So, you’re a commercial real estate investor, and you’re working on progressing your career each and every day. A big part of this process is taking the time to understand the key financial concepts and terminologies.

The concepts and terminologies that play a significant role in the decision-making process for both lenders and borrowers.

One such term is “amortization,” which can seem complicated at first but is essential to comprehend when working towards managing and partaking in successful real estate ventures. Specifically, amortization tables provide a clear overview of exactly what you’ll be paying each month for your commercial real estate loan.

This guide aims to demystify amortization and clearly explain the ins and outs of the concepts so you can use this as a tool for your future underwriting ventures. Everything you need to know is here, so let’s get into it.

What is Amortization?

Amortization is a method of paying off a loan using a fixed repayment schedule agreed between the borrower and the lender. With amortization, payments consisting of both principal and interest are paid off over a set period of time. Specific payment information and interest calculations will be outlined in the loan agreement.

The structure typically involves a declining payment of interest over time, where more interest is paid (in comparison to principal) towards the beginning of the repayment and gradually decreases over time, allowing more principal to be paid towards the end of the loan term.

Most notably, commercial real estate loans may have a different term and amortization. For instance, a loan might have a 10-year term with a 30-year amortization schedule. In such a scenario, the loan payments are calculated based on a 30-year repayment plan, but the outstanding balance (balloon payment) will be due after the 10-year term.

For example, you might take out a loan for $100,000 with an annual interest rate of 5% and a term of 10 years.

Here’s how you would calculate the monthly payments and create a basic amortization schedule for the first few months:

- Calculate Monthly Interest Rate: Convert the annual interest rate to a monthly rate by dividing it by 12. Therefore, the monthly rate = 5% / 12 = 0.004167.

- Calculate Monthly Payment: You calculate the monthly payment using a standard loan payment formula. In this case, the monthly payment=$1,060 approximately. You can check your answer by using the PMT formula in Excel.

- Determine Interest and Principal Portions of Payments: For each monthly payment, calculate how much is used to repay the interest and reduce the principal. Initially, the interest portion will be larger, but as the loan balance decreases over time, the interest decreases.

- For the first month, the interest is calculated as $417 approximately (loan balance $100,000 x 0.004167). The principal payment would be the total monthly payment ($1,060) minus the interest ($417), which equals $643 approximately.

- Next month, the new loan balance would be the old loan balance minus the principal portion of the first payment. In this case, $99,357 approximately ($100,000 – $643).

- Repeat this process until all the loan has been paid off.

Key Terms for Commercial Real Estate Amortization Tabl

- Balloon Payment – A balloon payment in a commercial real estate loan refers to a large, lump-sum payment that is due at the end of the loan term.

- Maturity Date – The maturity date in a commercial real estate loan refers to the date on which the loan must be fully repaid. It marks the end of the loan term, and at this point, the borrower is required to make a final payment to the lender that covers the remaining principal balance.

- Principal and Interest (P&I) – Payments on debts are typically broken down into two basic sections. The first is known as the principal, which is the original loan amount borrowed from a lender. The interest payment is an amount calculated, as a percentage, off of the outstanding principal. Interest payments are a borrowing cost you pay the lender in exchange for using the loan.

- Fixed vs. Floating Interest Rate – Some commercial real estate loans have a fixed interest rate, meaning the interest rate is agreed upon upfront, and does not change. However, a floating interest rate loan may fluctuate every month. Typically, floating interest rate loans are calculated using the lender spread (how the lender makes a return) + Index (SOFR is a common example).

The Amortization Table

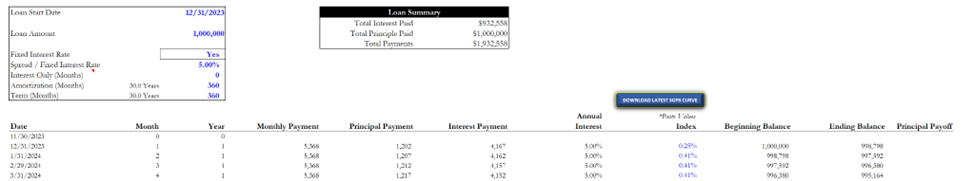

An amortization schedule, often called an amortization table, shows the breakdown of principal payments, interest paid, and the outstanding loan balance for each period.

Usually shown on an annual or monthly basis, the table will show the borrower’s monthly payment, how much of it will go toward your loan’s principal balance, and how much will be used on interest.

Sure, amortization tables come with a lot of math, but it’s rather simple when you lay all your data out in a table.

Here’s an example:

As you can see, there’s a detailed, chronological breakdown of every payment allocated towards a commercial real estate loan, helping you visualize how a loan is paid off in a transparent and understandable way.

Here is an explanation of the sections in the CRE Daily Amortization Table:

- Payment Number: This column lists the number of payments made over the loan’s total term in chronological order. This is broken down in months and years in our amortization table.

- Monthly Payments: This column indicates the total amount paid for each period. It remains constant throughout the loan term with an amortizing loan.

- Interest Portion: A sizable portion of your initial payments is typically dedicated to paying off the interest. This column reveals precisely how much of your monthly payment goes towards the interest.

- Principal Portion: This is the part of your monthly payment that reduces the outstanding principal. Initially, this may be a smaller portion of your payment than the interest. However, as you progressively pay off the interest, a larger fraction of your monthly payment is used to decrease the loan principal.

- Interest Rate: This is the monthly interest rate paid on the outstanding loan balance. The CRE Daily amortization table allows for fixed and floating interest rate calculations.

- Outstanding Balance: This records your principal balance after each payment. Initially, this starts with the total loan amount, but with each payment, it reduces gradually until it reaches zero by the end of the loan term.

Understanding your amortization table can empower you to make strategic decisions, like structuring additional principal payments, to save on interest.

An amortization table like this provides:

- A clear, birds-eye view of how your loan progresses over time.

- The amount of interest and principal paid.

- The balance remaining at any given time.

The Role of Amortization in Real Estate Financial Analysis

As an underwriter, amortization is your secret weapon for assessing risk and structuring smart real estate loans. But what exactly does amortization mean, and why should you care?

In short, amortization refers to how a loan’s principal balance decreases over time as payments are made. The amortization schedule clearly lays out this pay-down structure, showing the breakdown of interest vs. principal in each payment over the full loan term.

Conclusion

As you can see, the amortization table is a critical tool in loan management and real estate investment. They provide insights into loan repayment and balance reduction.

Its understanding benefits investors, borrowers, and real estate professionals, playing a key role in financial analysis, underwriting, and differentiating between fixed-rate and adjustable-rate amortization.

You can leverage this knowledge to enhance your financial strategy, confidently navigate loan repayment, and work toward your financial and real estate investment goals more effectively.

Download the Loan Amortization Calculator

Download our free amortization table and practice building it yourself! Or keep it to calculate loan payments for your next acquisition.