Actovia Overview

A must have for every CRE professional to identify opportunities and close deals fast, Actovia is a robust and versatile platform that provides comprehensive real estate and mortgage data for CRE professionals across the US. Actovia rolled out to the NYC market in May 2011 and now covers all commercial property and mortgage types across the United States. Actovia also boasts a NYC Violations Monitoring platform. In January 2020, Actovia acquired CrediFi, incorporating a $30M investment in national data, technology, and machine learning. Actovia’s focus has always been on true ownership and debt details. Debt details on Freddie, Fannie, CMBS, and all balance sheet loans uncover terms such as Rate, PPP, and expiration date. With its advanced search engine, rich dataset, and ease of use, Actovia enables users to access property ownership information, pinpoint accurate leads, and uncover off-market opportunities.

Our Take On Actovia

Best for brokers, lenders, investors, and service professionals looking to canvas leads and reach decision-makers.

Actovia is an accurate and robust real estate and mortgage data platform that offers CRE professionals a powerful toolset for property research, lead generation, and market analysis. Its expanding database and specialized features cater to small firms and large enterprises alike, making it a versatile solution in the industry.

Pros

Pros- High degree of data precision, well-thought-out data visualizations

- Comprehensive contact info, including owner/lender portfolio and analysis

- Powerful, versatile comps tools, including detailed mortgage intelligence

- User-friendly interface and intuitive tools with a minimal learning curve

- API integration, bulk data, customized features, and reports

- Concierge-level service with direct access to Actovia’s founder

Cons

Cons- Nationwide contact data (emails, phone numbers) may be limited for smaller portfolios. Actovia has contact data on portfolios with 10 or more properties.

- If information is not publicly accessible, it may not be available on the platform.

Data precision: Actovia’s focus on data precision is evident in the platform’s high level of accuracy with constant updates to the data. The data within NYC is top-tier, and dozens of data points exclusive to NYC are filterable to narrow their search. Actovia cleverly tackled the challenging nature of building an accurate nationwide database to great success. Their offering of daily real-time sales reports ensures that you are always up to date on the market.

Comprehensive Data and Contact Information: Actovia provides a clear view of property ownership, including contact details of the actual owners and the ownership tree, which is crucial for CRE professionals looking to connect directly with decision-makers.

Powerful, Versatile Comps Tools: Actovia’s comps tool is as powerful as it is versatile and on target. Find comps by unit price, price per square foot, neighborhood and more to accurately evaluate potential investment opportunities or execute due diligence. View comps results on the map to better sift through the results. Every lead list result can also generate comps at a click for your criteria within a given radius. A well-presented export can be sent and attached to relevant parties and documents.

Detailed Mortgage Intelligence: The platform shines when it comes to mortgage intelligence, offering detailed mortgage records, including past and current loans, terms, and payment histories. This level of transparency helps users assess financial risk and identify refinancing opportunities. The mortgage intelligence is particularly useful for brokers who are looking to provide clients with tailored financing options or for lenders seeking new prospects. Recently, Actovia launched Loan Reassignment details within their mortgage historical information. The feature is meant to easily identify where a loan is serviced. When a loan changes hands to another lender, the debt moves along with the original terms of the loan, including the interest rate.

