Office Investment Sees First Uptick Since 2021

Global investors are returning to the US office market as sales rise and leasing improves, signaling potential stabilization.

Good morning. Investor confidence in U.S. office properties is growing again, marking the first sales increase in years as buyers hunt for deals on both high-quality and redevelopment opportunities.

Today’s issue is brought to you by Vintage, which provides investors with an efficient and low-cost way to access the best assets the private market has to offer.

Market Snapshot

|

|

||||

|

|

*Data as of 01/29/2024 market close.

OFFICE COMEBACK

Investors Are Warming Up to the U.S. Office Market Again

Investors are returning to the U.S. office market, betting on discounted properties and a slow return-to-office shift, per The Wall Street Journal.

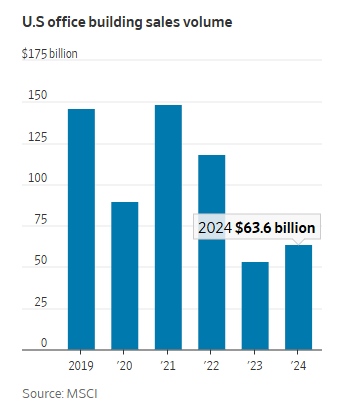

A surge in sales: Office building sales reached $63.6 billion in 2024, marking a 20% increase from the previous year—the first annual uptick since 2021, reports MSCI. Though still well below pre-pandemic levels, brokers expect momentum to continue into 2025, fueled by opportunistic funds with nearly $197 billion in available capital.

Leasing activity shows promise: As more companies enforce return-to-office policies, demand for top-tier office space is tightening in select markets, driving rent growth. Some landlords, like RXR in Manhattan, are investing heavily in renovations to attract tenants, banking on the sector’s gradual recovery.

Betting on a rebound: Foreign capital is returning, with Norway’s sovereign wealth fund resuming U.S. office purchases. It recently invested in eight properties across Boston, San Francisco, and Washington, D.C., acquiring a 50.1% stake valued at $1.9 billion.

Yet, a new threat looms: Despite rising investor interest, office values remain 35% to 60% below pre-pandemic levels, and many buildings struggle with high vacancies and looming debt maturities. However, with the Federal Reserve signaling stable interest rates, more property owners are accepting reality and listing assets for sale.

➥ THE TAKEAWAY

Comeback tour: The office market isn’t out of the woods yet, but well-capitalized investors see opportunity in distress. As leasing demand strengthens and sellers become more realistic, 2025 could mark the beginning of a slow but meaningful recovery.

TOGETHER WITH VINTAGE

Introducing Vintage's MHP Fund

Today’s issue is brought to you by Vintage Capital: invest in recession-resilient Mobile Home Parks.

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest directly or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

-

Recession-Resilient: Affordable housing demand drives stable returns in any economy

-

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

-

Proven Expertise: $80MM+ track record in mobile home park investments.

-

Tax-Smart Investing: Bonus depreciation offers tax advantages.

*Disclaimer: This is a paid advertisement. See full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Raising capital in 2025: Discover how leading firms adapt to shifting markets, leverage private equity, and tackle rising costs to remain competitive in Agora’s 2025 Real Estate Capital Raising Insights report.

-

Deal boom: Merger experts forecast a spike in US M&A activity, driven by a favorable economy, strong buyer demand, and regulatory shifts under President Trump.

-

Stack savvy: Craig Solomon, Affinius Capital’s vice chairman and CIO, shares insights on navigating both debt and equity markets to capitalize on current market conditions.

-

Confidence dip: As inflation expectations rise, a new survey shows consumers are starting 2025 with a more pessimistic outlook despite strong spending in 2024.

-

Strong growth: Medical outpatient buildings (MOBs) saw a 92.8% occupancy rate, driven by an aging population, rising healthcare spending, and increasing demand for healthcare services.

-

Leasing surge: BXP closed 2.3 MSF of leases in Q4, marking its best quarter since 2019 as office demand shows signs of recovery.

🏘️ MULTIFAMILY

-

Occupancy surge: The US apartment market recovered in 2024, ending the year at 94.8% occupancy, driven largely by a strong rebound in Class B apartments.

-

Freeze clarified: Rental assistance for multifamily remains unaffected by Trump’s executive order, which was temporarily blocked by a federal judge amid concerns over funding disruptions.

-

Sales surge: US apartment deal volume reached $146B in 2024, fueled by large deals and strong investor demand, with more growth anticipated in 2025 as multifamily remains the top asset class.

-

At any price: South Florida's multifamily investment market gains momentum as TA Realty buys a 300-unit complex for $118M, a $393K per unit price, signaling a recovery in the region's apt sales.

-

Bargain bin: The Martin Group expands its portfolio in Oakland with the $61M acquisition of the 19th & Harrison apartment complex, a deal significantly below its mortgage value.

-

Can’t keep up: Abington Properties is selling the 340-unit Hall Street Flats, 94% occupied and appraised at $74M, amid a glut of new apartments in Dallas-Fort Worth.

🏭 Industrial

-

Shifting focus: EQT Exeter exited its US multifamily fund due to a tough fundraising environment, refocusing entirely on industrial properties. The firm has acquired over 60 MSF of logistics space.

-

Downtrend: Logistics rents dropped globally in 2024 for the first time since 2008, down 7% in the US and Canada. SoCal saw the largest drop—over 20%—after leading pandemic rent growth.

-

West Coast cruising: In 2024, the Port of LA saw a historic 20% surge in container movement, hitting 10.3M units. This growth, second only to 2021, was driven by shifting shipping routes and labor disputes.

🏬 RETAIL

-

Rethinking retail: Retail giants like Lowe’s (LOW), Walmart (WMT), and Amazon (AMZN) are leveraging AI to optimize supply chains, store operations, and customer experiences.

-

Doing justice: The government auctioned off 14 retail properties, including the Hiram Square center in GA, previously owned by Jonathan Larmore, to recover funds from his $35M fraud.

-

Eating well: DLC secured a $41.7M loan from Webster Bank (WBS) to buy Danada Square West, a 315 KSF grocery-anchored shopping center in Wheaton, IL, as part of a JV with Crow Holdings Capital and Temerity Strategic Partners.

-

Mixed-use moves: NewQuest started construction on the retail component of Texas Heritage Marketplace, a $400M mixed-use development in Katy, which will feature a 750 KSF shopping center, apartments, medical offices, and more.

🏢 OFFICE

-

Good feeling: Metropolis Investment Holdings fully paid off a $150M loan for the office floors of 345 California Street in San Francisco, reinforcing its commitment to the city's office market.

-

Up for grabs: Lincoln Property and Goldman Sachs (GS) listed San Francisco’s 84 KSF Abbott Building for $30M—57% less than its 2020 purchase price—as the city's office market struggles with high vacancies.

🏨 HOSPITALITY

-

Very hospitable: JLL forecasts a 15–25% jump in global hotel deals this year, with cities like London, NYC, and Tokyo attracting institutional capital, while resort investments slow and conversions pick up the pace.

-

Picking up the pieces: Aeneas Venture Partners bought a historic downtown Phoenix warehouse for $17.2M in a foreclosure auction, jumpstarting the plan for a 25-story Fairmont hotel and condo tower.

📈 CHART OF THE DAY

With nearly 600 MSF of office space, Manhattan’s aging office stock is approaching an average age of 100 years, posing modernization challenges for building owners in an evolving market.

You currently have 0 referrals, only 1 away from receiving B.O.T.N Multifamily Deal Screener .

What did you think of today's newsletter? |