- Cautious Optimism: Despite inflationary pressures and lingering challenges, the economy is stabilizing, with moderate growth anticipated in the US.

- Capital Availability: Tight lending practices persist, but alternative financing sources like private equity and mezzanine debt are filling gaps.

- Top Picks: Industrial, data centers, and multifamily assets are leading the recovery, while office continues to face persistent challenges from high vacancies.

- Housing Market: Housing affordability issues and rising rents drive demand for multifamily and niche housing types, like senior living and student housing.

The year ahead promises to be a turning point for commercial real estate. After years of navigating high interest rates, inflation, and shifting market dynamics, experts are now cautiously optimistic about the road ahead. From the resurgence of multifamily and industrial assets to the continued office challenges, industry experts spotlight trends that could redefine the landscape.

In this comprehensive market outlook, we explore the predictions of 22 industry-leading brokerages and research companies, touching on economic recovery, sector performance, and emerging investment opportunities.

Colliers

Key Insights:

- Economic Strength Holds Steady: The US economy exceeded expectations in 2024 with strong consumer spending, low unemployment, and easing inflation despite high borrowing costs and lingering public concerns.

- CRE Market Sees Recovery Signs: While office spaces struggle with vacancies, industrial and multifamily sectors show resilience. Retail remains steady with decade-high occupancy rates, but new construction is slowing across sectors.

- Trends to Watch: Watch for policy-driven inflation pressures, tightening labor markets, and increasing insurance costs. Technology and AI adoption are accelerating, offering opportunities for growth and innovation.

- Capital Market Momentum: Investment activity is rebounding, with narrowing bid-ask spreads and institutional investors returning. Multifamily housing continues to lead in sales volume.

Colliers offers a cautiously optimistic perspective for 2025. CRE is showing signs of recovery, with industrial and multifamily sectors leading the way while office spaces grapple with record-high vacancies. Retail stays resilient with strong demand but faces rising costs and limited new developments.

Policy shifts, like immigration restrictions and tariff increases, could strain labor and drive inflation, but tax cuts and government spending aim to sustain growth. Though challenges like high borrowing costs and tight labor markets remain, consumer spending and easing inflation are bolstering economic resilience.

Technology is a bright spot as businesses prioritize AI and automation to boost efficiency and adapt to evolving challenges. With a mix of optimism and caution, 2025 could be a turning point for CRE, setting the stage for longer-term stability and growth.

PWC

Key Insights:

- Economic Transition Underway: The real estate market is poised for recovery as the Fed begins easing interest rates, signaling the start of a new cycle. However, higher costs and lingering uncertainties mean the rebound will be gradual.

- Evolving Trends Across Sectors: Industrial and multifamily sectors remain resilient with continued demand, while the office market struggles with high vacancies and the “flight to quality” trend. Retail is steady, but the bifurcation between high-performing and underperforming assets persists.

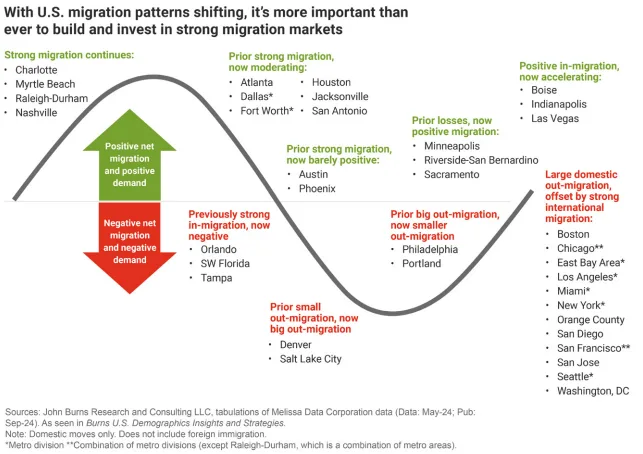

- Shifting Demographics and Climate Impact: Migration patterns are stabilizing, with some Sunbelt cities losing their cost-of-living edge. Climate risks are reshaping decisions, influencing where people and businesses choose to settle.

