- Many multifamily developers completed projects before the threat of steep tariffs, cushioning them from future cost spikes.

- With new construction slowing, landlords anticipate rent increases of up to 5% annually.

- High mortgage rates and economic uncertainty are keeping people in rentals longer, sustaining demand for apartments.

- Homebuilders, still active in construction, are facing rising material costs and labor challenges.

Overbuilding Pays Off

According to the WSJ, a supply glut once viewed as a liability is now looking like a stroke of luck for apartment developers.

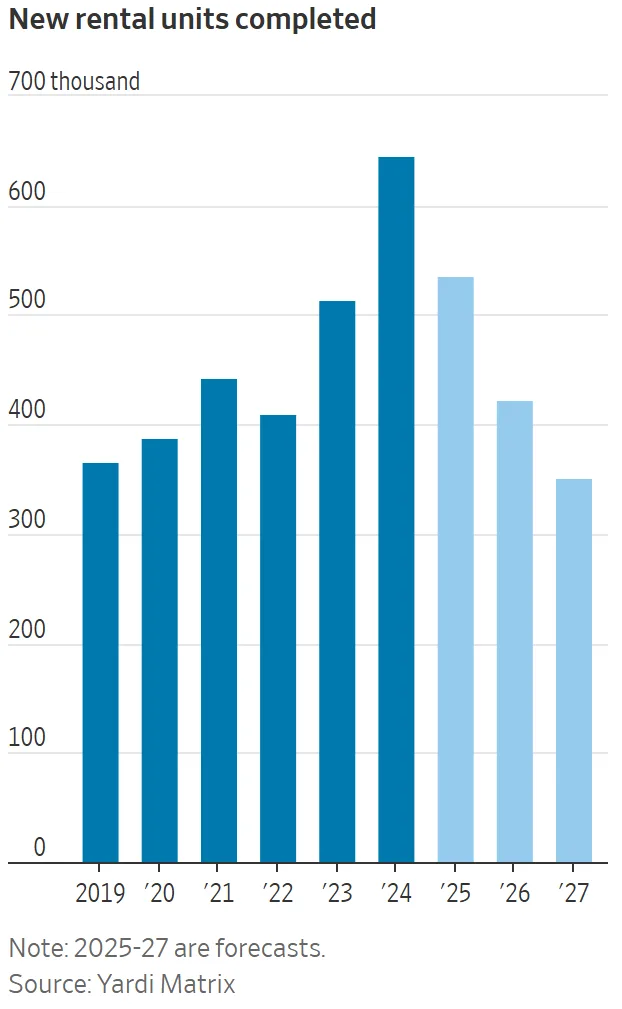

After delivering over 1.1M units in 2023 and 2024—the largest wave in four decades—multifamily owners are finding themselves well-positioned ahead of impending tariffs on imported construction materials.

“It’s not like they necessarily knew what they were doing,” said Moody’s economist Ermengarde Jabir. “But they’ve lucked out.”

With construction now slowing and demand holding steady, rents are expected to climb. Some landlords are already forecasting rent hikes of up to 5% annually, capitalizing on diminished competition from new projects.

Tariffs Hit Housing, But Timing Favors Rentals

Developers rushed to build when borrowing costs and materials were cheaper, insulating themselves from today’s volatile market conditions. Tariffs, particularly a 145% rate on Chinese imports, are likely to drive up the cost of steel, cabinetry, windows, and more.

While homebuilders scramble to stockpile materials and hedge against the increases, apartment developers are largely on pause—positioning them to benefit from a tighter supply pipeline without the burden of ballooning construction budgets.

Renter Demand Still Rising

The broader housing market remains locked in uncertainty. High home prices, low inventory, and mortgage rates hovering above 6.5% are pushing potential buyers to stay in the rental market longer.

This dynamic is already showing up in rental data. In Manhattan, net effective median rent recently hit a record high, according to Douglas Elliman. And CBRE forecasts that by year-end, owning a home will remain roughly 30% more expensive than renting.

“In a period of negative disruption, people want to stay put a little longer,” said Matt Vance, head of multifamily research at CBRE.

What’s Next

Landlords still face operational cost pressures, especially on maintenance and repairs. And while developers like Northwood Ravin have been offering incentives like free rent to attract tenants, that trend could reverse as new supply is absorbed.

If the current slowdown in starts, permits, and completions continues—and if multifamily tariffs further delay or deter new development—rents could rise faster and remain elevated longer.

Still, the wildcard remains the broader economy. A potential recession triggered by trade policy could cool demand across the board. But for now, multifamily landlords are in a rare sweet spot: demand is strong, supply is peaking, and the next wave of development just got a lot more expensive.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes