- Greystar tops NMHC’s 2025 rankings, managing 946,742 units and owning 122,545 as of Jan. 1—the most of any firm in the US.

- Operational growth was fueled by its absorption of Wood Partners’ portfolio, while ownership growth remained organic.

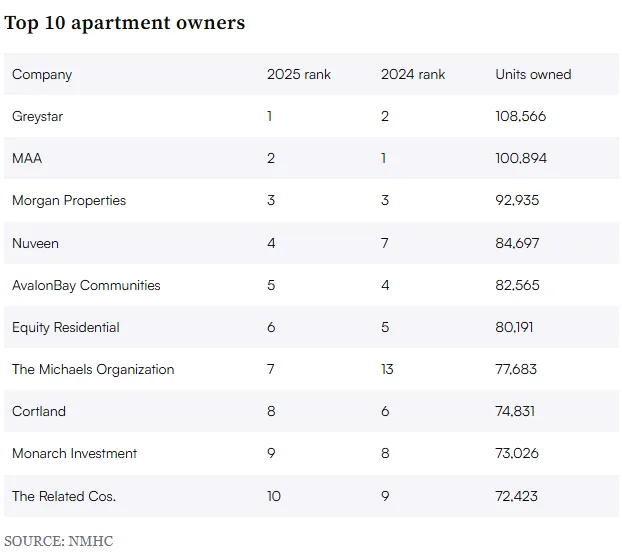

- MAA, Morgan Properties, and Nuveen round out the top four apartment owners, with ownership shifts in the Top 10 largely minimal year-over-year.

- Manager rankings remained stable, though firms like ZRS Management and Hawthorne Residential Partners saw notable growth in units under management.

According to Multifamily Dive, Charleston-based Greystar took the top spot in both ownership and property management categories, per the NMHC’s 2025 Top 50 lists.

As of January 1, the firm owned 122,545 units and managed 946,742, solidifying its status as the largest operator in the multifamily space.

Its acquisition of units from Atlanta-based Wood Partners fueled its growth on the management side, while ownership gains were achieved without external purchases.

The Ownership Landscape

Despite limited movement in the top tier, a few firms made notable jumps:

- UBS Realty Investors leaped 15 spots with 6,000 new units.

- FPA Multifamily gained more than 10,000 apartments, rising six spots.

- MG Properties climbed six places with a 4,000-unit increase.

Among the Top 10 Owners, AvalonBay Communities moved into the No. 5 spot, pushing Equity Residential to No. 6. The Michaels Organization made a significant leap to No. 7 from 13th place last year.

Top 10 Apartment Owners (2025)

New Faces on the List

Six companies debuted on the 2025 Top 50 Owners list, including:

- Hunt Cos. (El Paso) – No. 17

- Kairos Investment Management (Irvine) – No. 37

- MLG Capital (Brookfield) – No. 41

- S2 Capital (Dallas) – No. 44

- The Richman Group (Greenwich) – No. 46

- AMLI Residential (Chicago) – No. 49

The Managers Club

On the management side, the Top 10 remained largely unchanged, with only a minor switch between Willow Bridge Property Company and RPM Living.

Among the biggest gainers, ZRS Management added nearly 15,000 units organically and jumped six spots. CEO Darren Pierce emphasized their commitment to steady, acquisition-free growth.

Meanwhile, RangeWater saw the steepest decline, shedding nearly 20,000 units and falling seven spots.

Why It Matters

The apartment industry’s top firms are becoming more entrenched, with limited M&A activity and more reliance on organic growth. The fact that most of the top spots remained unchanged suggests a maturing market where operational efficiency and long-term relationships are outpacing aggressive acquisitions.

As the sector continues to consolidate, Greystar’s near-million mark hints at the scale future players may need to compete—and the increasing importance of brand trust and portfolio performance in managing multifamily real estate at scale.