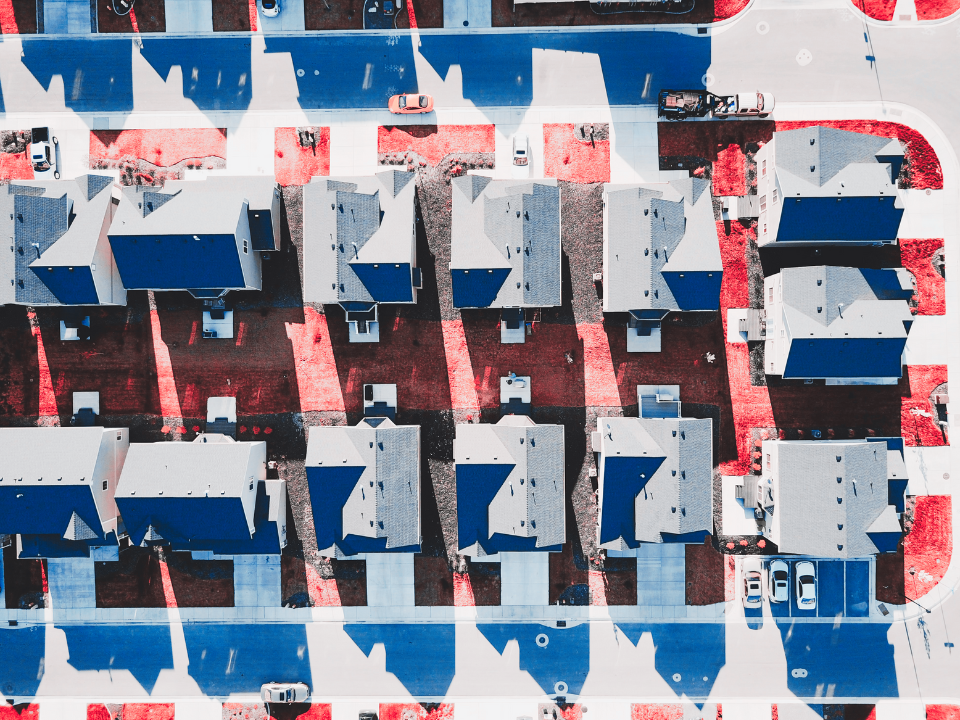

- In 2023, developers completed a record 93,000 new single-family rental homes, a 39% increase from 2022.

- Rental homes, ranging from one-bedroom cottages to large family houses, are increasingly being built in suburbs across states like Arizona, Texas, and Florida.

- Economic pressures such as high mortgage rates, which exceed 7%, and elevated home prices are compelling more Americans, including affluent ones, to opt for renting over buying.

Across the country, developers are swiftly building single-family rental homes to cater to those priced out of the buying market due to soaring home prices and high mortgage rates, as reported by WSJ.

Unprecedented Pace of Construction

Developers are rapidly building rental homes to cater to the increasing number of aspiring homeowners put off by soaring home prices and high mortgage rates. In 2023, 93K new single-family rental homes were completed—a 39% jump from 2022.

These rental homes vary in size and location, with a focus on the fast-growing Sunbelt. “Outer-ring” suburbs in states like Arizona, Texas, and Florida reveal a surge in rental demand attributed to high post-pandemic population and job growth.

The Burden of Buying

The trend of rising BTR construction is expected to continue, fueled by a systemic lack of affordable homes nationwide. Builders anticipate sustained demand even among wealthier families as home prices continue to outpace incomes.

And despite slowing rent growth, rental homes continue to command higher rents than similar-sized apartment units, drawing both affluent renters and people with no choice but to rent.

Doubling Down

Institutional investors are so confident in the single-family BTR market that they’re striking new deals with builders nationwide:

- STG Capital Partners’ 200-unit rental community in Paso Robles, CA—with 2BR and 3BR rents ranging from $3K–$3.7K—targets renters who prefer leasing. Notably, the median home price in Paso Robles is $700K.

- Chicago-based Heitman announced a $235M JV with homebuilder Crescent Communities to construct BTR homes in the Sunbelt.

- Invitation Homes (INVH) is planning to buy 500 under-construction homes in Charlotte, Nashville, and Jacksonville.

Why It Matters

Despite lending constraints, homebuilders are optimistic about the rental housing sector. Record levels of construction in recent years have led to over 99K ongoing rental home projects in 2024.

Meanwhile, investors foresee a growing and dependable BTR market. Systemic factors like rising home prices outpacing incomes, persistently high mortgage rates putting off potential homebuyers, and changing consumer lifestyle choices tied to the rise of remote work should continue to drive single-family rental demand for years to come.