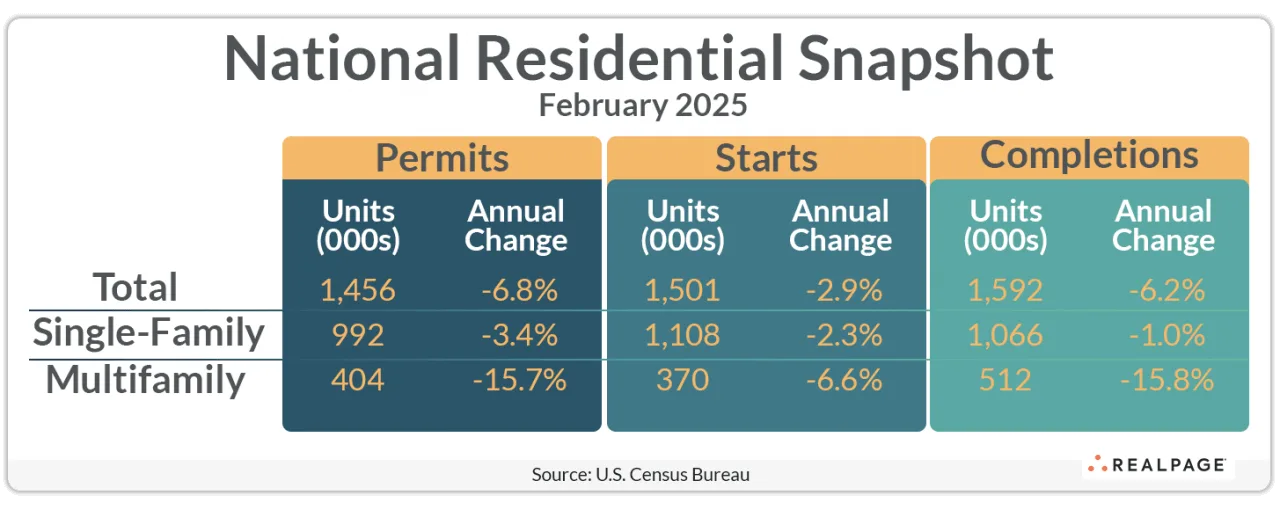

- Multifamily permits fell 4.3% from January and are down nearly 16% year-over-year to a seasonally adjusted annual rate (SAAR) of 404,000 units.

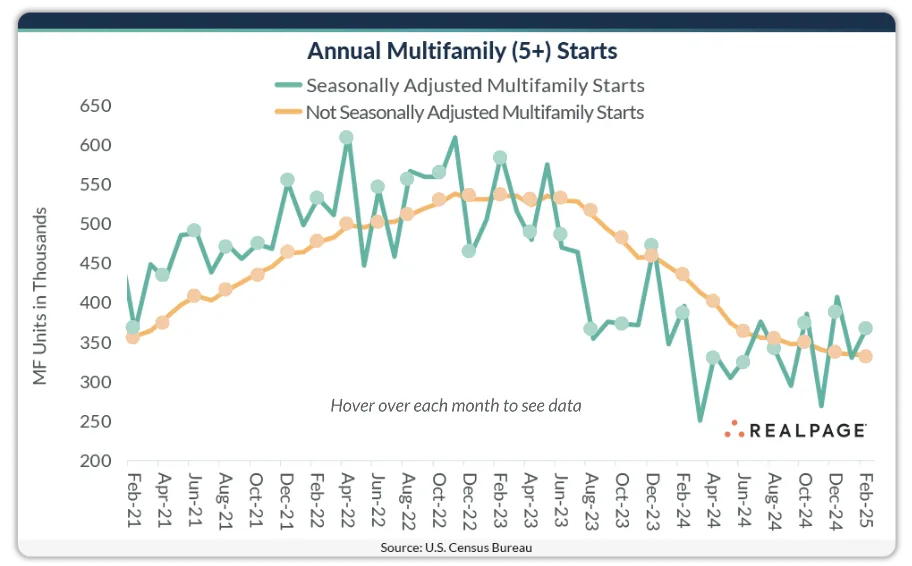

- Meanwhile, starts climbed 12.1% month-over-month to 370,000 units, though they remain 6.6% below last February’s pace.

- Regional data show permitting is down sharply in the Northeast and West but up in the Midwest and South.

In February, the SAAR for multifamily permitting fell to 404,000 units, marking a 4.3% month-over-month and 15.8% year-over-year decline, per RealPage.

The drop underscores continued developer caution amid persistent challenges such as elevated interest rates and construction costs.

Starts Rebound—But For How Long?

According to US Census Bureau and HUD data, multifamily starts rose to 370,000 units, a 12.1% increase from January.

Despite the monthly gain, starts are still 6.6% below the level seen in February 2024. The volatility of seasonally adjusted data suggests the market could be nearing the bottom of the current cycle.

Construction Activity Nears Stability

Multifamily units under construction stood at 754,000 in February, unchanged from January but down 21% from a year ago. Completions dropped 20.7% month-over-month and 15.8% annually to 512,000 units—another sign the pipeline is shrinking.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Single-Family Sees Mixed Signals

Single-family permits dipped 3.4% year-over-year to 992,000 units, flat from January.

However, single-family starts rose 11.4% month-over-month to 1.108 million units, despite being 2.3% below last year. Completions improved 7.1% from January, while the number of homes under construction remained steady.

Regional Dynamics

- Permits: The sharpest declines came from the Northeast (down 72.1%) and West (down 22%). The South and Midwest saw annual increases of 13.7% and 23.5%, respectively.

- Starts: Midwest starts fell 66%, and the South dropped 14.6%. In contrast, the Northeast surged 61.4%, and the West climbed 40.3%.

The Bigger Picture

With construction costs and borrowing rates still elevated, builders remain cautious. However, the stabilization in starts and under-construction figures could suggest multifamily activity is nearing a cyclical low. Regional shifts also highlight a migration of activity to more affordable and supply-constrained markets.