- Opportunities in Tech-Driven Growth: Data centers lead in investment prospects, while the multifamily sector shows promise despite short-term oversupply in certain markets. PropTech and automation are expected to redefine operations and tenant experiences.

PWC’s Emerging Trends in Real Estate report highlights a cautiously optimistic outlook for 2025. Easing interest rates are revitalizing real estate markets, but challenges like rising costs and uneven sector performance remain.

Industrial and multifamily properties continue to thrive, while the office market faces persistent headwinds due to remote work trends and tenant demands for premium spaces.

Shifting migration patterns and growing concerns over climate risks are influencing real estate strategies, with cost-of-living advantages in some regions fading. Meanwhile, tech-driven sectors like data centers offer long-term investment opportunities as the demand for digital infrastructure soars.

While challenges persist, the industry is entering a new growth phase, offering opportunities for those positioned to navigate the evolving landscape.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Deloitte

Key Insights:

- Cautious Optimism: CRE shows signs of recovery as global economic conditions stabilize. Falling inflation, potential interest rate cuts, and improved sentiment among industry leaders are driving renewed optimism.

- Focus on Sustainability and Tech: CRE firms are prioritizing sustainability initiatives like deep energy retrofits and leveraging new technologies like AI to enhance operational efficiency, manage climate risks, and attract next-generation talent.

- Shifting Investment Dynamics: With bottom-cycle pricing dislocations, investors are eyeing opportunities in high-growth sectors like industrial, multifamily, and digital economy properties while reevaluating strategies for office assets.

- Emerging Challenges: Elevated interest rates, refinancing risks, and rising climate-related costs remain significant concerns, as well as adapting to new tax policies and evolving tenant expectations.

Deloitte’s 2025 Commercial Real Estate Outlook highlights a cautiously optimistic landscape for CRE. After years of muted growth and economic uncertainty, a potential turning point is near as inflation slows and interest rates are expected to decline.

Leaders are shifting from defensive to proactive strategies, aiming to capitalize on opportunities in high-demand property sectors such as industrial and multifamily housing while leveraging advanced technologies like AI to enhance decision-making and operational efficiency.

Challenges persist, including refinancing risks for maturing loans and the impact of rising climate costs.

However, as industry sentiment improves and innovative approaches gain traction, 2025 could mark the beginning of a new growth cycle for CRE. The key will be balancing short-term hurdles with long-term strategies to position for a dynamic and evolving market.

CBRE

Key Insights:

- Economic Growth and Resilience: The US economy is set for moderate growth in 2025, driven by consumer spending, easing inflation, and improved corporate confidence. Interest rates are expected to drop but remain above pre-pandemic levels.

- CRE Recovery Across Sectors: All real estate sectors are entering a new cycle. Multifamily and industrial properties continue to thrive, while offices show early signs of stability. Retail remains strong, with low vacancies and growing demand for prime locations.

- Tech and Sustainability Priorities: Due to AI and cloud computing, data centers are booming despite challenges in power availability. Sustainability remains critical across sectors, with rising investments in energy efficiency and renewable power solutions.

- Challenges and Risks: Geopolitical tensions, high budget deficits, and labor shortages pose risks to the CRE recovery. Shifting trade and immigration policies could also impact growth.

CBRE’s 2025 US Real Estate Market Outlook paints an optimistic yet cautious picture of CRE’s recovery. Economic resilience, supported by robust consumer spending and corporate confidence, is setting the stage for a new growth cycle.

Strong demand for multifamily and industrial properties is leading the recovery, while the office sector is now stabilizing after years of high vacancies. Retail markets are buoyed by low availability and steady demand, particularly in suburban and Sun Belt areas.

Technology and sustainability are driving significant transformation, with data centers experiencing a surge in demand thanks to AI and cloud computing advancements.

However, power availability and construction delays remain challenges. Across the board, CRE stakeholders are focusing on energy efficiency and renewable power solutions to meet evolving regulations and consumer expectations.

Nareit

Key Insights:

- Economic Soft Landing: The US economy is well-positioned for a soft landing, with steady growth, moderating inflation, and low recession risks.

- Public-Private Valuation Convergence: The gap between public REITs and private real estate valuations is narrowing, paving the way for a resurgence in property transactions and better alignment in market pricing.

