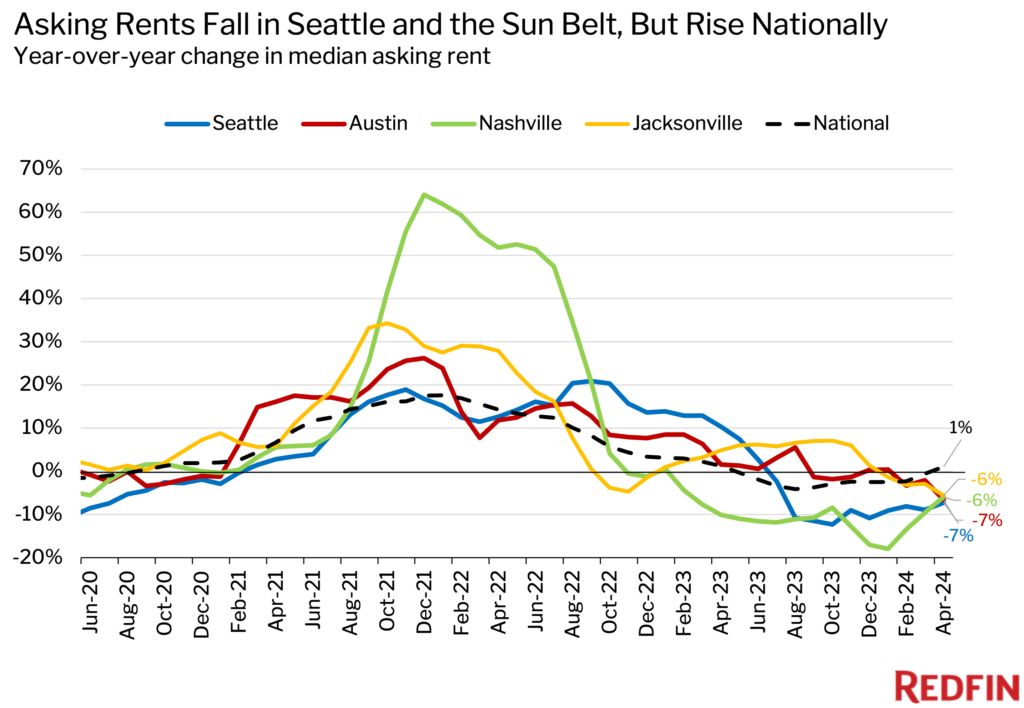

- Nine out of the ten U.S. metros with the steepest rent declines are in the Sun Belt, with Seattle being the only exception.

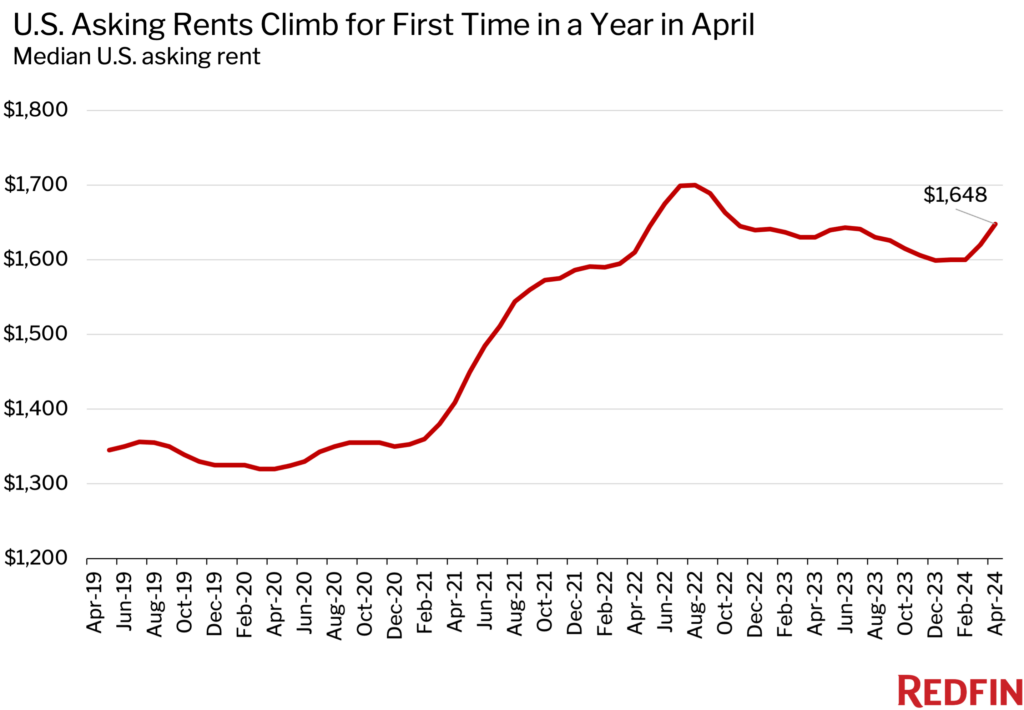

- Nationwide, the median asking rent rose 1% year-over-year in April 2024 to $1,648, marking the first increase in a year.

- The construction boom in the Sun Belt during the pandemic has led to a surplus of rental units, resulting in lower rents due to increased vacancies.

A recent Redfin analysis of median asking rents in newly listed apartment buildings among 33 major metros revealed significant variations.

Sunbelt Living

In 2023, the Sunbelt suffered substantial rent drops, attributed mostly to an oversupply of new apartments.

Among key cities, Seattle saw the biggest YoY rent drop of 7.3%, followed by Austin (-6.6%), Nashville (-5.9%), Jacksonville (-5.6%), Miami (-5%), San Diego (-4.7%), Phoenix (-4.6%), Charlotte (-4.5%), Tampa (-4.3%), and Orlando (-3.2%).

While many Texas and Florida metros saw setbacks, there are signs that rent stability is emerging. But for now, renters in these regions are winning big, with many taking advantage of lower rents to upgrade to larger apartments.

Regional Rent Variations

Nationally, median asking rents rose by 1.1% YoY in April to a cool $1,648 per month and by 1.7% from March.

Rent hikes were especially prevalent in the Midwest, which has been growing in popularity, according to RentCafe. The Northeast also enjoyed higher rents thanks to fewer new constructions.

Notable annual rent hikes were seen in cities like Minneapolis, which notched a 10.3% YoY rent hike. Cincinnati (+9.9%), Chicago (+9.1%), NYC (+8.9%), DC (+8.6%), Indianapolis (+8%), Virginia Beach (+7.7%), Houston (+6.7%), Boston (+5.7%), and Detroit (+4.9%) also reported higher rents.

Why It Matters

Redfin’s data hints at a more balanced rental market after the post-pandemic upheaval. Rents are rebounding nationally and the up-and-down rental rollercoaster ride seems to be near an end. And although near 2022’s record highs of $1,700 per month, rents have steadied compared to previous years.

Mortgage rates are perhaps the main driver of higher rents right now. The current average 30-year-fixed mortgage rate is hovering around 2x the 2.65% multi-decade low seen briefly in 2021.