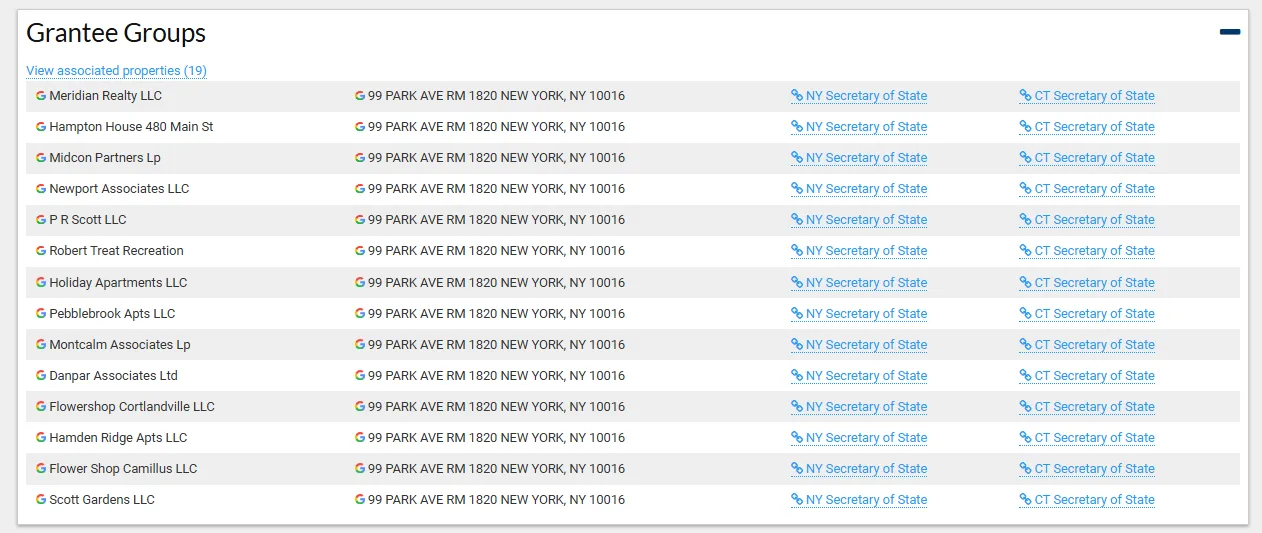

Owner and Lender Portfolio and Analysis: The ability to view the entire profiles of all lenders and owners empowers users to analyze the buying, selling, and lending habits for more accurate research. Lender profiles show properties financed and loan volumes, bank contact and affiliate information. Owner profiles also roll all properties and show a breakdown of violations and analytics. Each is linked to every property for easy perusal. Actovia added Grantee Groups under the Owner Tab in Nationwide to provide an even broader view into who owns what. Actovia rolls up all LLCs under the same Grantee location for the subscriber to view other properties aligned to that LLC. Users can also filter by ranges of property counts by Grantee to find mid-size to institutional-sized ownership. Here’s how Grantee Groups is displayed on a property in Connecticut:

Thought-out data presentation for busy CRE professionals: Much of Actovia’s data is presented in easy-to-read charts and graphs to give brokers as many visual aids as possible. Lists can be viewed in a filterable spreadsheet format or a card-style and map layout.

User-friendly interface and intuitive tools with a minimal learning curve: The platform is designed with the end-user in mind, offering easy-to-use tools that reduce the need for extensive training. A live demo is generally enough to start using the system. Continued use reveals many additional intuitive features to optimize canvassing and lead gen.

Concierge-level service with direct access to Actovia’s founder: Actovia prides itself on being a concierge boutique platform that puts client needs above all. Subscribers will regularly ask founder Jonathan Ingber their data questions. Actovia truly cares about each of its subscribers and provides white glove service to help them find their niche in the market and their next deal.

API integration, bulk data, exports, customized features. and reports: Actovia offers API integration to other CRM products. Actovia routinely delivers bulk data and builds custom features, lead lists, and reports to suit each client’s needs. Data exports to CRM, PDFs, or Excel files, giving clients the opportunity to seamlessly blend proprietary company and public data.

Nationwide contact data may be limited for smaller portfolios: While Actovia has made significant strides in expanding its ownership contact database, its coverage is still growing. This can be a drawback for users seeking data on properties linked to smaller portfolios. Actovia does uncover contact information for all portfolios 10+ properties. Actovia also provides a link to the Secretary of State directly for the registered business entity for all properties which is also rolled up into portfolios.