- REITs’ Competitive Edge: REITs benefit from disciplined balance sheets, low debt costs, and access to diverse capital sources, positioning them to outperform private market competitors and capitalize on emerging growth opportunities.

- Sector-Specific Strengths: Data centers, telecommunications, healthcare, and self-storage are poised for growth, while traditional property sectors face challenges with softening fundamentals and fluctuating demand.

The 2025 outlook from Nareit highlights a cautiously optimistic path forward for the CRE market, driven by an anticipated economic soft landing and a narrowing valuation gap between public and private real estate. These factors, alongside easing interest rates, are expected to revitalize property transactions and enhance market activity.

While traditional property sectors like office and retail face headwinds, REITs are well-positioned to thrive due to their disciplined financial strategies and focus on growth in high-demand sectors such as data centers and healthcare.

Access to cost-advantaged capital and focus on innovation gives REITs a competitive edge in navigating a dynamic CRE landscape. Although risks such as fiscal uncertainty and potential trade conflicts persist, aligning valuations and stronger fundamentals could usher in a brighter year for CRE and REITs, setting the stage for renewed growth and investment activity in 2025.

Oxford Economics

Key Insights:

- Steady Economic Growth with Rate Cuts: Global economies are poised for moderate growth in 2025, with central banks cautiously loosening monetary policies. The US, bolstered by fiscal and trade policy changes, is set to outperform other advanced economies.

- Capital Growth Driven by Rentals: CRE capital values are expected to grow modestly, driven by robust rental performance rather than yield compression, with the industrial and residential sectors leading.

- Window of Investment Opportunity: The next 12–18 months present a favorable entry point for CRE investment, especially in European markets like the Nordics and Benelux, where rental growth and supply-demand balance offer attractive returns.

- Rise of Alternative and Niche Sectors: Investors are increasingly allocating to alternative property types such as data centers, senior housing, and energy infrastructure, driven by megatrends like aging populations and AI-driven tech growth.

- Challenges Persist: Geopolitical risks, trade conflicts, and climate-related uncertainties may temper growth, but CRE’s inflation-hedging characteristics provide resilience in a volatile landscape.

Oxford Economics’ 2025 outlook for global CRE highlights a cautiously optimistic path forward. Moderate economic growth, supported by gradual rate cuts and resilient rental markets, sets the stage for a modest recovery.

While capital value growth will rely on income returns rather than yield compression, key sectors like industrial and residential are expected to perform strongly. The next 12–18 months offer an attractive investment window, particularly in European markets with favorable supply-demand dynamics.

Investors are diversifying into alternative and niche property sectors, driven by megatrends such as AI adoption and an aging population. Geopolitical instability, climate impacts, and volatile inflation remain a challenge. With strategic planning and a focus on emerging opportunities, 2025 presents a promising yet complex landscape for CRE growth.

Trimont

Key Insights:

- Regional Variations in Recovery: The US CRE market is experiencing a lagging recovery, influenced by high levels of maturing debt and rising interest rates. Meanwhile, Australia and other international markets like Asia-Pacific show optimism with growing demand in sectors like “Beds and Sheds” (residential and industrial).

- Strong Asset Class Performers: Data centers and industrial/logistics sectors are thriving globally, driven by digital transformation, AI, and e-commerce growth. Multifamily and living sectors are gaining momentum in regions like Asia-Pacific due to housing shortages and affordability issues.

- Global Challenges Persist: Rising borrowing costs, geopolitical risks, and supply chain disruptions remain key obstacles. In the US, hybrid work models are straining the office sector, while global markets face construction delays and increased material costs.

Trimont’s 2024 review and 2025 predictions for global CRE highlight a nuanced recovery across regions and asset classes.

The US faces challenges with maturing debt and shifting office demand due to hybrid work. Meanwhile, Australia and Asia-Pacific are seeing growth driven by strong residential and industrial demand.

