According to TractIQ’s Q3 Self-Storage REIT Report, existing storage customers continue to show little resistance to ECRIs (Existing Customer Rate Increases).

Each of the 4 self-storage REITs expressed cautious optimism heading into 2025 while remaining vigilant in operations during a challenging economic and housing environment.

Key REIT Report Findings

- Bid-ask spreads between buyers and sellers are narrowing for acquisitions

- The customer remains resilient as evidenced by higher average length of stays, strong credit, and insensitivity to price changes (ECRIs)

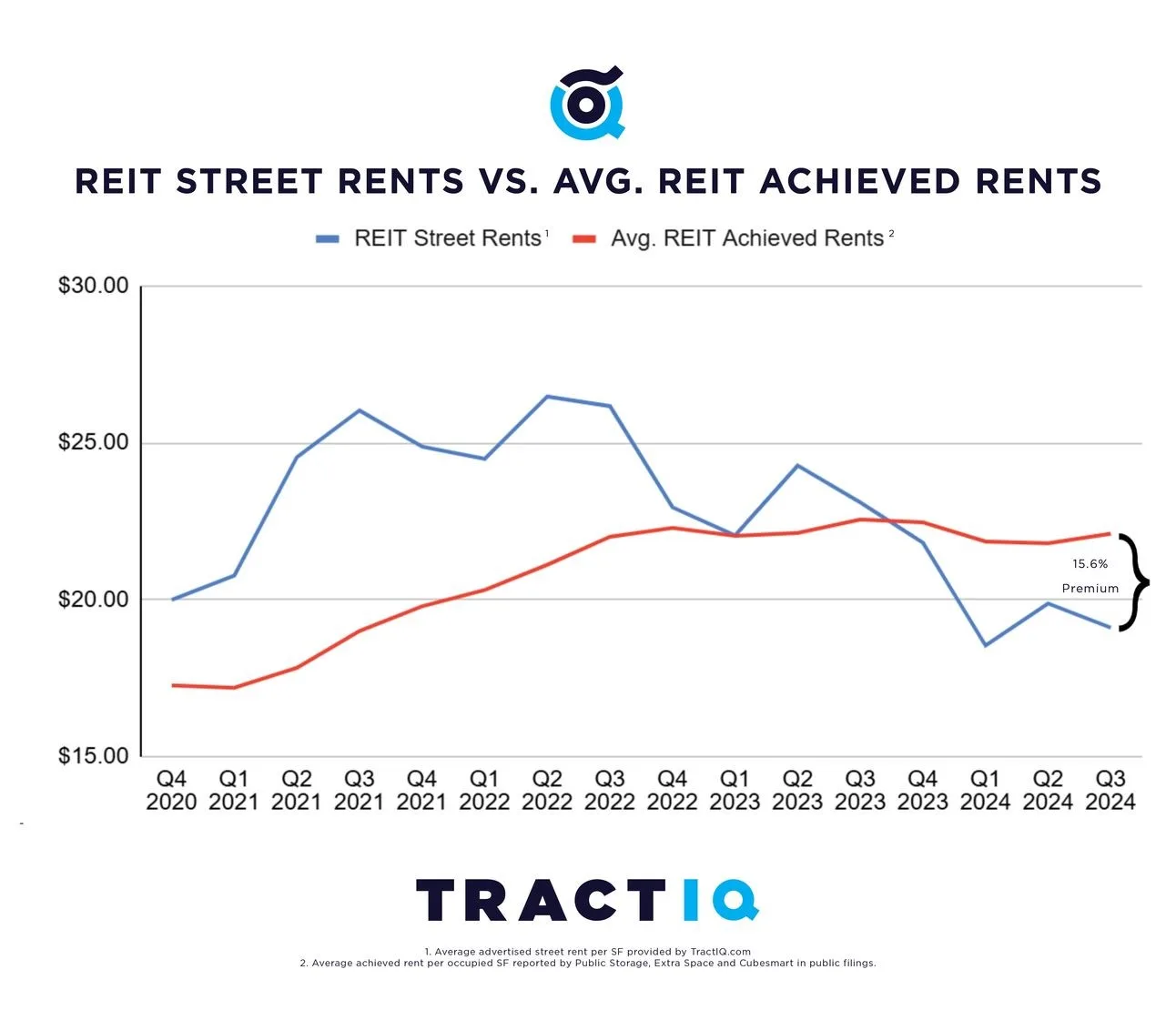

- REIT Rent Per Occupied Square Foot Versus Street Rent (since 3Q23):

- REIT advertised rates have decreased -20.8%, and rent per occupied square foot has decreased 2.0% since Q3 2023.

- ExtraSpace’s advertised rates have dropped -59.9%, while rent per occupied square foot fell -4.2%.

- CubeSmart’s advertised rates have risen 8.6%, while rent per occupied square foot has stayed the same.

- Public’s advertised rates have fallen -18.5%, while rent per occupied square foot slipped -2.1%.

- The new customer market remains extremely competitive, as evidenced by large deltas between move-in rates and move-out rates:

- ExtraSpace’s same-store average move-in rate was $121 per unit for the quarter versus a move-out rate of $175 (~30% higher)

- Public’s same-store average move-in rate was $14.45 PSF for the quarter versus a move-out rate of $20.81 (~30% higher)

- New supply continues to be less and less of a headwind for the industry:

- In 2019, 50% of CubeSmart’s stores were affected by new supply.

- In 2024, 27% of CubeSmart’s stores were affected by new supply.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Lastly, ECRIs remain crucial to revenue management strategies.

According to Noah Starr, CEO of TractIQ, “REITs are using their advertised rates as a smokescreen to lure in customers at a low price before aggressively increasing prices. Due to the sticky nature of self-storage, customers historically have been able to absorb these price increases; however, the proliferation of ECRIs risks killing the golden goose and lessening the future demand of storage.”

Although ECRIs are prevalent across the board, each REIT has a slightly different implementation strategy resulting in premium differences.

Breakdown of the 15.6% premium across each REIT:

- Extra Space in-place rates are 26.7% above their advertised rates

- Public Storage in-place rates are 3.0% above their advertised rates

- CubeSmart in-place rates are 19.9% below their advertised rates

To learn more, download TractIQ’s Q3 2024 Storage REIT Report.