Demand for luxury second homes surged during the height of the pandemic. With today’s high interest rates, tight inventory, and uncertain economics, one may assume the luxury home market has taken a hit.

The data suggests otherwise. Despite numerous challenges, the luxury housing market demonstrated remarkable resilience last year.

According to The Agency’s 2025 Red Paper, the number of U.S. homes sold for $1 million or more increased by 5.2% in the first half of 2024, while the median price for high-end properties surged by 14.2%.

This starkly contrasts the broader market, where overall home sales plunged by 12.9%, and the median price edged up by just 5%.

Elevated mortgage rates have dampened demand across the general housing market, but the luxury sector remains largely unaffected.

With deep pockets and fewer financial constraints, wealthy buyers are less reliant on loans. According to The Agency’s report, nearly half of all luxury homes sold in the first quarter of 2024 were paid for in cash.

So, is the luxury second-home dream still alive for high-net-worth families? The data suggests it is, but there’s also more to the story.

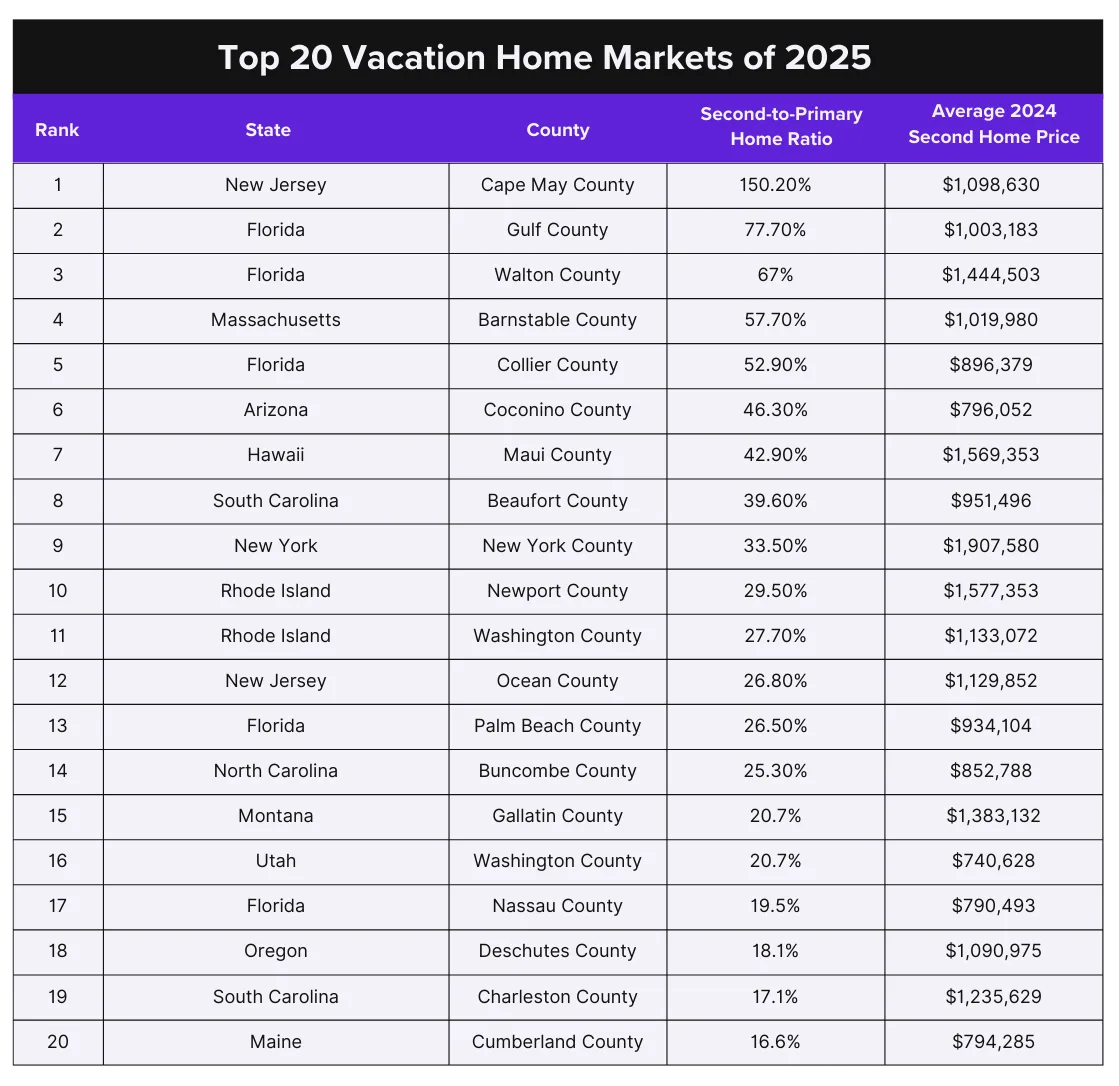

Pacaso, a leader in co-ownership home purchases, analyzed the markets that saw the most significant year-over-year growth in luxury second-home transactions from 2023 to 2024.

As we look ahead to 2025 and beyond, these second-home destinations are poised for even more growth, offering savvy buyers a chance to claim their slice of paradise.