Data centers, bolstered by AI and cloud adoption, and the living sector (especially build-to-rent models) are emerging as global investment priorities.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Invesco

Key Insights:

- Shift in Market Dynamics: As interest rates stabilize, CRE is transitioning toward a more balanced environment. Core sectors like multifamily and industrial continue to lead, while office properties face ongoing challenges due to hybrid work trends.

- Emerging Opportunities: Growth is driven by alternative asset classes like data centers and healthcare facilities, which are gaining investor interest due to long-term trends in digitalization and aging demographics.

- Challenges in Financing: Rising borrowing costs and tighter credit conditions are prompting a focus on capital efficiency and strategic asset selection to maximize returns.

- Sustainability Focus: ESG considerations remain a priority, influencing investment strategies and asset performance metrics as stakeholders look to align portfolios with environmental and social goals.

Invesco highlights a transitional period marked by stabilization in interest rates and evolving investment priorities. Multifamily and industrial sectors maintain strong performance, while alternative assets like data centers and healthcare are emerging as key growth areas. The office market, however, continues to face headwinds from hybrid work models.

Despite challenges such as rising borrowing costs and tight credit conditions, the market is ripe with opportunities for strategic investors focusing on sectors aligned with long-term trends.

Sustainability and ESG goals are shaping investment decisions, offering a path forward for resilient and forward-thinking portfolios. The outlook reflects cautious optimism, emphasizing adaptability and precision in navigating the evolving CRE landscape.

Matthews

Key Insights:

- Interest Rates and Market Dynamics: The Fed’s recent rate cuts are setting a more favorable tone for short-term lending. However, mixed signals from bond markets and persistent inflation concerns indicate ongoing challenges for long-term financing.

- Sector-Specific Trends: Industrial and logistics assets continue to outperform, driven by e-commerce and supply chain demands. Multifamily housing shows signs of stabilization, while office and retail sectors remain under pressure, though medical office properties stand out for their stability.

- Capital Availability: CRE lending is expected to surge in 2025, with life insurers, bridge lenders, and agencies actively deploying capital. Investors should act on deals with positive leverage rather than wait for perfect market conditions.

- Emerging Opportunities: Sectors like senior housing and self-storage face challenges but hold long-term potential. Meanwhile, medical office properties remain a favorite due to low tenant turnover and reliable demand.

Matthews’ 2025 outlook reflects cautious optimism. The Fed’s rate cuts are helping stabilize short-term financing conditions while capital markets prepare for increased lending activity in 2025.

Industrial and logistics properties remain strong performers, driven by robust e-commerce trends, while multifamily housing shows early signs of recovery. However, office properties continue to face challenges, with demand favoring Class A spaces over older stock.

With abundant capital from diverse sources, 2025 offers opportunities for investors willing to act decisively on deals with positive leverage. Alternative asset classes like medical offices and senior housing stand out for their resilience and long-term growth potential.

JLL

Key Insights:

- Recovery and Opportunity: The global real estate market is poised for recovery in 2025, with improved liquidity and increased investor confidence driving activity. However, performance will vary significantly across geographies and property types.

- Supply Constraints: Supply shortages will persist across major property types, particularly in the US and Europe. Prime office, industrial, and living spaces are expected to face high competition, creating opportunities for redevelopment and retrofitting.

- Early-Mover Advantage: 2025 offers a key window for early movers to capitalize on market opportunities before competition intensifies. Investment in sectors like data centers, logistics, and alternative living assets will likely yield strong returns.

- Sustainability Drives Strategy: Decarbonization and energy efficiency are becoming integral to real estate strategies to ensure ESG compliance, reduce costs, and mitigate obsolescence risks.

JLL’s 2025 Global Real Estate Outlook anticipates a pivotal year for the industry as the market transitions into recovery. Improved liquidity, early signs of increased investor activity, and a narrowing bid-ask gap suggest that confidence is returning.

However, competition for prime assets will intensify with ongoing supply shortages and rising demand for high-quality spaces. This will drive interest in redevelopment and alternative markets, particularly in sectors like data centers, logistics, and sustainable living.

Sustainability and energy efficiency are reshaping real estate strategies, offering cost-saving and growth opportunities. While challenges like geopolitical risks and energy costs persist, the market rewards agile investors and developers who seize opportunities in this evolving landscape.

