- Loyalty membership grew 14.5% in 2024, reaching 675M and outpacing hotel room supply growth.

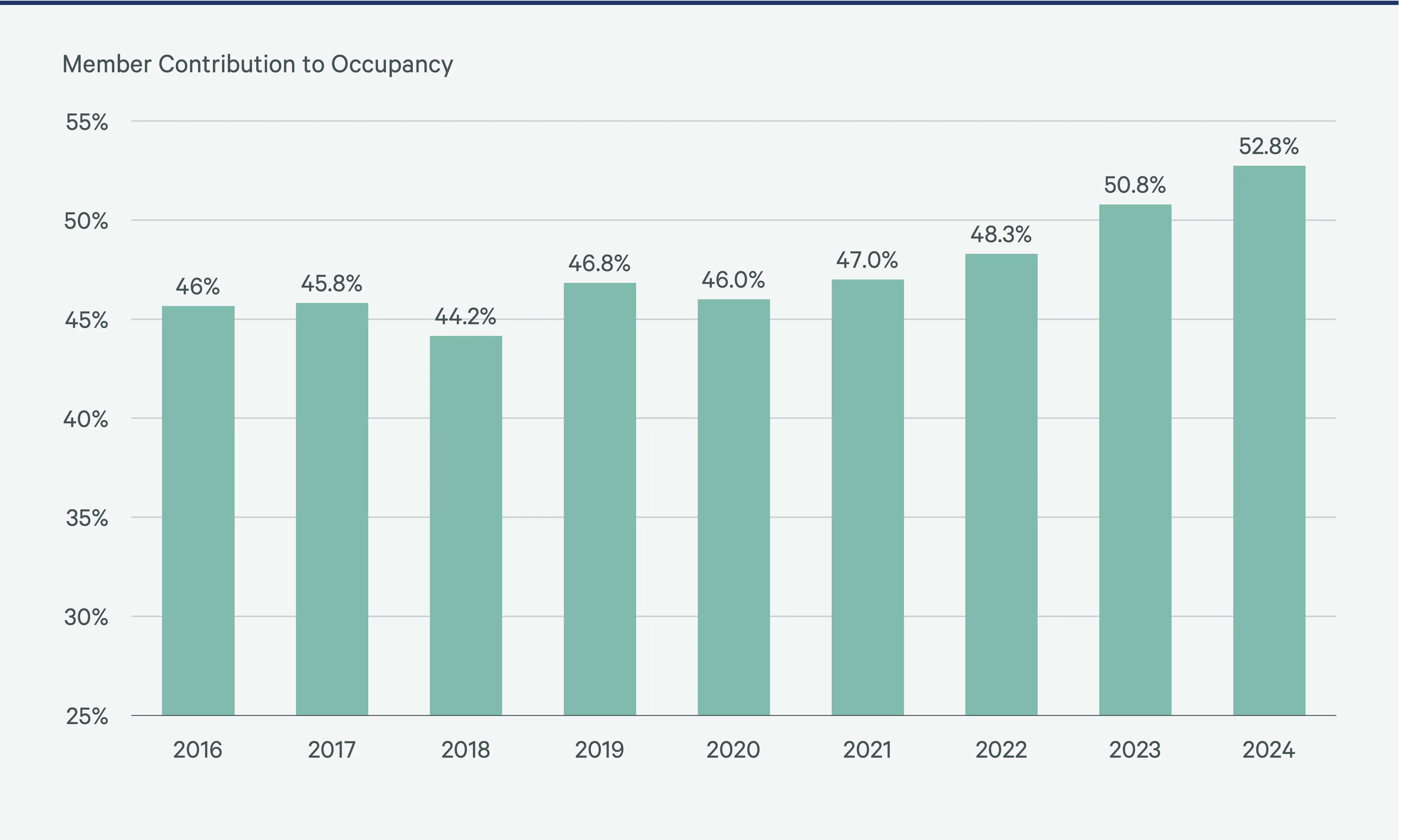

- Loyalty members drove 52.8% of occupied room nights, reinforcing the programs’ role as reliable demand generators.

- Average room nights per member fell by 4%, as more infrequent and credit card-based travelers joined.

- Program costs remain low, at just 1.6% of total revenue, despite a 4.4% increase in loyalty fees.

Membership Growth Fuels Occupancy

Hotel loyalty programs are no longer just perks for frequent travelers—they’re a powerful demand driver. Membership jumped 14.5% in 2024, outpacing the 6.7% growth in available rooms, as reported by CBRE.

That increase pushed members per room to a new high of 137, emphasizing the role of loyalty in maintaining occupancy and guest engagement.

Although the rapid growth introduces challenges in segmenting and targeting the most profitable guests, it helps buffer against economic downturns and shifts in travel patterns. Standard perks like free Wi-Fi, water, and flexible check-in continue to resonate with travelers while supporting guest satisfaction metrics.

Redemptions Fuel Future Demand

In 2024, loyalty members redeemed points as quickly as they earned them. The average liability per member dropped 5.3% to $17.85—or just 11.3% of the average daily rate—suggesting that guests are using their points for short-term rewards, keeping them engaged and encouraging repeat visits.

For hotel owners and operators, this trend opens opportunities to drive ancillary revenue during slower seasons through incentives like F&B credits and exclusive experiences.

New Traveler Behaviors Emerge

While loyalty-related occupancy increased, the average room nights per member fell from 1.1 to 1.0. The decline reflects a changing loyalty demographic: more “retail” travelers who sign up via credit cards or brand partnerships rather than traditional frequent-stay guests.

These new members present both a challenge and opportunity—brands must now convert casual users into high-value repeat customers.

Loyalty Programs vs. Other Channels

Loyalty fees increased 4.4% in 2024, slightly ahead of total revenue growth (2.7%), pushing the cost per occupied room to $5.46. That equates to 1.6% of total revenue—up slightly from 1.58% in 2023 but still modest in the context of overall operations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Even as costs rise, loyalty programs continue to outperform other distribution channels in terms of ROI, serving as a stable and cost-efficient strategy—particularly during off-peak periods when occupancy is more difficult to maintain.

From Guest to Loyalist

To stay competitive, brands must focus on loyalty conversion—turning one-time or infrequent guests into long-term members. That means leveraging data-driven personalization, emphasizing experiential redemptions, and measuring performance closely.

Owners and investors alike are paying attention. When benchmarked correctly, loyalty-driven assets can command premium valuations and outperform reliance on more expensive booking channels like OTAs.

Bottom Line

Hotel loyalty programs aren’t just holding their ground—they’re evolving into indispensable tools for driving occupancy, smoothing demand cycles, and delivering long-term value for both brands and owners.