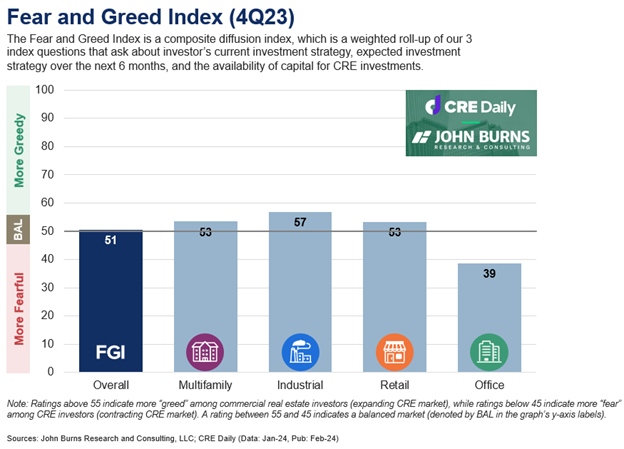

Conducted jointly by John Burns Research and Consulting and CRE Daily, the Fear and greed index examines current commercial real estate investor sentiment and expectations over the next 6 months, as well as changes in access to capital and asset values.

The 4Q23 report is based on findings from 972 members of the commercial real estate community across multifamily, industrial, retail, and office sectors.

The Findings

The Fear and Greed Index debuts at 51 out of 100, with the individual cre sectors varying between index values of 39 and 57. The Fear and Greed Index uses a scale of 0 to 100, where a value below 45 indicates a contracting market and a value above 55 indicates an expanding market. Values between 45 and 55 indicate a balanced market.

Key Insights

- A significant majority (66%) of investors are opting for a “wait-and-see” approach, maintaining their current investment exposure. This represents a marked increase from the 49% reported in the previous quarter.

- Despite this caution, there’s a prevailing optimism, with more investors planning to increase their cre exposure in the coming six months across all sectors, except for Office.

- The Federal Reserve’s recent signals towards potential rate cuts in 2024 have been a catalyst for this optimism, suggesting a possible influx of investment capital if these cuts are realized.

Sector-Specific Trends

- Industrial Real Estate stands out as the most favored sector, with expectations of value growth by the end of 2024. This optimism is driven by the absorption of supply and the sector’s resilience.

- Retail is also expected to see value growth, benefiting from strategic investment and market adjustments.

- Multifamily and Office sectors, however, are anticipated to face challenges, with expectations of further declines in asset values. These sectors are navigating through headwinds such as excess supply, slower job growth, and increasing insurance costs for multifamily, along with reduced demand and occupancy rates for office spaces.

Big Picture

If the Fed does end up cutting rates this year (as is our base case), expect some upside for cre values in sectors that have been depressed by a lack of capital. However, be aware of headwinds to fundamentals for certain property types in 2024, such as office buildings in central business districts and multifamily buildings in markets with significant construction.