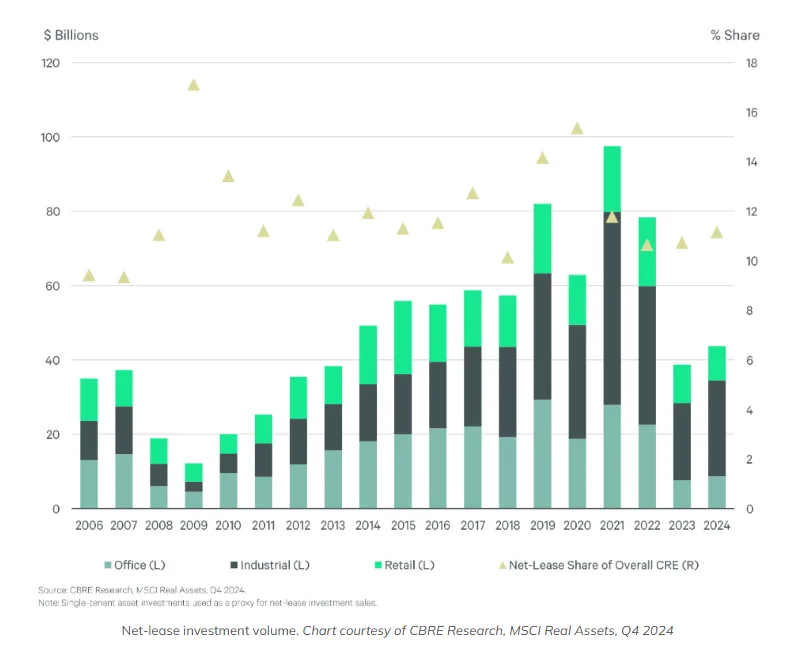

- Net lease investment volume rose 19% QoQ and 57% YoY in Q4, reaching $13.7B.

- Full-year 2024 net lease investment volume grew 13% to $43.7B.

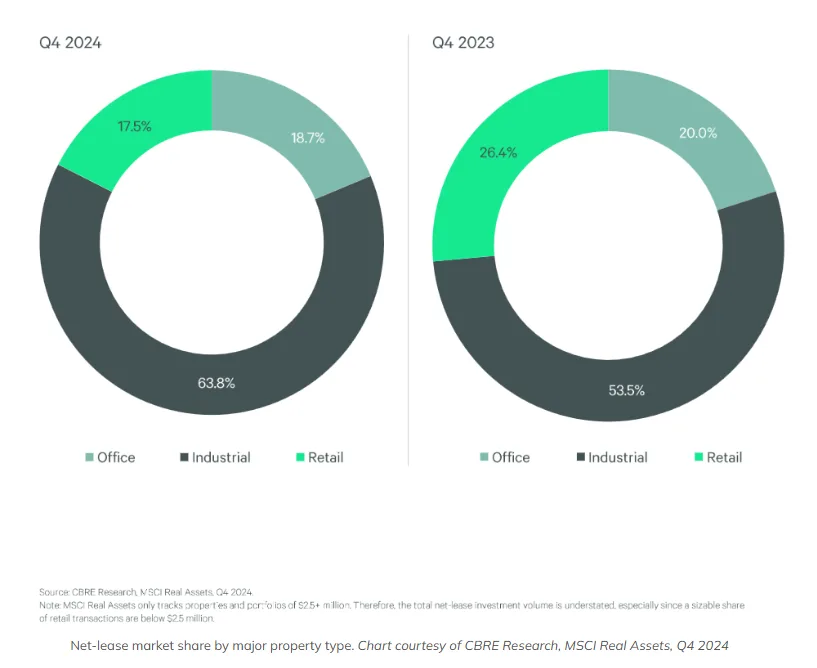

- Industrial and logistics assets dominated, comprising 64% of transactions.

- Rising cap rates and stable long-term leases continue to attract investors.

- NNN energy leases are emerging in multifamily as a creative financing solution.

Net lease investment surged in Q4, with volumes up 19% QoQ and 57% YoY to $13.7B, according to CBRE.

By The Numbers

This growth contributed to a 13% increase in full-year 2024 volume, totaling $43.7B, per CommercialSearch.

Industrial and logistics properties dominated, capturing 64% of the market in Q4, up from 54% a year earlier.

Meanwhile, net lease investment in industrial assets grew 87% YoY, revealing strong demand for logistics and distribution facilities amid ongoing e-commerce expansion and supply chain shifts.

Investors Crave Stability

Will Pike, vice chairman of net lease properties for capital markets at CBRE, said the sector’s resilience stems from its predictable cash flow and risk-adjusted returns. “We expect continued momentum this year, especially in retail and industrial, as capital prioritizes low-risk opportunities amid potential market volatility,” Pike added.

Joseph Yiu, partner at Leste Group, also noted that investors are turning to net lease assets as fundamentals and rent growth in other CRE sectors weaken. “With 2% to 3% annual rent escalations and wider cap rates over the past 24 months, net lease investments are increasingly attractive for creditworthy borrowers,” Yui explained.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

End-of-Year Deals

A confluence of factors drove Q4 deal flow, according to Damon Juha, partner at Saul Ewing. “Investors responded to the Fed’s interest rate cuts, paid all cash for smaller deals, and moved quickly to close transactions before year-end amid election uncertainty,” he said.

Net lease investments remain a lower-risk entry point for private investors, though Juha added that the sustainability of this momentum depends on inflation trends and interest rates.

Emerging Trends

Private investors continue to drive most transaction activity, despite economic headwinds like high interest rates and inflation, said Lanie Beck, Northmarq senior director. “Industrial assets have outperformed, while retail and office remain mixed, with investors favoring essential tenants and niche opportunities like healthcare,” she noted.

Meanwhile, NNN energy leases are gaining traction in multifamily, particularly in mixed-use developments, said Sean Doak, CRO at PearlX. “With high interest rates and construction costs, developers are leveraging NNN energy leases to finance projects while shifting maintenance, insurance, and taxes to tenants,” he explained.

Despite the sector’s growth, some analysts urge caution. Dave Sobelman, CEO of Generation Income Properties (GIPR), pointed out that industrial deals today largely consist of sale-leasebacks by non-investment-grade tenants seeking capital—a departure from pre-2020 trends.

Additionally, while Q4 saw an uptick, overall net lease transaction volume remains at historically low levels, comparable to post-GFC 2009–2010, according to Northmarq data.

Looking Ahead

As the market recalibrates, the net lease sector is expected to remain a stable investment option. Investors will likely continue prioritizing industrial and retail assets with essential tenants, while niche segments like NNN energy leases could gain momentum as capital constraints persist.