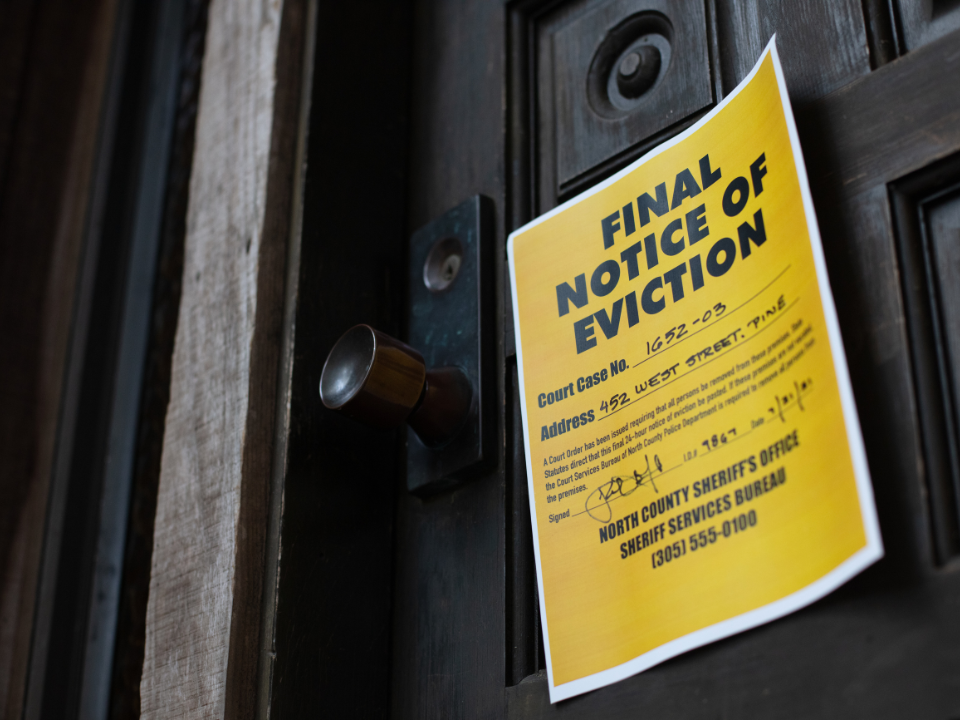

- The D.C. Council unanimously passed an emergency bill to address the crisis of unpaid rent, focusing on reforming the Emergency Rental Assistance Program (ERAP).

- The new legislation aims to expedite the eviction process while balancing protections for tenants and financial stability for housing providers.

- Mayor Muriel Bowser voiced her support, with additional funding measures being implemented to prevent subsidized affordable housing from foreclosure.

The D.C. Council took an important step in addressing the growing unpaid rent crisis affecting affordable housing providers, unanimously passing a bill designed to reform the Emergency Rental Assistance Program (ERAP).

As reported by Bisnow, the emergency legislation was fast-tracked and now awaits Mayor Muriel Bowser’s signature.

Emergency Maneuvers

The emergency ERAP bill is seen as a critical measure to tackle unpaid rent and delayed evictions, which have left many affordable housing providers in precarious financial positions (to put it lightly).

The mayor expressed her support for the bill at a press conference on Monday and outlined new initiatives, including allocating $80M from the Housing Production Trust Fund for bridge loans to help subsidized housing avoid foreclosure.

Key Changes

The bill modifies several pandemic-era changes to ERAP that have been complicating eviction proceedings.

Specifically, it aims to give judges more discretion in eviction cases involving pending ERAP applications and limits tenants to one stay per case for such applications.

Housing providers, Mayor Bowser, and Council Chairman Phil Mendelson noted that some tenants have been filing multiple ERAP applications, delaying evictions while accumulating substantial unpaid rent—now totaling $100M across the city.

Controversial Amendment

The bill was amended by Councilmember Robert White, who chairs the Committee on Housing. His amendment added flexibility around ERAP documentation and allowed court extensions for tenants awaiting delayed ERAP payments.

While this amendment drew criticism from housing industry representatives, Mendelson ultimately supported it, stating it addressed practical concerns from the landlord-tenant courts.

Despite initial opposition to the amendment, Dean Hunter, CEO of the Small Multifamily Owners Association, seemed satisfied with the bill’s overall passage, though he called for further actions to prevent foreclosures.

The Apartment and Office Building Association (AOBA) also showed optimism, calling the bill a “significant first step” toward stabilizing the situation.

Higher Stakes

The stakes are high for D.C.’s affordable housing market. Mendelson emphasized that if providers cannot pay their mortgage debts, these properties could face foreclosure, which would eliminate affordable housing covenants that protect the units.

Mendelson indicated there are more plans to advance permanent legislation in the coming months. Several council members also highlighted the urgency of further measures to protect the D.C. housing market, with Councilmember Kenyan McDuffie emphasizing the risk of defaults and the potential destabilization of affordable housing if no additional actions are taken.

The emergency legislation is just the beginning of what will likely be a long process to stabilize the affordable housing sector in D.C., and additional permanent solutions will be required to safeguard both tenants and housing providers in the future.