- The US office sector may be nearing a valuation bottom, supported by stabilizing occupancy and strong demand for newer, high-quality assets.

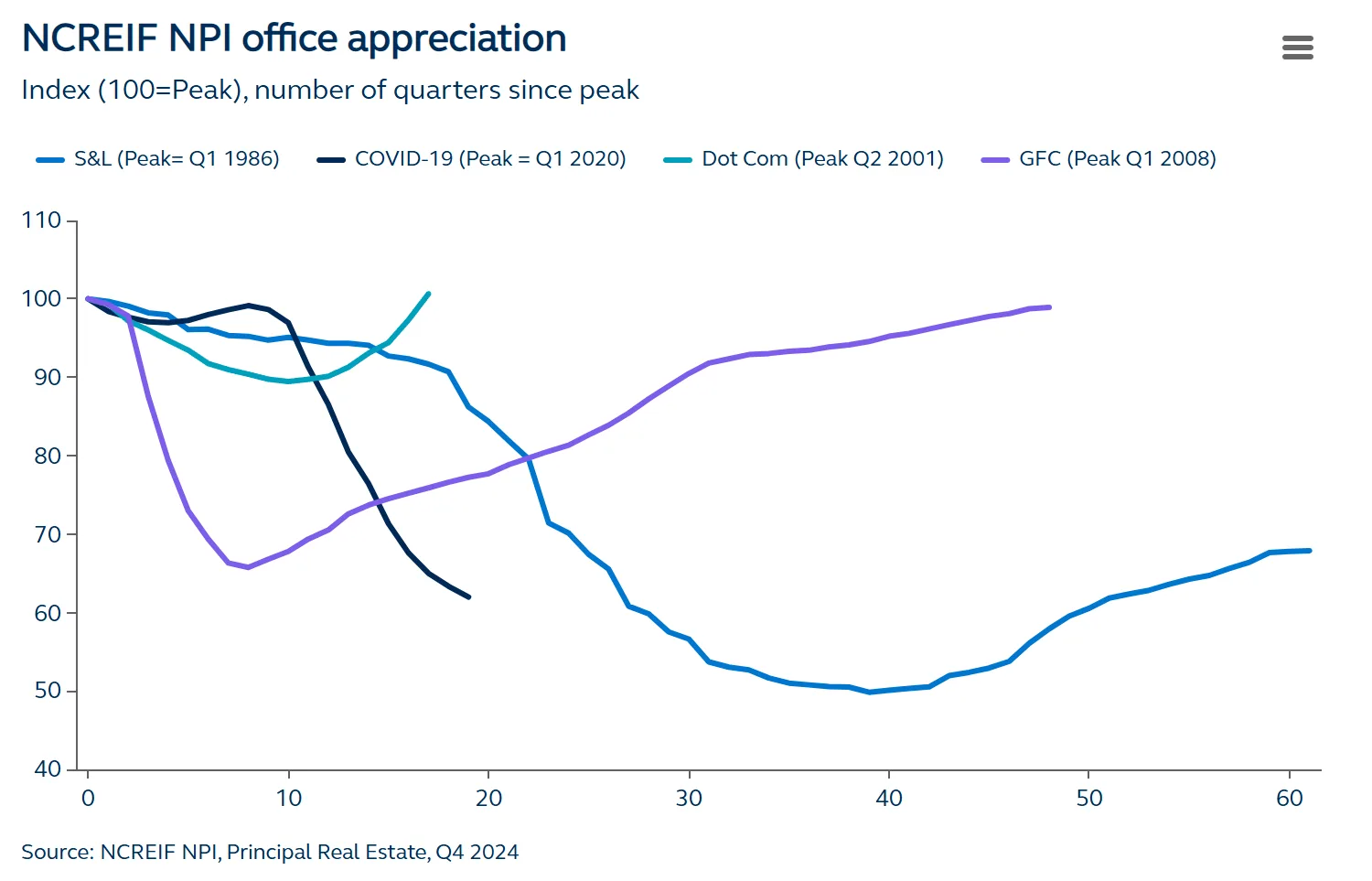

- Office remains the most challenged commercial real estate segment, with valuations down 38% since 2020 and nearly $300B in loan maturities due by 2027.

- A bifurcated recovery is emerging, favoring modern, Class A assets in strong markets, while older properties face functional obsolescence and repurposing pressure.

- Despite structural headwinds, opportunistic investors with the right capital can benefit from pricing dislocations and distressed debt or equity plays.

