Why Smart Investors Stress Test Deals Before Investing

Underwriting multifamily properties isn’t about making the numbers work but ensuring they hold up.

Multifamily real estate deals often look strong in a single set of projections, but how do they perform if market conditions shift? What happens if rents grow slower than expected? If expenses rise faster? If exit cap rates expand?

Too many investors rely on best-case scenarios without considering what could go wrong, leading to investments that look great on paper but collapse under stress.

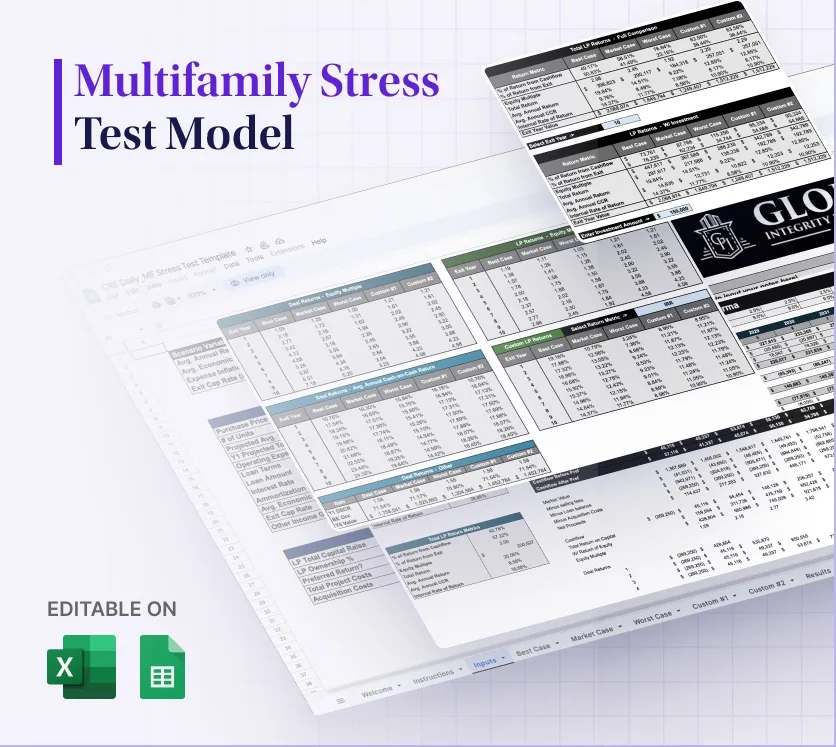

That’s why we built the Multifamily Investment Stress Test Spreadsheet, a powerful tool that lets passive investors pressure-test a deal under multiple economic scenarios before committing capital.

This isn’t just about confirming best-case returns. It’s about risk-adjusted returns—understanding how a deal performs under stress and identifying the real risks before investing.

How the Multifamily Stress Test Works

The spreadsheet is structured with seven sheets:

- Input Sheet – Enter deal assumptions

- Five Stress Test Scenarios – Pre-built best-case, worst-case, market base case, and two custom stress cases

- Results Sheet – A fully automated breakdown of how returns shift across scenarios

📌 Only the blue cells should be edited—all other formulas are locked to prevent errors.

This Model Tests 4 Critical Risk Factors

1️⃣ Rent Growth Assumptions

How much does a small miss on rent growth affect returns? Investors often assume steady 3-5% rent increases, but market conditions change. Can the deal still work if rents rise slower than expected?

2️⃣ Economic Vacancy Stress Testing

Vacancy includes loss to lease, turnover, and bad debt. If market vacancies increase, will the deal still cash flow? Many investors only test physical vacancy, ignoring the real risk of economic vacancy.

3️⃣ Expense Inflation & Cost Expansion

Insurance, taxes, and payroll often outpace rent growth. The model allows you to stress test expansion inflation, ensuring that the deal remains profitable even if expenses rise faster than expected.

4️⃣ Exit Cap Rate Expansion

The largest driver of projected returns is the exit cap rate assumption—which investors can’t control. Even a small increase in cap rates can turn a strong deal into a low-return investment.

This spreadsheet quantifies that risk so investors aren’t left hoping for the best.

How to Use the Stress Test Spreadsheet

1️⃣ Input the Market Base Case – Enter your sponsor’s projections in the blue cells on the Input Sheet

2️⃣ Review the Pre-Built Stress Cases – The tool automatically generates five scenarios, including best and worst case

3️⃣ Customize Your Own Stress Tests – Adjust Custom Test #1 and #2 to see how different risks affect returns

4️⃣ Analyze the Results – The Results Sheet breaks down how LP and deal-level returns change across scenarios

5️⃣ Toggle Exit Years for Deeper Insights – Adjust the exit year toggle to see projected IRR, equity multiple, and cash-on-cash for any exit year

📌 Key Tip:

The loan amount should be permanent, not a bridge or rehab loan. Underwriting should reflect reality, not optimistic projections.

What The Results Sheet Tells You

This model calculates both deal-level and LP-specific returns, allowing investors to see how stress-tested variables impact their actual cash flow.

✅ Equity multiples (levered) in all five scenarios

✅ Returns displayed for years 1–10

✅ Exit year toggle to compare projected returns at different hold periods

This ensures investors aren’t just seeing one IRR number but an actual risk-adjusted breakdown.

Why This Model Should Be Standard for Passive Investors

Too many investors assume their proforma numbers will hold up. But the best investors test assumptions until they break. Here’s what this tool uncovers:

Hidden Risks – Does the deal depend too much on rent growth? Are operating expenses too thin?

Cash Flow Gaps – What happens if debt costs rise? Will the deal still cash flow in a downside scenario?

Stronger Investment Decisions – A deal that holds up under stress gives investors true confidence.

This Model is Built to Answer a Simple Question:

👉 If things don’t go as planned, is this still a good investment?

Don’t just underwrite to make a deal work. Underwrite to ensure it works.

Final Takeaway: Making Risk-Adjusted Returns the Standard

A sponsor’s job is to sell you on a deal. Your job is to make sure that deal holds up.

Underwriting isn’t about getting to a “yes.” It’s about testing a deal until you know it’s solid, even under pressure.

This spreadsheet was built to help passive investors make informed, stress-tested investment decisions.

MF Stress Test Model

"*" indicates required fields