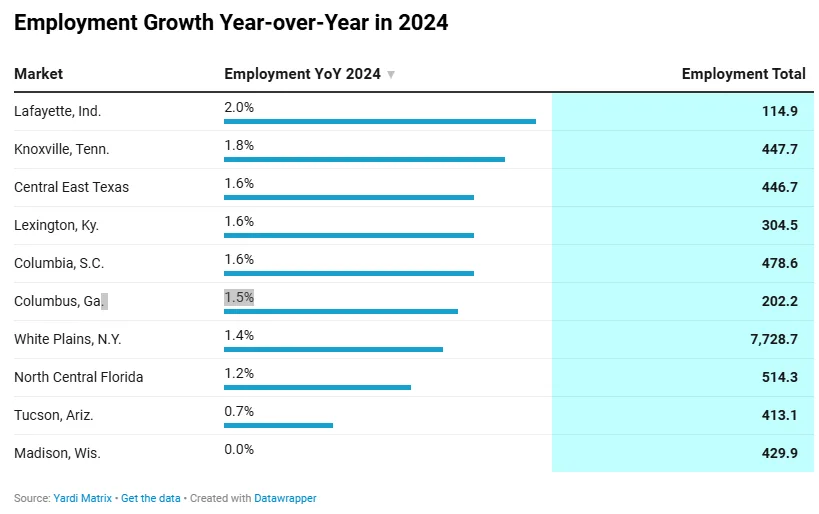

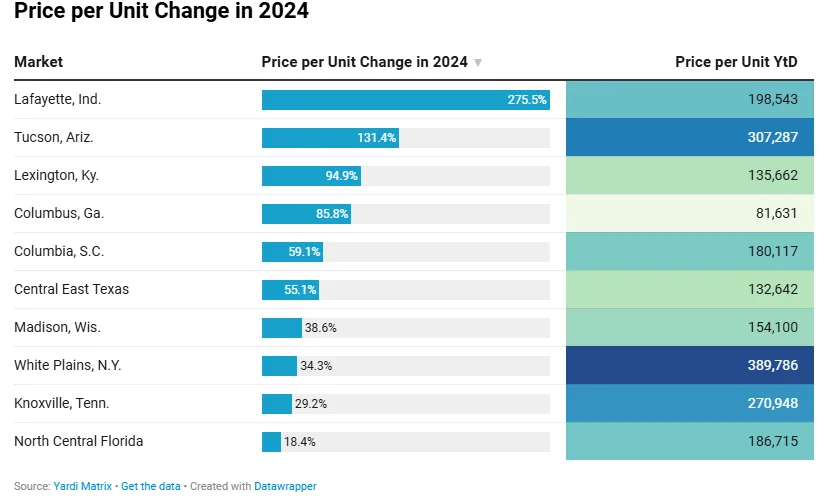

- Smaller metros are outperforming amid national headwinds, with markets like Tucson, White Plains, and Lafayette seeing strong investor demand and significant price-per-unit (PPU) growth.

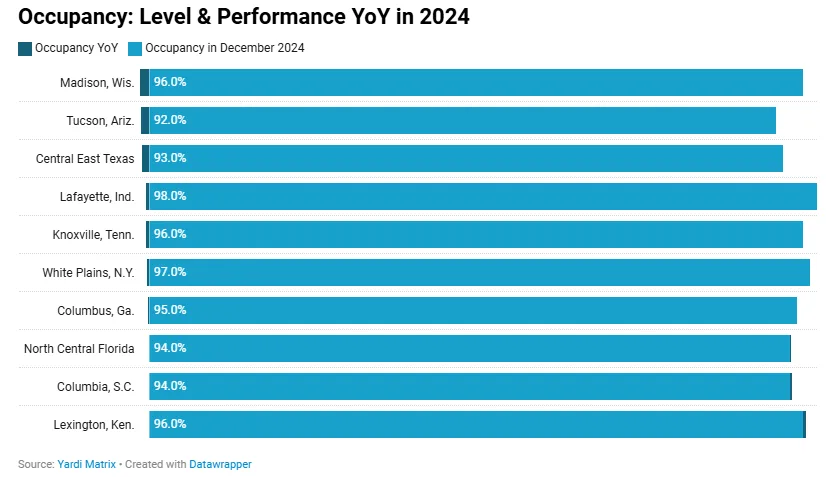

- Occupancy remains strong, with six of the top 10 markets reporting rates above 95%; Lafayette led at 98%.