Post-Pandemic Realities

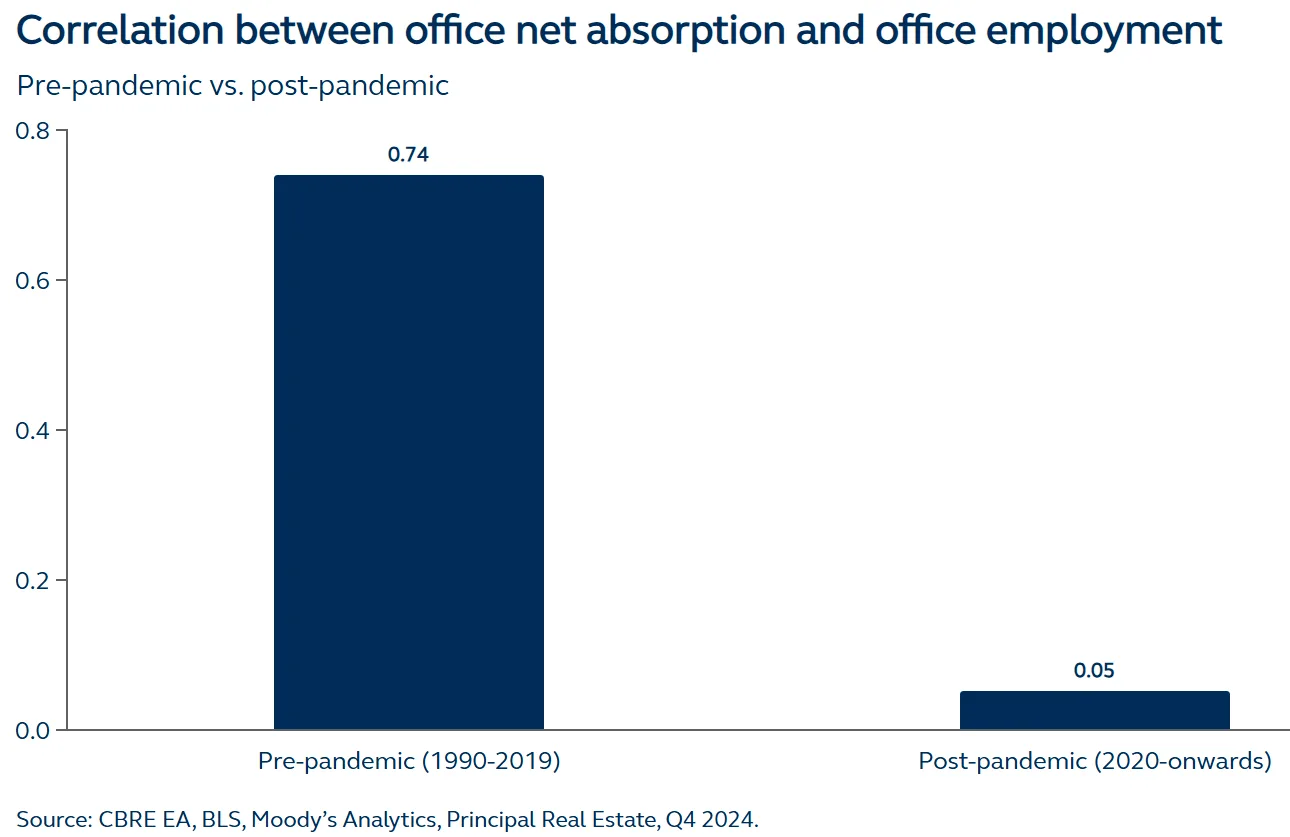

As reported by the Principal Asset Management, The US office sector, once tightly linked to job growth in professional services, is undergoing a structural shift. The pandemic’s legacy—remote and hybrid work—has fundamentally altered space utilization, decoupling office demand from employment trends.

As a result, leasing activity has diverged sharply from historical norms, and older office assets face declining relevance. Against this backdrop, the prospect of an office recovery is beginning to take shape, though it remains uneven and highly dependent on asset quality and location.

At the same time, the office sector has had to absorb broader commercial real estate headwinds. A 170-basis-point rise in 10-year Treasury yields from post-GFC norms has pressured valuations across property types. But for office, weak fundamentals have compounded rate-driven valuation stress, with the sector experiencing the steepest price corrections of any asset class.

