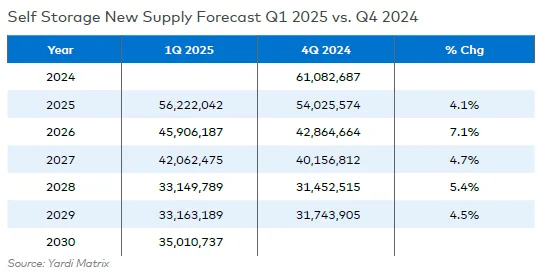

- New self-storage supply forecasts increased by 5% across all years, but this is due to expanded market tracking rather than actual development growth.

- Self-storage construction starts declined by 20% in 2024 compared to the previous year, which is expected to continue in 2025.

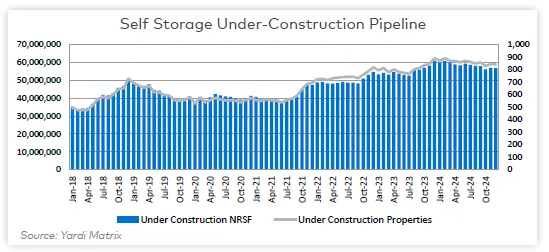

- The under-construction pipeline shrank by 6.7% YoY, indicating a slowdown in new supply coming to market.rn

- The prospective pipeline contracted by 25.3% YoY, signaling declining developer interest in new projects.rn

- Rental rate growth remains negative in most markets, creating additional challenges for new development feasibility.rn

- Self-storage supply growth is expected to slow to 2.0% of total inventory by 2027 and drop further to 1.5% by 2029, indicating long-term supply constraints.rn

The self-storage industry is experiencing a shift as new development activity slows and economic factors create headwinds for future supply growth. According to the latest yardi matrix Self Storage Supply Forecast for Q125, total projected supply has been adjusted upward by approximately 5% across all forecast years. However, this increase is primarily due to expanded market coverage rather than a fundamental shift in development activity.

While demand for self-storage remains steady, new construction is slowing due to rising interest rates, prolonged completion timelines, and weaker rental rate growth. Developers are cautiously approaching projects, and the number of planned and prospective projects is declining.

Short-Term Forecast: 2025-2027

Declining Construction Starts and Pipeline Contraction

The Q125 report confirms that self-storage construction activity is slowing significantly. New construction starts in 2024 were down 20% YoY, and this decline is now becoming evident in the under-construction pipeline.

At the end of Q424, 56.8M net rentable square feet (NRSF) were under construction in markets that had been tracked for at least 24 months. This figure represents 94.3% of the total under-construction pipeline, which totals 60.2M NRSF. The pipeline contracted by 1.8% QoQ and 6.7% YoY, reflecting the slowdown in new developments.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

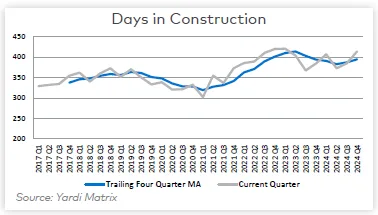

Rising Construction Timelines

The average time to complete a self-storage project has increased.

- Projects completed in Q424 took an average of 413 days (13.8 months) from start to finish.

- The trailing four-quarter average completion time rose to 394 days (13.1 months).

- Construction delays are driven by a combination of material shortages, labor constraints, and financing challenges.

Given the decline in new construction starts, self-storage supply growth in 2025 and 2026 will be slower than in previous years. The development pipeline peaked in December 2023, and the current trend suggests a continued decline in the number of projects breaking ground.

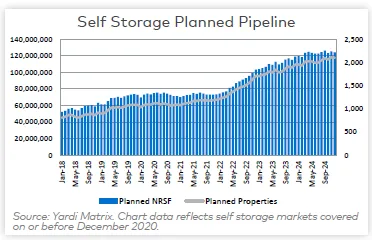

Planned Pipeline Stagnation

The number of self-storage projects in the planning phase remained flat for most of 2024 and even turned negative in Q4. For markets tracked for at least 24 months, the planned pipeline totaled 124.2M NRSF, representing 95.1% of the overall planned pipeline of 130.6M NRSF.

- The planned pipeline declined by 1.8% QoQ.

- The pipeline grew by just 4.4% YoY, a slowdown compared to previous years.

- The time projects spend in the planning phase has significantly increased. In Q424, self-storage projects spent an average of 583 days (19.4 months) in planning before breaking ground, a record high.

This stagnation in planned projects suggests that self-storage development has cooled from its peak in 22-23 and is now stabilizing at lower levels.

Long-Term Forecast: 2028-2030

Supply Growth Expected to Slow Further

Looking further ahead, Yardi Matrix anticipates that the supply of new self-storage units will moderate to 2.0% of the total stock by 2027 and 1.5% by 2029.

This projection indicates that fewer new projects will be delivered in the later years of the forecast, potentially leading to supply constraints in some markets.

Prospective Pipeline Declining Sharply

A key indicator of future supply, the prospective pipeline, is shrinking.

- At the end of Q424, the prospective pipeline contained 38.1M NRSF, of which 35.4M NRSF (92.9%) came from long-tracked markets.

- This marks a 10.2% QoQ decline and a 25.3% YoY decrease.

The prospective pipeline peaked at 49.4M NRSF in Q323 but has now declined to mid-2022 levels. This suggests that fewer developers are pursuing new projects due to economic uncertainty or higher barriers to entry.

Challenges Facing the Sector

1. Higher Interest Rates and Financing Constraints

One of the most significant challenges for self-storage development is the Fed’s higher-for-longer stance on interest rates.

- Rising borrowing costs have made financing new projects more expensive, reducing developers’ willingness to break ground.

- This is particularly problematic for value-add projects and ground-up developments, which rely on favorable financing conditions.

2. Weak Rental Rate Growth

Self-storage rental rates remain under pressure in most markets.

- Advertised rental rate growth turned positive MoM in January, but YoY growth is still negative.

- A weak rental rate environment makes new developments less financially viable, discouraging new supply additions.

3. Deferred and Abandoned Projects at Elevated Levels

While the number of deferred and abandoned projects declined from mid-2024 highs, these figures remain above historical levels.

- At the end of Q4, the deferred pipeline stood at 4.07M NRSF, down 2.5% QoQ but still 30% higher than late 2022 levels.

- Abandoned projects stabilized in Q4. In December 2024, 33 properties were abandoned, which was in line with the three-month average but still four times higher than in 2022.

These trends suggest that economic and financial challenges continue to weigh on developers, leading to more projects being postponed or canceled altogether.

Bottom Line: A More Balanced Market Ahead

The self-storage sector is entering a moderation phase characterized by slower development activity, longer construction timelines, and constrained future supply growth.

- Short-term supply growth remains positive, but the long-term outlook suggests fewer new projects breaking ground.

- The declining prospective pipeline and persistent financing challenges will likely result in a more balanced market in the coming years.

- Developers are increasingly cautious, and new supply levels may not keep pace with long-term demand, particularly in high-growth markets.

Market selection and project feasibility will be critical factors for investors and developers in 2025 and beyond. As rental rates stabilize and financing conditions evolve, the sector’s trajectory will depend on broader economic trends and shifting consumer demand for self-storage solutions.