Berkadia

Key Insights:

- Rising Multifamily Demand: Absorptions are projected to outpace completions in 2025, signaling a shift in market dynamics. Decreasing vacancy rates and sustained rental demand are set to give operators greater pricing power.

- Rent Growth Recovery: After nearly two years of stagnant rents, increased wages and lower rent-to-income ratios are creating favorable conditions for rent growth in 2025, especially in major employment hubs.

- Single-Family Housing Challenges: With mortgage rates hovering around 7% and record-high home prices, the single-family housing market remains financially inaccessible for many, driving demand for multifamily rentals.

- Economic Stability Supports Multifamily: Wage growth and return-to-office trends are strengthening renter demand, providing optimism for the sector as operators gain leverage and the market stabilizes.

Berkadia’s 2025 outlook for the multifamily housing market is optimistic, signaling a rebound after two years of stagnation. Operators are regaining pricing power, with unit absorptions projected to surpass new deliveries and declining vacancy rates. Wage growth has outpaced rent increases, improving affordability and setting the stage for a more balanced market.

The unaffordability of single-family homes, driven by high mortgage rates and rising prices, continues to shift demand toward rentals. As renters benefit from economic stability and return-to-office trends, multifamily housing is positioned for a strong year ahead.

With fundamentals aligning to support a rental rebound, 2025 looks promising for the multifamily sector.

Schwab

Key Insights:

- Market Volatility Ahead: While US stocks performed well in 2024, 2025 is expected to increase market volatility due to potential policy changes, high valuations, and global economic uncertainties.

- Economic Crosscurrents: The Trump administration’s proposed tax cuts and deregulation may boost growth, but higher tariffs and immigration restrictions could create stagflationary pressures, complicating monetary policy and labor market dynamics.

- Fixed Income Challenges: The Fed’s cautious rate-cutting approach could slow down borrowing costs, while inflation risks and fiscal policies add complexity to bond markets.

- Global Opportunities and Risks: Trade policy uncertainties threaten global growth, but easing interest rates and steady economic recovery could support international stock performance, especially in developed markets.

Schwab’s 2025 outlook highlights a year of contrasts, with opportunities tempered by challenges. The US stock market enters 2025 on a high note, but investors should brace for heightened volatility as fiscal and trade policies under the new administration create uncertainty. Proposed tax cuts and deregulation may support growth, but risks from rising tariffs and immigration restrictions could offset these benefits, impacting inflation and labor market trends.

The Fed’s cautious approach to rate cuts reflects inflationary concerns tied to potential policy changes in the fixed-income market. Globally, trade policy remains a wildcard, but easing central bank rates and improving economic fundamentals offer optimism for international stocks.

Schwab advises focusing on high-quality assets, maintaining diversification, and preparing for a dynamic but potentially rewarding investment landscape in 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

RSM

Key Insights:

- Electricity Demand Drives Construction Opportunities: Rising electricity needs from AI, EVs, and green energy create opportunities for contractors, especially through federally funded infrastructure projects like the IRA and IIJA.

- Office Faces Continued Pressure: The office market remains distressed with high delinquencies, rising loan maturities, and lower transaction volumes. However, strategic investors may find value in smart renovations and well-located properties as the market recalibrates.

- Shifting Housing Market Offers Builder Potential: High mortgage rates and home prices are dampening activity, but builders can capitalize on affordability challenges and demographics by focusing on innovative, cost-efficient housing solutions.

RSM paints a mixed but forward-looking picture for construction and real estate in 2025. The construction sector is poised for growth as infrastructure projects linked to energy resilience ramp up, offering contractors significant opportunities.

Meanwhile, the office market continues to struggle with financial and occupancy challenges, but long-term prospects remain as tenant preferences evolve.

The housing market’s affordability crisis is a pressing concern, yet builders can thrive by leveraging lower material costs and shifting consumer demands.

Hines

Key Insights:

- The Dawn of Opportunity: Hines anticipates 2025 to be a pivotal year for real estate recovery and repositioning, fueled by improving global fundamentals and central banks easing interest rates.