Signs Of Stabilization

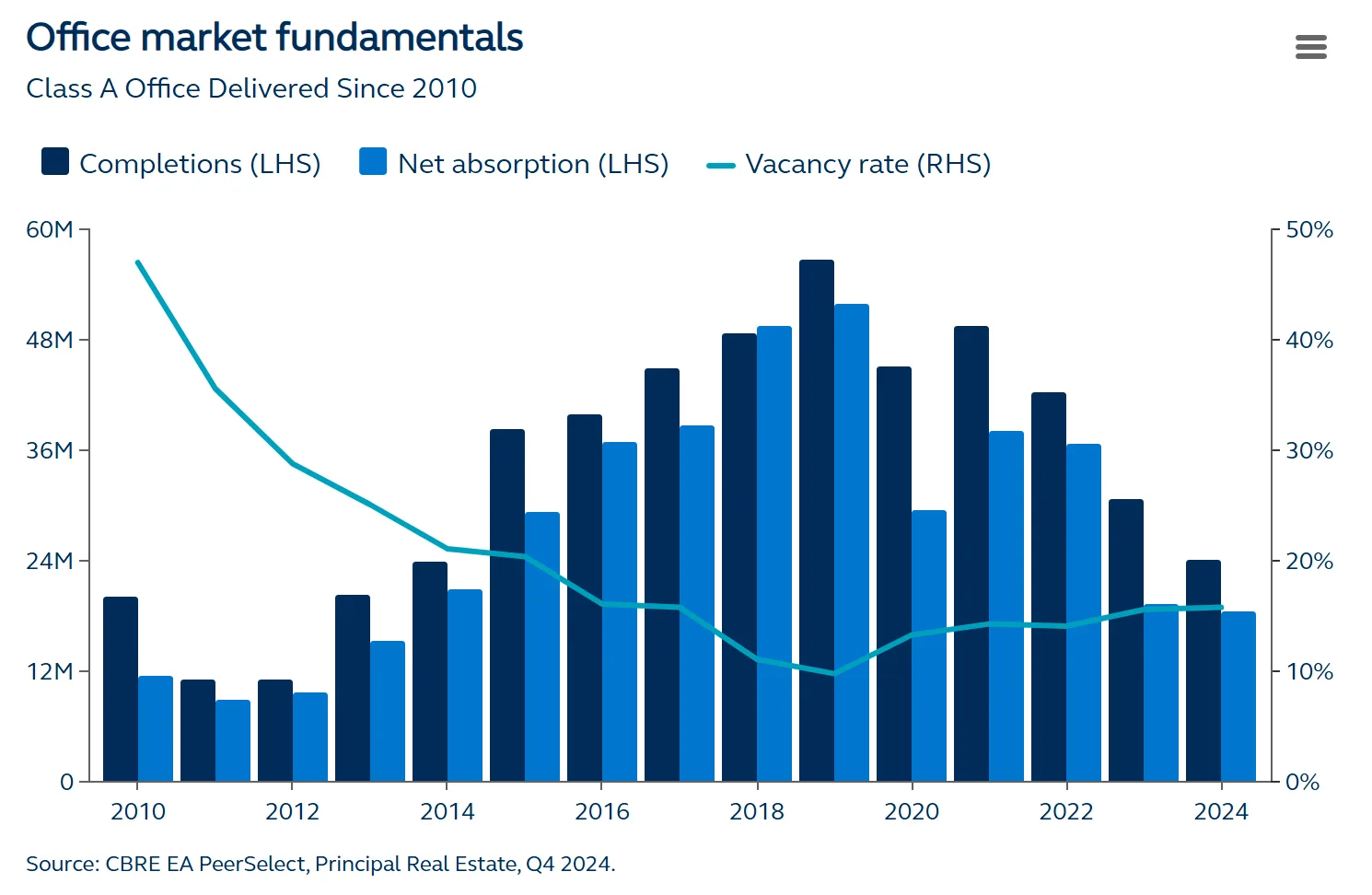

Despite the turbulence, the market is beginning to show signs of equilibrium. Office vacancy rates have plateaued near a national high of 19% since mid-2024, while newer Class A buildings are faring relatively well. Properties delivered after 2010 boast lower vacancy rates—around 15%—and positive net absorption, a sign that demand for modern, amenity-rich space remains intact.

Corporate mandates to return to office, along with evolving workplace strategies, are contributing to improved occupancy. Still, much of the sector’s performance divergence comes down to asset quality and location, furthering a bifurcated recovery narrative.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Distress And Debt Maturities Loom Large

Nashville struggled in the past to expand transit, even as its population grew by nearly Although fundamentals are stabilizing, financial pressures persist. According to the Mortgage Bankers Association, nearly $300B in office debt will mature over the next two years—at a time when valuations remain 38% below 2020 levels. This puts added strain on refinancing efforts and may force sales or restructurings, especially for underperforming properties.

Institutional capital remains cautious. Office allocations within the ODCE Index have fallen to 18%, well below pre-pandemic levels. The pullback reflects both uncertainty around long-term demand and weak leasing economics. Today, landlords often spend up to 60% of a lease term recouping upfront tenant costs, eroding profitability and ROI.

A New Office Investing Playbook

Going forward, the office sector will be less about broad-based rebounds and more about selective, active investment. Opportunities exist, but they’re likely to come through distressed sales, lending gaps, or value-added plays in top-tier markets.

Investors equipped to take leasing and exit risks may find value in acquiring assets at discounts to replacement cost. Meanwhile, lenders with appetite for risk-adjusted returns could benefit from tighter credit conditions and higher-yielding debt investments.

Outlook: Risks Remain, But So Do Rewards

While macro risks—geopolitical, economic, and policy-driven—could still stall or reverse recovery trends, the long-term outlook for office is no longer uniformly bearish. Instead, it’s a story of divergence: quality over quantity, selectivity over scale.

Bottom Line

The worst may be over for the US office sector, but its path to recovery will be uneven. Investors who can navigate the complexity and embrace an active, high-conviction strategy may be best positioned to capitalize on the sector’s evolving landscape.