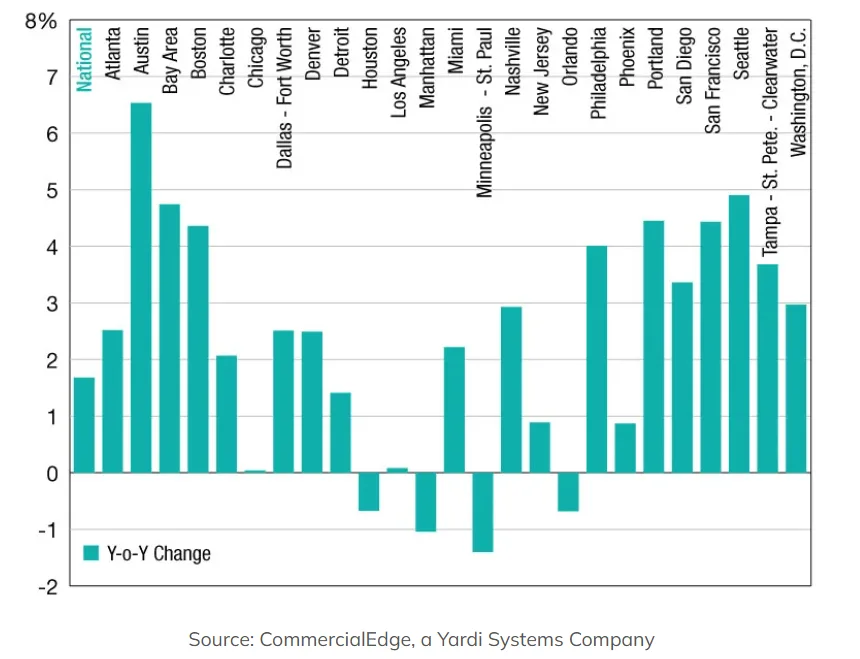

- The national office vacancy rate rose 1.7% year-over-year in March 2025, reflecting sustained supply-demand imbalances.

- Austin led all major US metros with a 6.5% annual increase in vacancy, followed by Seattle, the Bay Area, and Boston.

- While many West Coast markets saw elevated vacancies, East Coast metros like Manhattan and Orlando experienced modest improvements.

Widespread Weakness Persists

According to the latest CommercialEdge report, national office vacancies are still rising, albeit at a slower pace than earlier periods.

As of March 2025, the vacancy rate rose by 1.7 percentage points compared to the same time last year, continuing a trend of sluggish leasing activity and elevated supply.

Austin and Tech Markets Struggle

Austin reported the steepest year-over-year jump in vacancy—up 6.5%—extending ongoing oversupply issues in several Sun Belt markets. Other large increases were seen in Seattle (4.9%), the Bay Area (4.7%), and Boston (4.3%), indicating continued leasing challenges in markets reliant on tech and life sciences.

West Coast Recovery Lags

Portland and San Francisco each saw 4.4% increases in vacancy, with San Diego not far behind at 3.4%. These numbers reflect a slower recovery on the West Coast, where hybrid work trends and corporate downsizing are still impacting tenant demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Bright Spots on the East Coast

While many markets remain challenged, some cities posted year-over-year improvements. Minneapolis–St. Paul saw the largest decline at -1.4%, followed by Manhattan (-1.0%) and Orlando (-0.7%), signaling either an uptick in leasing or a pause in new office deliveries.

Florida markets displayed contrasting trends. Tampa–St. Petersburg–Clearwater’s vacancy jumped 3.7%, while Miami held relatively steady at 2.2%, hinting at diverging tenant dynamics within the state.

Why It Matters

Persistent high vacancy rates in key US office markets underscore the long-term implications of remote work and changing corporate space needs. While some cities are stabilizing, others—especially those with ongoing construction pipelines—continue to struggle.

What’s Next

With more companies reevaluating office footprints, future vacancy trends may depend heavily on subleasing activity, conversion projects, and localized economic recovery. Markets with limited new supply and diversified tenant bases may be best positioned for a rebound.