- Strategic Sector Focus:

- Living: A global housing shortage and rising rental demand present strong investment opportunities, especially in regions where renting is preferred.

- Retail: Years of restructuring have stabilized fundamentals, with open-air and grocery-anchored formats showing the most promise.

- Industrial: Despite cooling fundamentals, industrial assets remain appealing due to embedded rent growth and limited new supply.

- Office: While still recovering, select markets with newer, energy-efficient spaces offer tactical opportunities.

- Challenges Ahead: Persistent geopolitical tensions, ongoing energy crises, and AI’s infrastructural demands could create hurdles, but disciplined investment strategies remain critical.

Hines is optimistic about 2025, labeling it a turning point for global real estate markets. After a period of high interest rates and market repricing, the firm sees this as an opportune time for strategic investments across sectors.

Housing shortages and rental demand are reshaping the living sector, while the retail market shows renewed vitality after a decade of restructuring. Industrial assets, though moderating, continue to offer growth potential, and even the struggling office sector reveals pockets of opportunity in select markets.

Challenges like geopolitical instability and the pressures of AI’s growing infrastructure needs persist. Still, Hines emphasizes that a cautious, long-term approach focusing on fundamentals, not speculative gains, will be key in navigating these complexities. Investors are encouraged to act decisively to capitalize on opportunities during this promising phase of the real estate cycle.

Goldman Sachs

Key Insights:

- Broader Market Uncertainty: While the baseline forecast for the US includes solid growth, cooling inflation, and non-recessionary rate cuts, the distribution of possible market outcomes is broader due to potential policy shifts under the new administration.

- Trade and Tariff Risks: Tariffs on Chinese goods are expected, but broader tariffs could lead to significant inflationary pressures and global trade disruptions.

- Strengthening Dollar: US economic resilience and policy divergence with other economies will likely reinforce the dollar’s strength.

- High Equity Valuations: US equities are stretched in valuation, which could amplify reactions to economic or policy shocks.

- Diversification and Hedges: Strategies like holding long US dollar positions and exposure to TIPS and non-US bonds are recommended to navigate tail risks.

Goldman Sachs forecasts continued US economic strength and equity market resilience. However, the optimism is tempered by potential policy risks from the new administration, including tariffs that could disrupt global trade and increase inflation. High equity valuations and fiscal uncertainties add to the mix, making markets vulnerable to shocks.

The firm advises a balanced approach: maintaining exposure to US growth opportunities while hedging against downside risks with diversification and protective strategies like bonds, commodities, and selective international assets.

Despite the challenges, Goldman Sachs sees modest positive returns across asset classes, highlighting the importance of discipline and strategic positioning in an uncertain environment.

S&P Global

Key Insights:

- Diverging REIT Performance: Healthcare, industrial, and specialized REITs are expected to lead dividend growth in 2025, benefiting from high demand in sectors like e-commerce and healthcare facilities.

- Office REIT Struggles: Office REITs continue to face challenges, including low occupancy rates and weak financial performance, leading to stagnant or declining dividends.

- Dividend Growth Outlook: REIT dividends are projected to grow modestly by 5.5% in 2025, below the historical average. Industrial REITs are forecasted to experience the strongest growth.

- Sector Trends: Due to digital transformation, data centers and logistics remain robust, while residential REITs gain traction despite affordability challenges in the single-family housing market.

S&P Global’s 2025 US REIT outlook highlights a mixed landscape. While industrial and specialized REITs are expected to shine due to resilient demand in sectors like e-commerce and data centers, office REITs remain the weakest link, burdened by low occupancy and tepid market conditions. Dividends across REIT categories are set for modest growth, with industrial REITs leading the charge.

Healthcare REITs are also positioned for continued strength, driven by rising demand for medical facilities. Meanwhile, residential REITs benefit from increasing rental demand as housing affordability issues push more people to rent.

Despite sector-specific challenges, the REIT market appears poised for incremental recovery, underpinned by structural demand in key growth sectors.

PIMCO

Key Insights:

- CRE Recovery: Certain sectors, like multifamily and data centers, are showing signs of stabilization, with valuations beginning to bottom out. Class A properties are near recovery, but Class B and C assets face ongoing challenges.