If you’re dreaming of a high-end getaway, these are the top markets to watch:

Scenic shores & high demand

Coastal states dominated the vacation home market last year, with buyers favoring scenic beachfront destinations. Florida leads the nation, claiming five spots in the top 20 and solidifying its status as a luxury second-home hotspot.

Gulf County, part of Florida’s Forgotten Coast, offers 244 miles of pristine shoreline, emerald-green waters, and outdoor adventures like kayaking, year-round fishing, and the St. Joseph Peninsula State Park. With no high-rises or heavy traffic, it’s a peaceful retreat just hours from Atlanta.

The Northeast also remains a stronghold for vacation homes, with New Jersey, New York, Massachusetts, Maine, and Rhode Island ranking high.

Cape May County, New Jersey’s southernmost county, attracts second-home buyers with upscale beach towns, from Ocean City’s family-friendly Boardwalk to Cape May’s Victorian charm and Wildwood’s amusement rides.

Second-home prices in Cape May County averaged $1.1M in 2023, which contributed to the area’s high demand. Tourism continues to thrive, with spending up 4.1% in 2023 to $7.7B from $7.4B in 2022, according to the Cape May County Department of Tourism.

The rise of inland mountain retreats

As second-home investments grow, inland and mountainous regions have become prime locations for buyers seeking privacy, outdoor recreation, and breathtaking landscapes.

Coconino County, AZ, is a haven for outdoor lovers, offering world-class hiking, skiing, and breathtaking scenery. Home to Flagstaff and surrounded by the vast Coconino National Forest and the world’s largest ponderosa pine forest, it’s a prime location for second-home buyers.

Iconic destinations like the Grand Canyon and Antelope Canyon add to its allure. With second homes averaging over $796K and comprising 46% of the housing market, the county remains a top choice for those seeking adventure, natural beauty, and a luxurious mountain retreat.

Then there’s Buncombe County, NC, boasting Asheville’s vibrant arts scene and views of Blue Ridge Mountain. Meanwhile, Gallatin County, MT (Bozeman, Big Sky), attracts buyers with world-class skiing and fly fishing near Yellowstone.

With natural beauty, exclusivity, and investment potential, these inland escapes have become a top choice for luxury second-home buyers in 2025.

Top-dollar luxury vacation home markets

The average price of second homes can vary widely across the country, with several high-end markets standing out:

New York County has the highest average second-home price, at $1.9M. Domestic and international buyers continue to drive the demand for upscale pied-à-terres in Manhattan.

Maui County, HI ($1.57M), Newport County, RI ($1.57M), and Charleston County, SC ($1.23M) are also premium-priced vacation home markets and historically popular vacation hotspots.

Unsurprisingly, Florida continues to command premiums for its high-quality vacation properties, with Walton County ($1.44M) and Palm Beach County ($934K) standing out.

These elite markets offer an attractive mix of prestige and stability for investors and buyers who aren’t afraid to write big checks for their dream luxury vacation homes.

Top vacation home markets under $1M

While some second-home markets cater to luxury buyers, others provide more affordable vacation home options.

These markets offer natural beauty and recreational opportunities but appeal to buyers seeking second homes below the $1M threshold. Several stand out for their relative affordability.

Washington County, UT, near Zion National Park, has second homes averaging $740K, a 43% premium over the $515.8K Zillow Home Value Index (ZHVI) as of January 31, 2025.

Coconino County, AZ, has second homes priced at $796K, 28% above its $622.2K ZHVI. Cumberland County, ME, offers second homes at $794K, nearly 50% above its $527.8K ZHVI.

Then there’s Nassau County, FL, with vacation homes averaging $790K, a 69% markup over its $467.3K ZHVI.

Notably, while these markets offer relative affordability, they still command premiums over standard home values in their respective areas.

Demand for second homes remains strong

The US luxury second-home market is enjoying fresh demand despite macroeconomic headwinds and ongoing market uncertainty.

While high-end luxury markets command premium prices, more affordable second-home options exist, balancing exclusivity and accessibility.

Coastal retreats, mountain hideaways, and prestigious urban destinations continue to attract buyers seeking an opulent escape or a solid investment.

Simply put, those searching for a luxury getaway should take heart. Market trends indicate the second-home dream is far from fading—it’s just changing to meet new buyer preferences.

Your dream vacation home is now within reach

Traditionally, owning a second home required significant upfront capital plus maintenance despite limited usage, which put vacation home ownership out of reach for many.

The good news? Pacaso makes luxury vacation home ownership easy and accessible, offering equity appreciation, exclusivity, and flexibility. With their homes occupied 90% of the year, the company also drives local spending, supporting local economies.

Backed by investors like SoftBank and Maveron, Pacaso’s data-driven co-ownership model lets you buy fractional shares (⅛ to ½) of fully managed, high-end vacation homes in top destinations. Their hassle-free platform simplifies purchasing, financing, property management, and resale.

It’s no surprise Pacaso has already facilitated nearly $1B in transactions, helping 1.5K+ homeowners access premier vacation properties that would otherwise be out of reach in 40+ destinations across four countries.

Whether you’re looking for a beachfront retreat, mountain escape, or anything in between, Pacaso is the smart, seamless way to own a slice of the world’s most coveted vacation homes.