- Hurricane Helene, which caused up to $26B in damage, is not expected to significantly impact CRE insurance rates due to its classification as a heavily uninsured event.

- Insurance premiums for CRE have begun to stabilize after years of consecutive increases, with a slight decline in rates noted in 2Q24.

- Rate adjustments will vary depending on location and risk factors, with Florida properties facing the highest potential insurance premiums.

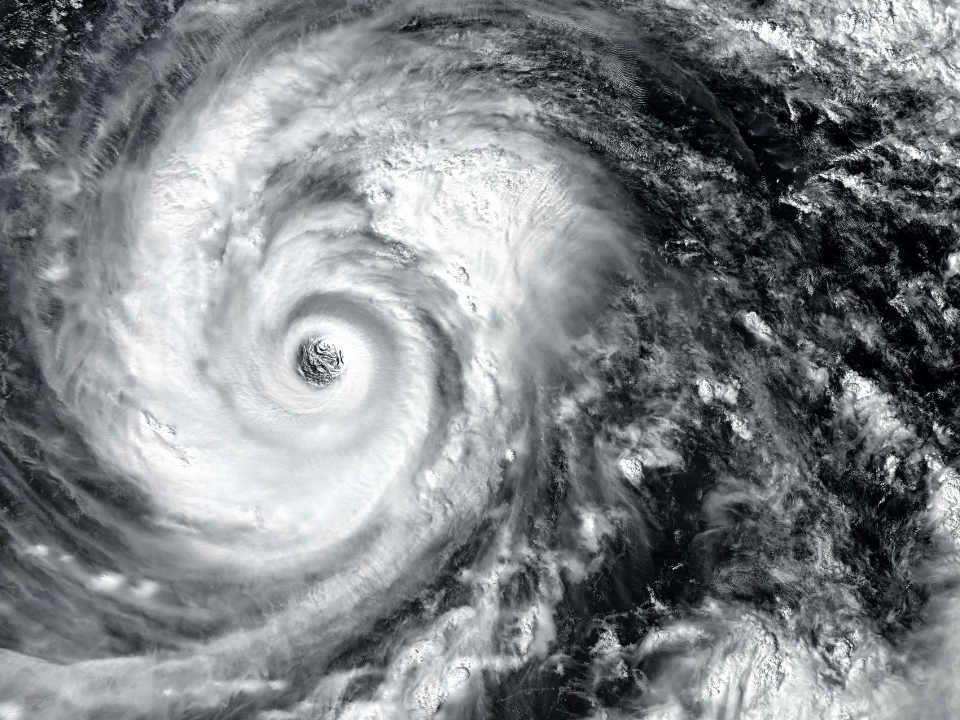

As the Southeast continues to recover from Hurricane Helene’s destruction, CRE owners and operators are beginning to question the storm’s potential impact on their insurance premiums.

However, experts say the storm may not lead to significant changes in insurance costs, given the extent of uninsured damages, as reported in CommercialSearch.

Limited Impact?

Hurricane Helene, while devastating, is not expected to significantly impact CRE insurance rates.

Mike Chapman, National Director of Commercial Markets for HUB International, explained that the event is “heavily uninsured,” meaning economic losses are substantial but the impact on the insured side is relatively minor. Chapman added that Helene is not being factored into HUB’s 2024 hurricane forecast.

Moody’s Analytics has estimated total property damage from Hurricane Helene to be between $15B–$26B. Still, given its status as a non-reinsurance event, the overall effect on the insurance market should remain limited.

Shifting Premiums

Commercial property insurance rates, which had been steadily climbing for 27 consecutive quarters, finally declined in Q2.

According to Aon’s latest market dynamics report, the rate of increase fell from +3.4% in 1Q24 to -0.94% in 2Q24, a notable shift. Experts point to changes in supply and demand as the driving factors behind this easing trend.

Vincent Flood, U.S. Property Practice Leader for Aon, noted that a profitable year for insurers in 2023 prompted reductions that began in March and continued through the following months.

As a result, owners and operators renewing policies in the latter half of 2024 may see rates lower than previously expected.

Rate Adjustments

Despite the overall decline, Aon’s report highlights a differentiated approach to rate adjustments depending on property characteristics and locations:

- For desirable accounts or properties outside of Florida with low natural catastrophe (Nat-Cat) exposure, rates may fall by as much as 10% or remain flat.

- Properties with a history of losses or less favorable occupancies can expect flat to modest rate hikes of up to 5%.

- Florida-only properties or those with significant Nat-Cat exposure are likely to see rate hikes of 10% or more.

Flood emphasized that renewal timing can also significantly impact premiums, as 70% of policies are renewed in the first half of the year, with Q2 being the busiest renewal period.

Proactive Risk Management

Some commercial real estate firms are already seeing benefits from proactive risk mitigation efforts.

Patrick McGinley, President of Management Services at Vestar, reported that his company achieved a decrease of over 3% in annual insurance rates before Hurricane Helene. This was attributed to high maintenance standards and a proactive risk management approach, which helped reduce claims over the past five years.

McGinley highlighted that maintaining a strong focus on safety, paired with more competition in the insurance market, contributed to this positive outcome. Vestar remains committed to these practices to ensure cost-effective coverage.

Climate Change Challenges

As severe weather events become more frequent due to climate change, insurance companies are faced with the ongoing challenge of adapting their risk management and response strategies.

Ben Bailey, Managing Director and Head of JLL’s Work Dynamics Insurance Business, highlighted the unique role insurance companies are playing in addressing climate change risks. “The increasing frequency of climate-driven events is forcing insurers to adopt more aggressive business continuity plans and response measures.”

Bailey added that this pressure also motivates insurers to manage their own carbon footprints more proactively to mitigate reputational risks.