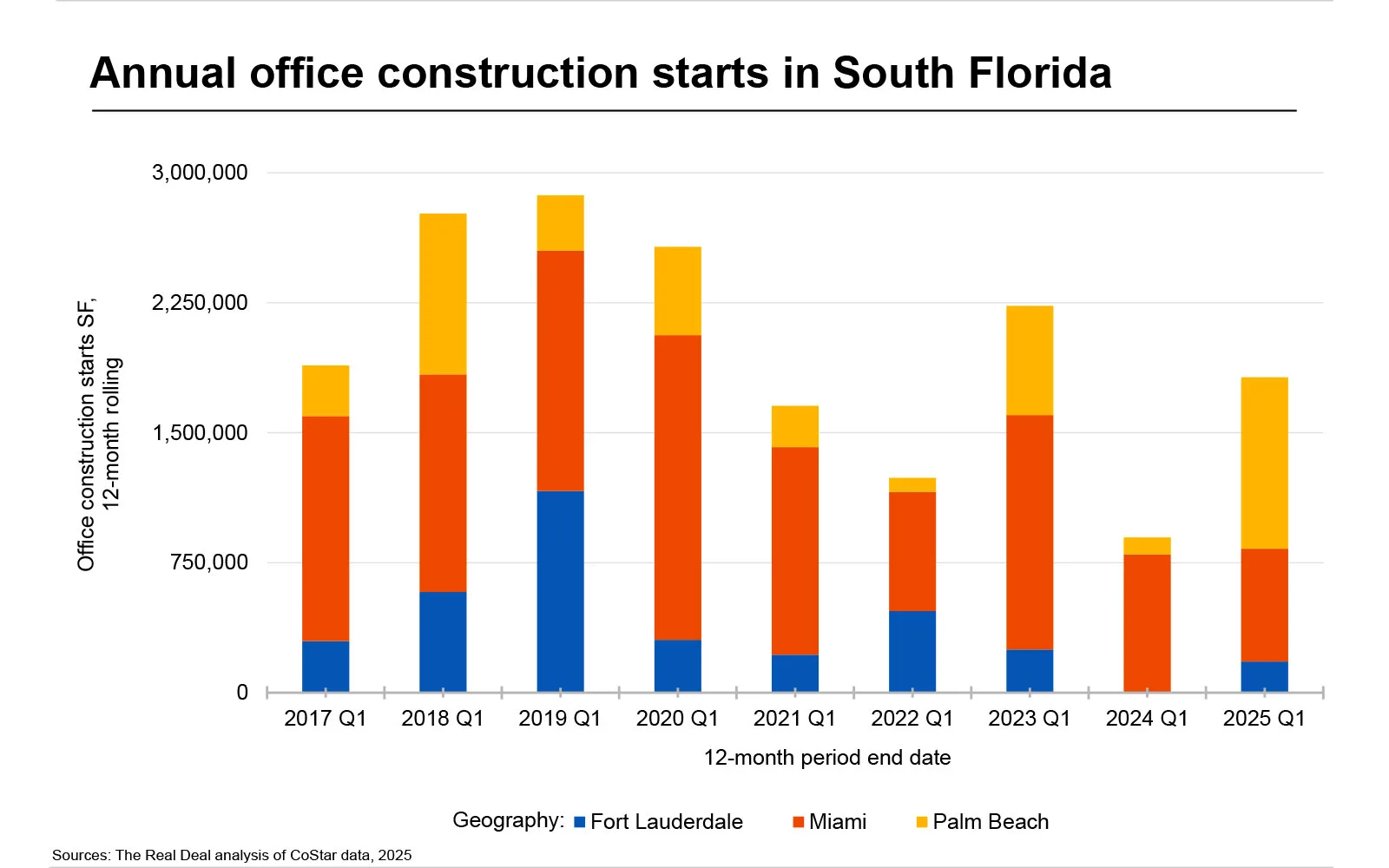

- New office construction in Miami-Dade dropped to 650,900 SF, the lowest annual total since at least 2017, per CoStar data.

- High interest rates, falling property values, and stricter lending standards are making new office projects financially unfeasible.

- Most new developments are mixed-use or owner-occupied, with speculative standalone office buildings nearly disappearing.

- Palm Beach County is the exception, leading the region in office starts thanks to billionaire Steve Ross’ developments in West Palm Beach.

Miami-Dade’s Office Boom Goes Bust

After years of hype and high hopes for Miami-Dade’s office market, a sharp office slowdown has taken hold. According to CoStar data, just 650,900 SF of new office construction broke ground countywide over the past year—a sharp drop that marks the lowest total since at least 2017.

During the pandemic boom, an influx of businesses relocating from the Northeast and West Coast sparked a surge in demand. But fast forward to today, and an office slowdown has taken hold, per the Real Deal.

Why It’s Happening

The current slowdown stems from a cocktail of economic headwinds:

- Rising interest rates and insurance premiums.

- Fewer large-scale tenants moving into the region.

- Construction financing has tightened, with lenders pulling back.

- Tariffs and immigration policies from the Trump administration are raising costs and limiting labor access.

Add to that declining international and domestic in-migration, and the pipeline of potential tenants looks increasingly dry.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Cost Conundrum

With Class A office construction now costing up to $500 PSF, and Class B around $300, the numbers no longer add up. Developers like IMC Equity Group are opting to buy discounted existing properties instead of building from scratch. IMC’s $49M purchase of Sawgrass Technology Park in Sunrise—at just $95 PSF—is a case in point.

Where Construction Is Still Happening

While Miami-Dade is pulling back, other parts of South Florida are still seeing some activity:

- Palm Beach County leads the region, thanks to billionaire Steve Ross’ aggressive development strategy in West Palm.

- Broward County has just one office project underway: the 180,000 SF T3 FAT Village in Fort Lauderdale.

In Miami-Dade, current construction is mostly limited to owner-occupied projects or mixed-use developments, including:

- Ken Griffin’s Citadel HQ in Brickell (1.3M SF).

- Banco Santander’s 41-story tower.

- Royal Caribbean’s 380,000 SF HQ at PortMiami.

- One Kane Concourse, the only standalone speculative office building under construction.

What’s Next?

The outlook remains dim for new office construction in Miami-Dade. With migration numbers falling and demand uncertain, developers are wary. Even newly completed buildings in hot markets like Wynwood are struggling to lease their space.

The office slowdown is expected to persist in the near term, as rising costs, cautious lenders, and a shrinking workforce discourage speculative development. As CoStar’s Juan Arias puts it, unless you’re Steve Ross—who’s already soaking up demand in Palm Beach—it’s “really tough” to justify breaking ground on a new office tower.

For now, it’s a time to buy, not build. And even then, only if the numbers pencil out.