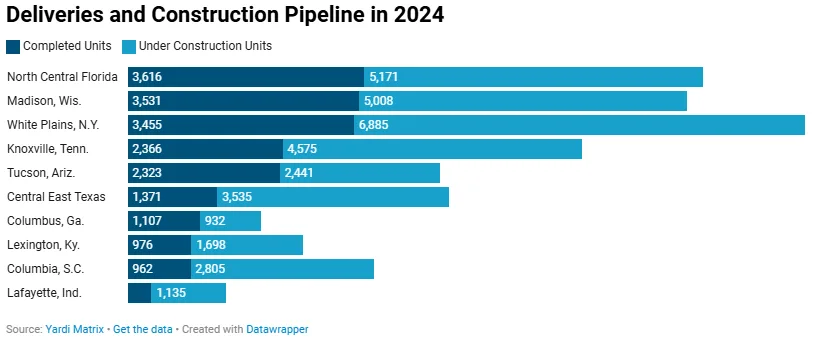

- Construction pipelines are active, especially in White Plains (6,885 units), North Central Florida (5,171), and Madison (5,008), indicating continued confidence in local demand.

- Investor returns are surging, with price-per-unit gains far outpacing the 3.3% national average—up to 276% in Lafayette and 131% in Tucson.

According to Multi-housing News, while national multifamily trends in 2024 leaned toward moderation, select smaller and secondary markets managed to outperform, setting the stage for continued growth in 2025.

Using Yardi Matrix data, these top 10 emerging multifamily markets were chosen based on employment gains, unit deliveries, pipeline volume, occupancy, and investment performance.

Let’s dive into the metros leading the pack this year:

1. Tucson, Ariz.

Tucson’s affordability, university presence, and growth potential place it at the top of this year’s emerging markets list. Despite a modest employment gain (0.7%) and the lowest occupancy rate (92%), investment interest soared, with price per unit rising 131% to $307,287—second highest on the list.

2. White Plains, N.Y.

Proximity to NYC and a booming pipeline (6,885 units under construction) secured White Plains’ second spot. With 97% occupancy and the highest price per unit at $389,786, investor confidence remains strong as the metro builds on New York City’s economic momentum.

3. Madison, Wis.

Though Madison saw a rare 0.1% employment contraction and a 1.4% dip in occupancy, it remains a stable Midwest player with healthy occupancy (96%) and active development. A $154K PPU—still below national average—underscores affordability and room for further growth.

4. Central East Texas

Anchored between Austin and Dallas-Fort Worth, this region is seeing steady expansion. Employment rose 1.6%, with 3,535 units underway. Price per unit surged 55% to $132,642, still well under the national average—offering investors strong upside potential..

5. Knoxville, Tenn.

With a 1.8% employment gain and a strong construction pipeline (4,575 units), Knoxville is climbing the ranks. Occupancy remains high at 96%, and prices jumped 29% to $270,948, showcasing the market’s increasing value proposition.

6. Lexington, Ky.

A new entry this year, Lexington is backed by a strong manufacturing base and a tight multifamily market. Occupancy rose 0.4% to 96%, the highest gain in the list, while PPU nearly doubled to $135,662. Deliveries were modest, keeping supply in check.

7. North Central Florida

Fueled by spillover from Orlando and Jacksonville, this region led all metros with 3,616 units delivered in 2024. Occupancy ticked up slightly to 94%, and while PPU growth was the lowest (+18%), the average price remains close to national benchmarks at $186,715.

8. Columbia, S.C.

Supported by strong job growth (1.6%) and a tight construction pipeline (2,805 units), Columbia posted a 40-basis-point gain in occupancy. Price per unit climbed 59% to $180,117, making it one of the most balanced investment markets in the ranking.

9. Columbus, Ga.

Despite the lowest pipeline (932 units) and transaction volume ($12M), Columbus made a strong debut. Employment grew 1.5%, and occupancy stayed firm at 95%. Most notably, PPU rose 86% to $81,630—the most affordable entry on this list.

10. Lafayette, Ind.

Lafayette tops the list for occupancy (98%) and PPU growth (+276%). While its overall size and volume are smaller, its proximity to Indianapolis and Chicago, along with robust employment growth (2%), makes it a compelling market to watch.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

With economic uncertainty continuing into 2025, investors are broadening their horizons beyond gateway cities. These emerging metros offer compelling fundamentals—high occupancy, development pipelines, and outsized investor returns—setting the tone for the next wave of multifamily investment.

What’s Next

Expect sustained interest in smaller, affordable metros with strong employment drivers and expanding pipelines. As national pricing trends flatten, these emerging markets offer room for appreciation and better margins—making them hot targets for capital in 2025 and beyond.