- Higher delinquency rates point to potential strains on CRE values and loan portfolios.

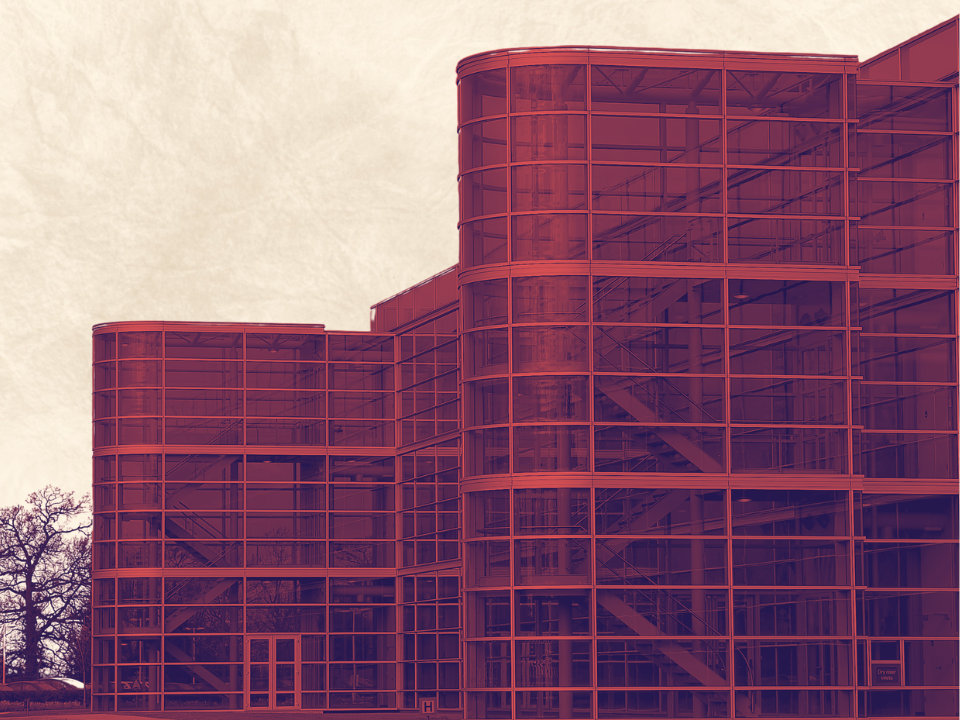

- Office sector vulnerability stems from rising rates, slow growth, and tight lending conditions.

- Class B and Class C offices face prolonged recovery periods and potential value drops.

Fitch Ratings revised its projections for 2024 and 2025 office loan delinquencies higher, as reported by Bisnow.

Delinquency Forecast

Fitch Ratings revised their U.S. CMBS office delinquency forecast upwards projecting an 8.4% delinquency rate for 2024 and 11% for 2025, surpassing the peak of the Global Financial Crisis (8.1%). Notably, the office delinquency rate was already up to 4.3% in April.

The office sector faces multi-year challenges like higher interest rates, slower economic growth, and declining office demand, making refinancing very difficult. Special servicing, here we come.

When Lower Rates?

The updated forecast arrives as the latter half of the year nears and anticipated rate drops have yet to arrive. Since last July, the Federal Reserve has maintained rates between 5.25–5.5%. But because inflation has eased, there remains hope for rate cuts later this year.

Office properties continue to be the most frequently affected type of commercial real estate when it comes to delinquencies and foreclosures. Bisnow reported that commercial foreclosures in March more than doubled compared to the same period in 2023.

Prolonged Recovery

The office sector’s recovery this cycle will likely be slower and more prolonged than after the GFC. This means office valuations, even after recovering, may not be at their pre-pandemic levels. They’ve already dropped around 40%.

Why It Matters

Granted, this isn’t as bad as the 47% drop we suffered during the GFC. But it’s the lowest level in the last four years, and the market hasn’t bottomed out yet. The slow recovery is expected to lead to weaker performance and higher loan losses.