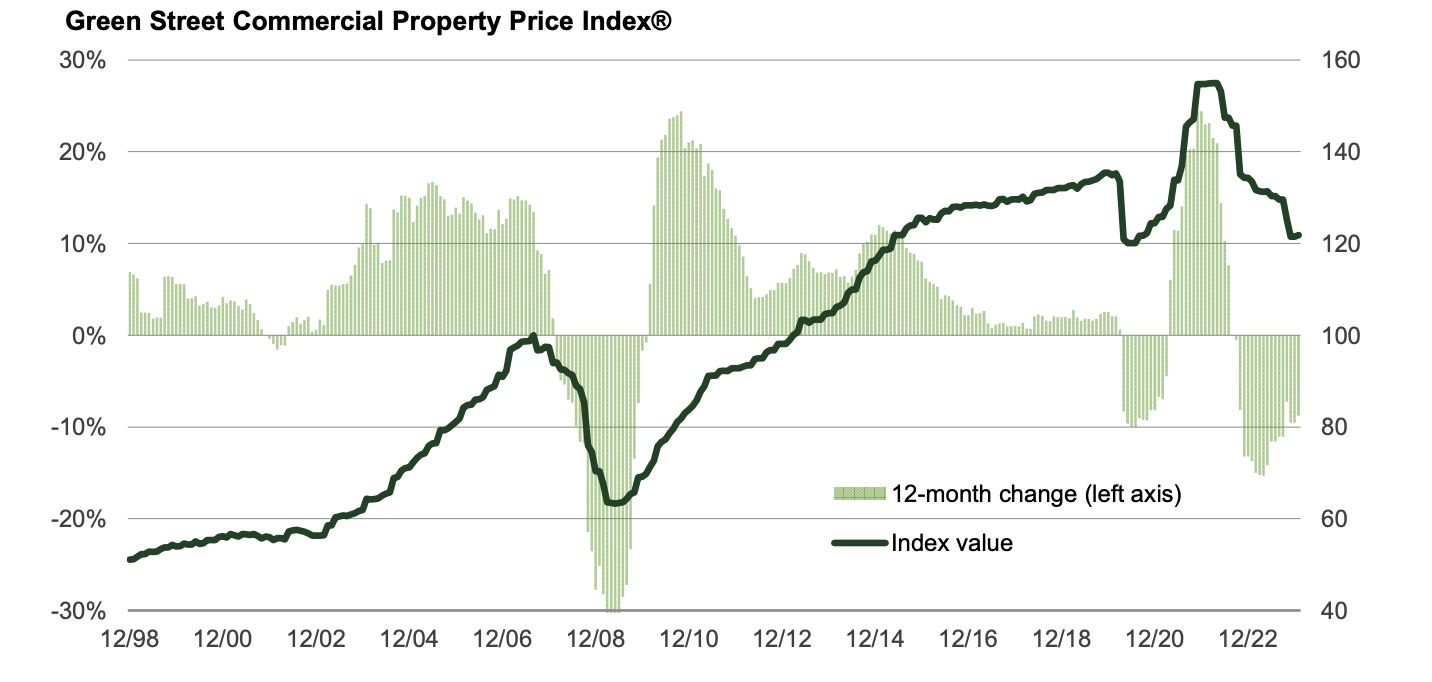

Green Street’s property price index, a key indicator in the industry, increased by 0.3% for the month. The rise in property prices indicates a shift in the commercial real estate landscape, potentially signaling the end of a downward trend or at least a stabilization.

Driving the market: Various factors contribute to this uptick, including the formation of opportunistic debt vehicles aimed at acquiring properties at discounted prices and a narrowing bid-ask gap, indicating improved market confidence. Even major players like BlackRock are expressing confidence in the market’s recovery, advocating for investment in commercial real estate after adjustments due to tight credit conditions last year.

Between the lines: While the overall trend suggests a positive outlook, not all sectors within commercial real estate are experiencing the same trajectory. The office sector, in particular, continues to face challenges, with values expected to decline further. This divergence highlights the nuanced nature of the market’s recovery, with certain sectors poised for growth while others grapple with ongoing challenges.

What they’re saying: “For most property types, pricing has probably hit its low,” stated Peter Rothemund, Co-Head of Strategic Research at Green Street. However, he cautioned that the office sector remains an exception, with values anticipated to continue declining.