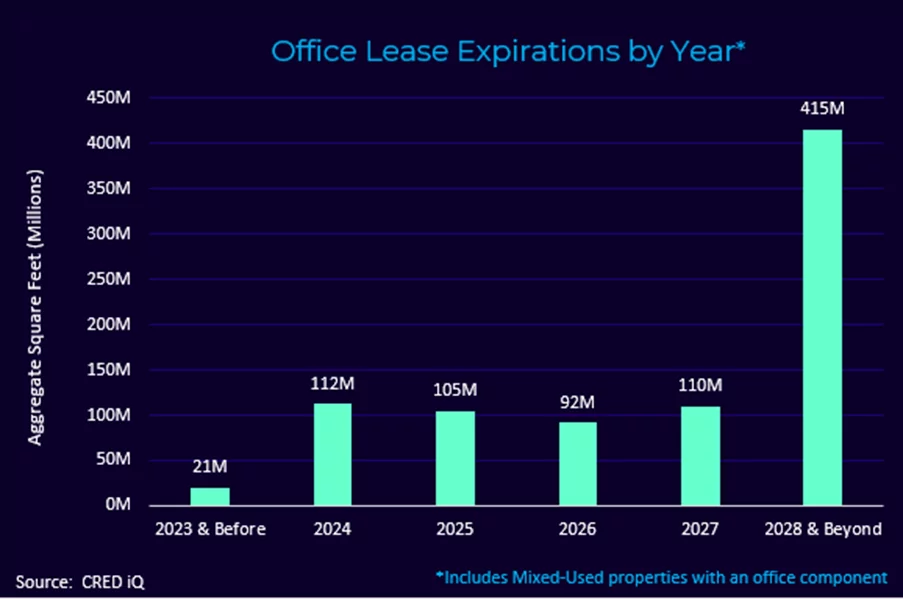

This comes at a time when office vacancies nationwide are at an all-time high, a trend exacerbated by the sustained growth of remote working and economic uncertainty.

Why it matters: The intersection of record-high vacancy rates with impending lease expirations poses significant risks to the office sector. Landlords face the prospect of downsizing and non-renewal by tenants, which could lead to increased vacancies and reduced revenue.

- This scenario is especially concerning considering the distressed rate for CMBS office loans, which was reported at 9.9% as of December 2023.

- Plus, tenant needs and preferences are changing as businesses continue to adjust their real estate strategies in response to the evolving work landscape.

Between the lines: The data from CRED iQ, which examined over 866 million square feet for CMBS office and mixed-use collateral properties, indicates that the most significant lease expirations are concentrated in major markets.

- The New York MSA leads with over 173 million square feet of leases set to expire through 2028, followed by other major markets like Los Angeles, Chicago, Philadelphia, and San Francisco.

- Notable assets facing significant lease rollovers include the Worldwide Plaza in New York and the Google and Amazon Office Portfolio in the San Jose market.

What they are saying: Industry experts suggest that while many tenants may renew or expand their office footprints, the high vacancy rates—exceeding 20% in some markets—highlight a substantial risk of downsizing or non-renewal.

- This scenario could lead to reduced cash flow for landlords and potentially trigger more distressed situations in the CRE sector.

- However, there’s also a potential upside: lease expirations could offer opportunities for landlords to reset rents higher if market conditions permit, though this is heavily contingent on the overall economic environment and evolving tenant preferences.