If info is not publicly accessible, it may not be available on the platform: Some of Actovia’s effectiveness is contingent on public or purchased data availability. If certain information is not publicly accessible, it may not be available on the platform, which is an issue for most cre data providers. Actovia’s manual research does a fine job to fill many of these public data gaps.

Actovia Product Offerings

Actovia is a versatile tool for CRE professionals. It provides the data and tools needed to identify opportunities, manage client relationships, and streamline workflows.

NYC and Nationwide platforms

The flagship Actovia NYC and Nationwide platforms allow users to search by address, owner, parcel, company, phone number, and more. Users can also add notes and appointments directly to properties and view results in various formats, like spreadsheets or maps. Actovia also provides a clear view of property ownership, including the contact details of the person behind the LLC. Users can also view all of the properties owned by that person. Users will also receive a daily email with all transactions reported sold or refinanced in NY and a weekly email with liens and trades.

CMBS Loans Database

Actovia’s Nationwide platform includes a comprehensive database for CMBS loans, allowing users to filter by property type, mortgage expiration date, number of CMBS loans, and state or sale date. This tailored search is essential for identifying owners managing multiple CMBS loans or zeroing in on specific properties. This feature is handy when creating precise lead lists, allowing firms to track, connect, and grow efficiently.

NYC Violations Monitoring Platform

Actovia’s specialized violations platform was created for mortgage brokers and loan officers to quickly assess the risk of a property and owner. By aggregating all violations across a portfolio, the system analyzes property or owner risk. Actovia violations are also a crucial tool for service providers and expeditors aiming to help owners resolve code issues and avoid costly judgments. This feature enhances the platform’s utility by offering a solution to a common problem NYC brokers and property owners face.

CRM Integration: Actovia includes a built-in CRM system that helps users manage leads, track client portfolios, organize and share notes, and sync appointments with their Outlook and Google calendars. Key features include creating custom owner profiles, tracking contacts by lead stage, managing buyer preferences, and connecting lead lists with Actovia’s CRE search engine. Users can easily add an owner’s contact info directly to their contacts from the property search. They can also create listings and help find buyers looking for that property type within the platform.

API for Bulk Data Feeds: Actovia offers API feeds that allow clients to export data directly into their CRM systems, such as Salesforce and Hubspot, facilitating bulk data handling and integration.

Custom Solutions: Actovia has access to deeper data to power custom solutions out of the scope of the platform. Actovia routinely develops custom features on the platform to suit their clients’ needs.

User Experience

Actovia’s data is top-tier; its interface is simple and effective. Users can quickly navigate the platform’s extensive features with minimal training.

The search function is user-friendly and offers a range of search options and filters, including address, owner, company, phone, and email. The ability to export data in various formats (PDF, Excel, etc.) adds to its versatility.

Users can create customized lists by filtering nearly every available data field. The data can be visualized in different formats, such as spreadsheets and maps, or aggregated by the owner or lender.

Customer Support

Actovia is known for its high level of customer support, with users reaching out directly to the team for help. Actovia’s concierge service helps clients find their niche and provides custom solutions on and off of the platform.

While Actovia doesn’t offer a Help Center and only limited tutorials on its website, users get a free live demo upon signing up and can expect a quick response when reaching out by phone or email.

Pricing

Actovia operates on a month-to-month subscription model, with pricing ranging from $319 to $389 per user per month, depending on geographic needs and user limits. Discounts are available for multiple accounts, annual subscriptions, and upfront payments.

Unlike many other providers, Actovia doesn’t require an annual commitment. The team is confident in its product and believes offering the flexibility of a monthly subscription is best for its clients.

Competitors

Reonomy

Reonomy is a commercial real estate data platform that provides comprehensive property information and insights to real estate professionals, investors, brokers, lenders, and other industry stakeholders. The platform aggregates vast data from various sources, including public records, tax assessments, transaction histories, and more, to offer detailed information about properties across the United States.