- Focus on Debt Over Equity: PIMCO prefers real estate debt investments, especially in higher-risk opportunities like rescue capital and gap financing.

- Sector Highlights: Strong demand continues to support multifamily housing, particularly in markets like the Sun Belt.

- Caution in Certain Areas: The office and life sciences sectors face headwinds due to shifting tenant preferences and oversupply in specific markets.

PIMCO’s 2025 CRE outlook reflects cautious optimism, emphasizing a slow and uneven recovery across sectors. While green shoots exist in multifamily housing and data centers, challenges persist for lower-tier office properties and certain niche sectors like life sciences.

Success in 2025 will require a strategic mix of debt and equity investments, emphasizing geographic and sector-specific opportunities. Investors should be selective, focus on high-quality assets, and remain prepared for continued market volatility.

M&G Investments

Key Insights:

- Equity Market Dynamics: While US equities are positioned for continued performance, international markets such as Europe and Asia offer compelling opportunities driven by cyclical recovery and sector-specific strengths.

- Private Markets Resurgence: Private equity and credit are showing signs of recovery as IPO markets revive and lower rates reduce default risks. Investors are increasingly diversifying into alternative strategies.

- Real Estate Recovery: Real estate markets are entering a recovery phase, with constrained supply and stabilizing valuations creating opportunities for selective investments, particularly in core sectors like housing and logistics.

M&G’s 2025 outlook is cautiously optimistic, emphasizing a shift from broad market strategies to active and selective investment approaches. High government debt and slowing economic growth remain challenges, but opportunities abound in recovering private markets, targeted equity sectors, and real estate.

With volatility likely to persist, adaptability and focus on fundamentals are key for investors seeking to navigate the complexities of the year ahead.

Moody’s

Key Insights:

- Revenue Growth Across Most Property Types: CRE revenue is expected to rise in 2025, supported by strong macro fundamentals. However, the office sector continues to face challenges due to hybrid work and high vacancies.

- Stabilizing Property Valuations: Lower interest rates and steady long-term bond yields are anticipated to stabilize property valuations, creating a foundation for recovery in transaction volumes and leverage.

- Sector-Specific Trends:

- Retail: Positioned for strong growth, driven by robust consumer spending and near-full employment.

- Hospitality: US revenues have surpassed pre-pandemic levels, though European revenues remain uneven.

- Industrial: Demand stabilizes, but oversupply in some markets tempers rent growth.

- Office: Persistent vacancies and declining rents highlight ongoing challenges. Only a modest recovery is expected in the latter half of the year.

- Improved Refinancing Rates: Lower interest rates will likely enhance refinancing opportunities, though elevated delinquency rates, especially in office properties, remain a concern.

Moody’s forecasts revenue growth and valuation stabilization for most property types as macroeconomic conditions improve.

Retail and hospitality are leading the charge, benefiting from robust consumer spending and the recovery in international tourism. However, the office sector faces continued headwinds, with high vacancies and declining rents due to hybrid work trends.

Meanwhile, in Europe, easing credit conditions and lower interest rates are expected to improve market dynamics.

While the recovery in CRE is uneven and sector-specific, a combination of lower borrowing costs and stabilizing market fundamentals is creating opportunities for investors in 2025.

Northspyre

Key Insights:

- A Positive Shift for CRE: After two challenging years, CRE is poised for recovery in 2025, fueled by anticipated interest rate cuts and improved investment activity.

- Sector-Specific Highlights:

- Multifamily: A temporary oversupply is expected to stabilize, with rent growth rebounding to 3% by 2025, driven by strong demand and a national housing shortage.

- Office: The sector remains under pressure, with high vacancy rates and sluggish demand persisting into late 2025.

- Retail: Adaptation to modern consumer shopping behaviors continues, with improved foot traffic and modest rent growth in certain markets signaling stability.

- Industrial: Shifting from rapid growth to strategic management, industrial real estate focuses on high-tech, smart spaces to drive efficiency and meet modern manufacturing demands.

Northspyre’s analysis is optimistic for a CRE recovery in 2025. After grappling with high inflation and interest rates, the industry is on the rebound, with interest rate cuts and capital market improvements expected to set the stage for growth.

