- Yardi Matrix increased its multifamily supply forecast for 2025–2027 by roughly 2% on average, driven by a still-large under-construction pipeline and rising completion times.rn

- Starts are down sharply in 2024—off 36.4% from 2023 levels—pointing to a supply slowdown by 2026, though completions will remain elevated through 2025.rn

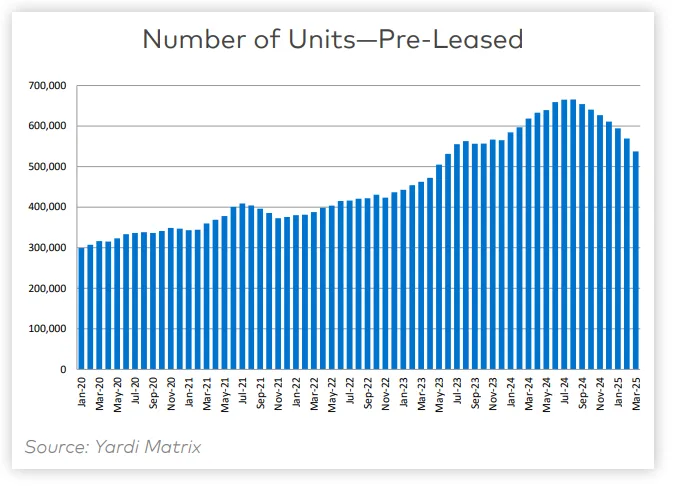

- The under-construction pipeline peaked in March 2024 and has declined since, but it still supports over 500,000 unit completions in 2025.rn

- Construction times reached multi-year highs in Q1 2025, with average completion durations extending across all asset classes.

Supply Update: A Slight Lift for the Near-Term Forecast

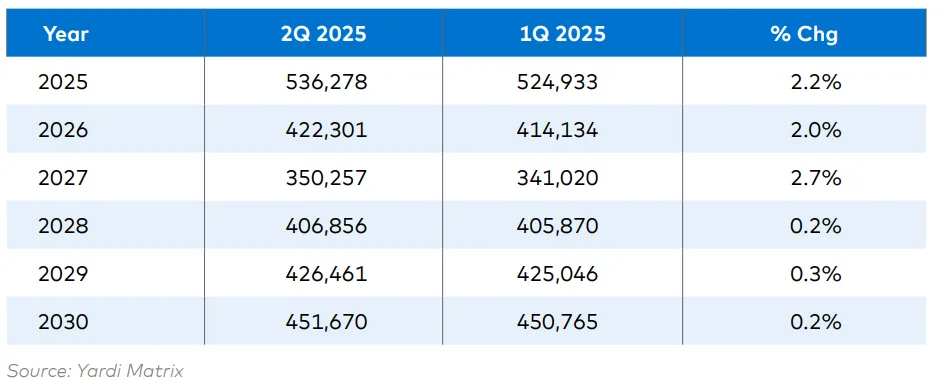

yardi matrix’s Q2 2025 update nudges up expected multifamily completions for 2025 through 2027. The biggest increases were for 2027, where completions are now forecast at 350,257 units, a 2.7% bump from Q1’s projection. In 2025, completions are now pegged at 536,278 units, up 2.2%, while 2026 is expected to see 422,301 units, a 2.0% increase.

The upgrade stems from a marginally larger under-construction pipeline than previously estimated, despite a full year of contraction following the March 2024 peak.

Starts Decline, But Completions Still Holding

Multifamily starts have dropped sharply—down 36.4% year-over-year as of Q1 2025, and 40.7% compared to 2022’s peak. Still, completions remain elevated, largely due to long construction timelines and residual momentum from the 2021–2023 development boom.

Completion times are climbing:

- Garden-style properties averaged 718 days to complete, a new high.

- Mid-rise projects took 837 days, also a record.

- High-rise properties jumped to 1,043 days, up nearly six months from their recent average.

This extension is contributing to higher active inventory figures, despite fewer starts.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Segment Breakdown: Market-Rate Supply Slows Most

Completions for market-rate and partially affordable units—traditionally the bulk of multifamily supply—are projected to decline by 37.6% from 2024 to 2026. By 2026, these property types will account for just 75.1% of all new supply, down from 84.2% in 2019.

Affordable and senior housing are expected to see more moderate declines:

- Affordable: down 24.3% from 2024 to 2026

- Single-family rentals: down 26.7%

- Senior housing: sees the least volatility, with a rebound in 2027 forecast.

Long-Term Outlook: Gradual Recovery After 2027

The forecast holds steady for 2028–2030, anticipating a gradual recovery after new supply bottoms out in 2027. Higher tariffs and policy uncertainty could dampen growth, but easing monetary conditions may partially offset the impact.

Despite short-term caution, the planned pipeline holds 1.117M units, and the prospective pipeline expanded to 3.346M units, up 11.1% year-over-year. Developers appear to be betting on a market rebound in the latter half of the decade.

Why It Matters: Planning for a Post-Peak Market

After a decade-high in 2024, multifamily supply is set to taper through 2027. For developers and investors, the key challenge will be navigating rising costs, extended build times, and slowing starts—while preparing for eventual demand recovery. The data suggests a near-term dip followed by a longer runway for strategic re-entry.

Stay tuned: Yardi Matrix expects clearer direction on the impact of tariff policy and construction costs by mid-2025.