- Phoenix recorded just 170,521 SF of office construction starts across three projects in early 2025—one of the lowest among peer metros.

- Only 17 properties traded through February, totaling $42M at an average of $124 PSF, well below the $177 national average.

- Coworking space more than doubled year-over-year, reaching 2.9M SF across 155 locations.

- Vacancy stood at 18.7%, while office-to-residential conversions gained traction, with 16.5M SF rated moderately feasible for reuse.

A Slow Start for New Office Development

Phoenix’s office construction activity remains muted in early 2025, as reported by Commercial Search. According to the information, developers broke ground on only three projects totaling 170,521 SF. No new deliveries were recorded in the first two months, reflecting a 100% year-over-year decline in new supply.

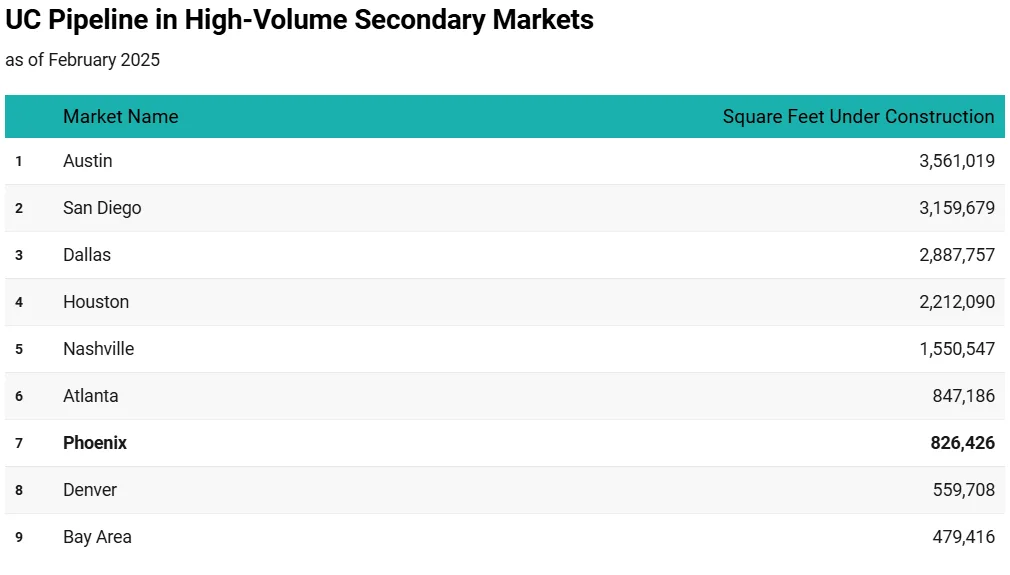

The metro has just 826,426 SF under construction, equal to 0.6% of total inventory—below the national 0.7% average and trailing leading secondary markets like Austin (3.7%) and San Diego (3.2%).

The largest project underway remains Gilbert Spectrum’s Building 3, a 199,222 SF property expected to complete this April. Two other notable developments include HonorHealth Medical Campus at Peoria and HonorHealth Medical Campus at Pima Center, both medical office facilities expected to deliver in 2025.

Transactions Lag, Prices Stay Below Average

Only 17 office properties traded across Phoenix in the first two months of 2025, totaling 817,702 SF and $42M in sales—a year-over-year decline of 8.1%.

Notable transactions include:

- The Forum at Gilbert Ranch, a 92,440 SF building sold for $23.5M to Baseline Partners.

- 1415 W. 3rd St. in Tempe, an 82,266 SF flex office sold for $16.8M to Sportex Safety.

With an average sale price of $124 PSF, Phoenix remains more affordable than peer markets like Houston ($139), Dallas ($131), and San Diego ($662).

Flex Office Footprint Doubles

Phoenix’s coworking inventory surged past 2.9M SF in early 2025, more than doubling its 2024 total of 1.2M. The shared office sector now represents 2% of the market—on par with the national average and higher than Dallas, Austin, and Houston.

Top providers by footprint include:

- Regus (557,012 SF)

- Industrious (259,344 SF)

- Expansive (207,095 SF)

- Spaces (171,460 SF)

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Vacancy Holds Steady in The Valley

Phoenix’s office vacancy rate clocked in at 18.7%, under the national average of 19.7% and better than high-vacancy metros like Austin (27.4%), Dallas (23.8%), and Houston (23.1%).

New leasing activity included a 24,722 SF lease signed by RED Development, though large-scale deals remain scarce.

Adaptive Reuse Gains Momentum

Amid falling valuations and rising vacancy, investors are eyeing office-to-residential conversions. CommercialEdge’s Conversion Feasibility Index identified only five buildings in Phoenix with Tier I scores (90–100), totaling 504,627 SF and built between 1929 and 1977. However, 169 properties fall into Tier II, suggesting broader opportunity for redevelopment.

A prominent example: Caliber Cos. is converting Canyon Corporate Center—a 312,000 SF office campus in an Opportunity Zone—into a 400-unit residential project. The $40M project is expected to deliver by 2027.

Why It Matters

Phoenix’s sluggish start in 2025 underscores ongoing headwinds for the office market—from limited new development to weak investor activity. But adaptive reuse and a growing flex space footprint point to strategic shifts aimed at long-term repositioning.

What’s Next

As economic and workplace trends evolve, Phoenix’s office market will need to lean on flexible space offerings and creative reuse strategies to remain competitive in the Sun Belt landscape.