Costar

CoStar is a widely recognized and utilized commercial real estate information company. It provides a comprehensive database of commercial properties and market intelligence to a broad spectrum of users, including investors, brokers, landlords, and tenants. The platform offers various services and tools that enable users to access detailed information about available properties, market trends, property analytics, comparables, lease and sale listings, and research reports.

Trepp

Trepp, founded in 1979, provides data, technology solutions, and insights to the structured finance, commercial real estate, and banking markets. Trepp offers a suite of products for monitoring and analyzing both securitized and non-securitized commercial mortgages and properties, whole loan portfolios, and nationwide commercial mortgage financial statistics.

Property Shark

PropertyShark is a comprehensive property research tool designed for real estate professionals. It offers detailed data on properties across the United States. Founded in 2003 and acquired by Yardi in 2010, the platform provides access to ownership information, sales history, zoning details, permit filings, and more.

FAQs

u003cspan style=u0022font-weight: 400;u0022u003eActovia is a subscription-based cloud platform that provides comprehensive real estate and mortgage data for CRE professionals across the US.u003c/spanu003e

u003cspan style=u0022font-weight: 400;u0022u003eYes. Actovia allows potential users to sign up for a free trial on their website.u003c/spanu003e

u003cspan style=u0022font-weight: 400;u0022u003eActovia’s customers primarily include CRE investment sales brokers, CRE mortgage brokers, and investors looking for off-market properties. The platform also serves a variety of professionals seeking to identify CRE property owners, such as energy efficiency specialists, benchmarking businesses (particularly in NYC due to specific Local Law filters), mold restoration services, pest control companies, and janitorial services. Actovia’s customer base is diverse, including anyone who requires detailed ownership and mortgage data.u003c/spanu003e

u003cspan style=u0022font-weight: 400;u0022u003eSubscription prices range from $319 to $389 per user per month, with discounts for multiple accounts and upfront payments. Actovia subscriptions operate on a month-to-month basis, so users are never locked into a long-term commitment. u003c/spanu003e

How We Evaluated Actovia

When evaluating Actovia, we examined several factors, including:

- Data accuracy, platform tools, and service offerings: We dug into Actovia’s datasets, features, products, and services, including its full suite of data services.

- Pros and Cons: We checked the boxes on what potential clients are looking for and compared features that make Actovia stand out from its competitors.

- Ease of use: We examined Actovia’s user-friendly platform, the intuitive onboarding process, and how quickly a new user is likely to understand and take advantage of the platform’s full functionality.

- Customer support: We evaluated Actovia’s customer support network and scored it on response times, training materials, and access to customer service reps.

- Pricing and transparency: We examined how Actovia products and services are priced and whether readily available pricing info is available on its website.

Summary of Actovia Review

Actovia delivers on its promise of data precision, advanced search capabilities, and effective lead tracking. Its commitment to providing high-quality CRE and mortgage data and CRM integration gives users a competitive advantage in the complex CRE landscape.

Whether you’re dealing with CMBS loans or navigating the NYC or Nationwide markets, Actovia equips users with the confidence to make informed decisions, identify off-market deals, and uncover leads across the US.

Actovia proves to be an indispensable tool for any CRE professional seeking reliable, comprehensive data solutions.

Disclaimer

This page may contain affiliate links. If you make a purchase or investment through these links, CRE Daily LLC may receive a commission at no extra cost to you. These recommendations are based on our direct experience with these companies and are suggested for their usefulness and effectiveness. We advise only purchasing products that you believe will assist in reaching your business objectives and investment goals. Nothing in this message should be regarded as investment advice, either on behalf of a particular security or regarding an overall investment strategy, a recommendation, an offer to sell, or a solicitation of or an offer to buy any security. Advice from a securities professional is strongly advised, and we recommend that you consult with a financial advisor, attorney, accountant, and any other professional who can help you understand and assess the risks associated with any real estate investment. For any questions or assistance, feel free to contact [email protected]. We’re here to help!