Multifamily and industrial properties continue to lead as resilient asset classes, while retail demonstrates adaptability and office real estate slowly charts a path to recovery.

The broader CRE market is embracing innovation, with smart technologies and data analytics driving efficiency and reducing costs for developers and investors alike.

While challenges like loan maturities and uneven sector performance remain, the overall sentiment points to brighter days ahead for CRE.

Capital Economics

Key Insights:

- US Policies in Focus: A potential second Trump administration could bring economic shifts with tariffs, tax reforms, and immigration policies impacting GDP, inflation, and key sectors like manufacturing.

- Europe’s Challenges Persist: Sluggish growth, structural issues, and political instability in major economies like France and Germany will keep Europe in the spotlight. Widening bond spreads in Italy add to fiscal worries.

- China’s Ongoing Struggles: The combination of US tariffs, slowing GDP growth, and structural property sector challenges is pressuring China’s economy. Government stimulus may provide short-term relief but will not solve long-term issues.

- Inflation and Rates to Ease: Global inflation is cooling, and central banks like the Fed and ECB are expected to make modest rate cuts.

- Dollar Dominance Endures: The US dollar remains a cornerstone of global trade and finance, maintaining its influence despite challenges from alternative currencies.

Capital Economics outlines five major themes shaping the global economy in 2025, emphasizing a mix of risks and opportunities. A potential Trump administration could introduce significant policy changes in the US, affecting everything from tariffs to GDP growth. Meanwhile, Europe faces a tough year ahead with stagnant growth, political turbulence, and fiscal challenges, particularly in Italy.

China is grappling with structural hurdles and tariff pressures, though government stimulus may provide short-term boosts. Globally, inflation is easing, paving the way for slight rate cuts from central banks. Through it all, the US dollar remains a dominant force in global markets, highlighting its resilience despite increasing geopolitical tensions. For investors, these themes signal a dynamic and evolving year ahead, requiring caution and an eye for emerging opportunities.

Eastdil Secured

Key Insights:

- Improving Debt Liquidity: CMBS markets are experiencing a resurgence, with spreads tightening and refinancing options increasing, even for office loans.

- Return of Bank Lending: Banks are re-entering the CRE lending space, driven by improved liquidity, regulatory easing, and growing competition.

- Shifts in Office Utilization: The push for full in-office workweeks could positively impact urban office markets, aligning with increased office attendance and more refinancing opportunities.

- Capital Deployment Opportunities: With sidelined capital in money market accounts at record levels, the gradual reallocation to long-term investments could significantly benefit CRE markets.

- Historical Rate Normalization: Interest rates are stabilizing, with the 10-year Treasury expected to settle around 4%. This creates a favorable backdrop for real estate investment and lending activity.

Eastdil Secured’s outlook signals a positive shift for CRE, with improving debt liquidity, tighter CMBS spreads, and the return of bank lending. These developments are set to ease financing constraints and invigorate market activity, particularly in previously challenged sectors like office real estate.

2025 could see increased capital deployment as sidelined funds begin moving into long-term investments. Combined with stabilizing interest rates and stronger office utilization driven by return-to-work mandates, this sets the stage for a strong CRE recovery.

While risks like tariffs and global instability persist, Eastdil’s analysis leans bullish, calling 2025 a year of opportunity for investors and lenders alike.

CRE’s Overall Outlook for 2025

While challenges like high interest rates, climate impacts, and uneven sector recoveries persist, CRE in 2025 shows promising signs of stabilization and growth. Multifamily, industrial, and data centers are leading the way, supported by strong demand and innovative solutions. Meanwhile, the office sector continues to grapple with high vacancies, but strategic redevelopment and market adjustments offer glimpses of a rebound.

The recurring theme for CRE in 2025 is resilience. By adapting to shifting market conditions, leveraging emerging technologies, and focusing on long-term strategies, the industry is positioning itself for a brighter future. The challenges of the past few years have brought reinvention and growth opportunities. The road ahead may not be smooth, but the coming year offers a critical moment to capitalize on these changes and build momentum for the years to come.