- The Federal Reserve anticipates prolonged stress in CRE, predicting challenges will persist for years.

- Overall, CRE conditions in the U.S. have deteriorated, with rising delinquency rates and falling deal prices.

- U.S. banks, particularly smaller regional ones, face higher exposure risk, but are well-positioned enough to handle recent stress tests.

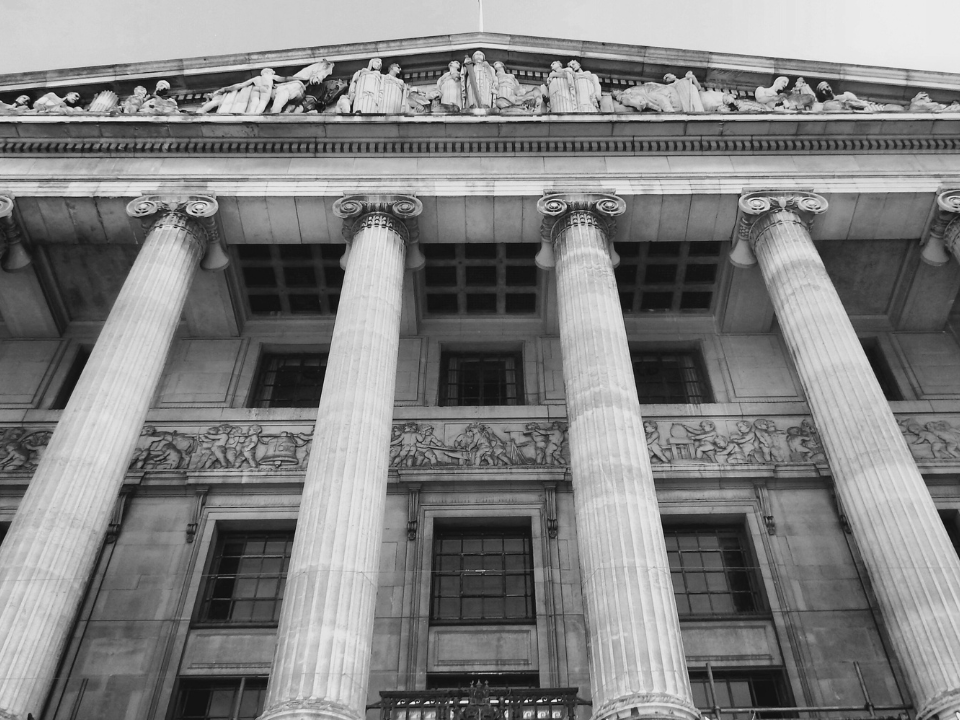

According to Globest, the U.S. Federal Reserve has expressed guarded optimism about the overall economy but remains cautious regarding the commercial property market.

As reported on Barrons, during recent reports to Congress and minutes from June’s Federal Open Market Committee (FOMC), the Fed emphasized prolonged stress driven by high interest rates and shifting work patterns.

Economic Overview

In its recent Monetary Policy Report to Congress, the Fed noted that inflation is falling but still above Chairman Jerome Powell’s 2% target, with the federal funds rate holding steady between 5.25% and 5.50%.

While the labor market remains strong, job growth and wage increases are slowing, and GDP growth is moderate. The Fed indicated that rate cuts would not occur until it has greater confidence that the economy is on track to achieving its inflation target.

Banking Blues

CRE continues to face significant stress, with delinquency rates going up in Q1 while remaining above long-term averages.

Meanwhile, bank portfolios are under pressure, partly due to a reliance on uninsured deposits, reminiscent of issues that led to the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank.

Declining equity prices for regional banks, which are sometimes more exposed to commercial property mortgages, also reflect concerns over CRE loan quality.

Notably, despite some reports of more CRE originations, particularly in multifamily and nonfarm nonresidential, underwriting standards have tightened, making refinancing difficult.

The minutes from the June FOMC meeting also revealed that credit quality deteriorated further in April and May, especially in the office, hotel, and retail sectors, with rising CMBS delinquency rates.

What’s Next

Powell emphasized that CRE’s challenges will persist for years due to high interest rates and the shift to hybrid work. He stressed the importance of banks honestly assessing and managing their risks.

The good news is that the Fed’s latest stress tests concluded that large U.S. banks and most regional banks are equipped to handle current risks, though some smaller banks with local CRE exposure may face greater challenges depending on the market.